That’s how much money our oil futures trade ideas generated over the past two weeks and I certainly hope everyone got a piece of theirs but, out of curiosity, how did our other trade ideas do in this terrible market? We track our virtual portfolios but we have many trade ideas during members chat on both sides of the fence so let’s take some time to review what worked and what didn’t work as the Dow dropped 500 points since the holiday.

Keep in mind this is just virtual performance and I’ll do my best to not miss anything and I’m going to include the Friday before the holiday weekend so we can review what our mind-set was as we set ourselves up for the long weekend as well as how we handled the moves since in both our daily posts and our Member Chat. I’m not going to narrate each day, that’s what Stock World Weekly is for – I’ll just make quick comments on the trades when appropriate. Keep in mind, with all options trading, once you make a quick 20%, you should be looking for the exits (see our Strategy Section) by setting stops (and we also stop out with a 20% loss of course) – we are just lucky when we happen to do better.

TGIF – Dollar Done Diving or Destined to Drop?

In the main post (main post trade ideas can be read daily by Report Members or higher – the rest are in our Private Member Chat), I discussed shorting oil futures off our $101.90 (at the time) target. We didn’t like waiting for $102 because sometimes it failed. Oil finished at $99 this week but was as low as $97.24 as we put pressure on the NYMEX pump crew by accepting their bogus offers to buy oil over $101 per barrel. This post was the first one where I decided to go public with what we were doing, hoping to break the back of the market manipulators at the NYMEX by letting as many people as possible in on the trade. This is also where I laid out our bearish fundamental case for oil so good for review. My comment in the morning post was:

As I mentioned yesterday, this week’s action is fake, Fake, FAKE and we are waiting for the pump-job today to run it’s course and, as long as we remain below our 2.5% lines, we’ll be adding shorts into the long weekend because we think 75 will hold on the dollar and then, like Richard Gere in "An Officer and A Gentleman" the Dollar will have nowhere else to go but up. Speaking of UUP, we will be liking them long again this morning and the Jan $20 calls are only $1.85, which is very little premium with UUP at $21.62. If pressed, we can sell short calls against it but UUP was at $23.40 in Januarywith the Dollar at 81 so that would be perhaps a 50% gain in the UUP calls if the Dollar goes up 7.5% but we’ll be very happy to take $2.20 (20% gain) and run on a good pop.

- We were wrong about the Dollar (short-term) and the UUP calls are now just $1.65 – down 11% but I still like them.

- TZA June $40 calls at .65 were the Member Alert trade, we cashed out our bear side today, these finished at $2.80 – up 330%

- DIA June $124.75 calls at $1.25 were a trade idea in the same Alert, they hit $1.75 the next morning for a 40% gain.

- Oil was re-shorted at $100.90 at 11 – Billions were made on the futures.

- USO June $39 puts at .80 were also selected for non-futures players, they topped out at $1.10 on the 2nd – up 37%

That trade idea was from 11:04, at 11:12 I noted to Members:

That trade idea was from 11:04, at 11:12 I noted to Members:

Holy crap, someone just spent an incredible amount of money to prop up USO as it was about to fail $39.75! I’d love to say that proves they are going down but whoever this is has a lot of money and is willing to spend it to keep oil from failing this level. Still, seems desperate and doesn’t change my weekend outlook (to keep shorting).

- SEAC Jan $7.50/10 bull call spread at $2, selling $10 puts for $1 (net $1), still $1

- LNKD Aug $90/85 bear call spread at $3.40, selling June $95 calls for $1.85 (net $1.55), now $3.70 – up 100%

- EDZ June $17 calls at $1.55, now $2.55 – up 65%

- CCJ July $28 puts sold for $1.05, now $2.45 – down 133% – I still like CCJ but longer term now. 2013 $25 puts can be sold for $4.20 and that puts another $1.75 in your pocket while you wait and drops the net entry to $22.20 with CCJ at $26.03.

