Courtesy of The Automatic Earth

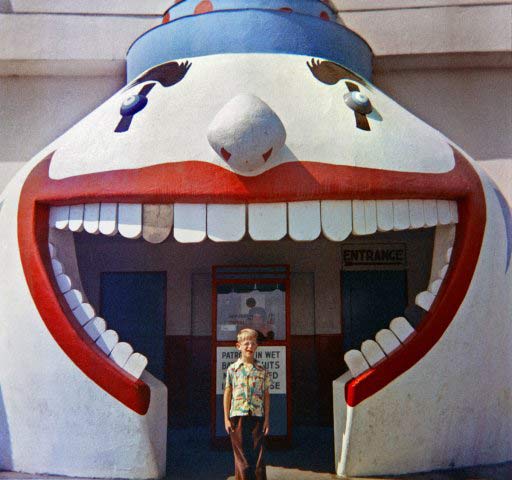

Fun House, Santa Cruz, California Beach Boardwalk

Ilargi:

Don’t you love farce?

My fault I fear.

I thought that you’d want what I want.

Sorry, my dear.

Kick out the clowns.

Get rid of the clowns.

Don’t bother, they’re here.

• d’après Stephen Sondheim

Where we find ourselves today has just about all been entirely predictable, as readers of The Automatic Earth know only too well; we’ve predicted most what’s happening now pretty accurately (going forward, remember what we’ve said about the dollar and about gold). Not predictions of the exact timing, but that’s not the essence, except perhaps when you’re a day trader; but even they have children.

The essence is the very simple fact that a debt crisis can’t be averted with more debt (again, barring warfare, zero-point energy and meteor strikes). And that a debt crisis of the present magnitude inevitably leads to a credit crunch that paralyzes entire economies, in this case even the whole global economy as we have come to know it.

Once you accept that, measures completely different from what we have seen so far and what is now being touted once more, are called for. But we’re not getting these different measures; it’s as if those who "lead" the world are able to live and think in two dimensions only, whereas comprehension of a third dimension is needed to understand the issues at hand.

.jpg) All these so-called leaders refuse to accept the possibility that monetary and fiscal policy may not hold the tools to fix the mess and get back to normal, or whatever passes for it. Yes, there’s a political crisis. But it’s not that they can’t get their act together to dump more public funds into the alleged right places, it’s that dumping public funds is the only measure they can think of.

All these so-called leaders refuse to accept the possibility that monetary and fiscal policy may not hold the tools to fix the mess and get back to normal, or whatever passes for it. Yes, there’s a political crisis. But it’s not that they can’t get their act together to dump more public funds into the alleged right places, it’s that dumping public funds is the only measure they can think of.

The underlying idea is that if banks’ assets (debts) would be marked to market right now, the banks would be broke. By injecting trillions more, the hope is that asset values will recover. Still, that is not what has happened so far; the opposite has happened. It’s the notion that markets are cyclical, hence they must come up again. But even if that’s true, cycles can be long, and the banks don’t have decades to save themselves.

Short version: by issuing trillions more in debt, governments and central banks -apparently- hope they can turn around financial markets, and have them recover to heights that would turn today’s losses into tomorrow’ profits (or at least more bearable losses).

There are lots of voices that will tell you that we didn’t need to be where we are, that things could have been done: (If Leadership Fails, Prepare for Recession!). They all mean more or less the same things: capital injections into the financial industry. A financial industry that is by and large broke and now depends on money from governments and their taxpayers all of whom are by and large broke.

Amidst all the fear and panic and selling, let me repeat what I’ve said a thousand times by now: there is no way out of this crisis that does not involve defaults on debt, restructuring of debt and bankruptcies caused by debt. Nothing else will achieve anything other than window dressing. In other words: all we’ve seen so far has been window dressing, and of a very expensive kind.

Yes, it’ll be tough, yes, it’ll be severe, yes, it’ll be brutal. But isn’t it true that nothing’s more brutal than having to listen day after day year after year to over-paid clowns lying through their teeth and other body parts and then in in the end still wind up in a situation that’s in all likelihood even worse than where you would be if you’d have shut them out from the start?

