Are we "still too heavy"?

Are we "still too heavy"?

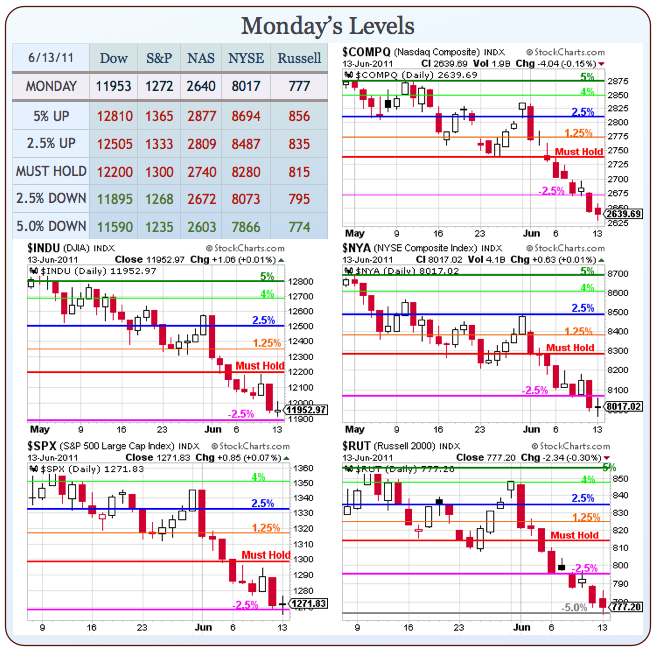

That was what I said about valuations back on May 4th, when we set new watch levels. $96 was our goal on oil, we hit that and went long yesterday. Of course, in our upside-down Wonderland Market, falling oil prices are somehow BAD for the Transports and we thought we accounted for that with our 2,448 target but they failed that last week and fell another 125 (5%) since then. Similarly (easier to write than say), the Nasdaq blew through our 2,700 line and bottomed out at 2,639 yesterday (-2.25%) but the Russell has been the biggest surprise, leading us all the way down to 773 in yesterday’s action before bouncing back to lucky 777.

As we expected yesterday, the Dollar was sacrificed on the altar of keeping the markets from going to Hell in a handbasket – dropping all the way from 75.20 to 74.80 (0.5%) which gave us only a flat market but the 74.60 line held in overnight and we’re back to 74.80 and now the pre-markets are wondering why they gained 0.75% in overnight trading. Oil popped all the way back to $97.80 before failing spectacularly back to $96.50 but we have stayed on the sidelines so far, waiting to see if we can establish a new (hopefully lower) range to trade in.

We did take a poke at higher oil prices with the USO July $39 calls at $1.10 and they finished the day right at $1.10 so very dull so far but we figured oil might be good for a pop into Wednesday’s inventories. We also shed most of our bearish bets on yesterday’s dip and flipped fairly bullish but we haven’t done a lot of bottom fishing yet as our main plan is to use a fake market rally to cash out the longs we have left and flip short into the holiday weekend. As the moment though, I have noticed that the Dow has been holding up much better than it’s peers and we have that lovely 12,000 line to use as a stop so let’s construct a short hedge that pays big bucks below 12,000:

Notice how the Dow is holding up better than the other indices. Part of that is a flight to safety as several Dow components are considered "safety stocks" like KFT, MCD, JNJ… But, in the long haul, they all fall down eventually so we can make a downside bet on the Dow that simply stops out over the 12,000 line with the DIA July $119/116 bear put spread (you buy the $119 puts and sell the $116 puts) at .95. That spread, by itself pays $3 (up 215%) if the Dow is below 11,600 on July’s expiration day (15th) but we can greatly enhance the returns by picking a Dow component we REALLY want to own and selling a short put to offset the cost of the spread.

The great thing about hedging with the short put offset is that, if the Dow does NOT go lower, it is doubtful that our short put Dow component will cost us money so our losses (on what is meant to be an overall protective hedge) is limited. We already played an AA spread yesterday so that’s a good one to start with (also alphabetically) and the July $15 puts can be sold for .63. That lowers our net on the bear put spread to .32 with an 837% upside on a Dow drop. On the Downside, we end up owning AA at net $15.32 (as we count the loss on the put spread) but, if we make $2.68 on the spread along with the .63 we collected for the short sale, then our entry on AA is down to net $11.75 – 22% lower than the current price. A couple of other fun Dow put sales are:

- BAC 2013 $7.50 puts at .60 – collect $600 (assuming 10 sold), net margin (may vary by broker) $750.

- CSCO Jan $14 puts at .92 – collect $920, net margin $1,900.

- DIS July $37 puts at .55 – collect $550, net margin $6,200.

- GE 2013 $15 puts at $1.40 – collect $1,400, net margin $1,400.

- HD Aug $32 puts at .82 – collect $820, net margin $5,150.

- HPQ Jan $31 puts at $1.60 – collect $1,600, net margin $3,100.

- INTC Jan 2013 $20 puts at $2.71 – collect $2,710, net margin $2,700

- MMM July $87.50 puts at .71 – collect $710, net margin $14,150.