Wow, that was a busy day! Fortunately we stuck to our guns and held bearish over the weekend (and Gordon Long pointed out on Monday that "The Economic Death Spiral Has Been Triggered" – worth a re-read with 2 week’s perspective!) but Tuesday, they made it tougher for us:

Manic Tuesday – Greece is the Word!

Greece being ‘fixed" is a running joke for us in chat. It’s how they push the Euro up and the Dollar down. My comment in the morning post, with the pre-markets flying, was: "Yeah, that’s right – I’m going to get on the bandwagon after commenting in Member Chat at 2am that I thought the "fix" was total BS – with Portugal, Ireland and Greece looking like the coyote before he realizes he’s run off the cliff. That led us to conclude that oil would be a good short off the $101.50 line. Well, it was and fell to $100 but now it’s back to $102.50 pre-market, up almost 2% from Friday’s close for no reason at all other than the Dollar, which just gets weaker and weaker and weaker and weaker based on the extend and pretend policies employed by the EU and Japan – it’s ridiculous but what are we going to do about it? Obviously, we just short oil again at $102.50."

We managed to short oil at $103 that day on the spike up. Obviously, Billions were again made on that trade.

- USO June $39 puts at .50 (again), topped out at $1.10 – up 120%

- TBT weekly $32 calls at $1.35 – stopped out at $1.50 – up 11%

- UNG 2013 $10 puts sold for $1.20, now $1.15 – up 4%

- SQQQ July $24/25 bull call spread at .35, selling June $23 puts for .30 (net .05), now .55 – up 1,000%

- Oil futures shorted at $103 again as they ran up into the close – more Billions

My theme of the day was to ignore the rally because it was just end of month window dressing. That afternoon I made a prediction that is working out so far as I Asaenz asked me what I thought June would look like:

June/Asaenz – Well, I’m still looking for a serious correction, not this 5% BS so yeah, I’d be getting cashy and waiting for a pullback, if not playing for one. I think that QE2 will morph and not really go away but also that anything other than a new, aggressive program, which is politically undoable at the moment, will be a failure. They NEED a correction to sell more easing so correction first, then more stimulus.

Which Way Wedne$day – Let’s Break The $peculator$

This was the day I officially declared war on the NYMEX speculators. Taking oil up to $103 on Tuesday was the last straw and we had been playing around in the futures and saw a pattern that I felt we could exploit and I laid out my strategy in this widely published post to make sure it would literally cost them Billions of Dollars every time they tried to pretend to want oil for over $101 per barrel (based on my premise that this "demand" at the NYMEX was nothing more than fake market manipulation).

I reiterated the above SQQQ hedge, which made 1,000% so far, in the main post along with, of course, the oil futures short at $103 for more Billions. I went through a big explanation of the whole process and why it would kill the speculators if we shorted the futures. Had Obama given me the $3Bn I asked for, we could have eliminated the national debt by now but at least he took my suggestion to use the Strategic Petroleum Reserve to help us bust the speculators (thank you Mister President!). See, it does pay to vote Democrat! After telling Members I thought we should stay the bearish course into that relentless rally, I was a little worried and that morning I said:

I spent pretty much all day yesterday warning Members not to fall for the other kind of blatant manipulation as the funds gave us a mega window-dressing day. Today I will either be a hero or a goat but, when push comes to shove – you do have to go with your gut and my gut was screaming BS at yesterday’s move from the minute we opened all the way until that ridiculous close.

- The morning Alert to Members was that SQQQ play again (I REALLY liked that trade idea!).

