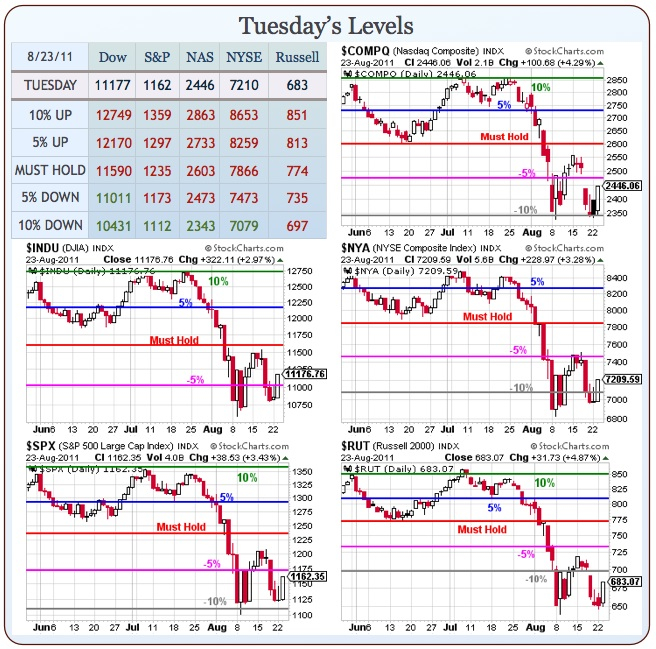

We are forming right up into that "W" pattern we expected.

We are forming right up into that "W" pattern we expected.

Can it really be this easy? Just a little dip into the Fed’s Jackson Hole conference on Friday and then Uncle Ben says the magic words and we’re back off to the races despite the concerns about – well, EVERYTHING…

Indexes in Asia are NOT pretty on the Japan downgrade, with the Hang Seng dropping 408 points (2%) to 19,466, only saved by the bell on a very harsh rejection at 20,000.

Shanghai was only off 0.5% but it was a big drop after lunch, also finishing at the day’s low. China Life (LFC) had terrible earnings, falling 12% on the Hang Seng. The Nikkei finished down "just" 1.1%,not so bad after the debt rating cut. Exporters got whacked with TM down 1.6% and SNE down 2.9%. India fell 0.9%.

"The readings are not wildly positive, but a lot of the bears have been suggesting that the economy is falling off a cliff…These numbers just do not support that idea," said Michael McCarthy, chief market strategist at CMC Markets in Sydney.

Europe seems unfazed by all this and is up 1.3% in Germany (go EWG!), 1.1% on the CAC and now the FTSE is getting lazy at 0.25%. EU Factory orders fell in June (we need to give up on June and July and look for Aug data) and German Business Confidence hit a 14-month low and that is August data! The EU is also scaling back their defense spending. We currently spend 6.66% of our GDP on Defense, the rest of NATO spends an average of 1.7% and they think it’s too much.

Also, I hate to piss Conservatives off so early in the morning and I know France is evil so that point doesn’t need to be made but 16 of the wealthiest families in France have gotten together to ask that a special tax be placed on the top 1% to help their country balance it’s books. This is how adults handle a financial crisis:

We, chairmen of companies and business leaders, business men and women, finance professionals or wealthy citizens, call for an exceptional levy that would target France’s richest taxpayers.

This exceptional tax should be calculated in a reasonable way and designed so as to avoid undesirable effects, such as capital outflows and an increase in tax evasion.

We are aware of the fact that we have benefited from a French model and a European environment which we are attached to and which we want to help preserve. This tax is not a solution in itself: it must be part of a wider reform of the tax system, encompassing spending as well as tax receipts.

At a time when rising public debt and deficits are threatening France’s and Europe’s future, and when the government is asking everyone to show solidarity, we feel we must contribute.

Here in America, it’s still "gimme, gimme, gimme" by our top 1%, who are always looking for a handout at the expense of the bottom 99% and yesterday we got a nice move up what was generally a short squeeze as well as rumors that the US would once again ban short selling in the financials. As David Fry notes:

Here in America, it’s still "gimme, gimme, gimme" by our top 1%, who are always looking for a handout at the expense of the bottom 99% and yesterday we got a nice move up what was generally a short squeeze as well as rumors that the US would once again ban short selling in the financials. As David Fry notes:

Financials were finally able to participate in the rally although not Bank of America (BAC). The entire financial sector remains much oversold and was ripe for a countertrend move. The only positive news for future earnings is massive lay-offs about to take place reducing costs.