The real problem is not, as a plethora of voices is now proclaiming, that governments have a hard time reaching consensus on recapitalizing the banking system. The real problem is that they are still, despite all the trillions squandered on exactly this approach, even considering doing so.

When we hear Lagarde, or Zoellick, or anyone of the "trusted" media pundits, say that all that’s really needed is for "leaders" to "get their act together", what they mean is that a lot more money should be pumped into the financial system, and into broke governments. For people like Paul Krugman and his ilk, there is only one possible problem with stimulus measures: that they’re too small. In other words: if a stimulus measure is large enough, it will solve any problem.

However, that idea of course carries its own problem: that the agent that does the stimulating will itself get into financial trouble. And who then will bail IT out? These ideas are based on the notion that no amount of debt can be large enough to overwhelm an entire financial system, or economy. That is not a very intelligent notion, if you ask me. It carries with it the idea that debt can be cancelled out with more debt.

The IMF’s Global Financial Stability Report this week suggested that European banks could be "saved" with a capital injection of perhaps around $400 billion. But the IMF, like everyone with a pair of functioning neurons, knows full well that that wouldn’t save the banks. It would only and simply allow them to live another day or two. And then the game would start anew, exactly like it has over the past, let’s say, 50 months. This is true of all stimulus, all QEs, all of it.

That is, unless a miraculous growth spurt appears out of the blue and against all the odds dictated by reality as we know it today. In other words, more capital injections simply and only mean more double or nothing gambling. We need restructuring, not replenishing. We need to sleep this one off, not get a refill.

This is not a simple difference of opinion, where one option is as valid as the other. There is no way the Lagardes and Zoellicks of the world can "know" that what they propose will achieve what they say it will. They refuse to believe – at least in public, let me add-, and therefore even consider, that the banks and indeed the entire system can go belly-up. And they also refuse to believe that throwing more money into the pit will not at some point be enough to fill that pit.

We need to get rid of these clowns. Unfortunately, I have very little faith that we actually will, if only because in the end, as much as our "leaders", we all are the clowns. As the Sondheim song goes: "Don’t bother, they’re here". Getting rid of the clowns is an almost entirely hypothetical situation, in the exact same way that solving debt with more debt is.

What governments need to do at this stage, and it’s years overdue, is to ringfence their citizens, in order for them not to lose even more money than they already have. And then to combine that with a massive restructuring, with many defaults and bankruptcies, of the banking system (but without losing citizens’ deposits) and the non-banking system that carry too much debt on their books.

Our present day "democratic" political systems are woefully inadequate to kick out the clowns and replace them with people that make sense, and are willing to do so for the masses.

But until we get a system that is capable of achieving this, we are in for a whole lot more misery.

Behind a painted smile.

Second pic credit: Jesse’s Cafe Americain

Weekend Reading, courtesy of The Automatic Earth – Click on Titles for Full Articles:

Global markets whipsawed higher and lower at the end of a tumultuous week as panic over a Greek default was tempered by hopes that politicians will step in to calm Europe’s debt crisis.

The FTSE 100 closed up 25.20 to 5,066.81 on Friday, but ended the week down 5.62pc, with £78bn knocked off the value of Britain’s blue-chip companies. While the index closed higher, it had fallen as much as 1.6pc earlier in the day, dropping through the pyschologically important 5,000 mark.

Obama urges France and Germany to move quickly to find a solution to the eurozone crisis, while UK chancellor George Osborne claims Britain is ‘ahead of the curve’

EU leaders were under renewed pressure today to agree immediate steps towards a full-scale rescue of ailing eurozone economies or risk a stock market rout when exchanges open on Monday. Fears that months of debate over how to resolve the Greek debt crisis had brought the world economy to another "Lehman’s moment" led several prominent analysts to warn that the situation could spark a run on bank stocks next week…

Stocks fell, pushing the MSCI All- Country World Index of 45 nations into a bear market for the first time in more than two years, after the worsening European debt crisis and threat of a U.S. recession erased more than $10 trillion from equities since May.

