It’s all about Slovakia.

It’s all about Slovakia.

How ridiculous is that? Today, Slovakia’s opposition leader (who we have never heard of and will never think about again once this is over) said lawmakers must find a way to approve Europe’s enhanced bailout fund, which was rejected yesterday amid a dispute over the future of Prime Minister Iveta Radicova (don’t try to pretend you’ve heard of her either!). Slovakia “must sign up to the rescue fund,” Robert Fico said late yesterday, adding that his party, which didn’t back the measure yesterday, is awaiting a proposal from the ruling coalition.

Radicova said the only country in the 17 nations that use the euro that has yet to approve European Financial Stability Facility, must find a solution to approve the EFSF “as soon as possible.” No time for a new vote has been set. “Eventually a yes vote will be secured,” Tim Ash, head of emerging-market research at Royal Bank of Scotland Group Plc in London, said by phone yesterday. “Does Slovakia really want to be alone among 17 euro-zone members states on this one, and when the future of Europe is at stake?”

Do they? Gee, I don’t know – seems kind of fun, doesn’t it, when a nation of 5.4M that is rumored to be "one of those countries in the East" is suddenly in a position to decide whether or not the Global Banking System goes into free fall or not. This is not to knock Slovakia but consider that a small nation with a per capita GDP of $22,267 per person (less than 1/2 the US or Western Europe) and a total GDP of $86Bn (less than 1/3 of Greece) is being given this kind of leverage.

And that leverage is very real because Robert Fico now has the power to move your portfolio up or down about 10% this week and all it would take is for an investment firm (who do know who Robert Fico is, because they have researchers who are paid to know this stuff) to perhaps set him up with a nice retirement account in exchange for perhaps making a public statement in opposition to the bailout perhaps at 1pm – after the investment firm has had a chance to load up on short positions that they will also be able to leverage 10 to 1.

If Robert Fico were a Republican – I would consider it a fait accompli and just short the market but, fortunately, Robert Fico used to be in the Communist Party – so he probably has some principles. I love the card on the left from the very cleverly done "Slovakiacards" web-site. Now, let’s direct our attention away from Slovakia for a moment and see what’s happening with the other 6,994,600,000 people in this World:

The Euro popped 1% overnight to test $1.38 in expectations of a yes vote in Slovakia (damn, back to them again!) and the Pound is back in synch with the Euro, testing $1.58 at the exact same moment. The Swiss could not be happier as they got the Euro/Franc ratio back to 1.24 – a full two points over their target level. That sent the Dollar back down to 77, a nice 1% drop overnight and guess what? That sent the US futures up 1% – what an AMAZING coincidence, don’t you think?

So, what could not be accomplished during regular market hours yesterday – bringing the S&P over 1,200 – is now mission accomplished in the thinly-traded futures. Not to be cynical but, if you are going to have some Slovakian Government officials torpedo a vote that will tank the markets – isn’t it a good idea to run them up first and bring in a bunch of suckers to sell to?

So, what could not be accomplished during regular market hours yesterday – bringing the S&P over 1,200 – is now mission accomplished in the thinly-traded futures. Not to be cynical but, if you are going to have some Slovakian Government officials torpedo a vote that will tank the markets – isn’t it a good idea to run them up first and bring in a bunch of suckers to sell to?

We expected to hit a lot of resistance at 2,600 on the Nasdaq but resistance is futile when the Bots are running the Futures – especially when you have "great" news like Greece being fixed – again.

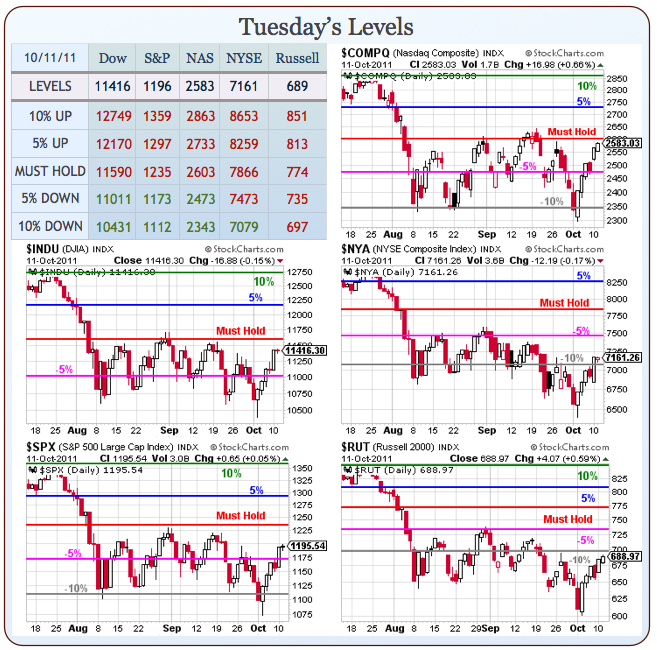

We remain a bit skeptical until we get back over our "Must Hold" levels and hold them for more than a day. AA led us off with poor earnings and poor guidance last night but much of that was from a "dramatic" reduction in orders out of Europe. If we do make 3 of 5 of our Must Hold Levels on our Big Chart – then it will be time to play the upside and the Russell is quite the laggard, still down below that 10% line so TNA will be looking attractive again if the RUT can mange to get over that magical 700 line.

Oil should make a fun short this week and we’re back to $86.05 this morning (from a low of $84 yesterday) but not on anything oil has done – just the Dollar falling over a point from yesterday’s low in the commodity. Gold is similarly excited, testing $1,695 and silver briefly broke through $33 again but has since backed down to $32.71. We’re certainly not shorting anything if the S&P is able to hold 1,200 and make it back over the Must Hold line at 1,235 but let’s make sure that actually happens before we get too bullish.

They need to keep the Dollar below 77.50 to keep us bullish today – let’s watch that as well as whether or not oil has the nerve to hold $86 into tomorrow’s inventory report. At 1pm we have the $21Bn, 10-year note auction and we’ll see how that affects TLT but we already had our fun with the trade from last Wednesday’s post, where our play was the weekly $124/121 bear put spread with an offset. That trade made the full $1,450 – 2,900% over the $50 cash cost but it worked because we were PATIENT and waited for TLT to go up before we shorted it – just like our friend the Bankster, who is very likely doing the same thing with the broader market the morning.