Wow, what a week!

Wow, what a week!

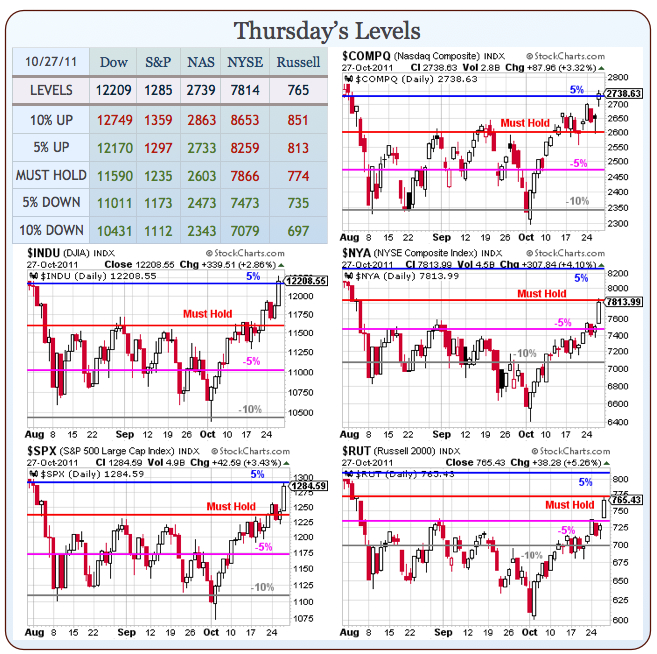

What a month in fact. Another good day and our 10% lines will be back in play on the big chart. As I said on Tuesday morning, we were looking to take back the +5% on the announcement of the EFSF and I had made our bullish position pretty clear the day before on BNN, but I didn’t expect us to hit it THE NEXT DAY.

That’s what we like to call "too far, too fast" and it’s a very dangerous way to rally the markets. Back on September 29th in "Thrill-Ride Thursday – Finding Bottom" I laid out our bullish case when it was VERY unpopular saying:

The hardest thing about range trading is following Warren Buffett’s advice to "Be greedy when others are fearful and be fearful when others are greedy." Yesterday we discussed the importance of ignoring the noise of the rumor mill and focusing on the FACTS as we make our investing decisions. With shorter-term TRADING – we have to pay a bit more attention to the technicals but it’s all about taking small profits over and over again.

I had spent the week before laying out my case for why Greece did not matter anywhere near as much as people thought but the most important point I made (that is back to being relevant today) was this:

I spent last week laying the foundation for why we should not be freaking out about Greece but one thing I have learned is you can’t preach Fundamentals to TA people (or use logic on Conservatives) – the words just wash over them like the dog in this Farside cartoon… As I said yesterday (the same 3:10 comment to Members): "I’d rather play the Bull side until the bears prove their case because the absence of constant, relentless bad news is likely to cause a rally."

Germany had approved the expansion of the EFSF that day (September 29th) by a vote of 523 to 85 – not even remotely close despite the fact that the MSM had been telling us the Germans would NEVER go for it. Amazingly, not even a month later – investors were still surprised when it passed through the EU on schedule. My comment that morning was:

This is the exact opposite of what 99.9% of the "news" was saying and I even challenged Members yesterday to find articles that said something positive about the EU and it was slim pickings for sure! Now the 140% expansion of the still-unused rescue fund to $600Bn will be questioned as "too small" even though Greece needs just $11Bn to pay for this year’s needs and, of course, since there is still an EU Parliamentary process to go through – we will still see the Punditocracy banging the fear drums as they chase the beautiful sheeple in and out of positions at will.

I named XLF at $12 as my top pick (now $14) with a trade idea to buy 50 2013 $10/11 bull call spreads for .45 ($2,250) and sell 20 2013 $9 puts for $1.10 ($2,200) for net $50 on $5,000 worth of spreads. Now that the panic has subsided, we are well on the way to a full 19,500% gain on the trade but the $9 puts have already fallen to .50 ($1,100) and the spread is up to .85 ($4,250) for net $3,150, which is already a $3,100 gain off of $50 in less than a month (14,700%) and we "only" have another 4,800% left to gain in our best case and that’s not really worth the bother, is it?

