In a previous article, we outlined two different methods that can be used to time the market and help the retirement investor avoid the kind of downtrend that has plagued this market over the last ten years. We believe such protection is necessary given the likelihood of continued market volatility.

This article will show the results of backtesting the first method presented in the earlier article. It involves initiating long or short trades based on a market index crossing its 10-month simple moving average. We started the test from January 2001 to have at least a 10 year sample.

Backtesting the Index

For the test, we used the S&P 500 ETF (SPY). We initiated a long SPY position once it moved above its 10-month SMA and shorted SPY when it crossed below the same average. We entered our trades the beginning of the month after the index closed above or below the average. This induces some lag and has some negative impact discussed later in this article. In an IRA account, it is not possible to sell an instrument short without fully obligated collateral (in this case cash), but there are many inverse ETFs that can be used as effectively as index shorts – for example, SH the ProShares Short S&P500. For those unwilling to short the market, we have also run the simulation with long positions only, exiting the market when the index crosses under the SMA.

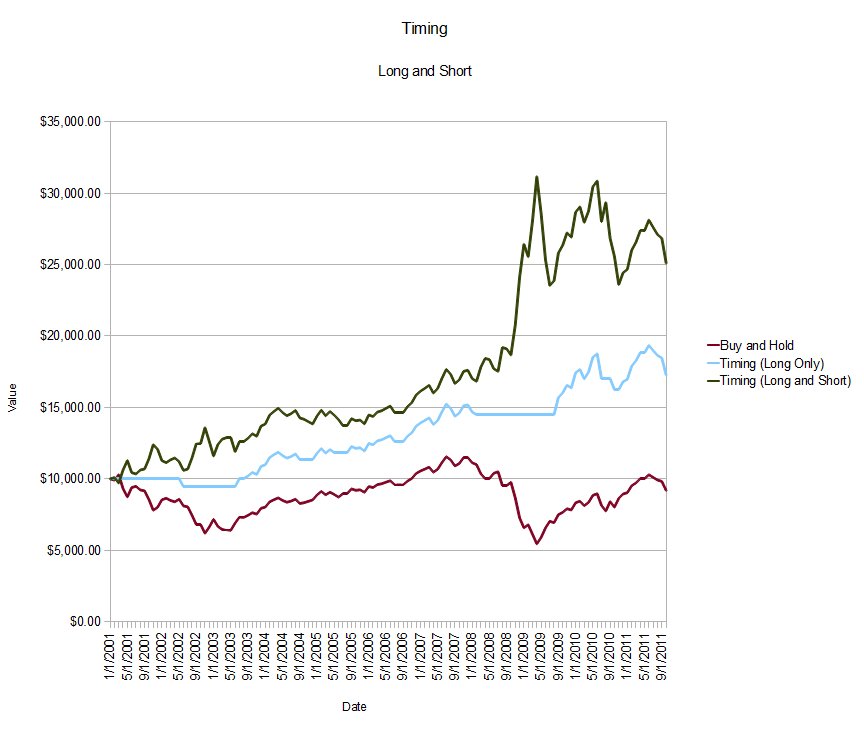

Figure 1 – Backtesting results with an index ETF

The final results as of 10/1/2011 are:

Buy and Hold – $9,181.79

Long Only – $17,257.86

Long and Short – $25,091.75

These results are only as accurate as the data available and exclude any dividends, commissions and taxes (none in an IRA obviously), but they are nonetheless telling. A buy and hold strategy over the past ten years basically broke even (this was the "Lost Decade") while a long only strategy shows gains of over 72%.. Not great after 10 years, but it beats losing money! A long and short approach yields 151% gains over the past 10 years. Not bad considering that Bernie Madoff could have stayed out of jail and still made good on his promise if only he had use this method.

Looking at the graph, we can see that there are still some large drawdowns especially in the Long and Short test. This is the result of the large and rapid market moves that have occurred in the last 3 years. While this method keeps you in the trend (or in cash), in the long run it cannot avoid the type of sharp moves like the ones witnessed in July and August 2011 when the index lost over 10% in two weeks.. Also keep in mind that we are not using any stops in our trading approach. We let the system index crossover determine our entries and exits. There is little doubt that the system could be improved by using sensible stops that will keep the investor in longer up trends while limiting the damage of violent corrections. One such approach would be to use the Average True Range (ATR) to calculate stops, but that is a topic for another article.

