108%!

108%!

That’s how much Greece is paying today to borrow money for a year! In theory, if you lend Greece $10,000 today, next year they will pay you back $20,800. In THEORY that is because, at 108% – IF they actually borrowed at that rate, you could be very sure that they would not be around to pay you. That’s the joke of this whole thing – we have these insanely unrealistic prices being set on bonds, which only hurts the people who have outstanding ones and need to redeem them as Greece doesn’t actually borrow money for even double-digit interest rates. It’s all a silly, artificial construct that is only useful in spreading panic among investors.

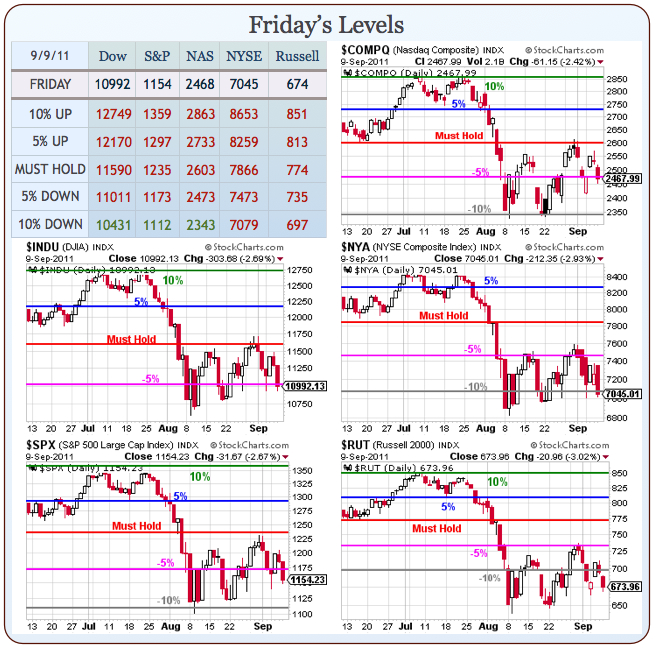

Unfortunately, investor panic is all you need to really destroy the Global economy – as we proved in 2008. As you can see from the chart on the right, we are currently mirroring the same path we took 3 years ago as we head into October and, in fact, our financial sector is performing WORSE than it did when we had ACTUAL major bank and minor country failures – not just rumors of them.

On Friday, Greece’s finance minister, Evangelos Venizelos, blamed “organized rumors” for renewed speculation that Greece would default, and said the country intended to comply with all terms needed for the bailout that European countries agreed to in July. But the fact that the details of the deal have yet to be locked down has unnerved some investors.

In a speech this week, Josef Ackermann, the chief executive of Deutsche Bank, said it was not justifiable for politicians to demand that European banks raise more capital, as Christine Lagarde (DSK’s evil replacement), the head of the International Monetary Fund, had done. “It’s obvious,” he said, “that many European banks would not be able to handle writing down the sovereign bonds they hold on their banking books to market levels.”

But, he said, it would “risk undermining the credibility” of European bailout packages “if politicians were to now send out the signal that they do not believe in the success of those measures.” And, he argued, forcing banks to raise capital now would anger investors by forcing the dilution of current shareholders.

But, he said, it would “risk undermining the credibility” of European bailout packages “if politicians were to now send out the signal that they do not believe in the success of those measures.” And, he argued, forcing banks to raise capital now would anger investors by forcing the dilution of current shareholders.

"Risk undermining the credibility of European bailout packages?!?" Is this guy freakin’ kidding? Greece is being "bailed out" and the market rate on their debt is 108% – what on Earth does Ackermann think a lack of credibility does look like? I expect this head-up-the-ass nonsense from the G7 but the head of DB should know better! Of course, all Ackermann really cares about is how this affects his own bank when what he should be concerned about, along with his Bankster buddies, is getting together with the G7 and coming up with an actual solution to this problem.

Unfortunately, as I mentioned in the Thursday section of our Range-Trading Review – Ackermann and his Bankster buddies are pretty much Sociopaths, who LOVE the market panics – until it finally comes too close to home and affects them. Then they transform into whiny little children who want Mommy and Daddy to come bail them out after their little schemes fall apart. Jesse’s Cafe American followed up on this idea over the weekend – pointing out that Wall Street criminals share many common characteristics with psychopaths, as Capitalism has developed into a system that precisely rewards that sort of behavior.

That’s why EVERYBODY is lying to us, all of the time. The Banks lie, the Government lies, the Regulators lie, the Corporations lie, their Media lies – even the ratings agencies, who are supposed to be an objective measure of truth – LIE to us! It’s an endlessly depressing cycle of self-dealing BS by a bunch of children who get away with whatever they can and then lie when they are caught. At the moment, virtually every country on the planet is caught after having borrowed much more money than they can possibly pay and promising their electorate much more than they can actually deliver.

