Courtesy of John Nyaradi.

Courtesy of Chris Ciovacco, Ciovacco Capital

The most important story as we head into the new week – from Bloomberg:

Germany said European Union leaders won’t provide the complete fix to the euro-area debt crisis that global policy makers are pushing for at an Oct. 23 summit. German Chancellor Angela Merkel has made it clear that “dreams that are taking hold again now that with this package everything will be solved and everything will be over on Monday won’t be able to be fulfilled,” Steffen Seibert, Merkel’s chief spokesman, said at a briefing in Berlin today. The search for an end to the crisis “surely extends well into next year.”

We noted on Friday, the markets were showing some signs of a possible short-term reversal. The recent rally off the October 4 intraday low was strong, which means it may take a day or two before any bearish trends re-emerge. Buyers may still step in over the next day or so on pullbacks.

We looked at the markets from numerous angles on Sunday. The S&P 500 has three pockets or bands of resistance:

- If we break 1,237, 1,250 becomes a logical level

- If we break 1,250, 1,275 becomes a logical level

- If we break 1,275, 1,320 becomes a logical level

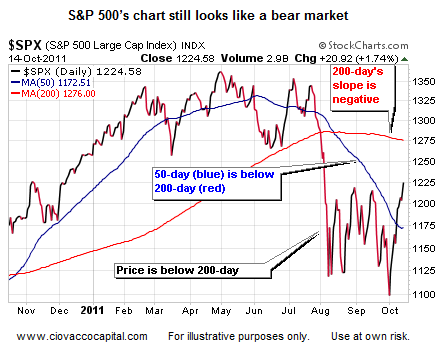

The statements from Germany this morning decrease the odds of breaking of through 1,237 or 1,250. Any move higher may prove to be short-lived, but we will have to see how things play out. As shown in the chart below, the current rally in stocks has done little-to-no damage to the longer-term bearish case. If you took the dates off the chart below and asked anyone with experience in technical analysis, “Is this a bull market or bear market?”, they would not hesitate with the answer, “bear market”.

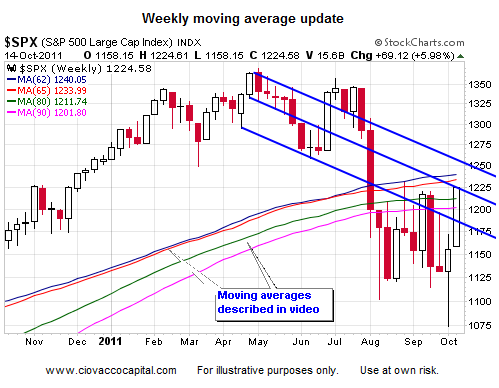

On October 11, we released the video below (bottom) explaining how a band of weekly moving averages, historically, has served as a bull/bear demarcation line. The chart below provides an update to the levels discussed in the video. As of Friday’s close, the S&P 500 remained below the upper band of moving averages, which aligns well with the ongoing profile of a bear market. The range of the weekly moving averages below is 1,201 to 1,240. A relatively short-term move above 1,240 would not negate the bearish case, but a prolonged stay above 1,240 would increase the odds of bullish outcomes. As we noted on Saturday, numerous challenges remain in Europe.

October 11 video: After you click play, use the button in the lower-right corner of the video player to view in full-screen mode. Hit Esc to exit full-screen mode.

Courtesy of Chris Ciovacco, Ciovacco Capital

Click here to learn more about John’s book and for a free membership to Wall Street Sector Selector