Kudos to Dylan Ratigan for losing his temper and telling the TRUTH:

Ratigan is everything a reporter used to be in the days when integrity mattered. He told CNBC to shove it rather than toe the line and push their snake oil and his show is a breath of fresh air in an otherwise stale media landscape. I love the way he sits there listening to the same political BS as we all do from his panel for 3 minutes and 45 seconds and then literally explodes in RIGHTEOUS anger. I often feel the same way and, as my Members know, I sometimes explode the same way but to see a host do it on TV (other than Jon Stewart) is just fantastic – it’s what this country needs if we are ever going to save ourselves – complete change in the system.

Ratigan is everything a reporter used to be in the days when integrity mattered. He told CNBC to shove it rather than toe the line and push their snake oil and his show is a breath of fresh air in an otherwise stale media landscape. I love the way he sits there listening to the same political BS as we all do from his panel for 3 minutes and 45 seconds and then literally explodes in RIGHTEOUS anger. I often feel the same way and, as my Members know, I sometimes explode the same way but to see a host do it on TV (other than Jon Stewart) is just fantastic – it’s what this country needs if we are ever going to save ourselves – complete change in the system.

As Dylan says: "I have been coming on TV for 3 years doing this and the fact of the matter is that there is a refusal on both the Republican and Democratic side of the aisle to acknowledge the mathematical problem, which is that the United States of America is being EXTRACTED – it’s being extracted through banking, it’s being extracted through trade, and it’s being extracted through taxation and there’s not a single politician that is willing to step forward and deal with this."

Yesterday was a ridiculous day in the markets, with the Dow rising 250 points, then falling 500 points and then rising 800 points into the close for a net gain of 429 points on the day. We had a lot of fun trading it but it’s sad to see our markets trading like a 3rd World country. I have warned Members for years that: "If our government pursues Asian-style Central Banking policies they will subject our markets to Asian-style market swings" (see "Stock Market Crash – Year One in Review – The Gathering Storm"). In July of 2009 I warned:

Our stock markets have already started trading like those crazy Asian markets. Why? Manipulation is why. Control of the media by government and business allows focused messages to go out to the people so investors can be stampeded in and out of the markets at the will of the people who control the message.

You need to look no further than yesterday’s insanity to see how this madness plays out (chart by David Fry) as the Fed failed to deliver and explicit QE3 message at 2:15 and by 2:45 we were down 3.5%. But then, a miracle occurred and someone threw the BUY switch at around 2:45 and the crowds stampeded the other way in the best Bugs Bunny fashion.

Fortunately, at 2:46 I had already put up a note to Members in Chat to take the money and run on our bearish play (the IWM Aug $63 puts, up 66%) and we flipped bullish at 2:50 with the DIA Aug $111 calls at $1.50 and those made a nice double into the close (we went back to cash to be safe). That’s 166% on two trades in two hours – which is why I just don’t understand why people are so unwilling to go to CASH!

Cash is good, cash if flexible and, if the Dollar rises, cash is even a good investment. This is a TERRIBLE market to be invested in. Whether you are bullish or bearish you can lose 10% of your virtual portfolio overnight. Even if the market comes back the next day, math becomes your enemy as $100 losing 10% becomes $90 but $90 gaining 10% becomes just $99 so you end up leaving $1 on the table which is, as Dylan points out, an EXTRACTION of your wealth by Wall Street.

Cash is good, cash if flexible and, if the Dollar rises, cash is even a good investment. This is a TERRIBLE market to be invested in. Whether you are bullish or bearish you can lose 10% of your virtual portfolio overnight. Even if the market comes back the next day, math becomes your enemy as $100 losing 10% becomes $90 but $90 gaining 10% becomes just $99 so you end up leaving $1 on the table which is, as Dylan points out, an EXTRACTION of your wealth by Wall Street.

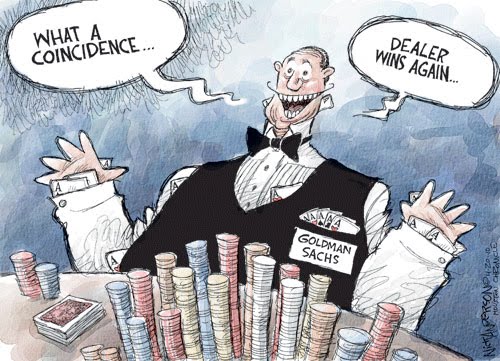

"THEY" don’t care if you win or lose – as long as you play the game. That’s why hucksters like Cramer will run you in and out of positions until you are wiped out and then the Cramers of the World will wait a few days for the next bunch of suckers and do it all over again. This is how the system is designed and, as much as I try to teach people to BE THE HOUSE, and not the gambler – there are still many many people who are gambling on these markets and, when the swings get this wild – the risks simply become unacceptable.