Now that we have a method that has proven profitable over the last ten years, could we improve on it by using leveraged instruments?. There are many such instruments available in the market now:

-

Leveraged ETFs (2x or 3x)

- Options – on the index, or for more leverage on the leveraged index ETFs.

How do these fare using the Long and Short method? The problem we have for the leveraged ETFs is that they are somewhat new to the market, so our backtesting date range is limited. As for options, historical data is sparse or expensive so we will use what is our disposal – in this case the data from the Thinkorswim trading platform. It is not perfect, but should give us a good estimation of the results using leveraged products.

Leveraged ETFs

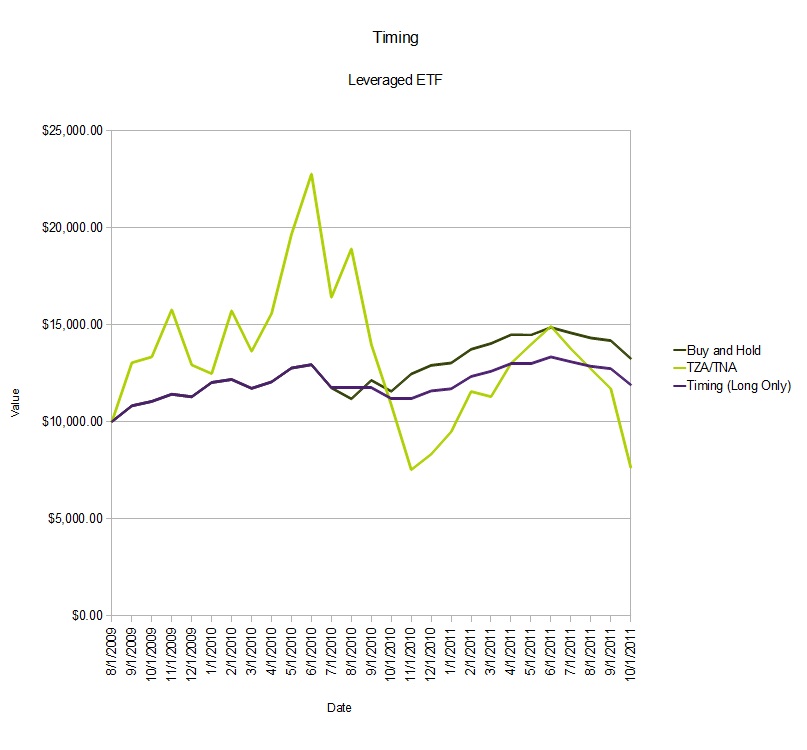

For this test, we will use the triple leveraged ETFs, TNA and TZA. They are quite liquid and mimic the moves of the Russell 2000 index.. Following the rules that we have outlined, we bought TNA when the index crossed above its 10-month SMA and bought TZA when the index crossed below the average. For comparison, we have also included the results of the buy and hold method and the timing method (long only).

Figure 2 – Leveraged ETF results

We could have included a slightly longer period of time as we had data going back 8 more months. However, when these ETFs were created, the market was already in a downtrend and we wanted to start with a new trend to be more accurate. This period is also not ideal as the market was in an uptrend the entire time except for 2 short term corrections. Notice that the buy and hold equity curve is somewhat constant. This period outlines 2 shortcomings:

- The timing method does not do well when the market trends for a long time with short corrections. Note that buy and hold does beat the timing method over the 2 years. The timing method will not lose money, but it will not make as much either.

- The leverage ETFs have some value over short periods of time, but corrections in one direction or the other plays havoc on the returns. The biggest problem with these ETFs in the long term is the constant decay induced by the market ebb and flow which is the reason why they have to be reset on a regular basis. They usually die from the proverbial death of a thousand cuts. With no stop in place (not an ideal trading scenario), the smallest of change of direction will drive the equity curve to the ground.

On the other hand, these ETFs have some potential in a more controlled trading environment as, for example, your initial investment would have gone up 125% after the first year. But with some stomach churning downturns. Switching between the 2 ETFs is what caused the biggest dip in 2010. TZA got hacked in half when the market recovered quickly. Note that switching back to TNA at the beginning of 2011 produced a quick recovery of the equity curve. But the last 2 months have been brutal on that ETF.

In order to produce a more accurate conclusion on the use of these ETFs for timing the market we would need to study them over a longer period of time like 10 years for example. They do show potential, but are hampered by their structure.