- MSFT 2013 $22.50 puts at $2.75 – collect $2,750, net margin $3,100.

- VZ 2013 $35 puts at $5.10 – collect $5,100, net margin $6,318

- WMT Jan $50 puts at $2.05 – collect $2,050, net margin $7,750.

Keep in mind, when you sell 10 puts, you are committing to BUYING 1,000 shares of the stock at the strike price so make sure you REALLY, REALLY want to own the stock at the net entry! Notice some short sales give you more bang for your margin buck and I can’t, for example, imagine anyone who wouldn’t want to have 1,000 shares of GE at net $15 as a long-term hold, so sales like those are a no-brainer – if you have room in your long-term virtual portfolio. Others, like DIS, we make a bigger margin commitment because our chance of assignment is higher (DIS is now at $38.37) but we also know we can ultimately roll the July $37 puts to the Jan $30 puts (now .75) so we pay the higher margin on the assumption it will be held open for a short period of time.

If none of the above put sales appeal to you, then you are just super bearish and you should just take the bear put spread with a reasonable stop. Heck, it pays 315% back on your money so if you slap $3,500 down on the spread and the Dow falls below the 11,600 target, you get back $11,025 – THAT’s NOT BAD! So a reasonable amount with a reasonable stop (using that 12,000 line and perhaps a stop-loss of $1,000) keeps the risk down vs. the potential $7,525 reward. Don’t forget, when we’re hedging – it means we have bullish plays we’re protecting and hopefully they make more than $1,000 if the Dow heads back up.

I wanted to get that out of the way first thing BECAUSE we went bullish and it’s good to have a hedge – in case we are wrong. Also, any of those short put plays make nice, naked, income producers and are a great way to initiate a position in any of those stocks you may be interested in. If you have $500,000 in cash sitting on the sidelines and you’re not sure it’s a good time to jump into the market, selling those Dow puts generates $19,840 against $55,318 in margin (35%) and you can very simply protect against a drop by buying DIA puts if the Dow heads below 12,000 or 11,950 or whatever line violates you comfort zone. These are the kinds of trades we do in our Income Virtual Portfolio every month.

I wanted to get that out of the way first thing BECAUSE we went bullish and it’s good to have a hedge – in case we are wrong. Also, any of those short put plays make nice, naked, income producers and are a great way to initiate a position in any of those stocks you may be interested in. If you have $500,000 in cash sitting on the sidelines and you’re not sure it’s a good time to jump into the market, selling those Dow puts generates $19,840 against $55,318 in margin (35%) and you can very simply protect against a drop by buying DIA puts if the Dow heads below 12,000 or 11,950 or whatever line violates you comfort zone. These are the kinds of trades we do in our Income Virtual Portfolio every month.

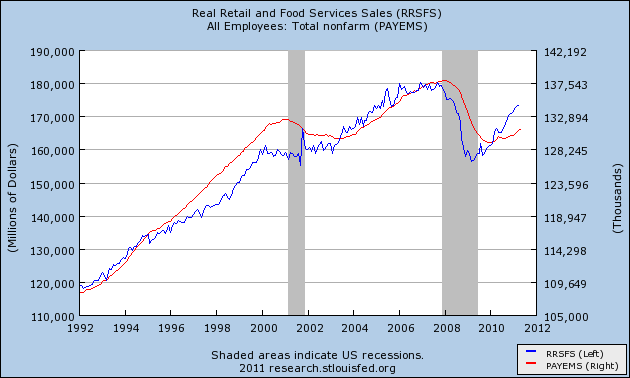

We have May Retail Sales, which should be better than -1% expected ex-auto but with auto, maybe worse. PPI is doubtful to be down to 0.1% although I guess we did pull back a bit off the crazy April commodity highs and it’s all relative to the prior month so maybe not so bad looking there either. Business inventories in April (which did have weak retail sales) is very possibly a build and people still think builds are good (on the assumption that they will be sold) so, on the whole, we could have a positive data day tomorrow. – My predictions for today from yesterday’s Member Chat

8:30 Update: I love it when a plan comes together! Retail Sales ex-auto were UP 0.3% and down 0.2% including auto sales. PPI was up 0.2%, as expected with even the core PPI up 0.2% and we’re waiting on Business Inventories at 10. My other prediction for the day was that some way, somehow – "THEY" would kill the Dollar and that already happened last night with the usual suspects like Bill Gross and Jim Rogers taking their whacks at the Dollar as these are men who are happy to work towards the destruction of the life savings of 300M Americans as long as it pays enough to gas up their Gulfstream. Think about it – when’s the last time CNBC asked a poor person what they thought about anything?

8:30 Update: I love it when a plan comes together! Retail Sales ex-auto were UP 0.3% and down 0.2% including auto sales. PPI was up 0.2%, as expected with even the core PPI up 0.2% and we’re waiting on Business Inventories at 10. My other prediction for the day was that some way, somehow – "THEY" would kill the Dollar and that already happened last night with the usual suspects like Bill Gross and Jim Rogers taking their whacks at the Dollar as these are men who are happy to work towards the destruction of the life savings of 300M Americans as long as it pays enough to gas up their Gulfstream. Think about it – when’s the last time CNBC asked a poor person what they thought about anything?

