Wheeeeee, what a fun weeek!

Wheeeeee, what a fun weeek!

I couldn’t say how many “fixes” we’ve had over the past two years but there have been plenty. Each has proven ephemeral but each new effort has become more assertive. This current plan now comes with wide global support. We have to remember these governments have skin in the game for their own economies. BRIC countries have plenty of “stuff” to export to a healthy euro zone so they’ll be supportive. Bernanke is also determined to be a player rumored to be adding $100 billion in aid to Europeans. Also in support were the ECB, the SNB, the BOJ and the BOE. I guess you could say; “it takes a village”, eh? – David Fry

Bears should know they can’t fight the Fed and when the Fed brings all of it’s buddies along with their various economic weapons – it’s probably not the best time to stand up to them. We still need to hear the word on QE3 next Wednesday or all these gains will vanish in a puff of smoke but, really, what are the odds that all this leads up to a Fed meeting where they say: "No more free money"?

In our current environment, any whiff of the European financial crisis abating seems to send the markets higher. "Somehow we’re back to a risk-on trade again," says Custom Portfolio’s David Twibell, but the problem in Europe is very serious, and if there was an easy solution, we would have already solved the problem. "The market is being a bit Pollyannaish right now," he says.

In our current environment, any whiff of the European financial crisis abating seems to send the markets higher. "Somehow we’re back to a risk-on trade again," says Custom Portfolio’s David Twibell, but the problem in Europe is very serious, and if there was an easy solution, we would have already solved the problem. "The market is being a bit Pollyannaish right now," he says.

We went risk-on on in a big way on Monday, as we bet on the manipulators to manipulate (seemed like a reasonable premise) and today is the day we take those profits off the table and use some of them to hedge for the weekend. I laid out the trade ideas from our Monday and Tuesday morning posts on Wednesday and it now looks like FXE will finish above $37 for the full 1,100% gain so we’re off to a good start already!

XLF is an Oct spread but on track and the Short FAS $8 puts for October are already down to .30 (up 70%) so there’s no sense waiting a month for the last 30%, is there? Certainly not after we make 70% in a week! VXX is well below $45 so that spread should make the full 200% (was "only" up 56% at Wednesday’s review) and TNA is miles in the money and that .08 spread was up 1,462% on Wednesday but should return the full 3,650% today – not bad for a spread that was initiated Tuesday morning…

Now, unfortunately, it is time for my usual "Now we are in the middle of our trading range and it’s harder to call direction" speeches. The reason we can come up with trade ideas that return 3,650% in 4 days is BECAUSE we wait for the indexes to move into the right position within our trading range and we wait for other factors to line up like (in this case) a high VIX, high negative sentiment, the political climate (which people say I pay too much attention to) and, of course, the recent AND incoming data. When we are patient, we get fat pitches like that to swing at. We still may swing and miss but at least, if you wait for the right pitch, there’s a chance of knocking one out of the park.

