Abbott and Costello could not keep a bit going this long.

Abbott and Costello could not keep a bit going this long.

Greece is obviously on first with the rest of the PIIGs on second and the EFSF is clearly in the "I don’t know" position on third base. Tomorrow can remain the pitcher as he throws to today and there was no yesterday on Abbott’s team and there isn’t one in the market either as we start with fresh and random nonsense every single day!

At least with Abbott and Costello there was some consistency in the positions but we are literally flipping the switch every few hours these days in what I call the "Bugs Bunny Market" where the retail investor is Elmer Fudd and Bugs Bunny is Lloyd Blankfein and his Bankster Gang of 12, stampeding the investing public in and out of positions by floating rumor after rumor until no one is left but their Trade Bots.

While tedious, this kind of market can also be very profitable. Back on September 29th, I wrote "Finding Bottom" and we turned very bullish in our $25,000 Portfolio, which was already near our $100,000 goal (now well over – see today’s update). I said in the morning post:

While tricky, it is not impossible to trade this kind of action. We are very fortunate to have been trading this exact range on our virtual $25,000 Portfolio and we just had our best 2 weeks of the year, despite the insanity.

What was that range? Why it’s the same one we’ve been trading all year on our Big Chart. It’s not really a complicated strategy. We get bullish at the bottom and bearish at the top and, in the middle, we are VERY CAREFUL. Ranges work until they don’t and then you have to wait, PATIENTLY, for a new range to present itself and then you play that.

What was that range? Why it’s the same one we’ve been trading all year on our Big Chart. It’s not really a complicated strategy. We get bullish at the bottom and bearish at the top and, in the middle, we are VERY CAREFUL. Ranges work until they don’t and then you have to wait, PATIENTLY, for a new range to present itself and then you play that.

We were very fortunate to get a huge sell-off from Mid-September through October 1st and even more fortunate to get the bull run we always wanted (virtually uninterrupted back to the top of our range) in the first two weeks of October. That added a tremendous $30,000 to our $25,000 Portfolio (120% of the base!) since the 29th and we’re doing a cash-out this week with around $130,000 – taking the virtual money and running ahead of the Holidays.

We will be starting a new, virtual, $15,000 White Christmas Portfolio on Monday with the goal of getting to $25,000 in time to hit the malls – enough to give everyone an IPad for the holidays. This will give our new Members a chance to participate from the beginning without having to wait for our new portfolio in January and, also, I don’t want to risk blowing the gains in the $25KP – it’s not every year make 1,300% (we began with $10,000 last June, ran up to $35,000, banked $10,000 and the rest is history) – so no sense in blowing it, is there?

The idea of the $25KP is that it’s the risk portion of a much more sensibly invested $250,000 Portfolio and, if we blow $10-15,000 playing aggressively – it won’t kill us (see Smart Portfolio Management III – The $1,000,000 Portfolio). If, on the other hand, we make $50,000 – that’s a 20% bonus to a $250,000 Portfolio, not at all inconsequential.

The idea of the $25KP is that it’s the risk portion of a much more sensibly invested $250,000 Portfolio and, if we blow $10-15,000 playing aggressively – it won’t kill us (see Smart Portfolio Management III – The $1,000,000 Portfolio). If, on the other hand, we make $50,000 – that’s a 20% bonus to a $250,000 Portfolio, not at all inconsequential.

So, just like we do with our short-term trades, we risk losing 20% and sometimes 40% in the hopes of getting the occasional double and, when we get a really big win, like we have this year with our $25KP, we plow that money right back into conservative positions so next year we can risk $25,000 out of our $350,000 portfolio. Pull that trick off a few times and retirement will be just around the corner!

As you can see from David Fry’s longer-term S&P chart – we’re actually still threatening a big break-out and all it should take is a kind word from the EU and we’re off to the races again as w pop that 154 dma at SPY 123.06. We were there in the morning and the line is falling, which makes it easier to pop but the real line in the sand is our Must Hold line on the big chart at 1,235 and the S&P topped out at 1,233.10 on Tuesday and we haven’t actually tested that line since we failed it in early August.

As I said to Members in Chat earlier this morning – it looks to me a bit more like we’re consolidating for a move up than failing resistance but this is a key inflection point and we could go either way. Today we will hear from not three but FOUR Fed Governors, who are going to try to spin yesterday’s AWFUL Beige Book (see yesterday’s Member Chat for my commentary) into market gold. My own retrospective commentary from Chat at 5:27 this morning was:

Bearish/Angel – Not with the Dollar up 1% – we held up well considering. Energy and commodities were a huge drag but we expect them to fall as we rotate back to real companies on earnings and the resolution of the EU crisis. That then causes a slowdown in tanker traffic and rail traffic and flashes all the wrong signals for the data junkies. Bottom line is (see Big Chart above) that we are consolidating at our breakout lines and every day we’re here is a lot more likely we’re forming a good base to move higher from than we’re turning lower.

Yentervention is still my biggest fear but a resolution to the EU issues that boost the Euro and tanks the Dollar should be a constant concern for the bears.

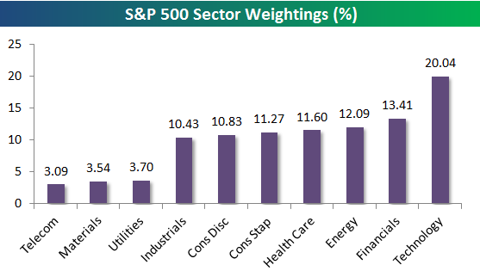

In the short run, it’s all about the Dollar and which side of the 77 line it falls on. Over that line will make it very hard for the Dow, Nasdaq and S&P to get over their Must Hold lines but under 77 and gravity is reduced – allowing them to float higher and form a better base. Meanwhile, as I mentioned above, fear coming out of the markets combined with the CTFC decision to reign in commodity speculation will put a lot of pressure on Energy and Basic Materials which make up about 16% of the S&P while some disappointing Technology earnings (20% of the S&P) are not helping – nor are Financial worries (13.5%) as we wait and wait and wait and wait for the next EU rumor that will send market participants scattering this way and that.

The latest word of the morning is that the Summit is delayed and that’s trashing the Euro and popping the Dollar and knocking our Futures down just ahead of the bell. What’s the rumor? Die Welt quotes sources as saying the German government does not rule out postponing this weekend’s summit. Isn’t that AMAZING? Half a point lost in the markets because of this conversation: "Hey anonymous source, is there no possible way that this weekend’s summit can be postponed?" "No, Mr. Reporter, I wouldn’t say that." – BOOM! There’s your story!

What idiocy – no wonder we’re cashing out the $25KP…