I’m back!

I’m back!

We’ll see if being away for a week has given me good perspective. It certainly seems like I picked the right week to skip as we’re right back where we were when I left so all that happened during the week (see Stock World Weekly for a great review) was just noise, I suppose.

We finished the week on a bearish note, shorting oil and the Dow (Nov $120 puts came in at $1.05) on expectations that SOMETHING would go wrong over the weekend. When the entire Global economy is held together by nothing but spit and bailing wire, it only takes just one more loose screw for the wheels to come off these bullish wagons.

This morning it’s one of those "meet the new boss, same as the old boss" things as the European markets realize that Italy may have a new Government this week but that’s sort of like announcing to the passengers on the Titanic that you have elected a new crew AFTER they hit the iceberg – maybe the new guys are REALLY good at bailing out water but you’re still going down eventually…

Italy’s parliament over the weekend approved additional austerity measures and economic reforms aimed at reassuring investors and Italy’s European partners that Rome can get its massive debt load under control. Silvio Berlusconi formally resigned as prime minister, with economist, Mario Monti, tapped to head a new technocratic government. In a test of market confidence, Italy sold €3 billion ($4.13 billion) of five-year Italian government bonds Monday morning and the yield rose sharply to 6.29% from 5.32% – up almost 20% since last month.

Italy’s parliament over the weekend approved additional austerity measures and economic reforms aimed at reassuring investors and Italy’s European partners that Rome can get its massive debt load under control. Silvio Berlusconi formally resigned as prime minister, with economist, Mario Monti, tapped to head a new technocratic government. In a test of market confidence, Italy sold €3 billion ($4.13 billion) of five-year Italian government bonds Monday morning and the yield rose sharply to 6.29% from 5.32% – up almost 20% since last month.

"It will take time for reforms to be implemented and for their beneficial impact on economic growth and debt dynamics to be realized," wrote strategists at Barclays Capital. "In the meantime, reforms are likely to contribute negatively to economic activity, suggesting that any risk rally on the back of the weekend’s news may not be sustained."

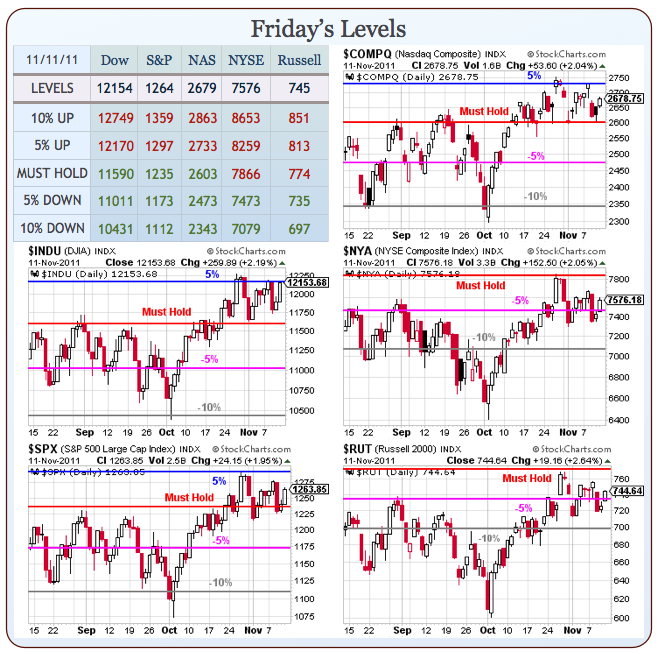

All right, we’re officially done worrying about Italy now. We worried about it last week and where did it get us? Nowhere! Down 400, up 400 but the bottom line remains that we are still in our trading range and it’s going to take more than a new Italian Government to get us over those 5% lines – as well as the 10% lines that mark the true tops of our range (which were tested in July).

All right, we’re officially done worrying about Italy now. We worried about it last week and where did it get us? Nowhere! Down 400, up 400 but the bottom line remains that we are still in our trading range and it’s going to take more than a new Italian Government to get us over those 5% lines – as well as the 10% lines that mark the true tops of our range (which were tested in July).

We will still be considering it bullish progress if we can simply hold those Must Hold lines for the week on the Dow, S&P and Nasdaq but it don’t mean a thing if the NYSE and Russell can’t get over their Must Hold lines so we’ll be watching 735 on the Russell (-5%) as the critical indicator that will turn us quickly bearish if it fails.

Our Financials are still weak with XLF at $13, still at the bottom of our target range for the year. Please don’t tell me we have a global recovery when our financials are still in the toilet – it’s ridiculous. While we were recently gung-ho buyers at $11, we are cautious buyers at $13 but I still expect a re-test of the 200 dma at $14.50 if we can catch a break by going maybe 3 consecutive days without another debt crisis (iffy).

