Wheeeee, what a ride!

Wheeeee, what a ride!

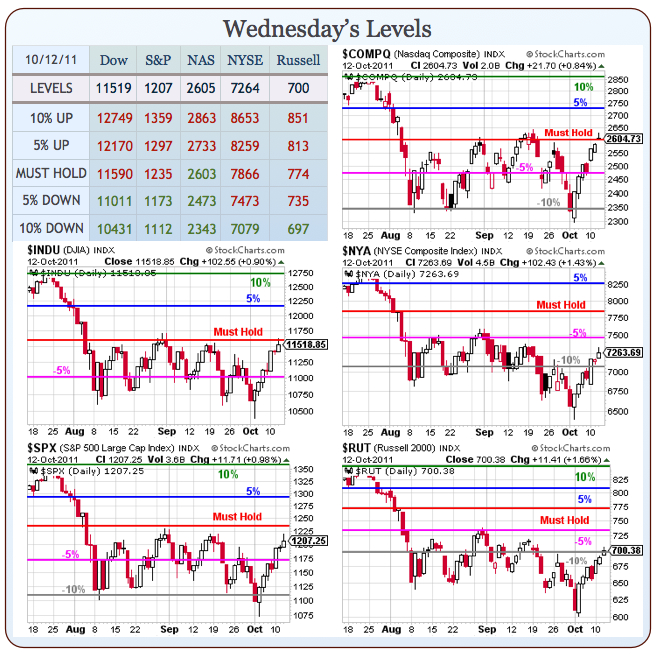

I hate to say I told you so but I did tell you so in yesterday’s morning post when I said: "Not to be cynical but, if you are going to have some Slovakian Government officials torpedo a vote that will tank the markets – isn’t it a good idea to run them up first and bring in a bunch of suckers to sell to? We remain a bit skeptical until we get back over our "Must Hold" levels and hold them for more than a day." As you can see from David Fry’s chart, a little cynicism is a good thing in these markets as the Slovakian vote was delayed again and the FT rumor popped the day’s bubble.

We discussed shorting oil at $86 (now $84) and gold at $1,695 (now $1,670) as good plays off the morning pump and, as usual, shorting TLT was a winner but now we’re near their theoretical support by the Fed so we’d rather see a run-up to $120 before we play them again. At 1pm, we have a 30-year note auction of just $13Bn but, as I pointed out to Members in Chat, this makes $52.5Bn of 30-year borrowing since August 15th – that’s not even two months!

Who can keep funding this kind of debt load? And it’s not just the US that’s borrowing at an ever-increasing pace – the EU is borrowing as much as we are and Japan is borrowing and Russia is borrowing and Brazil and India are borrowing – Africa would borrow if anyone would lend it to them and our NAFTA buddies, Canada and Mexico, who also borrow about $50Bn a year to fund their own deficits.

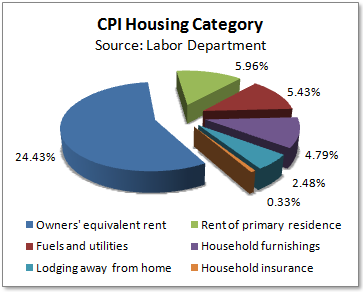

How is it possible, a logical person may ask, for almost every single country in the World to run a deficit at the same time? Either A) China has so much of a surplus that they are funding everyone else or B) Everyone is printing money 24/7 to pay bills they don’t have the income for and, if B is the case – where’s the inflation? Is it really possible that, on a planet with a $60Tn GDP and a $4Tn annual deficit (and yes, half of it is ours!) that prices go up less than the 6.66% (why does that number come up so often) printing of money that MUST be occurring somewhere to cover these bills.

How is it possible, a logical person may ask, for almost every single country in the World to run a deficit at the same time? Either A) China has so much of a surplus that they are funding everyone else or B) Everyone is printing money 24/7 to pay bills they don’t have the income for and, if B is the case – where’s the inflation? Is it really possible that, on a planet with a $60Tn GDP and a $4Tn annual deficit (and yes, half of it is ours!) that prices go up less than the 6.66% (why does that number come up so often) printing of money that MUST be occurring somewhere to cover these bills.

