Two weeks!

Two weeks!

European leaders have two weeks to settle differences and flesh out a strategy to terminate their sovereign debt crisis as global finance chiefs warn failure to do so would endanger the world economy. “The risk of a recession would be increased dramatically were the Europeans to fail to accomplish goals that they’ve set for themselves,” Canadian Finance Minister Jim Flaherty said after the G-20 meeting on Saturday.

The Brussels meeting “has the potential to turn into a positive historic moment,” Joachim Fels, London-based chief economist at Morgan Stanley, wrote in a note to clients yesterday. “But it could also easily turn into a negative catalyst.”

Europe’s plan, which has still to be made public, includes writing down Greek bonds by as much as 50 percent, establishing a backstop for banks and magnifying the strength of the 440 billion-euro ($611 billion) temporary rescue fund known as the European Financial Stability Facility. “The plan has the right elements,” U.S. Treasury Secretary Timothy F. Geithner said in Paris. “They clearly have more work to do on the strategy and the details.”

The G-20 officials — who met to prepare for a Nov. 3-4 gathering of leaders in Cannes, France (and we're fondly remembering London's 2009 meeting with the graphic on the right) — said in a statement that the world economy faces “heightened tensions and significant downside risks.” European authorities must “decisively address the current challenges through a comprehensive plan.”

The policy makers held out the possibility of rewarding European action with more aid from the International Monetary Fund, while splitting over whether the Washington-based lender’s $390 billion war chest needs topping up. Europe’s latest strategy hinges on putting Greece, whose government forecasts its debt to reach 172 percent of gross domestic product in 2012, on a sustainable path. Austerity has plunged the country deeper into recession and provoked civil unrest that threatens political stability.

My reaction to this in Member Chat this Morning was to call for shorting the jacked up Dow Futures (/YM) at 11,600, saying:

Speaking of the illusion of power – yet another G20 meeting ends with yet another plan to have a plan but this time, for some insane reason, they only gave themselves a week to fix everything. I’ll be writing about this this morning but the gist of it is the Finance Ministers have essentially sent their own leaders a message that the situation is dire and must be resolved now – before Q4 turns into a recession they can’t fix. The whole thing seems contingent on even more Greek cutbacks and is aimed towards, of course, bailing out Banksters and Bondholders with no actual help for the people so (and I need to read more) the whole thing sounds to me like the Banksters pulling the strings of people like Geithner to put pressure on the leadership to get the Free Money train rolling again.

Well, I've had time to do more reading and I've found no reason to change my mind – this seems like a power-grab by the Finance Ministers who are trying to push the Leaders to throw more money at the Banks to "solve" things (again). Perhaps the now Global pressure of Occupy Wall Street is making "THEM" nervous and forcing their hands so, if you are one of the 99% – now is an excellent time to pay attention to politics and listen – you'll quickly find out who your real friends are!

Well, I've had time to do more reading and I've found no reason to change my mind – this seems like a power-grab by the Finance Ministers who are trying to push the Leaders to throw more money at the Banks to "solve" things (again). Perhaps the now Global pressure of Occupy Wall Street is making "THEM" nervous and forcing their hands so, if you are one of the 99% – now is an excellent time to pay attention to politics and listen – you'll quickly find out who your real friends are!

Meanwhile, the Dow has already turned negative, dropping to 11,537 at 8 and that's a nice $315 per contract to pay for a healthy breakfast or two. We have to be careful at the open as we still may get a pop on the "great" G20 news. While you can't fool all of the people, all of the time – some of the people really are morons and can be fooled all the time by the same old crap (don't call my a cynic – Lincoln said it!).

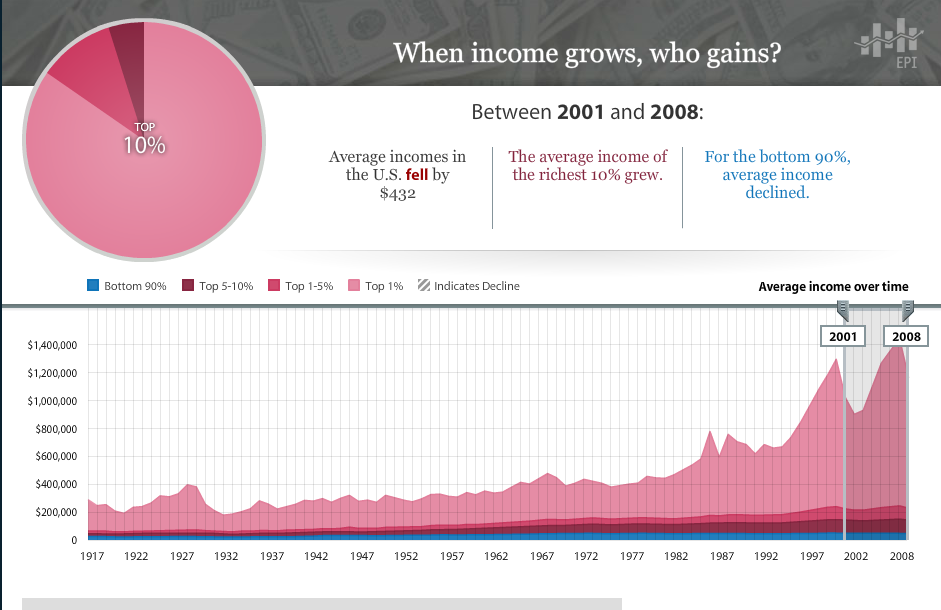

As the Occupy Wall Street movement goes global, everyone suddenly has an opinion about what everyone (well almost everyone) is upset about but it's really not very complicated, is it? Between 2001 and 2008 (under the administration of "he who must not be named") THE BOTTOM 90% MADE LESS MONEY!