A fun way to play for XLF to go up 10% is to buy the newly reverse-split FAS Jan $65/80 bull call spread at $6.80 and sell the $55 puts for $6.85 for a .05 credit on the $15 spread. While you risk being assigned XLF at net $54.95 (a 20% discount to the current price), the upside potential is a $14.95 gain or 29,900% on cash. If you want to take a bullish poke at the market, that’s probably the way to go between now and January.

Speaking of bullish pokes – Warren Buffett spilled the beans this morning on our IBM trade. Both Warren and I have liked IBM as a long-term hold, even as they reached record highs this year only Buffett had $10.5Bn to buy IBM with so his call is getting more attention than mine did. I feel better knowing Warren was the mystery buyer who was keeping the price higher than expected.

Speaking of bullish pokes – Warren Buffett spilled the beans this morning on our IBM trade. Both Warren and I have liked IBM as a long-term hold, even as they reached record highs this year only Buffett had $10.5Bn to buy IBM with so his call is getting more attention than mine did. I feel better knowing Warren was the mystery buyer who was keeping the price higher than expected.

Buffett said something all Members should take note of this morning – that he hopes that IBM goes LOWER now that he has accumulated a full position because then IBM will buy back more of their stock and his percentage of ownership will increase without him having to buy more. As I often preach to Members, we don’t care about the PRICE of a stock that we are looking to hold long-term – we care about it’s VALUE – and those are two VERY different things. My comment to Members on IBM in early October (after a poor ECRI report) was:

Back to ECRI – I don’t really care if they are wrong or right. In a recession, I want to own IBM. In a flat economy – I want to own IBM. In an up economy – I want to own IBM. The trick is – when can I buy it cheaply? If the only time I get to buy IBM (or MCD, KO, VLO, XOM, X, AA, FCX, GE…) cheaply is during a recession – then bring it on!

(From 8/29 Member Chat): If you think IBM is just a number on a chart then you can worry about QE3 and Bernanke and Europe and animal spirts and whatever other BS but if you think IBM is America’s best Tech R&D company (yes, better than AAPL) with an incredible international sales force, 100 years experience and more patents than any two other companies who are still managing to drop 10% to the bottom line in this economy plus pay a 1.8% dividend – then IBM may seem like a bargain at $169.

Congratulations to all of our Members who’ve been accumulating IBM this year – we certainly beat Buffett’s entry by selling puts that kept us well below $160 and now I think we have a pretty solid floor although I still don’t see $200 being broken this year without a QE3 announcement – just because you love a company, doesn’t mean you have to value it unrealistically. The same goes for our beloved AAPL at the moment, as we are back and forth on where a good re-entry would be. More on that later.

It’s not a huge data week but we have Fed speak from Bullard, Evans, Lacker and Fisher tomorrow and then Lacker again along with Renegren and Pianatto later in the week. We have some short-term note auctions and a 10-year TIPS auction on Thursday. PPI, Retail Sales, Business Inventories and Empire Manufacturing lead off our data tomorrow followed by CPI and Housing Data on Wednesday and Thursday is our big day with Housing Starts, Consumer Comfort (which needs to confirm Friday’s surprisingly good Consumer Sentiment), Philly Fed and, of course, another 400,000 Americans losing their jobs for the week. Friday brings us back to ECRI which, if you were paying attention 3 paragraphs ago, has been indicating a US Recession since early October.

It’s not a huge data week but we have Fed speak from Bullard, Evans, Lacker and Fisher tomorrow and then Lacker again along with Renegren and Pianatto later in the week. We have some short-term note auctions and a 10-year TIPS auction on Thursday. PPI, Retail Sales, Business Inventories and Empire Manufacturing lead off our data tomorrow followed by CPI and Housing Data on Wednesday and Thursday is our big day with Housing Starts, Consumer Comfort (which needs to confirm Friday’s surprisingly good Consumer Sentiment), Philly Fed and, of course, another 400,000 Americans losing their jobs for the week. Friday brings us back to ECRI which, if you were paying attention 3 paragraphs ago, has been indicating a US Recession since early October.

The Dollar needs to get below 77.50 in order for the indexes to gain traction and, for that, the Euro has to show us something over the $1.36 line so those will be our critical watch levels today as we essentially cross our arms and dare the market to prove us wrong for shorting oil and the Dow into Friday’s rally. Tomorrow morning is Germany’s Q3 GDP Report and we may see signs of significant damage as Germany gets "contagion" from the austerity measures they are forcing on their neighbors – so it would take a lot to get us to flip bullish today.

On the whole, we will see how the day goes before placing our bets for the week.