That’s why EVERYBODY is lying to us, all of the time. The Banks lie, the Government lies, the Regulators lie, the Corporations lie, their Media lies – even the ratings agencies, who are supposed to be an objective measure of truth – LIE to us! It’s an endlessly depressing cycle of self-dealing BS by a bunch of children who get away with whatever they can and then lie when they are caught. At the moment, virtually every country on the planet is caught after having borrowed much more money than they can possibly pay and promising their electorate much more than they can actually deliver.

We know politics has devolved into nothing more than a cynical power-grab, as illustrated in Mike Lofgren’s excellent "Reflections of a GOP Operative" and I anxiously await the Democratic version to give us a "fair and balanced" view so we can require people to read both articles before voting and perhaps "None of the Above" can win the next election. Meanwhile, we’ll have to play the hand we are dealt because it’s a dirty, crooked game but it’s also the only game in town and our job is to cut through all this BS and try to make some money (because that’s how you win the game!).

Rumors are out today that Moody’s will cut ratings on French Banks, due to their exposure to Greek holdings. That, to me, is a potential market booster because it’s firmly baked into this morning’s horrific sell-off (see my 6:11 Alert to Members) and isn’t Moody’s owned (in part) by Buffett who just invested in BAC because his analysis said the panic in the Financial sector was overdone? Yeah, that’s the guy. Moody’s already placed the three banks’ ratings on review in June to examine “the potential for inconsistency between the impact of a possible Greek default or restructuring and current rating levels,” the rating company said at the time.

Cuts are likely as the review period concludes, said the people, who declined to be identified because the matter is confidential. Moody’s currently rates BNP Paribas’ long-term debt at Aa2, the third-highest investment grade. Credit Agricole is rated Aa1, the second highest, while Societe Generale (GLE) is Aa2. Societe Generale has dropped 55 percent in Paris trading since June 15, while Credit Agricole tumbled 45 percent and BNP Paribas has declined 42 percent. The Bloomberg Europe Banks and Financial Services Index of 46 companies has fallen 30 percent in the period.

Barron’s kept the Gloom and Doom meter pinned to 1,000 this weekend with Jonathan Lang’s featured article which is, on the whole, nothing more than a re-hash of last week’s news like "Operation Twist," which we discussed in great detail in last week’s Stock World Weekly and an interesting take on GDP by super-bear Carmen Reinhart, who is the wife of Former Fed Monetary Affairs Director, Vincent Reihart but I challenge you to read this article, even after I just told you that, and try to get the impression that it’s not Vincent who has these views but his wife.

Barron’s kept the Gloom and Doom meter pinned to 1,000 this weekend with Jonathan Lang’s featured article which is, on the whole, nothing more than a re-hash of last week’s news like "Operation Twist," which we discussed in great detail in last week’s Stock World Weekly and an interesting take on GDP by super-bear Carmen Reinhart, who is the wife of Former Fed Monetary Affairs Director, Vincent Reihart but I challenge you to read this article, even after I just told you that, and try to get the impression that it’s not Vincent who has these views but his wife.

I spent a lot of last week noting to Members that there is a sustained, relentless effort by the IBanks and the MSM to FREAK OUT the retail investors ahead of the Fed Meeting on the 21st. Are things really worse now than they were in 2008? Mrs. Reinhart postulates we are down 2.2% in GDP from 2008 in real Dollar terms and I believe that and she also points out that real equity prices are off 15.6% over the same period. So our equities are 13.4% weaker than our GDP would indicate and, of course, we know productivity per person is up (2.2% less GDP with 15% fewer workers is EFFICIENT!) and Corporate Profits are WAY UP so how exactly does this lead Barron’s to conclude that we shouldn’t be buying equities?

TERRIBLE monsters are hiding under our beds – and they have CANDY! That’s what all this nonsense begins to sound like after a while. What we need to do is think about what is motivating the storytellers as we digest all this information. On the whole, it’s all just BS anyway as we continue to track the number one cause of market movement in Stock World Weekly and that’s – the Dollar!

TERRIBLE monsters are hiding under our beds – and they have CANDY! That’s what all this nonsense begins to sound like after a while. What we need to do is think about what is motivating the storytellers as we digest all this information. On the whole, it’s all just BS anyway as we continue to track the number one cause of market movement in Stock World Weekly and that’s – the Dollar!

See the chart on the right? That’s not a complicated relationship, is it? Equities are priced in Dollars so the Dollar gets stronger and you need less of them to buy your equities. The Dollar gets more valuable and the price of oil goes down relative to the Dollar and a stronger Dollar attracts investors into our notes, who are willing to risk a low rate of interest for a currency that is appreciating in value (gold pays you no interest at all yet you buy it because you think it will appreciate, right?).

It’s not a perfect correlation but it tracks very well over time. Right now, what’s pushing the markets is a 5% move up in the Dollar since Aug 29th that has taken the Dow down from 11,700 to 11,000 (5.6%) over the same period. Note in the chart below that the S&P, when priced in Euros, Yen or Pounds is UP – that’s right UP – over 5% since the 22nd and, when priced in oil, gold or copper – it holding it’s own quite nicely as well:

This is what you are panicking out of – the best performing asset class in the World (other than the US Dollar)! That’s why our "Cashy and Cautious" approach has been BRILLIANT – our cash sits on the sidelines (and we are long on UUP in the $25KP as well) while we slowly but surely pick up long-term equity positions as they fall back near their 2008 lows. It’s been tedious waiting for the opportunity but we knew it was coming so we waited PATIENTLY (well, some of us) for the right time to do a little bottom fishing.

So let them panic – let the Banksters and their MSM puppets chase the retail investors out of their positions because we’ll be waiting. Of course we’re not gung-ho bullish because there ARE actual problems but we do think they are blown way out of proportion at this point but, if they want to take the markets back to last year’s lows (about 10% lower) – we’ll be happy to ride it down. For now though, we don’t want to take the chance of missing out so we’re hitting our September’s Dozen as they come into our buying zone and we’ll remain on the lookout for other exciting opportunities as we re-test the bottom of our range.

So let them panic – let the Banksters and their MSM puppets chase the retail investors out of their positions because we’ll be waiting. Of course we’re not gung-ho bullish because there ARE actual problems but we do think they are blown way out of proportion at this point but, if they want to take the markets back to last year’s lows (about 10% lower) – we’ll be happy to ride it down. For now though, we don’t want to take the chance of missing out so we’re hitting our September’s Dozen as they come into our buying zone and we’ll remain on the lookout for other exciting opportunities as we re-test the bottom of our range.

We expected the Dollar to top out at 77.50 but, with the G7 failing to "fix" anything this weekend, the Euro fell all the way to $1.35 but we already played them long on Friday, choosing FXE at net $136 so we’ll see how that holds up today. Our logic is that’s the line the Swiss are going to defend and we expect to finish the week over $137 on FXE ($1.37 Euro) for a nice 1,100% return on our bull call spread. Hopefully, we’ll get some evidence that makes us comfortable taking some of our short-side profits off the table. On Friday we went with QID, TZA, TLT (short), DXD as very short-term bearish bets (which should all be doing fabulously in the morning panic), but we also went long on MCD, XLF and BCS in the afternoon (and long on RUT and Dow Futures in this morning’s Alert to Members) for some bottom fishing.

So we were a bit bearish on Friday, but short-term bearish for the weekend (expecting this morning’s dip as a follow-through from Friday, at least). We continue to have faith that our 10% lines will hold for our major indexes and that the NYSE and Russell will hold their early August lows. If we’re wrong, we have a very large list of longer-term puts we are working on (see Range Trading, Part 2 for update). XLF remains an excellent contrarian opportunity at $12 and the Oct $12/13 bull call spread is .50 and you can sell the $11 puts for about the same for an almost free $1 spread where the worst-case scenario is you end up long on the Financials at net $11. FAS is like XLF on steroids and, at $12 as well, you can sell the $8 puts for $1 and buy 2x the XLF calls so the margin is about the same but you can make $2 on the upside – a fun way to play!

VXX should be up huge this morning as well and we love to sell VXX when it’s high. The $49/46 bear put spread is $2 and you can sell the $51 calls for $1 for net $1 on the $3 spread that pays up 200% on Friday if the VIX doesn’t stay this excited. If it does, you can roll to the short Oct $62 puts that are now $2 to hopefully get out of the trade even when and if the market ever does calm down.

Those are the kind of trades we’ll be looking for in Member Chat this morning – selling what we can into these high premiums while we can. Maybe it’s too early – maybe the World IS ending and, if so, we have some hedges for that — let’s just try not to forget about the upside because, if it turns out the EU banks aren’t forced to re-mark their Greek notes against 108% interest rates and the EU and the IMF finally agree on a solution people have faith in and if Ben rides in on his helicopter to save the day in two weeks – then we’ll be VERY upset we weren’t more bullish, right?