I strongly suggest you re-read that post as most of the points I made then about trading off the bottom of our range and not getting overly bearish as we tested the bottom now apply, in the opposite, to how we should be thinking about the approaching top of our range (not there yet). We were greedy when others were fearful and we had great results – as I said at the time:

I strongly suggest you re-read that post as most of the points I made then about trading off the bottom of our range and not getting overly bearish as we tested the bottom now apply, in the opposite, to how we should be thinking about the approaching top of our range (not there yet). We were greedy when others were fearful and we had great results – as I said at the time:

We only fear missing a rally as we may never get another chance at these lows. While it’s possible that we get that 25% decline, we don’t fear that either as we will simply scale an and take net entries that are 40% lower than we are now and, if the markets fall that far and never recover – we’ll be a lot more concerned about stocking the shelter up with ammo than we will be about whether or not our XLF trade is performing well!

There should be nothing keeping the markets from moving back to the top of our range (+10% lines on the Big Chart) but the faster we get there, the more likely we are to bounce back as low-volume rallies generally have a hard time making it through major resistance points. We still have a good 5% move up to look forward to but we need to consider now the first part of Mr. Buffett’s warning and remember to be a little fearful when others are greedy!

To that end, we added 5 DIA Nov $119 puts at $1.52 to our White Christmas Portfolio, which I expect to do an official write-up for this weekend. We cashed out a couple of successful bullish plays and we were going to keep ourselves neutral but that little burst of energy the markets picked up into the close was too good of a shorting opportunity to pass up – just in case we get a little pullback off of what is now a 15% run in less than a month on the Dow. The relatively small entry allows us to roll the position if the upside momentum continues because – either way – we KNOW we want to have a nice hedge in place over the weekend. We also did a nice SCO spread while oil was testing $94, getting 5 SCO Nov $45/48 bull call spreads for $1.10 and selling the $42 puts for $1.60 for a net $250 credit on $1,500 worth of bearish oil spreads.

So you see, we don’t need to be at the dead bottom of a range or have a high VIX to take some nice, leveraged positions – we just need to find individual stocks and ETFs that are overbought or oversold which violate our FUNDAMENTAL outlook and then we can construct sensible positions to take advantage of the move we predict. The real key is to be PATIENT and wait for a good opportunity to present itself. That’s one of the great things about our Member Chat – it gives us something to do while we wait for the fish to bite!

Premium Membership to our Chat Room and Posts closes on Monday and new applicants will be wait-listed, probably through the holidays at least. There’s only so many questions we can answer during trading hours and I don’t like to let things get too crazy. I also have my own little vacation coming up next week (I still work most days, but from somewhere else) so it’s a good time to pull back from teaching new Members and doing a little team-building with the group we already have.

Premium Membership to our Chat Room and Posts closes on Monday and new applicants will be wait-listed, probably through the holidays at least. There’s only so many questions we can answer during trading hours and I don’t like to let things get too crazy. I also have my own little vacation coming up next week (I still work most days, but from somewhere else) so it’s a good time to pull back from teaching new Members and doing a little team-building with the group we already have.