- Also in the Morning Alert was USO June $39 puts at .55 (again), topped out at $1.10 – up 100%

- TBT June $32 calls at .35, now .77 – up 120%

- AGQ $255 June calls at $2, now .50 – down 75%

NFLX, CMG, PCLN, WYNN, BIDU – it’s a MoMo-fest holding up the Nasdaq and could become super-ugly if it breaks. – 11:14 in Member Chat

QQQ July $57 puts at $1, now $2.75 – up 175%

RIMM June $37.50/40 bull call spread at $1.65, selling $37.50 puts for .83 (net .82), now -$1.48 – down 277% (this position can be "fixed" by simply rolling the June $37.50 puts ($2.26) to the Jan $32.50 puts at $3.30 for a net credit of $1.04 and cashing out the spread at .80 means you are in the Jan puts at $1.84 for a net $30.66 entry. This is the advantage of only selling calls on stocks we actually want to own – the adjustments are fairly painless (also, the bull call spread should have stopped out at no more than 50% down).

- Profits were taken on oil at $100 – up Billions!

- IWM weekly $81 calls at $2.05, out at $2.25 – up 10%

Thrilling Thursday – Can We Make Another Billion Today?

Thrilling Thursday – Can We Make Another Billion Today?

Wednesday could not have gone better. We had widely circulated our Wednesday article on how to break the NYMEX speculators and the futures trade idea from Wednesday’s post to short 376,620 NYMEX contracts (1,000 barrels per contract) at $103 were good for a $1,129,860,000 profit – plenty to go around for all of our readers to participate and, more importantly, plenty of PAIN for the manipulators who were trying to generate fake demand for oil at $103 (the mechanics of this were explained in Wednesday’s post). Did we directly cause the NYMEX to collapse or was our timing just perfect? Either way, it worked and it worked so well that we relentlessly kept after them and shorted oil again at the $101.50 line in the new post.

We expected a dead cat bounce off the drop to our Must Hold lines so we led the day off with short put plays in our Morning Alert to Members aimed at generating $3,000 in income by June expirations that did not do too terribly considering the market has fallen an additional 3.75% since then:

- 10 INTC June $22 puts sold for .47, now .70 (down $230) – our eye is on rolling these to the July $22 puts at .97, putting another $270 in our pockets as we have faith on INTC into earnings.

- 5 GS June $130 puts sold for $2.40, now .45, (up $975) – these look good to expire worthless but, of course a stop at .60 is prudent to lock in gains

- 5 RIMM June $40 puts sold for $1.65, now $4 (down $1,175) – as above, these can be rolled to the Jan $35 puts at $4.30, putting another $150 in your pocket and the worst case is you own RIMM at net $33.05. That’s why short put selling is a FANTASTIC way to initiate stock positions. Consider that RIMM was at $40.43 on the second and fall to $36.56 as of Friday’s close so the puts ONLY lost $2.35 while the stock itself lost $3.87 so we are down $760 LESS than if we had bought 500 shares of the stock. Not only that but, rather than take even the $1,175 loss, we can simply postpone our purchase to January and now we have bought ourselves another $5 discount for our patience AND, if RIMM continues to fall, we can roll the Jan $35 puts ($4.30) to the 2013 $30 puts at the same price. So, as long as RIMM doesn’t go bankrupt and as long as RIMM doesn’t fall more than 15% a year – we can keep doing this all the way to zero if we have to! We can also employ call covers to collect more cash but you can see how powerful just the simple put-selling strategy can be to generate income AND protect your entry decisions.

- 5 HD June $35 puts sold for .75, now $1.71 (down $480) – can be rolled out to the August $34 puts even.

- 5 BA June $75 puts sold for $1.10, now $2.45 (down $675) – cab be rolled out to the July $72.50 puts at $2.05. Isn’t that amazing, we spend .40 of the $1.10 we collected and now we can own BA for net $71.80, which is $4 LESS than the $75.69 we entered at on the 2nd. Keep in mind these are BUYING strategies that happen to generate an income (if we don’t get our discount prices) so, rather than LOSING over $2,000 by buying the stock a little before the bottom, we have a $675 paper loss (and we can just take that loss if we change our mind about BA, but we haven’t) which only kicks in if we either end up buying BA BELOW $71.80 in July (now $72.69) or at whatever strike we roll to after that.