Sure, maybe some if it comes from Chinese lending (and they have debt too) – but not $1Tn. Not even $400Bn, I’m sure. Of course, inflation is in the eye of the beholder as a person with a mortgage of $1,200 a month who used to pay $30 for a tank of gas and now pays $60 and used to pay $1,000 a month for groceries and now pays $1,300, etc – may call that inflation but the Government says no, no, no – because the homeowner fails to take into account the declining value of their home, which the Government calculates positively as "Owners Equivalent Rent," which is calculated by asking sample homeowners the following question: "If someone were to rent your home today, how much do you think it would rent for monthly, unfurnished and without utilities?"

We were in Las Vegas this weekend and some people stayed in apartments that have been turned into hotels. To give you an idea of the effect of Owners Equivalent Rent, consider that these are $1M apartments with $6,000 monthly mortgages that are now renting out for $2,500 a month. Since that is $4,500 below break-even (forgetting taxes, fees, etc), that "savings" in OER is then subtracted from the increases in other CPI components and PRESTO! no inflation!

We were in Las Vegas this weekend and some people stayed in apartments that have been turned into hotels. To give you an idea of the effect of Owners Equivalent Rent, consider that these are $1M apartments with $6,000 monthly mortgages that are now renting out for $2,500 a month. Since that is $4,500 below break-even (forgetting taxes, fees, etc), that "savings" in OER is then subtracted from the increases in other CPI components and PRESTO! no inflation!

Even with all that mumbo-jumbo, the BLS’s own CPI Inflation Calculator shows a 27.92% rise in prices over the last 10 years. When rental rates begin to bounce back (and they already have), what was once a drag on the overall CPI will become a major booster on the way up so – unless you think we will continue to be able to rent $1M apartments for $2,500 a month – inflation is going to be a pretty good long-term bet.

8:30 Update: The usual 404,000 people lost their jobs last week but, according to last week’s Non-Farm Payroll report, they will all be able to find lower-paying jobs in less than 8 months so no one seems to care. The US continues to run a $500Bn annual trade deficit, which is mostly caused by the $1Bn of oil we import each day – that’s money that literally goes up in smoke as the nation moves through yet another decade without a cohesive energy policy.

All eyes are, of course, on our Must Hold Levels on the Big Chart – we couldn’t hold it yesterday, other than the Nasdaq, which finished right on the button, within 2 points of a level we predicted it would be at for a mid-point in 2011 back in March of 2009 – not too shabby. The Dow stopped dead on the line and the S&P had their usual trouble at 1,200 and couldn’t even manage a test at 1,235 – we’ll see what happens today.

It’s all about that 77.50 line on the Dollar – we need the Euro to get stronger so we can get weaker. Otherwise, there’s just too much downward pressure as we approach our major resistance lines. The Oil Report is at 11 am and that may be a drag as would a poor 30-Year Note auction at 1pm and we get our joke of a Treasury Budget at 2pm and then a look at the Money Supply at 4:30 today.

It’s all about that 77.50 line on the Dollar – we need the Euro to get stronger so we can get weaker. Otherwise, there’s just too much downward pressure as we approach our major resistance lines. The Oil Report is at 11 am and that may be a drag as would a poor 30-Year Note auction at 1pm and we get our joke of a Treasury Budget at 2pm and then a look at the Money Supply at 4:30 today.

So let’s stay on our toes. We still like our TZA (now $39.45) and SDS (now $22.50) as our primary hedges (see Monday and Tuesday’s posts) for Dollar over $77.50 and, of course, S&P below 1,200 – until we get a proper move over that level that holds for 2 full days – we’re skeptical of any move up – just like we rightfully were the last 4 times. Don’t worry though, Greece may still be "fixed" again as Slovakia ratifies the ESFS so we also like (IF the Dollar gets back below 77.50, which we do expect once the morning selling is done) our TNA spread from yesterday’s morning Alert to Members.

TNA is just under $40 and the Oct $40/43 bull call spread is still $1.30 and we listed several bullish offsets but our favorite one was shorting the GS Oct $90 puts, now $1.65 to offset the cost – we did a 50% cover in the virtual $25,000 Portfolio for a net $1,600 entry on a $6,000 spread and we’re stopping out if the short puts rise to $2 ($400 loss, probably at $94.50) or the Russell fails to hold 666 but, hopefully JPM’s earnings won’t scare GS too far down and we hit our $4,400 profit goal (275%) by next Friday.

If not – we’re playing both sides of the fence – as we should be when we’re in the center of our trading range.