Wheeeeeeeeeee!

Wheeeeeeeeeee!

Now THIS is an exciting ride. We had a great sell-off in the Futures this morning – the same Futures that I mentioned, in yesterday’s Morning Post, that we had shorted at S&P 1,200 and Russell 710 in a post I had titled "1,200 or Bust!" Of course we also called for our usual monthly oil short with the (/CL) Futures hitting $99 on yesterday’s inventory and now down to $86 (up $3,000 per contract).

Of course, for the Futures Impaired – we still have our straight USO Sept $32 puts at .90, which we whittled down to a .75 in yesterday’s Member Chat as well as the very lovely idea of the SQQQ Sept $25/28 bull call spread at $1 (spread with short RIMM Sept $22.50 puts to make it FREE) that I mentioned right in the 2nd paragraph of Tuesday’s post. Those were just the ideas we gave away for free! In Member Chat, yesterday’s morning Alert to Members was this:

As I said earlier, we like the Futures short at RUT (/TF) 710 and S&P (/ES) 1,200 but the big play today will be shorting oil (/CL) below the $88.50 line or, hopefully, below the $90 mark if they get that high. Expect the Dollar to re-test 73.50 and, if they hold it, then it’s a great time to hit the shorts but, with oil, we’re waiting on that inventory report at 10:30.

As an overall short on oil, the Sept $32 puts are down to .65 and .60 is a good spot to DD in the $25KP (10 more). AFTER that, with an average of .75 per contract, we want to consider rolling up to the Sept $33 puts, now .90 for .30 or less.

Another fun way to play an oil sell-off is the SCO Aug $53/54 bull call spread at .60, selling the XOM Aug $72.50 puts for .27 for net .33 on the $1 spread that’s 100% in the money at the moment.

Thank goodness we have a nice pop in FAS and we’ll look to do another 1/2 sale of the Aug $15s if they get back to .85.

That was a GOOD PLAN! That’s why we can say "wheeeeeeeeeeeee" when the market takes a nice dip like this. Although we flipped more bullish on FAS at the end of the day and we will regret that one, as we are likely to regret the short XOM puts (we will be LUCKY) if we don’t on this morning drop. We flipped a little (very little) more bullish into the close as our expectation was that Bill Dudley will save the markets this morning at 8:35, when the Fed’s dove of doves makes a speech on the Regional and National Outlook in Newark – a spot selected to make sure a very large amount of press can cover it.

That was a GOOD PLAN! That’s why we can say "wheeeeeeeeeeeee" when the market takes a nice dip like this. Although we flipped more bullish on FAS at the end of the day and we will regret that one, as we are likely to regret the short XOM puts (we will be LUCKY) if we don’t on this morning drop. We flipped a little (very little) more bullish into the close as our expectation was that Bill Dudley will save the markets this morning at 8:35, when the Fed’s dove of doves makes a speech on the Regional and National Outlook in Newark – a spot selected to make sure a very large amount of press can cover it.

Dudley is ALSO scheduled to speak tomorrow at 8:30, also in New Jersey, on the same topic at the Meadowlands Chamber of Commerce (the same one Tony Soprano belongs to). We did add a BIDU short (Sept $120 puts at $3.65) in the afternoon yesterday but we also went short on TLT with the Sept $106 puts at $2.70 in our virtual $25,000 Portfolio and those are going to need adjusting this morning! We tried a little bottom-fishing with two long-term plays in the Steel and Telco sector but if we don’t hear the word’s QE3 this morning – we’re going to be adding more to the bear side pretty fast (see last week’s "Hedging for Disaster – 5 Plays that Make 500% if the Market Falls").

Just like the above image of Dudley Do Right, William Dudley may be the market’s last hope as that Recession train is coming down the tracks and a combination of low sentiment and no confidence is tying our economy to the tracks while the villainous politicians (pick your own party!) make it impossible for anyone to win who isn’t paying them off. We had a nice discussion about this in Member Chat this morning, so I won’t get into it again here.

Just like the above image of Dudley Do Right, William Dudley may be the market’s last hope as that Recession train is coming down the tracks and a combination of low sentiment and no confidence is tying our economy to the tracks while the villainous politicians (pick your own party!) make it impossible for anyone to win who isn’t paying them off. We had a nice discussion about this in Member Chat this morning, so I won’t get into it again here.

