Riders on the storm

Riders on the storm

Into this house we're born

Into this world we're thrown

Like a dog without a bone

An actor out alone

Riders on the storm

What a crazy couple of week's we've been having! Very fortunately, in last month's update of our virtual income portfolio, we had already cashed out $33,084 - more than enough to take us through our first 8 months (our planned $4,000 a month to live on). We did that using just $200,000 of our $1M in buying power ($500,000 portfolio), staying very conservative and waiting for a bigger dip than the one we had had in June.

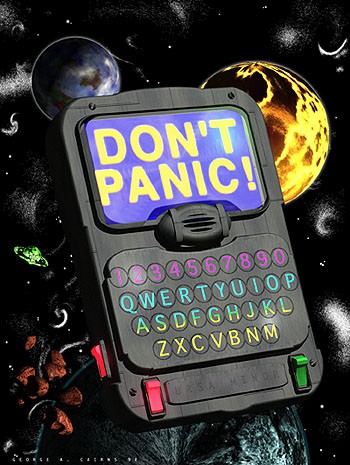

Well, here we are! We are now 10% below June's bottom and we did do a little bottom fishing, adding positions in WFR, SONC, IMAX, VLO, OIH, TBT and HOLI - positions we'll be reviewing below. To a large extent, we followed the strategy I called "Don't Just Do Something, Stand There" during this sell-off although it was (and still is) a nail-biter as we tested my August 2nd prediction of the "worst-case" scenario of a 20% drop from the top.

Well, here we are! We are now 10% below June's bottom and we did do a little bottom fishing, adding positions in WFR, SONC, IMAX, VLO, OIH, TBT and HOLI - positions we'll be reviewing below. To a large extent, we followed the strategy I called "Don't Just Do Something, Stand There" during this sell-off although it was (and still is) a nail-biter as we tested my August 2nd prediction of the "worst-case" scenario of a 20% drop from the top.

We stuck to our guns this week and had a lot of fun playing the wild gyrations with our short-term betting but the Income Portfolio is an exercise in managing a "low-touch" portfolio - one that does not require us to make daily adjustments. I am aware that can be frustrating for people who stare at the markets every day but that is what our short-term trade ideas are for in Member Chat. That goes for people who are retired or semi-retired too. You don't HAVE to play every day - or any day for that matter but you do need to work one week a month and that would be this week - the week of options expirations, when we do our update (this post) and then next week we make our adjustments (if any).