Courtesy of Yves Smith of Naked Capitalism

It is remotely possible that the EU officialdom will temporarily reverse the train wreck that started last Friday with the resignation of Jurgen Stark from the ECB. That was seen as a sign that Germany has adopted bailout fatigue as official policy. That in turn would mean that Greece will not get any more money lifelines (which as commentators predicted some time ago, means a likely banking crisis, which was the reason for them not to exit the Eurozone).

It is remotely possible that the EU officialdom will temporarily reverse the train wreck that started last Friday with the resignation of Jurgen Stark from the ECB. That was seen as a sign that Germany has adopted bailout fatigue as official policy. That in turn would mean that Greece will not get any more money lifelines (which as commentators predicted some time ago, means a likely banking crisis, which was the reason for them not to exit the Eurozone).

Mr. Market is giving a big vote of no confidence in European leadership, although the FTSE has reversed some of its early-session losses. The Dax is down 3.1%, the FTSE is off 1.6% (v. 2.2% earlier), and the CAC is down 4.1%. The Euro is at 1.4 (a recovery from when I started on this post) and gold is off about a half a percent (versus a bit over 1% earlier in the day).

But the other big development of last week, the ruling of the German constitutional court on the European Financial Stability Fund, was a major, and likely fatal, blow to the Eurozone. As our Ed Harrison and more recently Wolfgang Munchau of the Financial Times explain, the ruling makes it well nigh impossible for the Eurozone to implement measures that would create a fiscal authority (such as eurobonds) or even allow for an permanent backstop device (the European Stability Mechanism, due to go live in 2013. Note that the ruling did not address the ESM specifically, but the logic of the ruling appears to make a challenge to the ESM a slam dunk). The other way out is for the ECB to step into the breach and “print”, but the Germans have been firmly opposed to that, and Stark’s abrupt exit firmly underscored that point.

If you had any doubts as to the implications of these actions, the Germans appear to harbor no such illusions. Per Ambrose Evans-Pritchard, this is a calculated effort to put Greece to the lash:

First we learn from planted leaks that Germany is activating “Plan B”, telling banks and insurance companies to prepare for 50pc haircuts on Greek debt; then that Germany is “studying” options that include Greece’s return to the drachma.

German finance minister Wolfgang Schauble has chosen to do this at a moment when the global economy is already flirting with double-dip recession, bank shares are crashing, and global credit strains are testing Lehman levels. The recklessness is breath-taking….

Mr Schauble said there would be no more money for Athens under the EU-IMF rescue package until the Greeks “do what they agreed to do” and comply with every demand of `Troika’ inspectors.

Yet to push Greece over the edge risks instant contagion to Portugal, which has higher levels of total debt, and an equally bad current account deficit near 9pc of GDP, and is just as unable to comply with Germany’s austerity dictates in the long run. From there the chain-reaction into EMU’s soft-core would be fast and furious.

Let us be clear, the chief reason why Greece cannot meet its deficit targets is because the EU has imposed the most violent fiscal deflation ever inflicted on a modern developed economy – 16pc of GDP of net tightening in three years – without offsetting monetary stimulus, debt relief, or devaluation.

The Eurozone is addicted to a failing remedy. Even if it could get its integration act in gear, austerity, as we predicted, is only making matters worse. Greece’s finance minister just revised down the 2011 forecast from a 3.8 % contraction to 5.3%. (An interesting anomaly, as Clusterstock points out, is that Greek debt isn’t getting trashed further this morning).

And this is clearly a campaign. Reader Swedish Lex points us to a Reuters story, “ECB’s Stark tells Ireland to ramp up austerity” with the note, “The man must be mad.” Key extracts:

Ireland’s government should cut public sector pay again to get its budget deficit under control, Juergen Stark, the outgoing chief economist at the European Central Bank (ECB), said in an interview published in The Irish Times on Monday.

Speaking hours before his shock resignation on Friday, Stark said Ireland should accelerate efforts to get its budget deficit under control including breaking a pledge to public sector unions to leave wages alone.

“We fully appreciate what the government has already done in correcting public wages,” Stark was quoted as saying.

“(But) there is scope, further room for adjustment, and to be more in line with the wages in the public sector in the euro area as a whole.”

“The government should be even more ambitious in cutting the public deficit ratio, which is still at double-digit level.”

As we’ve pointed out earlier, Ireland is the poster child of “austerity makes debt hangovers even worse.” Its nominal GDP (which is what counts in measuring the impact on ability to pay) has contracted nearly 20%.

And while the German actions puts the future of the Eurozone very much in question, the immediate pressure on Greece comes not just from the news out of Germany but also from countries like the Netherlands that are demanding that Greece post more collateral to support the 109 billion euro facility supposedly agreed to last June.

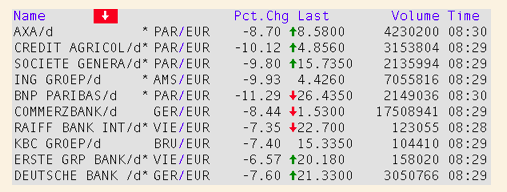

The most important casualties of a Greek default would be French and German banks. One of the reasons for the continued sell off is the fear that Moodys will downgrade French banks. A snapshot on the bloodbath, courtesy FT Alphaville (hat tip Ricard Smith):

In the Great Depression, it was the failure of Credit Anstalt that set off a series of banking failures and debt defaults. In our rerun of sorts, it looks like Jurgen Stark’s rigid adherence to a failed dogma that will set of an even bigger disaster. So much for the idea that economists had learned from financial crises and developed better reflexes. Economics has to an increasing degree become an exercise in promoting ideologies to defend the privileges of the rentier classes. They look to be about to be hoist on their own petard. Unfortunately, a very large number of innocent bystanders will suffer along with them.