As we expected on Friday morning, the EU stress tests were not good.

As we expected on Friday morning, the EU stress tests were not good.

My comment to Members at 3:41 on Friday, as we had an "incredible" (as in NOT credible) rally into the close was: "Notice how we went down on very heavy volume but we went up on two massive spikes – one at 2:45 and on at 3:05 and the rest was just suckers being reeled in to follow the move who got sold right back into. I’m still liking SQQQ, Aug $22/23 bull call spread is .55 now and you can sell the $21 puts for .50 for net .05 on the $1 spread. LOL – CNBC is surprised. Bill says "Hey, look at that, a rally in the last 20 minutes!" It’s only surprising when there isn’t one…"

After the bell, we discussed the fact that you can still trade the index puts after hours and the QQQ weekly (7/22) puts at .70 looked attractive too. That left us a bit bearish going into the weekend (as planned) so last night (yes, Sunday) I sent out a 10:16 Alert to Members to with trade ideas to go long on the Futures (Down, S&P, Nasdaq and Russell) while taking the short position on oil (/CL) at $97.50 and gasoline (/RB) at $3.15. By midnight we had our highs for the morning and at 2:49 am I commented it was time for the 3am trade (bullish on markets as the Dollar pulls back) and we set our stops at 4:46 and went back to bed and the market topped out 20 minutes later and gave us yet another bullish reload back at our levels – NOW, at 8am.

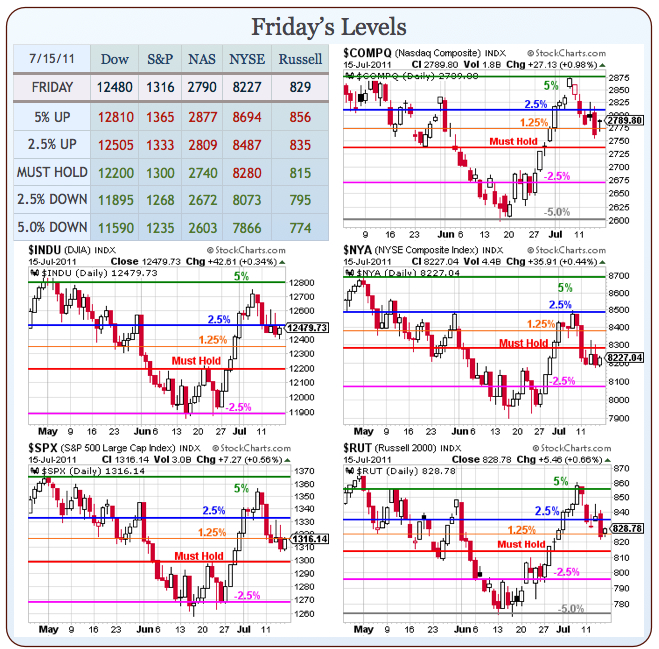

What were the bullish levels? Today there were for futures crosses above 12,375 on Dow futures (/YM), 1,306 on the S&P futures (/ES), 2,345 on the Nas (/NQ) and 623 on the RUT (/TF). We’re not to proud to make the same play over and over and over again – as long as it keeps working, right? This is the great thing about futures trading – it lets you make little adjustments to your virtual portfolio LONG before the rest of the market is in play. Had the markets gone straight down – we would not have needed to chase as we took the aggressive puts into the close but, as they found a floor – we were able to add longs, knowing we already had adequate downside protection. At this point (3rd time long) we have tight stops as we still expect a weak open based on the "sloppy M pattern" I pointed out in Member Chat this morning.

What were the bullish levels? Today there were for futures crosses above 12,375 on Dow futures (/YM), 1,306 on the S&P futures (/ES), 2,345 on the Nas (/NQ) and 623 on the RUT (/TF). We’re not to proud to make the same play over and over and over again – as long as it keeps working, right? This is the great thing about futures trading – it lets you make little adjustments to your virtual portfolio LONG before the rest of the market is in play. Had the markets gone straight down – we would not have needed to chase as we took the aggressive puts into the close but, as they found a floor – we were able to add longs, knowing we already had adequate downside protection. At this point (3rd time long) we have tight stops as we still expect a weak open based on the "sloppy M pattern" I pointed out in Member Chat this morning.

After seeing Friday’s prop job, we think anything can happen this morning and, frankly, we’d love to see them take it back to the midnight highs in the futures, which was S&P 1,315 and Russell 830, so we can get a chance to set up some more bearish hedges (we already did the Nasdaq and use the Dow for a long-term hedge) as we approach what John Nyardi calls "T Minus 5 and Counting to Economic Armageddon" (way to sugar-coat the title John!).

