China is still rolling along and the Fed says "maybe" on QE3.

China is still rolling along and the Fed says "maybe" on QE3.

That was all it took to get us to yesterday’s highs but we took the money and ran at 2:24, when I told Members in Chat "DON’T BE GREEDY!" As I had mentioned in yesterday’s post, our Morning Alert to Members put us long on Dow Futures (/YM) at 12,400 and Nasdaq Futures (/NQ) at 2,350, which made vast sums of money of course with the Dow up well over 100 points at the time. During Member Chat yesterday, we took advantage of the early dip to go long on TBT, FAS, WFR and QQQ while killing our short positions on USO, EDZ and FXI (see Monday’s post) as they had a great run and WE ARE NOT GREEDY!

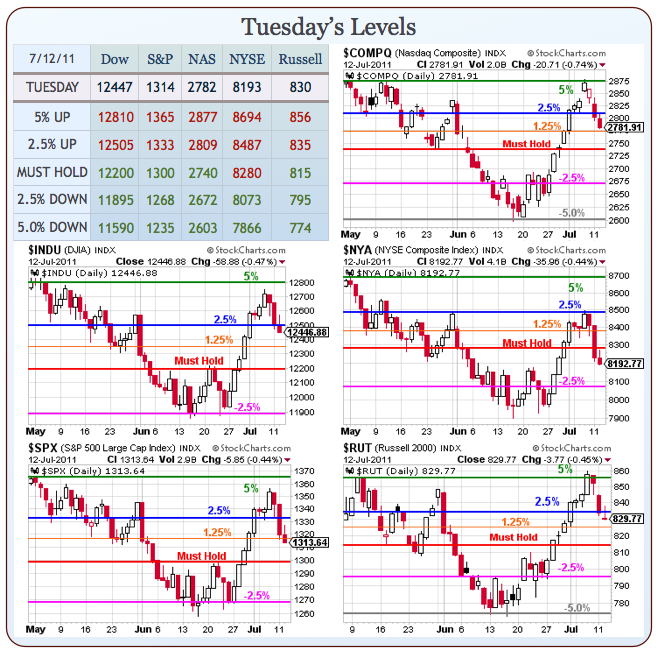

Of course we have our bull call spreads from last week so we’re pretty bullish BUT still cautious because our indexes are not holding their lines – especially the always-troubling NYSE, which did not hold the "Must Hold" line and when we name a line "Must Hold" well, it MUST be held!

The other thing I said to Members at 2:24 in yesterday’s Chat was:

Keep in mind this rally has 100 Dow points to go just to get us back to Friday’s close (12,660) so don’t be impressed with less (S&P was 1,344, Nas 2,860, NYSE 8,411 and RUT 852).

At the moment, we’re not even getting a 50% bounce of this morning’s bottom and Friday’s close was way below Thursday so it’s very easy to give us a "rally" by tanking the Dollar and floating rumors of MORE FREE MONEY but, for now – it does nothing to change the greater reality.

That’s good advise for today as well. A mere hint of QE3 does not change the cost of Italian debt, nor will it help our Treasury sell $21Bn worth of 10-year notes today at 2.9% (what kind of idiot would trust our Government to give them back Dollars with less than 3% interest to guard against inflation?), nor will it employ people and we ABSOLUTELY know that QE3, if done like QE2, is going to drive gasoline back over $4 (retail) and food to unbearable prices.

![[15691771-15691774-slarge.jpg]](http://1.bp.blogspot.com/_gy4LhGejSsA/Rq9hxGxLuGI/AAAAAAAABS0/Y07sFIyGBYo/s1600/15691771-15691774-slarge.jpg) Speaking of food – US ethanol refiners are now consuming MORE corn than livestock and poultry farmers for the first time, causing disastrous rises in the price of food as 40 PERCENT (40%) of last year’s corn harvest (5Bn bushels!) was burned up as fuel. Just to put this in perspective – only 10% of the entire US corn crop (1Bn Bushels) is actually consumed as food (think popcorn, corn syrup, corn flakes, corn starch, corn meal and, of course, corn on the cob, to get an idea of how much people eat!).

Speaking of food – US ethanol refiners are now consuming MORE corn than livestock and poultry farmers for the first time, causing disastrous rises in the price of food as 40 PERCENT (40%) of last year’s corn harvest (5Bn bushels!) was burned up as fuel. Just to put this in perspective – only 10% of the entire US corn crop (1Bn Bushels) is actually consumed as food (think popcorn, corn syrup, corn flakes, corn starch, corn meal and, of course, corn on the cob, to get an idea of how much people eat!).

So, with 300M people in America on the "all the corn you can eat" plan consuming "just" 1Bn bushels (3.3 bushels per person), consider that if we DIDN’T put 5Bn bushels in our gas tank and burn it – we could feed another 1.5 BILLION people! Isn’t that great – World hunger could be solved if Americans would just stop being idiots! Ethanol has many issues but enough food to feed 1.5Bn people replaces just 15% of our gasoline consumption – getting people to inflate their tires properly would replace 10% by itself…

We have driven corn prices 90% higher than a year ago with 5Bn bushels of corn creating 13.7Bn gallons of gas. How much cheaper is ethanol than gasoline? In Chicago trading yesterday, ethanol futures were 30 cents cheaper than gasoline futures and at 15% of a gallon of gas – that’s 4.5 cents a gallon saved (but it’s subsidized so we’re really paying for it in taxes anyway) but we pay $7 for a bushel of corn vs $3.75 last year. Boy are we dumb-asses!

We have driven corn prices 90% higher than a year ago with 5Bn bushels of corn creating 13.7Bn gallons of gas. How much cheaper is ethanol than gasoline? In Chicago trading yesterday, ethanol futures were 30 cents cheaper than gasoline futures and at 15% of a gallon of gas – that’s 4.5 cents a gallon saved (but it’s subsidized so we’re really paying for it in taxes anyway) but we pay $7 for a bushel of corn vs $3.75 last year. Boy are we dumb-asses!

Of course we could only WISH that was the dumbest thing being done in America these days but PLEASE – we still have our Government – and we elect only the dumbest of asses. Today Congress gets to chat with the Chairman of the Fed and, if you ever needed a reason for why I think there should be tests to see if people are smart enough to serve in Congress – just listen in on the questions they ask Bernanke (and this is the Finance Committee!).

The goal of the Republican Congresspeople is to get The Bernank to say QE3 as often as possible because their Bankster constituents want MORE FREE MONEY. The goal of the Democratic Congresspeople is to get The Bernnak to say that you can’t balance a budget without raising taxes or, failing that, to say that cutting Government spending does not create jobs. The goal of Ron Paul is to launch his 2012 Presidential campaign so let’s look forward to another exciting episode of "When Ron Paul Attacks".

Senate Republicans weaseled out of accepting Obama’s challenge to match one Dollar of tax cuts to $3 of spending cuts – proving they are not in the least bit serious about cutting the deficit – as they unexpectedly proposed that President Obama be given new powers allowing him to request an increase of up to $2.5T in the debt limit as long as he simultaneously suggested spending cuts of greater size. Notably, legislative technicalities mean the debt limit increase would be a shoe-in with no guarantee the spending cuts would ever face a final vote.

Senate Republicans weaseled out of accepting Obama’s challenge to match one Dollar of tax cuts to $3 of spending cuts – proving they are not in the least bit serious about cutting the deficit – as they unexpectedly proposed that President Obama be given new powers allowing him to request an increase of up to $2.5T in the debt limit as long as he simultaneously suggested spending cuts of greater size. Notably, legislative technicalities mean the debt limit increase would be a shoe-in with no guarantee the spending cuts would ever face a final vote.

This is, of course, a trick because it means a Republican President could spend another $6Tn (Bush still holds the record!) that we don’t have on bombs, tax cuts and oil subsidies while SIMULTANEOUSLY gutting Social Security, Medicare, School Lunches, Public Transportation and of course all the budgets for our regulatory agencies to keep them away from Big Business as they ship another 20M jobs overseas. If you care, this is one you should really write to your Congressperson (this post can be Emailed or Twittered or FaceBooked below) about as this plan is PURE EVIL!!!

We’re playing today bullish as long as they can get the Dollar below that 76 line and as long as we can quickly get the S&P over that 1,320 line and the NYSE holds 8,200. Of course we will be shorting oil on it’s silly run-up into inventories at 10:30, hopefully with another chance to short the Futures (/CL) below the $97.50 mark. USO Aug $37 puts at $1 should be a fun way to play as well.

It’s going to be a crazy day – be careful out there!

Email This Post

Email This Post  del.icio.us

del.icio.us  Digg

Digg  Reddit

Reddit  Stumble

Stumble  Yahoo

Yahoo ![]() Facebook

Facebook ![]() Twitter

Twitter