As David Fry notes in his Dollar chart, Bush love-child Rick Perry damned the Fed this weekend and it would be a true act of bravery at this point for Dudley to even suggest QE3 is wrong, under the threat of Treason from a sitting US Governor so we’ll see how this drama plays out this morning. Like yesterday, a strong move up in the Dollar in pre-markets is jamming down the futures and we’re going to need the buck to break to new lows to prop up the markets at this point.

In yesterday’s post, I warned you not to be fooled by the weak-dollar rally in the morning and suggested trading in your stocks and commodities for Dollars before they lost all their value. Today we are praying for the opposite – although we are still "Cashy and Cautious" and will benefit greatly from lower prices – we certainly don’t want to see the markets go back to the technical Hell they’ll be in if we break down here.

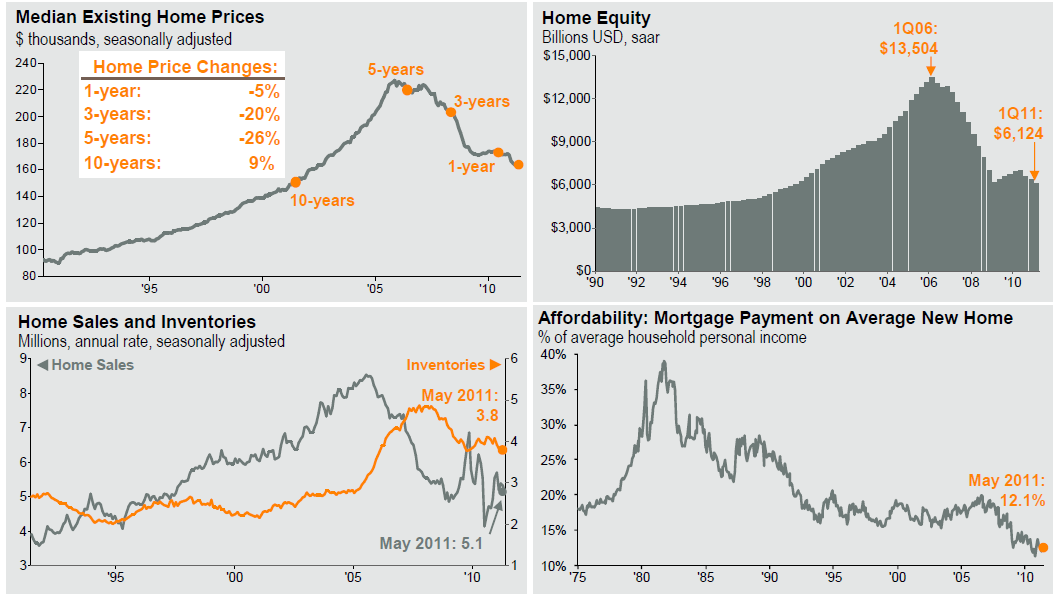

EU Banks (the ones that can’t be shorted) are leading the sell-off this morning as investors can’t see how they can possibly make any money at all if they can’t game the market with high-frequency trading. US regulators also slammed the banks by looking into local operations of Europe’s largest banks concerning possible funding issues. Regular banks, of course, won’t make any money until the economy perks up – especially the housing sector but this depressing set of charts from Barry Ritholtz and JPM show how amazingly unlikely that is with the US pursuing a policy of cost-cutting, rather than stimulus spending:

Anyone who tells you this can turn around without some serious Government spending and job creation may as well be selling you magic beans but the American public already sold their prize home equity cow for the magic tax cut beans and now their wages and benefits have been cut so low that even a 33% decline in home prices has done nothing to make homes more affordable – yet the very programs and agencies that enable the average American to buy a home are being gutted or eliminated under the new Congressional budget.

The market isn’t collapsing for no reason – it’s a very accurate assessment of our economic future and, as I’ve been saying all month – only QE3 can save us, but even that will just be another shoddy prop job and if Congress doesn’t change it’s tune very quickly – all the tax cutting in the World isn’t going to stop home prices from dropping another 20% – erasing all the progress that has been made since Clinton was in office. Who knows, perhaps the stock market will join it?