The key for the S&P is whether or not they can hold that 200 dma. If they cannot, they will pull that 50 dma sharply lower and that will likely cause an infamous "death cross" around the end of August and that will not bode well for the end of the year and, in fact, will begin to look very much like the Fall (and I do mean FALL) of 2008. Every day the S&P spends below that 50 dma tugs it lower – so even a move down that "successfully" tests support of our -2.5% lines, will actually be LESS encouraging as we really can’t afford a triple test of our lows:

Over in our Chart School, Declan Fallon has a more bullish take on the action, saying: "While it takes little to scare traders on the daily chart, there is little of real concern on the weekly chart. Yes, last week’s volume ranked as distribution, but all key indices are trading inside well defined channels. The Nasdaq eased away from 2,887 resistance, but weekly support is down at 2,700, some 90 points away from Friday’s close." We are, of course, long-term bullish, based on our premise that inflation will take hold and send everything flying higher over time. Declan’s weekly channel on the Nasdaq bottoms at 2,700, which is below our -2.5% line but his Russell channel bottoms at 775, right on our -5% line. Overall though, we see essentially the same range bottoms and now it’s up to our clueless leaders to "fix" the EU and US debt crises.

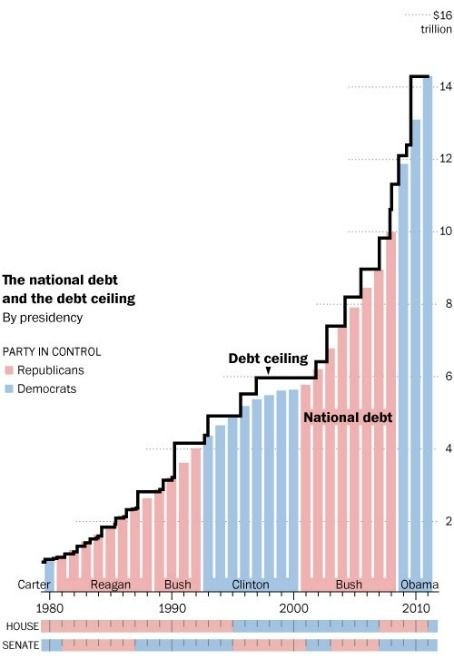

But what if they don’t want to fix it? What if, for example, one of the key participants stood to make a great deal of money by NOT having a debt ceiling agreement and putting the US into default? What if that someone was the GOP’s Chief Debt Negotiator, Eric Cantor? That’s right, Eric Cantor has bet more than a month’s salary on TBT – the ultra-short Treasury ETF and not only refused to abandon the position when conflict issues were raised but has apparently INCREASED his bet on a US Debt Default over time – the very Debt Default he is SUPPOSEDLY negotiating to avoid.

But what if they don’t want to fix it? What if, for example, one of the key participants stood to make a great deal of money by NOT having a debt ceiling agreement and putting the US into default? What if that someone was the GOP’s Chief Debt Negotiator, Eric Cantor? That’s right, Eric Cantor has bet more than a month’s salary on TBT – the ultra-short Treasury ETF and not only refused to abandon the position when conflict issues were raised but has apparently INCREASED his bet on a US Debt Default over time – the very Debt Default he is SUPPOSEDLY negotiating to avoid.

"Cantor’s involvement in the fund and negotiations is not ideal," TMF’s Matt Koppenheffer said. "I don’t think someone negotiating the debt ceiling should be invested in this kind of an ultra-short. We can only guess how much he understands what’s in his virtual portfolio, but you’d think a politician would know better. It looks pretty bad."

Because of this and other Republican idiocy, Jonathan Alter wrote an article in Bloomberg this weekend explaining "Why Obama has Already Won the Debt-Limit Fight." Meanwhile, my gal Michelle is looking like the front-runner in Iowa – a fantastic illustration of what a complete farce the Republican party is! Sadly, it won’t matter if Obama wins in 2012 because, if the Republicans still control the House and we have 4 more years like this one – it’s all over anyway.

I pointed out to Members this weekend that we had an opportunity to study Republican Logic 101, which is: "We can’t get a $4Tn deal done so let’s complicate things further by pushing for a $9Tn deal that will also never happen" – Coburn of Oklahoma to Offer $9 Trillion Budget-Cut Plan to Spur Debt Talks. We are finally getting to the end game where the Bankster puppets (in both parties) begin to push for our Federal Government, like Greece, to sell off our nation’s assets – as if we were already bankrupt and had given up on America’s future. THESE ARE OUR "LEADERS" PEOPLE – THROW THE BUMS OUT!!!

I’m all for giving back Alaska to Russia, of course. After all, we bought it for $7.4M and, even in today’s market, we should be able to get out with a slight profit. Maybe the Russians in Sarah Palin’s back yard would like to buy it back? We got Louisiana in 1803 for about $15M, which is $220M adjusted for inflation. At the time, France needed money to fund their idiotic military budget too and they had just held their own Tea Party back in Paris so raising taxes was also off the table. Manhattan, of course, was purchased for $24 but that was actually 60 Dutch Guilders, which was 24 ounces of silver, now $960. What’s my point? Was there EVER a time in which a Sovereign Nation sold off their assets and did not regret it later? You would know the answer to this if they still taught history in schools but they don’t teach history anymore because people who know their history would never put up with the IDIOCY we have in today’s politics!

So Grrrrrrrrrrrrrrrrr! I’m still bearish because our planet is run by fools and the only real "hope" that is keeping the markets up at all is that these fools are SO incompetent and SO bad at math and SO bereft of ideas that they will give up and hand out MORE FREE MONEY in a 3rd attempt to paper over the mess they have made. That’s why gold is at $1,600 an ounce this morning on this Global Ship of Fools….