The MSCI index, which slipped 0.3 percent as of 1:33 p.m. in Hong Kong today, has lost more than 20 percent since peaking on May 2, meeting the common definition of a bear market. It tumbled 4.5 percent to a 13-month low of 277.38 yesterday. The MSCI World (MXWO) Index of shares in developed nations also fell into a bear market yesterday, plunging 4.2 percent. The MSCI Emerging Markets Index reached the 20 percent threshold on Sept. 13.

Cameron speech says failure of eurozone leaders to stabilise single currency is taking world economy to brink

The global economy is close to "staring down the barrel" and is threatened by the failure of eurozone leaders to agree a lasting settlement to stabilise the single currency, David Cameron warned on Thursday night.As markets tumbled around the world, amid gloomy assessments from the IMF and the World Bank, the prime minister issued his gravest warning about the global economic outlook and bluntly told eurozone leaders to stop "kicking the can down the road". "We are not quite staring down the barrel but the pattern is clear," the prime minister told the Canadian parliament in Ottawa…

Greece Sees 50% Debt Write-Off in Orderly Default, Ta Nea Says

by Maria Petrakis – Bloomberg

Greek Finance Minister Evangelos Venizelos told members of the ruling party that he sees three possible outcomes to the debt crisis, including one that involves an orderly default with a 50 percent loss for bondholders, Ta Nea said, without citing anyone.

Venizelos outlined "good, bad and better" scenarios to lawmakers with the "good option" involving the implementation of the July 21 accord for a second financing package, which projects a 20 percent loss for bondholders, the Athens-based newspaper said…

With French banks now a daily highlight in the market’s search for the next source of contagion, and big, multi-syllable words such as conservatorship and nationalization being thrown about with increasingly reckless abandon, perhaps it is time to consider the downstream effects of a French bank blow up.

And we are not talking French sovereign troubles, which are about to get far worse with the country’s CDS once again at record highs means the country’s AAA rating is as good as gone. No: banks, as in those entities that are completely locked out from the dollar funding market, and which will be toppled following a few major redemption requests in native USD currency.

Which in turn brings us to…Morgan Stanley, the little bank that everyone continues to ignore for assumptions of a pristine balance sheet and no mortgage exposure. Well, hopefully we can debunk one of these assumptions by presenting the bank’s Cross-Border Outstandings, which "include cash, receivables, securities purchased under agreements to resell, securities borrowed and cash trading instruments but exclude derivative instruments and commitments…

Dutch central bank president says Greek default is ‘one of the scenarios’

by AP

The president of the Dutch central bank said in a newspaper interview published Friday that he no longer rules out the possibility that Greece may not be able to pay back its crippling government debt. A Greek default "is one of the scenarios," Klaas Knot said in an interview published in respected Dutch newspaper Het Financieel Dagblad.

"I won’t say that Greece cannot default," said Knot, who is the recently installed president of De Nederlandsche Bank and a member of the governing council of the European Central Bank. Knot’s comments are unusual because they come from a member of the European Central Bank’s 23-member governing council. The bank has insisted Greece must stick with its bailout plan and has opposed default as a solution…

Moody’s downgrades 8 Greek banks

by Elena Becatoros – AP

Moody’s ratings agency downgraded eight Greek banks by two notches Friday due to their exposure to Greek government bonds and the deteriorating economic situation in the debt-ridden country, whose government has struggled to meet the terms of an international bailout.

Moody’s Investors Service downgraded National Bank of Greece, EFG Eurobank Ergasias, Alpha Bank, Piraeus Bank, Agricultural Bank of Greece and Attica Bank to CAA2 from B3. It also downgraded Emporiki Bank of Greece and General Bank of Greece to B3 from B1. The agency said the outlook for all the banks’ long-term deposit and debt ratings was negative…

Greeks strike amid pain and anger over austerity

by Lefteris Papadimas and Tatiana Fragou – Reuters

Greek workers staged a 24-hour strike on Thursday forcing the transport system to a standstill in protest against the government’s intensified austerity drive to secure aid to save the debt-laden country from bankruptcy.