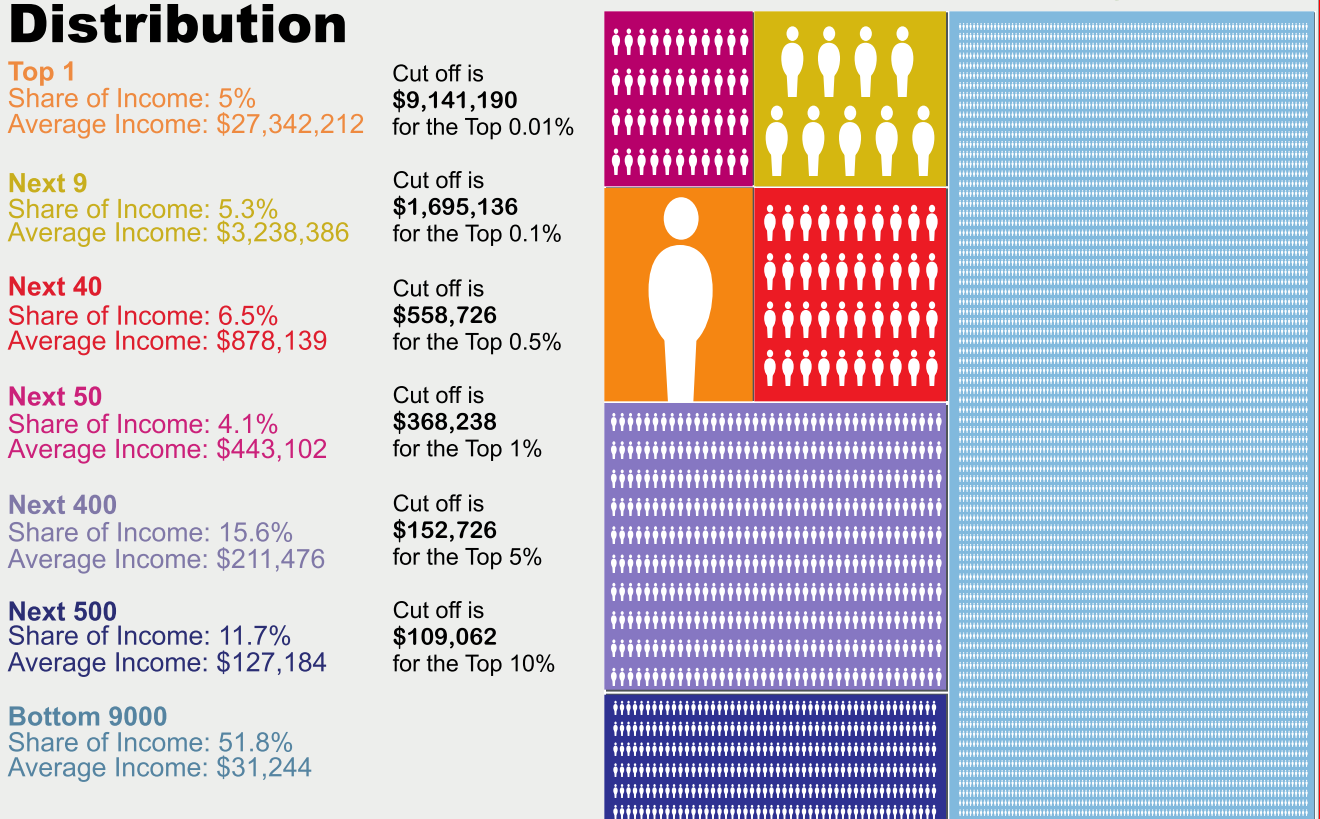

As you can see from the chart on the left – it is IMPERATIVE that we make sure we do not fall into the bottom 90% or we will have all of our money confiscated, as it has been by the top 4% since 1979. As I said on BNN the other day, the disparity between that top 1% and the next 9% is GREATER than the disparity between the bottom 90% and the top 10% but the people in the top 10% (like the anchor who asked me why I would identify with the 99%) just don’t seem to get it. They are getting screwed too – just a little more gently than the bottom 90% so they "go along to get along" with that tantalizing dream that – one day – they too will make it to the that $9,141,190 PER YEAR INCOME that marks the very bottom of the top 0.01% (30,000 Americans).

Why do people in the top 10%-1%, who make between $109,062 and $368,238 fight for the rights of people who make AT LEAST 30-90 times more money than they do NOT to pay taxes? Do they not understand that if, for example, TBoon Pickens, who made $3.6Bn two years ago, only pays 15% capital gains of $540M instead of 35% ($1.26Bn), that simply means that they need to cough up an additional $720M to cover the shortfall?

And it’s not even people like TBoone who are the real problem – it’s Corporate People like GE, who have paid just $1Bn in taxes on $40Bn in NET INCOME over the past 3 years. US Corporations netted $3.4Tn in income (declared) last year and paid a grand total of $192Bn in taxes – that’s 5.6%. If those corporations paid the same 35% that the other citizens pay (and they fought to be considered ordinary citizens, didn’t they?), then our Nation would have an additional $1Tn in tax revenues and we wouldn’t have a deficit and maybe Corporations would only have $2.5Tn of cash hoarded instead of the current $3.5Tn but then maybe that extra $1Tn would flow back through the economy and create jobs – maybe…

WE ARE THE 99.9% and we are NOT going to take it anymore!