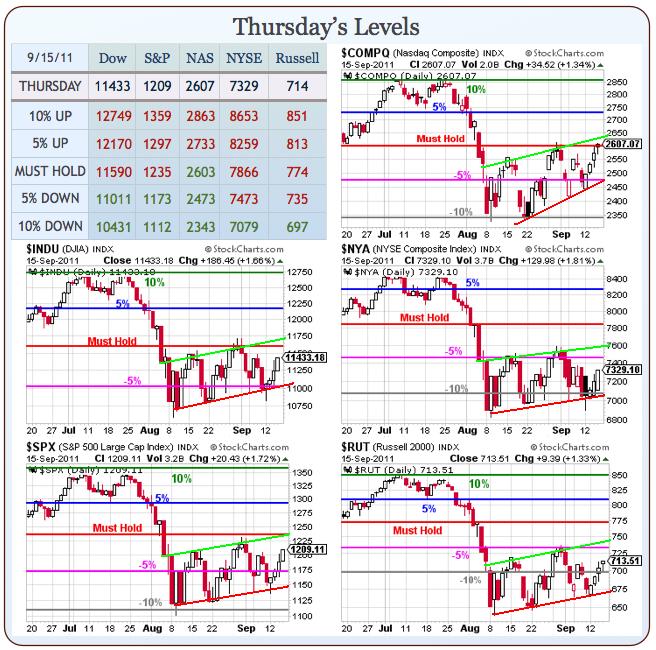

We’re currently watching these uptrending channels on our Big Chart and we are not at all impressed with any "rally" that doesn’t break over those rising green lines so the longer it takes – the higher the green lines will climb and the more it will take to impress us.

We’re currently watching these uptrending channels on our Big Chart and we are not at all impressed with any "rally" that doesn’t break over those rising green lines so the longer it takes – the higher the green lines will climb and the more it will take to impress us.

The Nasdaq made it over our Must Hold Level at 2,603 yesterday and today they need to hold it. We are still expecting to break over next week – thanks to the Fed, but you never know what nasty bit of news could hit us over the weekend so we’re not going to go too crazy into the close. We will be looking for some protective plays as we test the top of the channel on the Qs this morning.

Before you get too complacent with your stock positions – take a look at RIMM, who missed earnings last night and were slapped down 20%, despite already being down 57% from the February highs. We saw NFLX take a nice, 20% tumble this week as well. That one is another good example of waiting for the fat pitch as NFLX was at a still-ridiculous $280 on July 25th, when the trade idea on them in Member Chat was:

NFLX – That one is way too scary for me and no way on earth would I want to play them bullish. My favorite play on them, longer term, is the Jan $270/210 bear put spread at $20, selling the $325 calls for $21 for a net $1 credit on the $60 spread. The 2013 $400 calls are $22.50 so the bet is really a short $1 call that NFLX doesn’t make $400 in 18 months (up 41%) with the bonus kicker of a 6,100% gain if it turns out they aren’t as good as people think and they drop 30% instead.

We already had shorter-term aggressively bearish bets from the week they hit $300 (July 11th) which, of course, did great. This spread is technically still in progress but the Jan $270/210 bear put spread is already $59 out of $60 and the $325 calls are down to .30 so net $58.70 now off a $1 credit is a gain of 5,970% on cash in just over 2 months – not bad and certainly no sense letting it ride for 3 more months to make another 130% – although it’s kind of funny when you realize you can’t be bothered to make another 130% of your original investment in 3 months, isn’t it?

We already had shorter-term aggressively bearish bets from the week they hit $300 (July 11th) which, of course, did great. This spread is technically still in progress but the Jan $270/210 bear put spread is already $59 out of $60 and the $325 calls are down to .30 so net $58.70 now off a $1 credit is a gain of 5,970% on cash in just over 2 months – not bad and certainly no sense letting it ride for 3 more months to make another 130% – although it’s kind of funny when you realize you can’t be bothered to make another 130% of your original investment in 3 months, isn’t it?

Hopefully QE3 will give us more ridiculous run-ups we can short into down the road – those are always my favorite kind of long-term protection, rather than shorting an index that we actually hope will go higher. For now, we will watch and wait for our breakouts, sticking with the game plan we’ve been executing since the early August lows. To keep us on the Bull side, we need the S&P to hold their 1,200 target but we won’t be comfortable with betting up from here until we see the Russell and the NYSE poke through their -5% levels at 735 (21 points away, 3%) and 7,473 (144 points away, 2%) so it’s not too likely we’ll be having that feeling into today’s close.

Europe is drifting up around 1% this morning and at 9:55 we have University of Michigan Consumer Sentiment numbers, which are likely to suck. If we can get past those and the EU close, we can hope to finish at the week’s highs. As long as we’re holding those -5% lines we’ve had a good week though and this week it’s up to the EU not to blow it (again) and then it will be up to the Fed not to disappoint us on Wednesday afternoon.

Have a great weekend,

– Phil