Baby listen without thinking you better be without demands

Now don’t get edgy and don’t start blinking and don’t start making any plans

You try to reach a vital part of me My interest level’s dropping rapidly

It’s all excuses baby all a stall We just don’t get excited

Don’t get excited No don’t get excited Don’t get excited

Wheeeeeeee – this is fun!

It was "1,072 or Bounce" yesterday and the S&P fell all the way to 1,074.77 at 10am before heading higher but, as you can see from David Fry’s chart, we got a second chance to jump on the bull train as we lost almost all of the day’s gains into the afternoon stick.

In our morning Alert to Members (as noted in the morning post), we played the Russell Futures bullish off the 600 line and, as of 7:30 this morning, they are at 646 – up $4,600 per contract but that’s chicken feed compared to our trade idea from the morning post on TNA, where the Oct $28/33 bull call spread offset with the sale of the $23 puts came out to net .15 and this morning, after a $6 move (5% on the RUT) in yesterday’s action, that spread is already net $1.90 – up 1,167% in a day!

.jpg) The best possible outcome on that trade is netting $4.85 profit, which is a whopping 3,233% gain on cash but, when you make over 1/3 of your projected 3-week gains in the first day – it’s a good idea to take a little profit off the table! So, UNLESS we get a better than 1.5% gain today, we’re going to go back to Cashy and Cautious after a whole 24 hours on the bull side. Don’t blame the player – it’s just that kind of market….

The best possible outcome on that trade is netting $4.85 profit, which is a whopping 3,233% gain on cash but, when you make over 1/3 of your projected 3-week gains in the first day – it’s a good idea to take a little profit off the table! So, UNLESS we get a better than 1.5% gain today, we’re going to go back to Cashy and Cautious after a whole 24 hours on the bull side. Don’t blame the player – it’s just that kind of market….

As you can see from the Big Chart – there is NOTHING to get excited about as we bounce off our EXPECTED channel bottoms. We’re now firmly in downtrending channels on all of our indexes and we’re dangerously close to having to drop our ranges – which is a decision we take VERY seriously before acting. If we are forced to do that, the odds of a near-term recovery drop significantly.

So of course we’re thrilled with yesterday’s gains but it’s a move we’ve been anticipating for days and yesterday we finally got an excuse to take the markets higher. That doesn’t mean it’s a new trend. We still need to break over those circled levels at Dow 11,000, S&P 1,150, Nas 2,475, NYSE 7,000 and Russell 675 before we even begin to commit our sideline cash to more bullish positions.

As it stands now, we ended up 15/10 to 20/15 bullish (out of a 100 allocation) – just sticking with the plan of cashing out our bearish bets at the bottom of the range and adding more bullish plays but, when we can add bullish plays that make 1,167% in a day – we don’t need to go too crazy, do we? Also in the morning post, I mentioned our very aggressive VXX spread where the weekly $55 were shortable at $5 in the morning and the weekly $56 puts opened at just $1.20 – much better than we anticipated for a net $3.80 credit on the spread.

As it stands now, we ended up 15/10 to 20/15 bullish (out of a 100 allocation) – just sticking with the plan of cashing out our bearish bets at the bottom of the range and adding more bullish plays but, when we can add bullish plays that make 1,167% in a day – we don’t need to go too crazy, do we? Also in the morning post, I mentioned our very aggressive VXX spread where the weekly $55 were shortable at $5 in the morning and the weekly $56 puts opened at just $1.20 – much better than we anticipated for a net $3.80 credit on the spread.

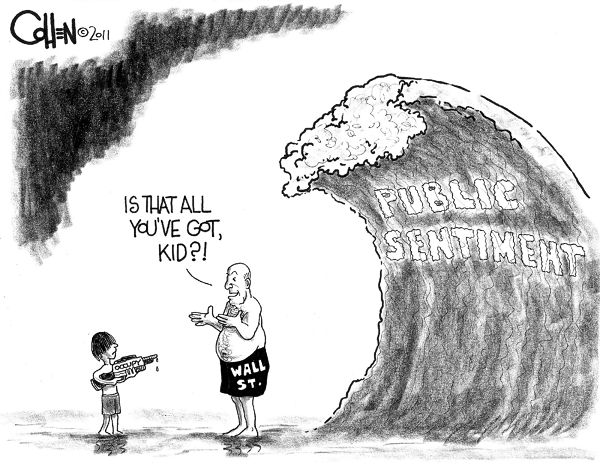

All we are doing is following PSW Rule #1, which is: "ALWAYS sell into the initial excitement." By selling as much premium as possible at our predicted top of the range, we give ourselves a nice buffer and those weekly calls can pull back fast. Already the $55 calls are down to $1.20 and should expire worthless on Friday while the $56 puts are $4.05, which is net $2.85 plus the initial $3.80 credit that’s already in our pocket is a $665 per contract gain in a day.

Another trade idea from the morning post was our usual TLT short play at $123. We had a little scare at the open as TLT topped out at $125 but we’re back to $121.75 this morning, a nice 2.5% drop on the day (notice how those 5% rule lines come up a lot!) and thank goodness as our play on TLT was from Monday, where we sold 5 weekly $122 calls for $1.65 in our $25,000 Portfolio and used that cash to fund the purchase of 5 weekly $124/121 bear put spreads at $1.70 for net .05. At the moment, that trade is flat so still playable this morning but if we don’t make our 1.5% gains today (and TLT should get below $120) then it’s too risky into the end of the week.

Trading is like fishing – we cast our nets and see what we catch. Yesterday we fished for TLT, TNA, VXX and USO and we had huge wins on 3 of 4 and that makes TLT the little one we throw back – there’s no need to stick with trades that aren’t performing as well as we like, is there?

Europe is still completely up in the air and China has been closed all week – so who knows what they’re going to do when they come back from vacation. Moody’s cut Italy’s rating yesterday, as did the S&P. Greece is on strike but Dexia was, in fact "rescued" yesterday (is that good or bad?) and the "Occupy Wall Street" movement is spreading to Main Streets around the country with demonstrators planning to storm the Goldman Sachs building in Jersey City on Thursday.

Europe is still completely up in the air and China has been closed all week – so who knows what they’re going to do when they come back from vacation. Moody’s cut Italy’s rating yesterday, as did the S&P. Greece is on strike but Dexia was, in fact "rescued" yesterday (is that good or bad?) and the "Occupy Wall Street" movement is spreading to Main Streets around the country with demonstrators planning to storm the Goldman Sachs building in Jersey City on Thursday.

Participants range from college students worried about job prospects to middle-age workers who have been recently laid off. The protests have been loosely organized around the concept, as Eric Sundman says, that "money shouldn’t influence politics, people should influence politics."

"I’m glad that everyone is getting active, and the fact that this is not partisan," said Sundman, who graduated recently with a culinary arts degree and has been unable to find steady work. "It’s not left, it’s not right; we’re all in this together. That’s what democracy is, and that’s what we’re trying to spread."