This is very interesting information from Lee, which I posted yesterday and am moving to a prominent spot in case you missed it. Zero Hedge observed today: 30 Year Bond Prices At Record Low Yield As China Flees, Direct Purchases Soar. ~ Ilene

Courtesy of Lee Adler of the Wall Street Examiner

Two weeks ago I began to report to subscribers of the Wall Street Examiner Professional Edition Fed Report that foreign central banks (FCBs) had begun to engage in unprecedented levels of disgorgement of their massive holdings of US Treasury and Agency paper. Prior to this year, the FCBs had typically absorbed the equivalent of 25% of new US Treasury issuance month in and month out. That was effectively a subsidy of US financial markets. It lowered long term interest rates artificially and injected cash into the US markets and banking system.

Two weeks ago I began to report to subscribers of the Wall Street Examiner Professional Edition Fed Report that foreign central banks (FCBs) had begun to engage in unprecedented levels of disgorgement of their massive holdings of US Treasury and Agency paper. Prior to this year, the FCBs had typically absorbed the equivalent of 25% of new US Treasury issuance month in and month out. That was effectively a subsidy of US financial markets. It lowered long term interest rates artificially and injected cash into the US markets and banking system.

Then about a year ago the FCBs began to slack off in their buying. In reality, that is what necessitated the Fed’s program of Quantitative Easing. The Fed had to step in and fill the demand gap left by the FCBs gradually reducing their rate of purchases. Had the Fed not acted when it did, long term Treasury yields would have started to rise and along with them mortgage rates and other long term rates, something that the US economy and the US Government simply could not afford.

When the negative unintended consequences of the Fed’s QE money printing, primarily skyrocketing commodity prices, exploded in Bernanke’s face, he was forced to discontinue the program and allow the Treasury market to fend for itself. The Fed had convinced itself through its self congratulatory and masturbatory in-house research, that there would be more than enough demand for Treasuries for the market to stand on its own without the Fed propping it up.

Ironically, the US bond market was rescued by the European sovereign debt and bank meltdown, so it appeared for a while that Dr.

Bernankenstein might be right and his monster experiment would be vivified on its own. The European panic triggered massive capital flight that ended up, where else, flooding into the US, mostly into purchases of Treasuries. Not only could the monster walk on its own, it could actually fly! Once again the Treasury market benefited benefited from an unusual subsidy, this one driven by fear. Bond prices flew into the stratosphere with yields sinking to record lows.

About 6 weeks ago, something changed. FCBs not only slowed their buying of Treasuries, they stopped altogether, reversed course and actually began selling them. Three weeks ago their selling reached a level that I characterized in my weekly Treasury update for subscribers as "dumping." It was simply unprecedented. I opined that this could be the beginning of the end of the Treasury bull market, in spite of any effect that the Fed’s new Operation Twist might have.

In fact, I expected that effect to be nil, and it has been. If anything, the announcement of Operation Twist, where the Fed offered to buy long term Treasuries from the Primary Dealers while simultaneously selling them short term paper, rang a bell for some investors. The Fed’s announcement told them that the time had come to sell their long term paper. If the Fed was buying, they decided that they would be glad to sell. Today, the yield on the 10 year Treasury note rose to 2.16%. That’s up an astonishing 44 basis points since last Thursday’s open.

Every other day, the Treasuries open on a huge gap. They are trading more like pork bellies than stodgy government bonds. Worst of all, the yield on the 10 year is up approximately 45 basis points since the low in yield reached the day after the Fed announced Operation Twist. Bernanke has egg all over his face. The man simply does not understand financial markets. And this move does not look like a fluke. As a result of today’s market, the yield on the 10 year has broken out of an intermediate term base. Unless yields pull back immediately, the implication is that the intermediate term target is 2.50. Meanwhile, Bernanke had assured investors that long term yields would fall as a result of his doing the Twist.

Apparently, the FCBs were among those who took the Fed’s announcement as a sell signal. They are selling at the heaviest pace in the 9 years that I have been tracking this data. Normally, prior to the last 5 weeks, the instances when they were actually net sellers were few and far between. What has been going on here lately is no less than a sea change.