Options

Another way to leverage your investment is with options. The problem in testing with options is that there are many strategies available – single options, spreads, and other multi-leg strategies. In a retirement account, selling naked options is not possible so we can already eliminate that strategy. Other strategies such as iron condors and butterflies are market neutral and this is not what we are looking for. We want strategies that will bet in one direction of the market. That leaves buying single options (no spreads), buying vertical spreads or calendars spreads. For now, we will not consider calendar spreads as simulating these trades over a long period of time would be very time consuming. That leaves buying single options and vertical spreads. Once we have chosen our instruments, we need to decide on strikes and expiration periods. If you believe strongly in the direction of the market, buying At-The-Money (ATM) options would make sense, but long dated options will have a lot of premium and in particular ATM and Out-of-the-Money (OTM) options. One must consider premium as the enemy of the investor. Over time it evaporates, reducing the value of the option even if you have bet the right direction. Deep In-the-money (ITM) options will have a lot less premium while still allowing you to leverage your investment. A vertical spread (either with calls or puts) somewhatalleviate the premium problem as you buy one option and sell another against it , thus reducing your premium exposure. The additional consideration is the choice of strike. The further your vertical spread is ITM, the more protection you will get from a move against it, but the greater you limit your profit potential. You will also need to choose expriration dates for your spread.

For backtesting options spreads our purchased options will be 20% ITM. These uually consist of only 20% premium As for the option dates,we will pick LEAPs with around 2 years until expiration, as bull markets can last over a year..

The earliest data that I have from Thinkorswim (TOS) that match our timing system date from June 2005 when we should have goneshort. Initiating a short trade means buying puts. And of course, we will buy calls to go long. To calculate returns with the options, I will use the Thinkback feature of TOS.

Here is a table of the results:

| Date | Option | Price | Number of contracts | Value | Date | Price | Value | Profit |

| 06/01/05 | SPY Dec 06 145 Put | $24.95 | 4 | $9,980.00 | 07/01/05 | $25.50 | $10,200.00 | $220.00 |

| 07/01/05 | SPY Dec 06 95 Calls | $28.55 | 3 | $8,565.00 | 12/15/06 | $47.40 | $14,220.00 | $5,655.00 |

Unfortunately, at the time there was no access to longer dated option and the system kept us long for 2 ½ years which were not covered by the LEAPS. But after about 18 months, we were up 66% on the initial investment. We’ll start again in February 2008 when the system indicates a time to go short.

| Date | Option | Price | Number of contracts | Value | Date | Price | Value | Profit |

| 02/01/08 | SPY Dec 09 160 Put | $26.40 | 5 | $13,200.00 | 08/03/09 | $60.40 | $30,200.00 | $17,000.00 |

| 08/03/09 | SPY Dec 10 80 Calls | $23.90 | 12 | $28,680.00 | 07/01/10 | $24.82 | $29,784.00 | $1,104.00 |

| 07/01/10 | SPY Jan 12 120 Puts | $25.57 | 12 | $30,684.00 | 09/01/10 | $21.08 | $25,296.00 | -$5,388.00 |

| 09/01/10 | SPY Jan 12 85 Calls | $27.60 | 9 | $24,840.00 | 10/01/10 | $32.65 | $29,385.00 | $4,545.00 |

| 10/01/10 | SPY Jan 12 135 Puts | $26.37 | 11 | $29,007.00 | 11/01/10 | $22.71 | $24,981.00 | -$4,026.00 |

| 11/01/10 | SPY Jan 12 95 Calls | $26.68 | 9 | $24,012.00 | 10/03/11 | $18.15 | $16,335.00 | -$7,677.00 |

| $11,433.00 |

The final tally is a profit of $11,433 after 6 years. This is on par with the results we had for the system going long and short with the ETF itself. Once again, putting stops in place would have preserved a larger profit but we just let the system determine when we entered or exited the trade. As we can see from these results, leverage goes both ways – we get larger percentage wins when the market moves in our favor, but our losses are compounded when we are wrong, as in the last 2 years when the market made rapid moves , both up and down It is also clear that when the market makes small moves over time, as it did in 2009, the decay inherent in buying options reduces the profit potential.

The advantage of options is that they offer many possible strategies. Since it is not possible to sell options in an IRA account, we need to look for strategies that will offset some of the premium decay like verticals for example. In a vertical, you buy one option and sell another one against it. Since the option you sell will have more premium than the one you buy, you therefore reduce the possible decay. You could also use a strategy like a calendar where you offset the decay by selling shorter dated options against you long position. This will probably be the topic for another article.