Striking taxi drivers and bus, metro and rail workers meant commuters had to use their own cars, triggering kilometers-long traffic jams and stranding tourists at hotels in Athens’ ancient city center for several hours. Unions said more strikes were planned…

Greece’s Middle Class Revolt against Austerity

by Ferry Batzoglou and Jörg Diehl – Spiegel

Small business owners in Greece have long been the backbone of the economy and reliable taxpayers in a country where tax evasion is rampant. That, though, is now changing. Self-employed workers like Angelos Belitsakos have had enough of rising taxes and have begun to revolt.

The people who could ultimately give Greece the coup de grace are not the kind to throw stones or Molotov cocktails, and they have yet to torch any cars. Instead, they are people like 60-year-old beverage distributor Angelos Belitsakos, people who might soon turn into a real problem for the economically unstable country. Feeling cornered, he and other private business owners want to go on the offensive. But instead fighting with weapons, they are using something much more dangerous. They are fighting with money…

No need to nationalise Greek banks – EU task force

by Annika Breidthardt – Reuters

Greek banks do not need to be nationalised but should receive direct support from the currency bloc’s bailout fund, the head of a new EU task force set up to help rebuild the Greek economy was quoted on Friday as saying. "The banks did rock solid business until the start of the debt crisis. Therefore I see no reason for nationalisation," Horst Reichenbach told the Handelsblatt newspaper.

"It would be desirable to support the banks themselves, such as with means from the euro rescue fund (European Financial Stability Facility) EFSF or with loans from the European Investment Bank."…

European officials look set to speed up plans to recapitalise the 16 banks that came close to failing last summer’s pan-EU stress tests as part of a co-ordinated effort to reassure the markets about the strength of the 27-nation bloc’s banking sector.

A senior French official said the 16 banks regarded to be close to the threshold would now have to seek new funds immediately. Although there has been widespread speculation that French banks are seeking more capital, none is on the list. Other European officials said discussions were still under way…

Fear gauge enters the red zone

by Ambrose Evans-Pritchard – Telegraph

Europe’s debt crisis risks escalating out of control as the world economy slides towards a double-dip slump with few shock absorbers left to limit the damage.

Key indicators of credit stress have reached the danger levels seen before the Lehman Brothers failure three years ago, with Markit’s iTraxx Crossover index – or "fear gauge" – of corporate bonds surging 56 basis points to 857 on Thursday. Societe Generale led a further rout of bank shares, crashing 9pc in Paris on concern that it might need recapitalisation to cope with losses on Italian and Spanish debt…

• Bank of America, Citigroup and Wells Fargo downgraded in US

• S&P cuts ratings on Italy’s Intesa Sanpaolo and Mediobanca

• IMF warns time is running out to solve financial crisisBanks on both sides of the Atlantic have been downgraded by ratings agencies just hours after the International Monetary Fund warned time was running out to tackle weaknesses in the global financial system.

The Washington-based IMF, which said that the exposure of European banks to debt in the weakest parts of the eurozone had ballooned to €300bn since last year, used its half-yearly global financial stability report (GFSR) to warn that there had been a substantial increase in risks to stability over the past few months. It said the sharp rise in market turmoil over the summer had been caused by investors losing patience with the inadequacy of reforms since the start of the crisis more than four years ago…

A Lack of Lending at European Banks Increases the Fear of Stagnation

by Jack Ewing – New York Times

This was supposed to be the month that European banks went back to debt markets to refill their coffers. It is not working out that way.