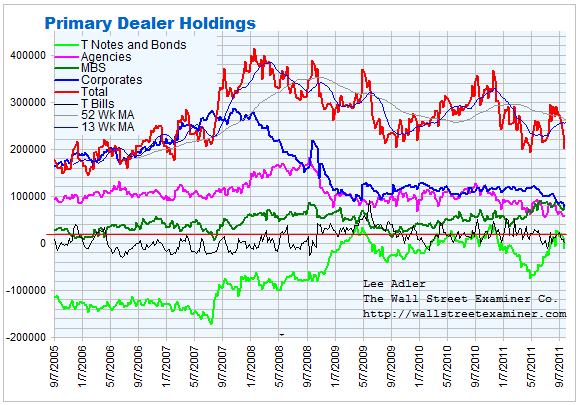

Making matters worse is that the Primary Dealers have also become massive sellers of Treasuries and all manner of fixed income paper in recent weeks. This chart of the Primary Dealer fixed income holdings is posted weekly in the Wall Street Examiner Professional Edition Fed Report. This data is released with a 10-day lag, so we only have data through September 28, but given the market action this week, this trend is certainly continuing.

The dealers appear to be in trouble. They began selling off their fixed income paper of all types in early September. That accelerated to what I can only characterize as wholesale dumping in the weeks ended September 21 and 28. It is no coincidence that those where the weeks where we began to see yields reverse from their record run.

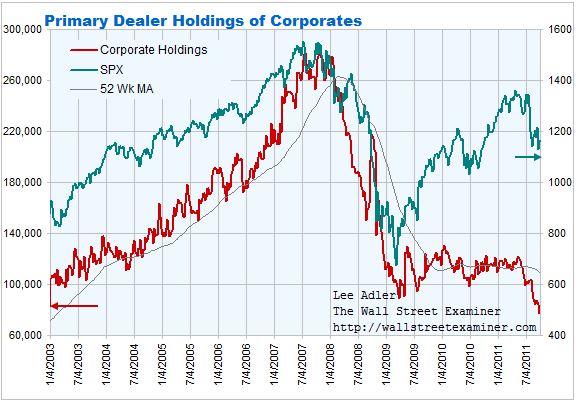

These are troubling developments, not just for their implications for the bond market, but for what they imply about the health of the backbone of the US financial system–the Fed’s Primary Dealer (PD) network. If the Fed is the head, these guys are the spinal cord. Isolating on just their corporate bond holdings the picture becomes even more troubling. If major corporations are supposedly doing so well and their balance sheets are in such great shape, why did the PDs not accumulate their fixed income securities throughout the equities bull market of 2009 and 2010? And especially why have they been frantically dumping their corporate holdings since June?

Something is rotten here. These are signs of major systemic stress.

It’s been a while since both stocks and bonds have rallied together. In recent months stocks could only rally when bonds sold off, which was rare. For the most part bonds were rallying and stocks were selling off. There just has not been sufficient systemic liquidity to keep levitating both markets simultaneously. It was either one or the other. But even the days where the stock market rallies when bonds sell off and yields rise may be coming to an end, and the day where both stock and bond prices fall and yields rise together, may be at hand.

These are just a couple of the factors that I track in my weekly reports covering the Fed, Treasury, Primary Dealers, foreign central banks, money supply, US commercial banking system conditions, fund flows and other key elements of US market liquidity. The fabric of the US financial markets is intertwined and complex. I track what I believe, from my years of observation, are the most important threads in that fabric, to try and gain an understanding of the context in which the markets are operating. That context is important to the technical analysis side of my work, where knowing the liquidity picture can help in understanding the patterns unfolding on the charts of the markets themselves. There are always loose ends, but more often than not, even with loose ends most of the threads tie together into a neat tapestry with a story that is clear. This may be one of those times, and it’s not a happy picture.

*****

Stay up to date with the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, and get regular updates on the US housing market in the Wall Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE’s Professional Edition risk free for 30 days!

Pic credit: Jesse’s Cafe Americain

Two weeks ago I began to report to subscribers of the Wall Street Examiner Professional Edition Fed Report that foreign central banks (FCBs) had begun to engage in unprecedented levels of disgorgement of their massive holdings of US Treasury and Agency paper. Prior to this year, the FCBs had typically absorbed the equivalent of 25% of new US Treasury issuance month in and month out. That was effectively a subsidy of US financial markets. It lowered long term interest rates artificially and injected cash into the US markets and banking system.

Two weeks ago I began to report to subscribers of the Wall Street Examiner Professional Edition Fed Report that foreign central banks (FCBs) had begun to engage in unprecedented levels of disgorgement of their massive holdings of US Treasury and Agency paper. Prior to this year, the FCBs had typically absorbed the equivalent of 25% of new US Treasury issuance month in and month out. That was effectively a subsidy of US financial markets. It lowered long term interest rates artificially and injected cash into the US markets and banking system.