As the Occupy Wall Street movement goes global, everyone suddenly has an opinion about what everyone (well almost everyone) is upset about but it's really not very complicated, is it? Between 2001 and 2008 (under the administration of "he who must not be named") THE BOTTOM 90% MADE LESS MONEY!

Doing the same work and making less money makes people angry. Hell, it makes lab rats angry so why are we surprised when people get upset with a negative reward profile? If EVERYONE were suffering, I don't think they'd be as upset but that's not the case at all.

The income of the top 10% (pink) grew EXPONENTIALLY from 1978 ($400,000) to 2008 ($1.1M), while the bottom 90% declined 10%. 110% of the economic growth since the last recession has gone to the top 10% and two thirds of that to the top 1% (that's why many of you in the top 10% are saying – "Gee, I don't earn $1.1M a year" – it's THAT skewed, even at the top!).

This income and wealth disparity is destroying our nation – assuming there is still a nation left to destroy as the top 10% in this country clearly don't believe they are on the same sinking ship as the riff-raff in the lower cabins. Still, what this weekend's G20 meeting amounts to was yet another call for the First Class passengers to be given all of the life-boats as bond-holders and Banksters get another several Trillion in bailout money to be paid for by harsh austerity measures placed on the bottom 99% (what does a top 1%'er care if the town cuts classroom sizes in the PUBLIC schools or if another clinic closes down or if retirement benefits are cut for Government workers?).

John Mauldin wrote an excellent article this weekend discussing the dangerous road we're traveling and put up this very important chart on the Velocity of Money – something we often discuss in Member Chat. My point (and John's) on this is that we are setting ourselves up for a crippling round of hyperinflation as we keep pumping money (supply) into the upper class while sucking it away from the lower classes – who are the people who actually spend the money (70% of our GDP is Consumer Spending).

The danger is that, as you can see from the chart, we had a 33% decrease in the velocity of money and we have filled that gap by increasing the supply of money (bailouts and Fed nonsense) by 50%. 66% x 150% = 99%, which is about how well our GDP has been holding up in this game.

But what happens to our GDP when the velocity of money kicks up even 10%? Well 73% x 150% = 109.5% – that's 9.5% inflation folks (assuming a flat output of good and services). It's not a very long road from there to some very serious inflation – just ask China! Should the velocity of money pick back up (and just a little pick-up in housing could do it) and we get back to 80% of where we were – 80% x 150% = 120% and that, my friends is some nasty inflation. Of course, hyperinflating our way out of debt is probably the best path we can take to solve this crisis. Just like we did in the 70s – we inflated our way out of debt with just a very minor increase in the velocity of money from 1.63 to 1.85 (7.4%) before Volcker took away the punch bowl in the 80s, which popped that housing bubble but not before our parents all became financial geniuses because they bought a house for $40,000 that they sold for $250,000.

THAT'S how we inflated our way out of the Nixon Recession and that's how we'll ultimately inflate our way out of the Bush Recession – the only question is, how long do we have to pretend we're fighting inflation while borrowing more and more money (at longer terms, of course) until we're ready to unleash the beast and let the money supply do it's work and give US Bondholders the same 50% haircut Greek Bondholders will be forced to take only we won't call it a concession – we will simply be paying them back with Dollars that are worth substantially less (worthless?).

THAT'S how we inflated our way out of the Nixon Recession and that's how we'll ultimately inflate our way out of the Bush Recession – the only question is, how long do we have to pretend we're fighting inflation while borrowing more and more money (at longer terms, of course) until we're ready to unleash the beast and let the money supply do it's work and give US Bondholders the same 50% haircut Greek Bondholders will be forced to take only we won't call it a concession – we will simply be paying them back with Dollars that are worth substantially less (worthless?).

That's why we can't afford to be out of the market – it's our best long-term hedge against inflation. As a fundamental investor – I keep preaching to Members that stocks do have actual values and those values, in good companies, will keep pace with whatever inflation throws at them. In fact, many companies thrive in an inflationary environment as their ability to control costs and pass on price increases (while holding wages down, of course) can drop quite a bit of extra cash to the bottom line.

BRK.B, IBM, KO, MCD, PFE, FCX, AA, BTU, PM, CAT, CHK, GE, V, T, VZ, VLO, BUD, C and JPM come to mind as companies that make nice long-term investments – especially using our buy/write strategy outlined in "How to Buy a Stock for a 15-20% Discount" – as it sure beats socking your money away in TBills for the next 10 years at 3% and trying your luck with inflation.

Meanwhile, we'll see how our levels hold up this week but I see nothing positive out of that G20 meeting and expect another 2 weeks of a wildly swinging, rumor-driven market – something we've learned to love at PSW as we play our trading range always to take us back to the center – until proven otherwise but, as I pointed out in our Income Portfolio Review this weekend – it's been a solid tow months and we're still waiting for a reason to stop range-trading.

It's just not happening yet.