On the contrary, debt issuance by banks has slowed to a trickle at the same time that short-term interbank lending is drying up. The financing drought raises questions about whether banks will have enough money to refinance their own long-term debt and still meet demand for loans…

European banks have already received 420 billion euros in funds to help recapitalize and are in a much better shape than three years ago, the European Commission said on Friday…

French banks could tip Europe back into a full-blown banking crisis

by Mohamed El-Erian – FT

Conventional wisdom may now be only half right when it comes to solving Europe’s mess. Fixing the sovereign debt problem is still necessary, but it may no longer be sufficient. Europe must also move quickly to stabilise the banks at its core in ways that go far beyond what the European Central Bank announced on Wednesday. As senior BNP Paribas executives prepare to tour the Middle East in an attempt to raise fresh funds and shore up confidence, other banks must also show greater urgency and seriousness in dealing with capital and asset quality shortfalls.

Much of the discussion on the crisis is based on the assumption that sovereign debt is both the problem and the solution. Initially, this was correct. The combination of too much debt and too little growth pushed the most vulnerable countries (Greece, Ireland and Portugal) into a classic debt trap. Timid policy responses then fuelled contagion waves that undermined other sectors…

Russia’s banks: Collateral damage

by Catherine Belton and Neil Buckley – FT

Fallout from the rescue of one of the country’s biggest lenders highlights oversight concerns

On a snowy Friday evening in late March, Andrei Borodin received a call as he flew out of Moscow on a private jet. Then president of Bank of Moscow, Russia’s fifth-biggest, he found himself under mounting pressure as VTB, the state-controlled lender that is Russia’s second biggest, tried to take over his bank. Just hours earlier, the government’s budget watchdog had called for his suspension while it audited what it believed were "dubious" loans to entities re?lated to Bank of Moscow…

Belligerent Berlusconi Toys With Europe

by David Böcking – Spiegel

Italian Prime Minister Silvio Berlusconi refuses to recognize that his country is in trouble. Vast debt, sluggish growth and rising borrowing rates indicate that Rome too may be infected by the euro-zone debt crisis. But the EU has few tools at its disposal to get Italy to take action.

After ratings agency Standard & Poor’s downgraded Italy’s credit rating a notch on Monday night, Prime Minister Silvio Berlusconi immediately went on the offensive. The appraisal of the country’s economic state seemed to be "dictated more by media reports than reality," he said. The Italian government is already balancing the budget, he added…

Spain’s Banking Mess

by Floyd Norris – New York Times

It’s not just sovereign debt.

Just when markets were focused on the risks of a Greek default and the possibility of contagion to other countries, Spain’s central bank reported this week that things were getting worse for that country’s banks — but not because they held a lot of Greek debt or bonds issued by other troubled European economies. The problem, instead, is the same old one. With Spain’s economy weak and home prices falling, bad loans are growing. And the central bank thinks things are getting worse…

Swiss Must Save UBS’s Bonus Pool or Die Trying

by Jonathan Weil – Bloomberg

Ever since UBS disclosed its latest gigantic loss, due to a supposedly rogue trader in London, the financial press has been obsessed with digging out trivial details, such as what the scandal means for the future of global banking regulation and whether it will cost UBS Chief Executive Officer Oswald Gruebel his job.

Then there’s the real story. Inside UBS’s vast investment- banking operation, we can pretty well guess there’s only one question that matters: "Does this affect my pay?" The short answer is it might. Only it doesn’t have to be this way…

A Visit to J-Village: Fukushima Workers Risk Radiation to Feed Families

by Cordula Meyer – Spiegel

Since the nuclear disaster at Fukushima, the power plant’s operator TEPCO has relied on temporary workers to help bring the reactors under control. Many of the workers, whose radiation levels are measured daily, say they are not doing the work for Japan, but for the money. SPIEGEL visited J-Village, which is strictly off-limits, and met the unsung heroes of Fukushima.

Milepost 231 now marks the end of the road. Barricades prevent traffic from proceeding farther north on Highway 6, a four-lane road that leads to the ruin of the Fukushima Daiichi nuclear power plant. Men in uniform are waving stop signs. In the evening twilight, a red illuminated sign flashes the following message: "No access… disaster law." Two policemen armed with red glow sticks vigorously turn away every lost driver. Three of their colleagues are blocking the exit to the right. They yell at anyone approaching on foot…