.jpg) We almost got back to Friday’s close on our expanded Big Chart and we have NO interest in taking bullish positions (other than working our way into very long-term positions we think are oversold) until we get back to our new "Must Hold" levels and those are still 10% away on the Russell and about 5% away on the rest. Anything less than that is just noise as we bounce off a major downward move in the market due to FUNDAMENTAL changes in the long-term outlook for GDP, Debt, Unemployment and Corporate Profits.

We almost got back to Friday’s close on our expanded Big Chart and we have NO interest in taking bullish positions (other than working our way into very long-term positions we think are oversold) until we get back to our new "Must Hold" levels and those are still 10% away on the Russell and about 5% away on the rest. Anything less than that is just noise as we bounce off a major downward move in the market due to FUNDAMENTAL changes in the long-term outlook for GDP, Debt, Unemployment and Corporate Profits.

A lot of this stuff has always been with us, I was pointing out 10 days ago that: "All of this is just a huge distraction from our GDP, which is now running at an average of 0.85% for the first half of the year. Keep in mind that our Government told us that GDP was 1.9% for Q1 3 months ago on Friday they said "Oops, did we say 1.9% – turns out it was actually 0.4%."

As much as I love myself, I find it hard to believe I was the only analyst in America who figured out this was a BAD thing. My commentary in that Monday morning post (8/1), when the Dow was spiking up to 12,200 was:

So this morning, Cramer is back to BUYBUYBUY and, amazingly, acting as if he expected this all the time after he stampeded his sheeple out of stocks at the bottom last week! What am I saying this morning? As I just posted in Member Chat – SELLSELLSELL! Not all of it at once but let’s take half our bullish profits off the table and set reasonable stops on the other half and let’s add to Friday’s disaster hedges and we’ll even take some speculative short-term downside plays because "good" news is already priced into the morning pop but the Obama/Reid deal still has to get past the lunatics in the House and that’s a coin flip at best.

EVEN If we do get a deal today – what does it fix? We’re still in debt, our GDP is far worse than expected, unemployment is still out of control and NOW – we are CUTTING Government spending. That is just BAT-SHIT CRAZY! Austerity is not growth. Again, look at the chart above – our $15Tn GDP is actually $13.3Tn, that’s 10% less than the benchmark both the Dumbocrats and the Republican’ts are using to base their income projections for the next decade. A $15Tn economy that is growing is the number they are using to project jobs and exports etc. and it’s already off by 10% and SHRINKING! This is lunacy folks – DO NOT GET SUCKED IN!

The next day, I was on TV and said we could have a 20% correction off the top and yesterday I said we should bounce 4% off that 20% bottom (sorry, not on TV). Today we have to hold that 4% line (15% off the top for luck, our -5% lines) or we’re back to being bearish. As I have to explain over and over again – I am not a flip-flopper – we are simply playing a very well-defined channel so try not to be surprised when I change my position at our inflection points and especially at the top and bottom of the channel (see yesterday’s post for channel charts) – THAT’S WHERE WE’RE SUPPOSED TO FLIP!

The next day, I was on TV and said we could have a 20% correction off the top and yesterday I said we should bounce 4% off that 20% bottom (sorry, not on TV). Today we have to hold that 4% line (15% off the top for luck, our -5% lines) or we’re back to being bearish. As I have to explain over and over again – I am not a flip-flopper – we are simply playing a very well-defined channel so try not to be surprised when I change my position at our inflection points and especially at the top and bottom of the channel (see yesterday’s post for channel charts) – THAT’S WHERE WE’RE SUPPOSED TO FLIP!

The chart on the right was done by Pentaxon, one of our PSW Members and it illustrates how low the S&P has fallen when priced in a global currency basket. This is INSANE folks! We are back near our March 2009 panic lows in constant currency. We had a very good time buying then and we will have a very good time buying again but that’s still another 10% or so down from here so, for now, we watch and wait – CASHY AND CAUTIOUS – because up or down – there will always be something to trade tomorrow if we keep ourselves flexible.

Even as I write this, the Dollar is being pumped up almost a full point pre-market (9am) and that is knocking our futures down 3% but that’s only back to where they were before that idiotic spike into the close (where we sold into the excitement). The goal of this WELL-PLANNED BS is to scare the retailers who caught a ride yesterday and keep them out of the down 2% open (and get the bears to place bets to be squeezed later) so Lloyd and the boys can flip the switch on the Bots and BUYBUYBUY. Once they are loaded up (probably the EU close but maybe sooner) they trash the Dollar and send the markets flying back up. Maybe they have some bullish announcements lined up in the form of upgrades or QE3 rumors but, whatever it is, it won’t come until after they print a scary open to keep Mom and Pop too terrified to pull the trigger as the market pulls away from them. I know this sounds cynical but if I don’t tell you it’s going to happen before it happens, you won’t believe how corrupt the system is when Dylan and I tell you, right?

PLEASE be careful out there.