In a normal market, we would just buy the stocks and hedge them but the market looks very weak so we’d rather hold our cash until we see a clear bottom. Also keep in mind this is something we can do every month that generates $3,000 in any flat or up market and even in this severe downturn (down 3.75% in a week), we only have a net $1,585 on the 5 positions so it’s easy enough to just pay the fine, walk away and try again in July. We still have a week to expirations and we do expect a bounce so we’ll see if these don’t turn around by next Friday but, if not, we execute our Rawhide Strategy and keep rollin’, Rollin’, ROLLIN‘…

It’s amazing how much great investing advice you can get from John Belushi (see Animal House). Anyway we didn’t get much of a bounce at all and kept heading down, great for our oil puts, not so good for the above short puts but that was just the Morning Alert to our Members and we didn’t even get to the winning trade in the same Alert that made up for all the losses of the short puts:

- 20 USO June $40 puts at net $1.10, out at $1.75 (up $1,500) – see how good it is to hedge? 5 long plays by themselves = $1,585 loss. 5 long plays and one short hedge = $85 loss but the losses are just on paper and the $1,500 is real cash in your pocket!

- XLF July $15 puts sold for .50, now .55 – down 10% – I still like these. In fact, we waited for two whole weeks to get our fill at .50 as we would be thrilled to own XLF long-term at net $14.50.

- Oil futures short at $100.60 – only $900M to be made on Thursday, a great disappointment.

$98.96!!! I feel another Billion coming on…. – 11:24 comment to Members

Same as yesterday except we started at $101.50 so $98.50 is good for an exit on oil and that’s $1.70 on the USO June $40 puts and that’s a nice gain too so all done in the $25KP and the futures for now! – 11:37 comment to Members (puts came in .05 better, bottom call was PERFECT!)

PLX Nov $2.50/5 bull call spread at $1.95, selling $5 puts for .50 (net $1.45), now $1.50 – down 3% – Our buy/write strategy will show paper losses when the VIX rises, even when the trade itself is on track. PLX is at $6.35 and is actually UP from our entry. We don’t care as long as they are over $5 at November expirations we make $1.05 (72%).

Playing the bounce/Asaenz – You have to think of it like a trampoline – it may bend a bit lower but not that likely to break. As I just said above, if oil doesn’t fail then XLE and OIH and XLF (who have way too much invested in commodities) may be able to recover but, if oil breaks lower – those levels may be toast. As the great and powerful WOPR once said: "Sometimes, the only winning move is not to play" – at least until we have more information. – 12:15 comment to Members

- Yet another oil short call at $100.50 at 2:21 – laid out Futures Scaling Strategy in Member Chat that day. – we hit $99.50 the next morning for gains of $500 per contract

- FAS weekly call spread at net .02 credit, expired at .14 – up 800%

- S buy/write – selling Jan $6 puts and calls for net $4.33/4.67, now net $3.72 – down 20%

S 2013 $5/7.50 bull call spread at $1.10, selling $5 puts for .76 (net .34), now net -.25 – down 173% – that’s silly of course because it’s an ownership play but the net is so cheap that a small fluctuation makes a very poor percentage loss. Still, notice how nice it is to pair a small hedge, like FAS (which was bearish) with bullish entries. Rather than getting burned with losses, this combination could have easily netted out a winner and we STILL own S for the long-haul.