The market isn’t collapsing for no reason – it’s a very accurate assessment of our economic future and, as I’ve been saying all month – only QE3 can save us, but even that will just be another shoddy prop job and if Congress doesn’t change it’s tune very quickly – all the tax cutting in the World isn’t going to stop home prices from dropping another 20% – erasing all the progress that has been made since Clinton was in office. Who knows, perhaps the stock market will join it?

8:30 Update: 0.5% CPI!!! That’s 6% a year and accelerating rapidly. As I mentioned yesterday, Nixon declared a national emergency and froze prices when we had 4% inflation. Not only that but what kind of idiots are lending us money at 2%? Economorons had actually gotten together and predicted 0.2% so to say this is bigger than expected would be quite the understatement.

We lost the usual 408,000 jobs last week and July’s real earnings fell 0.1%, even though the average workweek increased 0.3% as the American workforce moves ever closer to slavery. Real earnings for the year are down 1.3% so it’s no wonder that Japanese exports fell 3.3% on falling global demand.

We lost the usual 408,000 jobs last week and July’s real earnings fell 0.1%, even though the average workweek increased 0.3% as the American workforce moves ever closer to slavery. Real earnings for the year are down 1.3% so it’s no wonder that Japanese exports fell 3.3% on falling global demand.

Bill Dudley did NOT mention QE3, so no help there and what he did say was not encouraging – saying that US economic growth in the first half of the year was "quite a bit slower" than expected and he is revising down his forward forecasts saying only some of the restraints on growth in the first half of the year, such as high oil prices and Japan’s earthquake, can be considered temporary. "It is clear to me that not all of the weakness was due to these one-time factors, and in light of this, I have revised down my expectations for the pace of growth going forward," he said.

This is not good! Although you can argue that the revised outlook lays the groundwork for additional Fed action – apparently Rick Perry has, in the very least, turned the Fed overly cautious about even hinting that further easing measures can be bought into play. Combine this economy with an ineffective Central Bank that is hamstrung by meddling politicians who are, at the same time, pushing for austerity and you’d BETTER have some of those Disaster Hedges protecting your portfolio! As I warned in Monday’s post:

Dudley is scheduled to talk over Unemployment Claims at 8:35 on Wednesday and I hope he has a bullhorn because we’re also getting the CPI, Consumer Comfort, Existing Home Sales, Leading Economic Indicators and the Philly Fed that morning so, if there’s a chance for market mayhem this week – Thursday morning will be a good one!

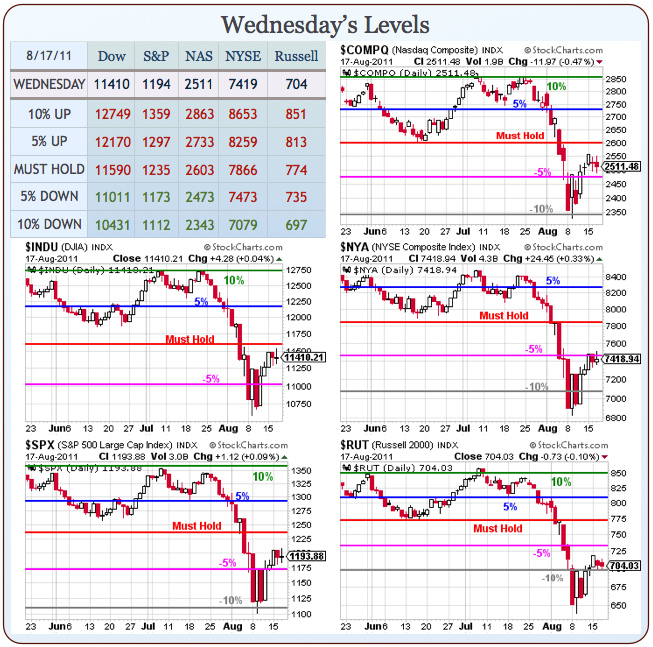

We’re still waiting on Existing Home Sales, Leading Economic Indicators and the Philly Fed at 10 am but it’s not likely any of those are going to save us. Once again we will be looking for a good reason to take the bearish money and run – but not without setting up a new layer of Disaster Hedges! We HOPE (not a valid strategy) to hold the tops of last week’s very depressing candles on our Big Chart for the day but, as I have been saying since last week – the more likely pattern is we move back to the lows and, since we were counting on QE3 to save us – there’s no telling where this may end up if we don’t get some Government help: