700 has been a tough nut to crack in our small-cap index.

700 has been a tough nut to crack in our small-cap index.

Dollar weakness has hurt the companies that do most of their business in the US, collecting crappy dollars for their goods and services and having to pay through the nose for high-priced commodities and imported goods. Small caps don't have the muscle to hold down wages in overseas factories while they boost productivity to the point of suicide like our beloved Apple can. No, while our small caps may have a plentiful supply of US workers willing to work "cheap" – we're still not at the point where our Government forces students to work in the factories as "interns."

So, while we wait for those IPhone 5's to roll off the assembly line, we'll be keeping an eye on the Russell, which should benefit from the recent strength in the Dollar, which is is up over 5% in September – although probably topping out at 78 – which is good, as it will give the markets a nice boost on the way back down.

Dow futures are already up over 200 points since 3am (when they were down 100) and, when our 3am trade is working, the bots are usually taking the markets higher. Nothing has changed in the news – Moody's went ahead and downgraded Credit Agricole and Societe General but maintained an Aa2 rating on BNP – the source of yesterday's big drop in France on the silly rumor that I told you in yesterday's post was nothing but blatant market manipulation by our favorite media mogul.

Don't worry, no one will be arresting Rupert Murdoch because – well, he's rich. Rich fixes everything, doesn't it? Rupert's pal, Chinese Premier Wen Jiabao (What? You didn't think he only buys Western politicians, did you?), says no one should rely on China to bail out the world economy. "Countries must first put their own houses in order," Wen said today. Asian stocks dropped following his comments, but European markets and futures have shaken the news off after the bank downgrades in a classic example of selling the rumor and buying the news.

Today the big rumor is bullish on news that Geithner is going to Europe to spread the religion of Easy Money in what will be the first time a US Treasury Secretary has been invited to attend a Eurozone FM meeting. Word is also out that Treasury will be supporting the Fed's "Operation Twist," which means both the supply of and demand for US TBills will be tightly controlled for the foreseeable future.

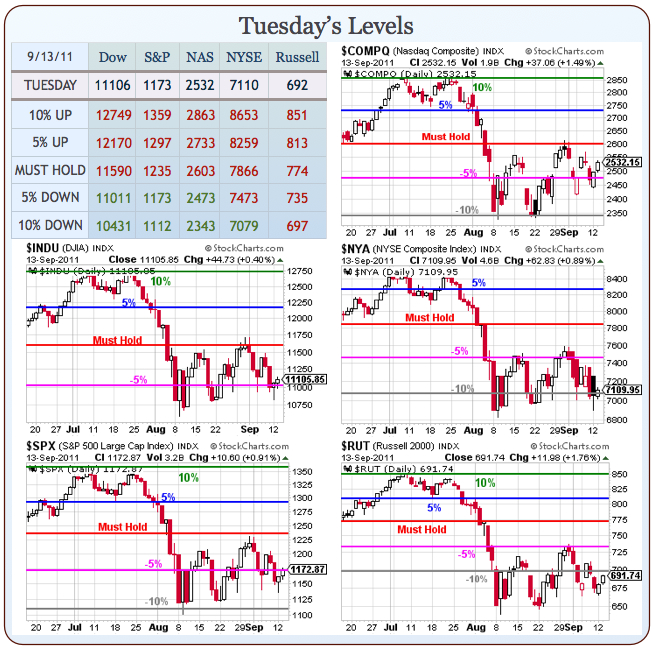

As I said to Members this morning, There’s still plenty of bad news out there so we remain skeptically bullish. Don’t forget, our pattern has been 500-600 points on a bull run and then a pullback and Russell 700 has been a brick wall to get through so we’ll watch that carefully for a sign that the markets are really ready to head higher. We bottomed out at 10,800 on Monday so 11,340 is our goal (5%) in the short-term on the Dow but we won’t get there without the Russell cooperating.

In Monday morning's post, we flipped bullish (20-25/15) after having a great ride down on our bearish trade ideas from the morning post (which you can have in your mailbox every morning pre-market) were:

- FXE at $136, now $136.75 (we already had a spread from Friday that makes 1,100% at $137).

- XLF Oct $12/13 bull call spread at .50, selling $11 puts for .48 for net .02, still .02

- FAS Oct $8 puts sold for $1 (alternate to above sale of XLF puts), now .50 – up 50%

- VXX Sept $49/46 bear put spread at $2, selling $51 calls for $1 for net $1, now $1.56 – up 56%

- TNA Sept $40/43 bull call spread at $1.30, selling RUT Sept $610 puts for $1.22 for net .08, now $1.25 – up 1,462%

Actually the TNA trade was from the bottom of yesterday's post as we were still bullish in the morning and, as I said to Members during Chat, it's a very tough market to call so we need to have a hypothesis and set levels that test our hypothesis and stick with it until/unless it is PROVEN wrong – now is not a good time to go with "feelings". Our theory was we would pop back to Russell 700 but now we DO NOT KNOW what will happen next so it's time to be cautious again and put some of those upside profits into some downside hedges. Zacks put out a good note on market uncertainty this morning saying:

"So what we have is a game of Russian Roulette. But instead of the usual rules where you have only 1 bullet and 5 empty chambers. I would say it's more like 3 bullets and 3 empty chambers. That leaves 50% chance for survival and healthier stock outcomes. And 50% chance odds of an economic "shot to the head" with resulting recession and ferocious bear market."

That quote is from an article I wrote Monday and pretty much sums up where we stand now. The best thing going for the market right now is that corporations have strong balance sheets and can generate decent profits with only modest demand. So with cash and bonds paying next to nothing, it makes stocks attractive by comparison.

The worst thing going for the market is what is happening in Europe. The more I read the more I think it ends poorly for them… and for the global economy. Which argument is stronger? You can spin the gun barrel to find out your fate. Or take a balanced approach that allows you to more nimbly shift your strategy as the outlook becomes clearer.

That's why I've already selected some bearish bets on the Futures in Member chat, shorting Oil (/CL), as usual at $90 along with the Dow (/YM) at 11,100 and the Russell (/TF) on a rejection at 697, which is 700 on the market index. All with very tight stops, of course. The reason is, as I mentioned above, that the Russell has a huge problem with that 700 line AND the Dollar has huge support at 77.50. Until those two break – we're simply locked in the same up and down trading range we've been in for ages.

That's why I've already selected some bearish bets on the Futures in Member chat, shorting Oil (/CL), as usual at $90 along with the Dow (/YM) at 11,100 and the Russell (/TF) on a rejection at 697, which is 700 on the market index. All with very tight stops, of course. The reason is, as I mentioned above, that the Russell has a huge problem with that 700 line AND the Dollar has huge support at 77.50. Until those two break – we're simply locked in the same up and down trading range we've been in for ages.

Hopefully we'll get stopped out of the Futures on encouraging words from Geithner, who is being interviewed by Jim Cramer at CNBC's Delivering Alpha Conference this morning but, since we had a strong run into the event already – we're still a bit skeptical. Our last trade idea in Member Chat was a protective Sept DXD $20/21 bull call spread at .25, offset with a short JPM Oct $28 put at .95 in a 4:1 ratio – risking net .05 to make $4 (7,900%) if the Dow drops. If we hold up today, we can take 2 of the spreads off the table and that turns it into a bullish play without sacrificing all of the 2-day remaining hedge.

The idea is not to flip bearish but to move back from 25/15 bullish to 25/20 and, if we begin to fail our levels, back to 20/20 as we stop out those winning short-term bullish trades. That's the game we have to play while we are trapped in this trading range but hopefully we won't need to as Cramer steers Geithner to say all the magic words that can encourage the EU this morning (up about 1.5% at 9am) ahead of the Secretary's trip because attitude is everything in this market.