Buying/David – I would not be so gung ho to buy things tomorrow. Best to stay cashy into the weekend! – 3:29 comment to Members

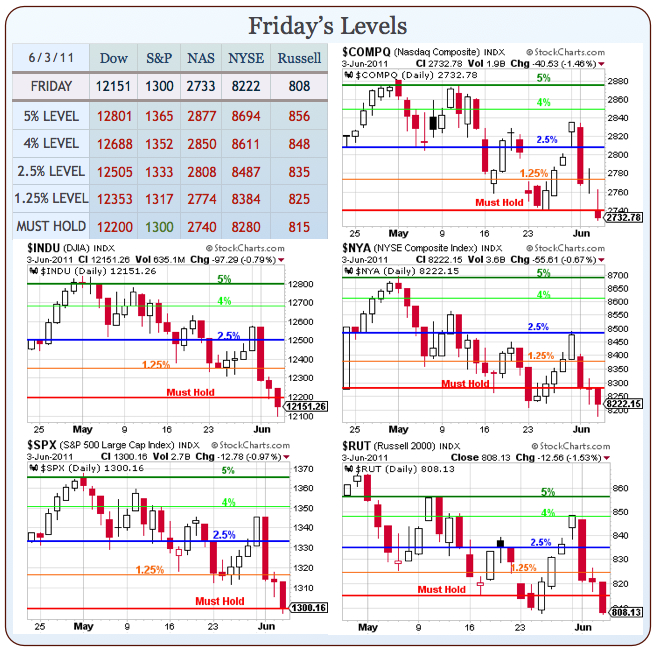

Damn! Look at the candles on the NYSE and the Nas – RIGHT on the lines! These are levels we have tracked all year – how’s that for a working system? Dow popped right off the floor at our spot, RUT about the same, only the S&P accomplished an air turn and we’ll see how they handle 1,317 tomorrow but doesn’t just saying 1,317 out loud make you realize how shakey things are? – Special Alert to Members at 4:44 am on 6/2

I think it’s a lose-lose because, if jobs suck, commodities keep falling and that drags the market down but, if jobs are good, then the Dollar goes up and that drags the market down. – Comments on Non-Farm Payroll Report at 5:58 am

TGIF – Stopping the Slide or Just Sliding to a Stop?

TGIF – Stopping the Slide or Just Sliding to a Stop?

I apologized for there only being $940M to be made on the NYMEX on Thursday – we really wanted that Billion but they had cut down the number of contracts available to sell faster than we could accept their phony offers to buy. I reiterated our strategy and renewed my call to the President to give me $3Bn and the keys to the Strategic Petroleum Reserve so I could smash the speculators and pay off the national debt at the same time. Obama did not give me $3Bn but HE DID open the SPR for us – allowing us, once again, to have a good old time shorting oil!

Non-members should note that we don’t usually spend so much time shorting oil but we do like to spend our time making money and oil was certainly where the money was the past couple of weeks!

We just took some longs in the futures in Member Chat as the Dow hit 12,100 and the Nasdaq hit 2,300 so we’ll see how those go with tight stops but that, along with $98.50 oil, was a discount trifecta we couldn’t turn down so – come on oil crooks – work your magic as we’re with you this morning! – Morning Post Commentary

- Oil went from $98.50 back to $101.50 – another $1,000 per contract (crazy, isn’t it?)

- Dow futures (/YM) went from 12,100 to 12,200 at $5 per penny per contact = $500 gain per contract

- Nasdaq futures (/NQ) went from 2,300 to 2,315 at $5 per .25 = $300 gain per contract.

- USO June $39 calls (yes, calls) at .85, topped out at $1.30 – up 52%

- QQQ June $57 calls at .50, topped out at .65 – up 15%

- NFLX June 10th $275 calls sold for $5, expired worthless – up 100%

TZA Jan $34/46 bull call spread at $3, selling RUT Dec $500 puts for $4 (net $1 credit), now net .50 credit (up 50%) – this is tricky but we collected $1 ($100 per contract) and now, if we want to buy it back, it would cost us $50 to get out so a net $50 gain. This is a fabulous hedge because we make money as long as the Russell holds 500 (now 779) so we expect wild swings in value but there are many ways to win this potential 1,300% gainer but up 50% on a 3.75% drop in the market is a great start!

