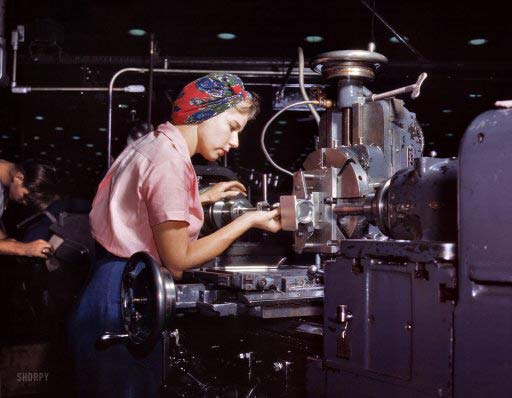

Courtesy of The Automatic Earth

"Women become skilled shop technicians after careful training in the school at the Douglas Aircraft Company plant in Long Beach, California. Planes made here include the B-17F Flying Fortress heavy bomber, A-20 assault bomber and C-47 transport"

Ilargi: It’s time to make one thing clear once and for all: the financial institutions at the heart of our economic system are finished, broke, bankrupt. Since 2008, they have been kept alive only by gigantic infusions of our, the public’s, money. We have been, and still are, told this is only temporary, and that the money will help restore them to health and then be repaid, but temporary has been 3 years and change now and there’s no restored health anywhere in sight.

The opposite is true: Obama launches another -even more desperate- half-trillion dollar jobs plan, and Europe is devising another multi-trillion dollar plan aimed solely at keeping banks from going belly-up, because these banks have lost anywhere between 50% and 90% of their market capitalization in the past few years, despite the multi-trillion capital infusions(!), and are still loaded to the hilt with investments, in sovereign bonds, in each other, in derivatives, that are so toxic they could blow them up at any moment.

If this were not true, if there were any possibility left that the banks at the heart of the system could indeed be saved and restored back to health with public funds, their assets would have been marked to market, and market confidence would thus be fully restored. The fact that mark-to-market is still religiously shunned 3 years after Lehman should tell you all you need to know about what’s real and what’s not.

There is no hope, no indication, and no possibility, that pouring even more taxpayer and future taxpayer capital into the leaks would stop the floodwater from entering. The leaks are both too big, and too numerous. If a possibility existed to seal the leaks with public funds, it would have been implemented by now, everyone -from banks to governments- would have taken their share of losses and we would now be talking about preventing the next crisis, not about how to deal with the present one, which has only gotten deeper as we’ve gone along.

The meme that comes from our "leaders" is that by saving the banks -and that way only-, we will be able to save ourselves. The reality is, however, that the banks are being saved at our expense, and we get poorer faster because of it.

And it’s worse than that: the banks are beyond salvation, which means there can and will be no end to the constant flood of money from us, from the public coffers, towards the financial system, as long as present leadership, and their meme of saving banks to save ourselves, remain in control.

It’s only when we drop that meme that we can start moving towards a world that, though admittedly much poorer and simpler than the one we inhabit today, will be less depressing, and less prone to saddle us with our present widespread mental burden of paralyzing powerlessness.

What we see in the media today is that markets are rising because the German Bundestag voted Yes to expanding the EFSF with another €200 billion or so. The news is received with relief. But it should be received, by ordinary people, with a reaction that’s 180 degrees different. Because it means another €200 billion of their money is wasted on a bottomless pit, money that could have been used to alleviate the trials and tribulations of the weak among us.

It means we are moving one more step closer to ourselves being the weak among us.

The interests of the banking industry are not our interests; the two are, in the present instance, incompatible. There are situations possible where this is not the case, but our present situation is not one of them. Indeed, our interests are today diametrically opposed to those of the banking system because that system is drawing its last breath, choking on an overkill of debt, and trying hard, aided and abetted by our political leadership, to drag us down with it.

If we are to have a feasible shot at building a future that’s humane, we must leave those banks to die that have no chance of survival, and we must rid ourselves of those "leaders" amongst us who refuse to build that future with and for us and who persist in taking our money only to hand it to a deeply bankrupt industry, which can subsequently use it to finance their election campaigns.

It’s one thing to ask people to make sacrifices in order to save their health care and education systems. It’s quite another to force, instead of ask, them to make sacrifices in order to save their banking system. And people will only take this lying down to an extent.

Greece’s austerity measures, both budget cuts and tax increases, will add up to some 20% of GDP. In comparison, US GDP is some $15 trillion. If the US were to adopt austerity measures equal to Greece, it would have to do so to the tune of $3 trillion per year. If memory serves, it presently has enough trouble trying to push through anywhere from $1.2 trillion to $4 trillion over 10 years.

The Greek bailout is built upon severe austerity measures. It is perhaps more than anything else a clear indicator of how the transfer of wealth takes place, from never-will-haves to never-will-have-enoughs. And the demands for further cuts just keeps on coming, in a vicious circle. The more cuts, the more the economy shrinks, the more demand for cuts there will be from the EU/ECB/IMF troika.

The day will come when the Greeks decide that if they have to go through hardship like this, they might as well at least be masters of their own fate. It’s one thing to decide amongst yourselves that you need to do with less so your children can do better. It’s another to have others decide it for you, and with no guarantees for the children either.

Austerity will be with all of us in the western world. That’s not something we can choose not to partake in. We can though, like the Greeks will soon, opt to take matters into our own hands. Let the banks go where banks go to die but protect people’s deposits as much as we can. This might make things worse for a while than continuing on the present path, but that is by no means even certain.

One thing must be clear though from now on in: the road we’re traveling on today leads nowhere. Well, nowhere good. The banks at the core of the system can not be saved, and even if they could we should wonder out very loud if we would do wise to save them, given the price we would need to pay, and the reward we would get for doing so.

Whatever our choice would be in that regard, we need to become masters of our own fates again. Then we can mark all assets to market, both our own and the banks’, add up the losses, restructure what must be restructured, cut what must be cut, but still while trying to preserve the institutions that keep us together as societies: our health care system, our schools, all the things that bind us together. Banks are simply not in that category.

We must get back to the core, preferably before it’s all we have left. We need to ringfence our basic needs. Banks are not included in that. Don’t let them fool you any longer into thinking that they are.