Looks like I picked the right week to go on vacation!

Looks like I picked the right week to go on vacation!

As we expected yesterday, we had a BS sell-off, followed by an even more BS run up, now followed by another sell-off and we’re right back where we were yesterday, which is great because you can just re-read yesterday’s post and there’s nothing to change except we hit our $97.50 target on oil, where I said yesterday I wanted to press our short bets, only pulling back if we rose over the mark (but still looking to re-short, even if that happened).

This is the pain of Fundamental Investing, you have to make your bets when all the technicals are going against you and the majority of traders are on the bandwagon going the other day. Yes, we miss a lot of good parties – but we celebrate with some huge wins when we get it right!

Although we did manage to pop below 77 on the Dollar yesterday, it didn’t stick as the Euro and Pound fell off a cliff this morning and the Dollar popped back to 77.50 and that 1% pop in the Buck was enough to send our Futures 2% lower, erasing all of yesterday’s ill-gotten gain and sending oil back to $95.50 already (6am).

Although we did manage to pop below 77 on the Dollar yesterday, it didn’t stick as the Euro and Pound fell off a cliff this morning and the Dollar popped back to 77.50 and that 1% pop in the Buck was enough to send our Futures 2% lower, erasing all of yesterday’s ill-gotten gain and sending oil back to $95.50 already (6am).

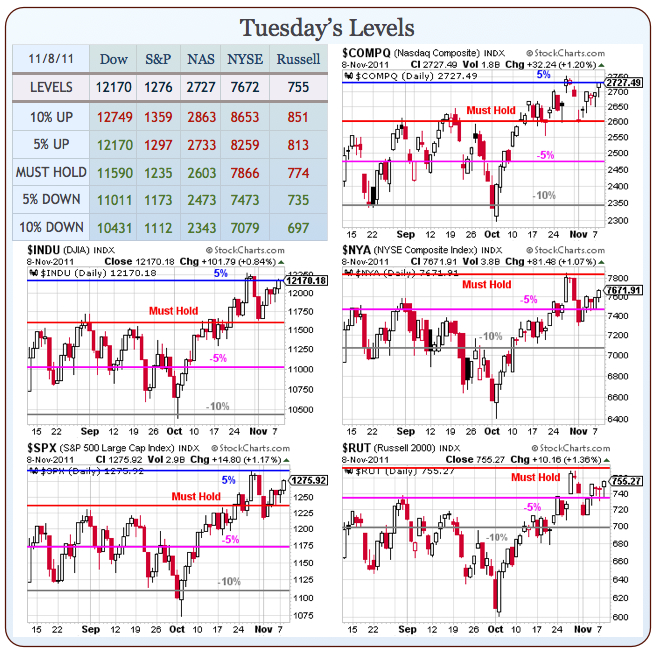

As you can see from our Big Chart – we hit our 5% lines on the nose on the Nasdaq and the Dow and yesterday’s post was my lecture on why the Dow didn’t have the Fundies to break that line so no need to re-hash it here.

The "scusa del giorno" for the market move is Berlusconi’s resignation, which is sending the interest on Italian 10-year notes over 7%. Belusconi may have been a lot of things but above it all, he was a businessman who engendered investor confidence – Italy may have cast that anchor away a bit too hastily.

Unfortunately, it looks like I will miss another exciting day as my boat is just pulling into St. Thomas and I have to go wake up the family so we can hit another all-day excursion. It’s been a great week to ignore the markets but I’m back at sea tomorrow so I’ll get a full day in and we can see if we can determine what’s real and what’s not in the current gyrations.

Unfortunately, it looks like I will miss another exciting day as my boat is just pulling into St. Thomas and I have to go wake up the family so we can hit another all-day excursion. It’s been a great week to ignore the markets but I’m back at sea tomorrow so I’ll get a full day in and we can see if we can determine what’s real and what’s not in the current gyrations.

Greece gets a new Government today and that’s always fun and Bernanke speaks at 9:30 so maybe a hint of QE3 to run us back up. Oil inventories are going to be a big deal at 10:30 but not as big as our own $24Bn, 10-year note auction at 1pm. Imagine if the US had to pay 7% to borrow money? That would be over $1Tn a year in interest alone! Oh well, I guess austerity would be the answer, right?

Have a great day,

– Phil