TZA Jan $34/46 bull call spread at $3, selling RUT Dec $500 puts for $4 (net $1 credit), now net .50 credit (up 50%) – this is tricky but we collected $1 ($100 per contract) and now, if we want to buy it back, it would cost us $50 to get out so a net $50 gain. This is a fabulous hedge because we make money as long as the Russell holds 500 (now 779) so we expect wild swings in value but there are many ways to win this potential 1,300% gainer but up 50% on a 3.75% drop in the market is a great start! - TZA Jan $34/46 bull call spread at $3, selling BA Jan $62.50 puts for $2.55 (net .45), now $1 (up 122%) – despite our Boeing trouble on the short puts, the Jan puts only went up to $2.70 while the TZA spread rose to $3.70 so good deal for us again. The reason we have two of these plays is most people don’t have Virtual Portfolio Margin accounts that are required for the trade with the short RUT puts so we pick a stock we REALLY want to own for the net (BA at $62.95) as our offset.

Again, look how nice it is to have a little downside hedge and notice that we took it (in this case at 10:18 am) after we put up a few bullish trades. BALANCE – it is ALL ABOUT BALANCE! As the great Mr. Miyagi said in the Karate Kid: "Better learn balance. Balance is key. Balance good, karate good. Everything good. Balance bad, better pack up, go home. Understand?" Substitute "trading" for "karate" and it’s probably the best advice I can possibly give you.

- CSCO 2013 $15 puts sold for $1.90, now $2.30 – down 21%

So, what do we have? Lots of Fed speak (and 2 shots later today too). Small auctions on Monday shouldn’t be market movers. Tuesday is the normal nonsense except Consumer Credit may show stress from high gas prices. Beige Book Wednesday can’t possibly paint a good picture and the 10-year (Weds) and 30-year (Thurs) both run the risk of being bad. I certainly don’t see any data points we can count on so a bull-market premise very much depends on the Fed’s ability to talk the Dollar back to 73. If something bad happens in Europe or Asia over the weekend, the Dollar could pop and we will fly below our must hold levels and things can get VERY MESSY so make sure you are well-covered into the weekend! – My comment to Members at 11:37 am on Friday, 6/3

- Oil futures short at $100.50, stopped out at $100 – up $500 per contract.

- USO June $40 puts at $1.10, now $2 – up 82%

- USO June $40 put at $1 average (nearer the close), now $1 – up 100%

- Oil futures short at $100.60, stopped out at $99.25 on Monday Morning – up $1,350 per contract

$1000.60 on oil – this is back to our sweet spot in the futures for a short but don’t forget they pushed it to $101 yesterday after hours and weekend futures are very messy as they close about 5pm but don’t open again until Sunday at 6pm so anything can happen in 2 days! – 2:52 pm comment to Members

Disasters/Gucci – As I said above, I like that TZA spread and it’s really a matter of if you feel well-covered or not. We don’t get all freaked out on being below the lines for a single day but I am VERY concerned that we’re below the lines and the Dollar is at 73.79 – that’s down almost 1% and the markets are down 1.5% so another 2.5% drop today – NOT GOOD. – 3:29 comment to Members

In Member Chat last weekend I reviewed 6 disaster hedges from the end of April/Early May to remind Members how amazingly effective a little hedge could be to protect your overall virtual portfolio. This the THE MOST IMPORTANT use of options – the rest is just having fun with leverage but options are a very powerful tool that can and SHOULD be used to hedge conservative virtual portfolios.

All in all, a pretty good week and an appropriate place to take a break and call this part one of the post as it’s getting a bit long. I hadn’t intended to make it so chatty but the main idea is to have a reference point so we can learn and improve in the future so it turned out that I did feel like there were things that were worth saying (and repeating).

I’m not sure there will be a Part II as Stock World Weekly did very extensive (and very good) coverage of last week’s exciting trading and, with an even more exciting expiration week ahead – I’m in more of a looking-forward mood at the moment!