That was easy!

That was easy!

Only 3 days of panic and we're back to manic already – I'd say that was a record but our last panic only lasted two days, on August 18th and 19th, when we dropped 600 points before bouncing back 800 points the next week so this last 3-day, 600-point drop was gentle by comparison. That, of course, did not stop the usual round of Doomcasters from declaring the end of the World (especially the European section) as we know it but that was all so yesterday morning and now it's 24 hours later and the Dow is up 300 from that bottom in the pre-markets.

Pre-market yesterday we were bullish but cautious, going long on Dow (/YM) futures at 11,000 (now 11,227 – up $1,135 per contract) and Russell (/TF) Futures at 666 (now 688, up $2,200 per contract) and our bullish EWG spread from the morning post should be going gangbusters already as the DAX pops 3% this morning!

We also laid out new hedge ideas on EDZ and GLD but the point of those was, wisely, to take the money and run on our old hedges as they bottomed out in the morning (max profit), trading in our well-ridden horses for fresh ones that have more time to expiration and lower deltas to snap back on a bounce is all part of our range-trading strategy – we may need those hedges again, just not now….

By the time the market opened, things looked too good not to play bullish and we ended up picking 19 bullish plays in yesterday's Member Chat with not one bearish one. My comment to Members in the 9:44 Alert, where we took a very aggressive upside play on the Dow was: "Damn, and I said I wasn’t going to get too bullish. Oh well, what can you do?" As I have been pointing out in our Range Trading posts – sometimes you just have to go with the flow…

Just 18 minutes later, I put up 6 long-term trade ideas on CAT, DIS, HOV, JPM, SKX and T as we took advantage of low prices, a probable bottom and a high VIX. The nice thing about our buy/writes is that they have a built-in 20% discount (see "How to Buy a Stock for a 15-20% Discount") and can usually be scaled in to ride out a 40% drop – so we have all the time in the world to add some protection if we do end up failing our range bottom. We also, of course, had our September's Dozen list of 13 (as with donuts, you get a bonus) aggressive upside plays that we finally got a chance to fill in on this dip.

So our day was busy to say the least. Today, I already warned Members in an early Alert that we have a ton of profits to protect so we'll be looking out for shorting opportunities other than TLT (which is working already) and GLD (which stopped working). Perhaps we will turn our attention back to oil if the scam artists at the NYMEX are going to pretend to want to pay more than $87.50 a barrel when, in fact, they have 678 MILLION Barrels of oil scheduled for delivery between now and the end of the year to Cushing, OK – a facility that can only handle 40M barrels a month!

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Oct'11 | 86.50 | 87.42 | 86.15 | 87.10 |

08:07 Sep 07 |

– |

1.08 | 30981 | 86.02 | 274510 | Call Put |

| Nov'11 | 86.73 | 87.68 | 86.45 | 87.34 |

08:07 Sep 07 |

– |

1.03 | 8870 | 86.31 | 195265 | Call Put |

| Dec'11 | 87.11 | 88.05 | 86.85 | 87.70 |

08:07 Sep 07 |

– |

1.00 | 6757 | 86.70 | 209213 | Call Put |

| Jan'12 | 87.41 | 88.21 | 87.21 | 88.14 |

08:07 Sep 07 |

– |

1.09 | 1081 | 87.05 | 94826 | Call Put |

These are the opportunities we look for in shorting oil because those October contracts (/CLV1) were $83.20 in pre-market trading yesterday and have been jammed up 3.8% already and we'll be looking for 5% over $83.20, or $87.36 as a good line in the sand to begin shorting this contract again so PUMP IT UP boys (when you don't really need it) – we'll be waiting for you!

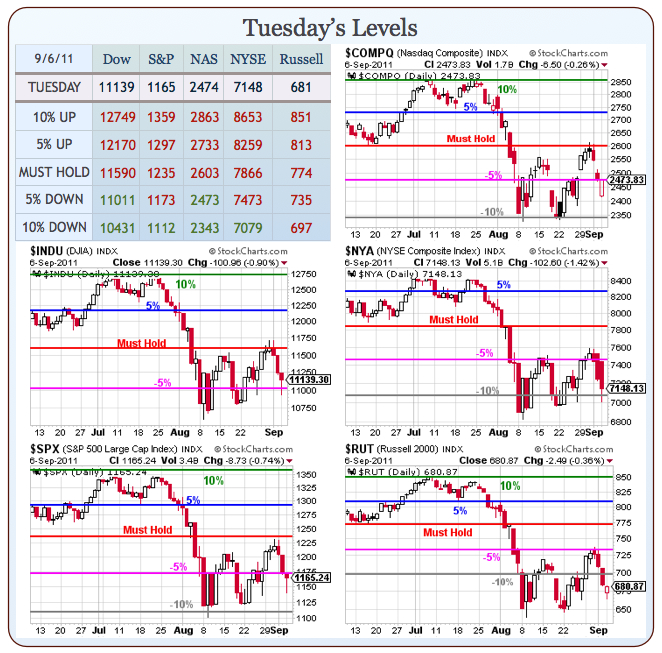

Yesterday morning I said we could remain bullish if the Dow finished over 11,000 and the Nasdaq held 2,473, which is our -5% line on the Big Chart. The Dow finished at 11,139 and the Nasdaq finished at EXACTLY 2,473. While we do use charts to illustrate our 5% rule, Members know I could care less about the squiggly lines on the graph. These are the same levels we have been using since the Spring of 2009 and that's where we get our ranges from. Our goal for today is to get the Russell over 697 and hold it – 700 has been an upside line in the sand for the RUT and, frankly, it's where we intend to start buying TZA hedges as they've performed so miserably at that spot in late August.

Yesterday morning I said we could remain bullish if the Dow finished over 11,000 and the Nasdaq held 2,473, which is our -5% line on the Big Chart. The Dow finished at 11,139 and the Nasdaq finished at EXACTLY 2,473. While we do use charts to illustrate our 5% rule, Members know I could care less about the squiggly lines on the graph. These are the same levels we have been using since the Spring of 2009 and that's where we get our ranges from. Our goal for today is to get the Russell over 697 and hold it – 700 has been an upside line in the sand for the RUT and, frankly, it's where we intend to start buying TZA hedges as they've performed so miserably at that spot in late August.

There has been no major news, no data and no new announcement to turn this market around – we are simply bouncing around in a trading range as we wait on the Beige Book this afternoon at 2pm (probably bearish) and then a speech from Bernanke at 1pm tomorrow and, of course, Obama's not very exciting jobs speech tomorrow night – which may end up disappointing investors again and send us back into panic mode.

For now though, fear is subsiding, gold is falling and the bears will be squeezed once again as it turns out the EU didn't fall apart overnight and still no major banks have failed and, of course – the IPhone 5 is coming!!!

This should be a great day for the bulls – let's have some fun.