Assuming everything is going according to plan, Greece should be "fixed" again tomorrow and that will pop the Euro over $1.45 and the Pound should at least test $1.65 to give our market and extra boost as we gather momentum into expiration day. Our goal for Friday is to get back to those "Must Hold" lines at Dow 12,200, S&P 1,300, Nasdaq 2,740, NYSE 8,280 and Russel 815. I had commented to Members at 1:40 in yesterday’s chat that "I smell a bottom" and my after-hours comment on levels was:

Levels – Not a robust looking chart but we pretty much held Friday’s lows with the Nas and the RUT weak on the SOX downgrade so we can excuse them for today. The Nas is right on that -3.75% line, which would be the bounce zone off the 10% drop from the top. The RUT’s line would be about 785 so they really need to get there tomorrow somehow.

We’ll be watching to see if we can take out that key level today but it’s all about keeping the Dollar below 75 and, to do that, the Yen will have to sacrifice it’s current 80.54 level while the Euro needs to hold $1.44 and the Pound $1.64. The data wasn’t that good – it was just good enough to stage a rally – which is good enough to give us a cheap entry on our DIA hedge so we are happy, happy, happy this morning! Assuming they can jam the Dollar back down to 74.50, we’d be looking for 1.25-1.50% gains in our indices, which is just what they need to look better for the TA people.

We’ll be watching to see if we can take out that key level today but it’s all about keeping the Dollar below 75 and, to do that, the Yen will have to sacrifice it’s current 80.54 level while the Euro needs to hold $1.44 and the Pound $1.64. The data wasn’t that good – it was just good enough to stage a rally – which is good enough to give us a cheap entry on our DIA hedge so we are happy, happy, happy this morning! Assuming they can jam the Dollar back down to 74.50, we’d be looking for 1.25-1.50% gains in our indices, which is just what they need to look better for the TA people.

It almost seems silly to look at the news in such a blatantly manipulated market but it is kind of fun to see what excuses they will be using to justify this morning’s rally:

China had some nasty inflation, as we expected yesterday, at 5.5% officially for May. That’s the fastest (admitted) pace in 3 years. This makes it more likely the Central Bank will tighten and helps keep the Dollar down on the theory that China will have to float the Yuan to keep inflation in check. China has already hiked their reserve requirements to 21.5% for large banks and 19.5% for smaller lenders. Over in Japan, the BOJ kept their lending rate unchanged at 0-0.1% (and wouldn’t you feel ripped off if they are charging you 0.1%?) but they did raise their economic outlook saying "Japan’s economy continues to face downward pressure, mainly on the production side due to the effects of the earthquake disaster, but is showing some signs of picking up.” Ashley Davies contends the sharp move higher in equities following the Chinese data last night means the market was more concerned about economic slowdown, which hasn’t materialized.

India also had a lot of inflation, 9.06% over there for May as India still includes food in their inflation figures – something China recently chose to de-emphasize for some reason. Expectations are for a Central Bank rate hike on Thursday. Speaking of hikes: Greek (17.5%), Irish (11.4%), and Portuguese (10.8%) 10 year sovereign yields are all on the rise today, sitting at record highs. Spain and Italy are lower by a hair.

India also had a lot of inflation, 9.06% over there for May as India still includes food in their inflation figures – something China recently chose to de-emphasize for some reason. Expectations are for a Central Bank rate hike on Thursday. Speaking of hikes: Greek (17.5%), Irish (11.4%), and Portuguese (10.8%) 10 year sovereign yields are all on the rise today, sitting at record highs. Spain and Italy are lower by a hair.

Of course such awful news brings on DOCTOR DOOM and Professor Roubini has not been shy about his opinion that “The muddle-through approach to the eurozone crisis has failed to resolve the fundamental problems of economic and competitiveness divergence within the Union. If this continues the euro will move toward disorderly debt workouts and eventually a break-up of the monetary union itself as some of the weaker members crash out.” Sure we may have heard it all before (and it was totally wrong last year) but it is summer re-run season, after all….

As I said, we flipped bullish yesterday as we had a very nice sell-off and we caught it right and we’re not greedy. Now we’ll see what kind of bounce they can put together but – if it’s not a REALLY big on – we’re going to lose interest pretty quickly and get back to mainly cash, teeing up for a possible collapse in July. Tomorrow we get the CPI, which should be in-line with the PPI and also Industrial Production at 9:15 and, of course, our oil inventories at 10:30 so plenty of fun and games ahead of Thursday’s job losses, Housing Starts (DANGER!) and the not-so-fabulous-lately Philly Fed Report. Then Friday is expiration day so they really need today to get the momentum going if they are going to clear Thursday’s hurdle and take us into Friday back at our Must Hold levels.

Boy, this is exciting!