Reminder: Pharmboy is available to chat with Members, comments are found below each post.

By PragCap, with graph courtesy of Gordon T. Long

Robert Reich describes what’s wrong with the economy in 2 minutes. His bullet points (thanks to Stephanie Kelton):

- The economy doubles since 1980, but wages flat. Where did the money go…

- All (or most) of the gains went to the super rich. And…

- With money comes political power. Taxes on super rich slashed, revenues evaporate. This leads to…

- Huge budget deficits. Middle class agitated, fights for scraps…

- Middle class divided. Buying and borrowing slow. Resulting in:

- Anemic recovery/economy.

I would add one very important point that Mr. Reich misses here:

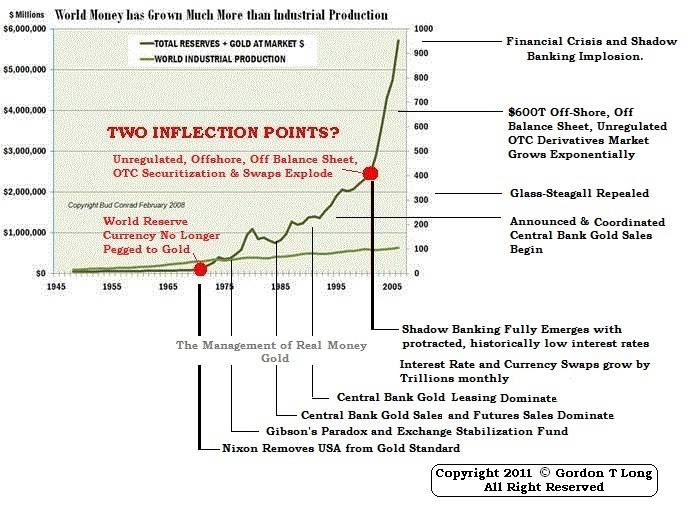

The real destruction has come in the growth of the financialization of the US economy. Since the 1970′s when the financialization of the USA began we have seen an increasing number of would-be entrepreneurs leave productive positions for Wall Street jobs where they largely help devise ways to help separate the middle class from their savings.

As the country grew more and more wealthy in the 1980′s and 1990′s (thanks to entrepreneurs like Bill Gates) the problem compounded because the demand for Wall Street’s services expanded (higher wealth meant higher demand for protecting that wealth). Wall Street convinces Main Street that the best way to protect their wealth is by giving it to them (2% at a time) and Main Street doesn’t know any better because they don’t (and still don’t) understand how the monetary system or the economic system in the USA actually works so they give their money to a trusted “expert”.

…Now we all suffer because of this cannibalization of capitalism.

Full article by PragCap here.