As a result, more defensive sectors, gold in particular sold-off sharply by over 3%. Gold also faces a critical options expiration period Thursday where Da Boyz in the pits will disadvantage as many investors as they can. So, why not get started early they must think? Bonds also saw profit-taking as another safe-haven asset was sold as stocks rose. But the Fed was able to sell $35 billion in 2-year Notes at a record low yield of .222%. Other commodities like oil, base metals and much of the agricultural sector were higher.

Supportive bullish economic news was not present as New Home Sales data continued lower. In a perverse way this is good news since we don’t need more inventory. But, the previous bullish mantra (if only for today): “Bad news is good, good news is better” was back en vogue Tuesday. In sum, the belief remains bad economic data will encourage Bernanke to launch another round of stimulus. For now anyway, the machines rule. Even though some investors might be pleased by a substantial rally such as Tuesday’s, they still don’t trust markets being conducted this way.

Although we were excited to see our bullish plays finally gain some traction yesterday, we remain unconvinced by the overall action until we get over the middle of those "W" patterns (the mid-month highs) but, on the whole, we are exactly on target for our prediction. What’s scary is the completion of the pattern (a big pop on Friday) is entirely dependent on the actions of just one man and, unfortunately, that man is Ben Bernanke.

Although we were excited to see our bullish plays finally gain some traction yesterday, we remain unconvinced by the overall action until we get over the middle of those "W" patterns (the mid-month highs) but, on the whole, we are exactly on target for our prediction. What’s scary is the completion of the pattern (a big pop on Friday) is entirely dependent on the actions of just one man and, unfortunately, that man is Ben Bernanke.

We still have a long way to go before we consider ourselves "bullish" but we have opportunistically played the bottom, especially in our long-term Income Portfolio, where we’ve been adding positions at the bottom of our pattern. Our other virtual portfolio is our $25,000 Portfolio and I sent out an update to Members last night and that one is up 168% for the year with another 132% to go to get to our $100,000 goal. That portfolio is the very definition of "Cashy and Cautious," with just 17% of the cash committed at the moment as we wait on the Fed’s signal on Friday morning.

I mentioned to Members this morning that it’s time to ignore June and July data and focus on August and September reports to see if we had an economic dip (possibly caused by Fukushima) or if we are in a lasting downtrend. I had already declared the market oversold on Friday so we took our aggressive longs (EWG, HPQ, TIE, TNA and a short VXX play were all mentioned in Monday morning’s post) 300 Dow points ago and now we are PATIENTLY waiting to see if this is indeed more than a simple bounce off the bottom.

I mentioned to Members this morning that it’s time to ignore June and July data and focus on August and September reports to see if we had an economic dip (possibly caused by Fukushima) or if we are in a lasting downtrend. I had already declared the market oversold on Friday so we took our aggressive longs (EWG, HPQ, TIE, TNA and a short VXX play were all mentioned in Monday morning’s post) 300 Dow points ago and now we are PATIENTLY waiting to see if this is indeed more than a simple bounce off the bottom.

Friday Morning’s main post had the EWG short Sept $19 puts at $1 and they dropped to .60 yesterday for a quick 40% gain while the short Jan $17 puts fell from $1.25 to .95 already (24%), which is pretty good movement for a longer-term play. The bearish VXX spread, on the other hand, has barely budged and is still playable as bets are running strong ahead of the Fed and still worth a look as the net .15 spread is capable of returning $5 (up 3,249%) if VXX finishes below 40 on September 16th.

July Durable Goods numbers were surprisingly GOOD this morning, up 4%, which is double what was expected and last month was revised up from -1.9% to -1.3%. Ex-Transport was 0.7%, much better than the negative numbers expected so the US Consumer is proudly "Not Dead Yet":

Of all the unlikely things, Meredith Whitney is jumping to the defense of BAC this morning, saying it doesn’t need a "mad dash to raise capital… they’re going to steadily raise capital over time." She defends CEO Brian Moynihan as "the right guy for the job," even as more investors believe the only cure for halting the stock’s 53% YTD decline is his ouster. Meanwhile, Germany sold €4.86B ($7B) of 10-year benchmark bonds at an average yield of 2.15%, the lowest since at least 1999 so the US has not cornered the market on the flight to safety.

ING will become the 1st European lender to test the bond market in size since early July, issuing a 10 year covered bond of at least €500M to be priced later today. Order books for the deal are at €1.5B. "To see the re-opening of the market … sends a strong signal," says a banker involved in the deal.

The only signal we’re looking for is to fill those gaps back to last Wednesday’s highs. I’m not expecting it to happen today but ahead of the Fed would be nice and that will give us a potential launch pad for Friday morning. HOWEVER – we will certainly have our hedges in place – just in case.

Still skeptical – but hopeful…