We got nothing useful from Bernanke yesterday.

We got nothing useful from Bernanke yesterday.

That’s not stopping the futures from running the Dow up 100 points off of yesterday’s bottom (8am) though because we’re back to that kind of BS market where you go long at the close (or after the close as was yesterday’s case) and then short after the morning pop because the data (reality) is TERRIBLE but the manipulation is so rampant that it’s reliable.

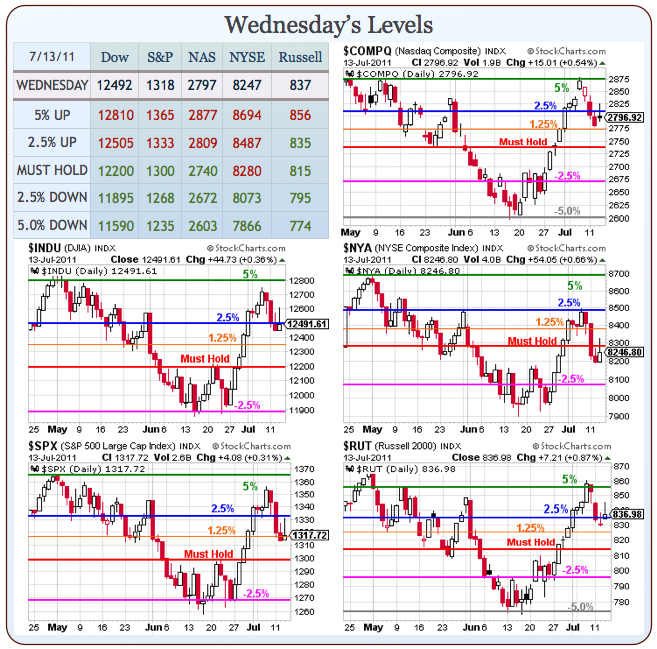

Fortunately, we have our 5% rule to guide us and we haven’t had a reason to change these charts in months as the market is obeying our range perfectly. Heck, these are the same lines we’ve been using since last November as the market is right where we predicted it would be for Q2 earnings.

Speaking of earnings: So far, so-so is the verdict with fairly uninspiring reports although JPM came in pretty well this morning, which suits us just fine because it’s one of the few specific financials we’re long on. Tomorrow morning we hear from C and FHN – that should be a lot more interesting than JPM’s report (5% beat).

We have a lot of data coming our way today, including the PPI, Retail Sales, Jobless Claims, Business Inventories, the Fed Balance sheet and the money supply along with day 2 of Bernanke’s BS on Capitol Hill – as if it really matters.

We have a lot of data coming our way today, including the PPI, Retail Sales, Jobless Claims, Business Inventories, the Fed Balance sheet and the money supply along with day 2 of Bernanke’s BS on Capitol Hill – as if it really matters.

Our trading day is already pretty much done as the old 3am trade worked like a charm and I called a top for Members at 5:33, when oil futures (/CL) hit the $98.50 line (now $98), which is up $500 per contract already so a nice base to get the morning started. This is just our normal monthly cycle of sticking it the speculators over at the NYMEX so thanks again boys – we couldn’t do it without all your efforts to screw over the American public so – right back atcha!

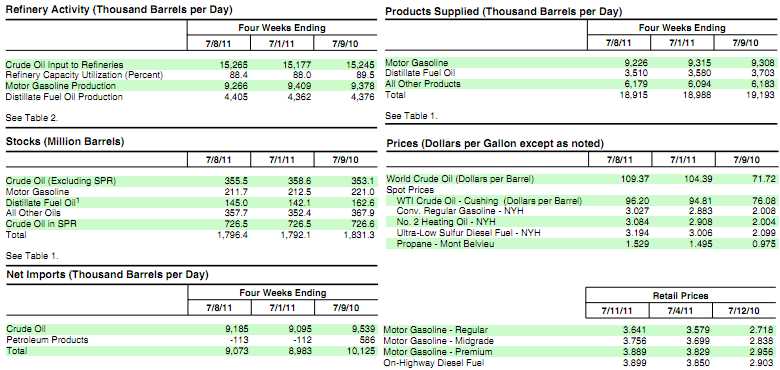

Once again yesterday we had a net build in US petroleum inventories of a whopping 4.3 Million barrels, led by a huge build in distillates and STILL not one drop of oil has been removed from the SPR. Imports picked up by 90,000 barrels a day but we are still being short-shipped over 7 Million barrels a week so over 11M barrels a week of demand destruction in the US with oil averaging $96.20 a barrel, still up 26% from last year despite 8% drop in US demand. Keep in mind that an 8% drop in US demand offsets a 20% rise in China, as they use just 9Mb per day but Chinese consumption has actually been pretty flat lately and 80% of 9 is 7.2Mbd and that’s where they were back in 2005 so our 1-year drop in consumption has already offset 6 years of Chinese growth – THAT’s the kind of BS CNBC is spouting when they try to sell you the "Chinese Demand" story – it only sounds good to people who can’t do the math – but that’s the audience they count on!

As Abraham Lincoln once observed, you can fool some of the people all of the time and all of the people some of the time and, as PT Barnum pointed out – we just need the fools with money. That’s what the oil market is all about because fools and their money are soon parted and the lack of regulation, dark pool trading and blatant manipulation make this the World’s longest running (and most costly to society) con game in history. Still, if Da Boyz at the NYMEX want to pretend they want to buy 185M barrels of oil at $98.50 or higher for delivery next Thursday – we will be thrilled to sell it to them!

|

Click for

Chart |

Current Session | Prior Day | Opt’s | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Aug’11 | 97.43 | 20:07 Jul 13 |

0.62 | 322211 | 97.43 | 185084 | Call Put | ||||

| Sep’11 | 95.75 | 20:07 Jul 13 |

0.64 | 130692 | 97.85 | 276749 | Call Put | ||||

| Oct’11 | 96.89 | 20:07 Jul 13 |

0.63 | 41545 | 98.27 | 79694 | Call Put | ||||

| Nov’11 | 78.01 | 20:07 Jul 13 |

0.62 | 29108 | 98.74 | 71525 | Call Put | ||||

| Dec’11 | 101.31 | 20:07 Jul 13 |

0.63 | 50153 | 99.24 | 201725 | Call | ||||

Already they’ve had to jam 276M barrels worth of contracts into the September delivery schedule and they might get away with this roll as they have 5 sessions left to move about 160,000 contracts (1,000 barrels per contract) from August to September with a rolling cost of just .44 per barrel. That’s still a $70M hit on 160M barrels and they already spent about 80M rolling the last 200M (because September looked like October a month ago) but what happens when that 300 Million barrel monthly roll hit’s December, which already has 200M barrels backed up in it? Yep, this is going to be fun!

"Only" 405,000 Americans lost their jobs last week, with is 22,000 better than last week but Continuing Claims were up 15,000 to 3.73M. The Producer Price Index dropped 0.4%, which is double what was expected but the Core PPI is UP 0.3%, which is 50% more than expected. A 3% drop in Crude Goods and a 2.4% drop in Food Prices masked some VERY NASTY inflation everywhere else – keep in mind it’s that Core PPI that the Fed uses to pretend inflation is in check and now that’s growing at a 3.6% annual pace and energy and food are already up 20% in the "non-core".

"Only" 405,000 Americans lost their jobs last week, with is 22,000 better than last week but Continuing Claims were up 15,000 to 3.73M. The Producer Price Index dropped 0.4%, which is double what was expected but the Core PPI is UP 0.3%, which is 50% more than expected. A 3% drop in Crude Goods and a 2.4% drop in Food Prices masked some VERY NASTY inflation everywhere else – keep in mind it’s that Core PPI that the Fed uses to pretend inflation is in check and now that’s growing at a 3.6% annual pace and energy and food are already up 20% in the "non-core".

June Retail sales were up 0.1% vs. down 0.1% expected by Economorons but was unchanged ex-auto vs. 0.2% (revised down from 0.3%) last month. So last month’s gain was overstated by 50% and this month Retail Sales are up 0.1% but prices are up 0.3% so – I’m not a "professional" economist but doesn’t that mean that people bought 0.2% LESS stuff and the only reason we had a gain is because they had to pay more money on the things they didn’t cut back on?

Is this bullish? I don’t think so… Auto sales were down 1.6% last month and that’s the only reason there is any kind of positive in this report as they bounced back a bit in graduation season. Gasoline sales were down 1% and sales at Food Services and Drinking Places were off 2% in June so we may be getting some disappointing results from US restaurants. Overall spending was down 4.5Bn from May in the "Not Adjusted" column but in the "Adjusted" column we look flat to May and that’s giving the market some hope and should give us another crack at shorting oil at $99 (tight stops, of course)! What a gift to start our day.

More nonsense from The Bernank this morning and we’ll be watching the Dollar, which will cause trouble for the markets if they can’t keep it below 75.25 and that would be some trick with the BOJ worrying about a Yen that is now trading at just 78.9 to the Dollar – a very scary level for Japanese exporters.