Courtesy of www.econmatters.com.

By EconMatters

We just received the most recent issue of The Basic Points by Don Coxe from the Coxe Strategy Journal (copy embedded below, also available on Scribd and Slideshare) where it points out banks, instead of economy, represents the greatest global risk. Here are some of the notable quotes from the report:

The big bankers of Wall Street and Europe are, it would seem, modern Bourbons, who have forgotten nothing [about their boom-built bonuses] and learned nothing [about the perils of physics-based risk models and excess leverage].

"It looks as if the Big Banks could be in a Triple Waterfall collapse formation that would force further assistance.

"….the herd of Too Big to Fail banks should have been culled, thereby freeing up liquidity and capital for well-managed organizations."

But not all banks are bad apples,

"…. the index of Canadian bank stocks reveals an industry that has continued its long tradition of behaving itself, thereby dramatically outperforming its counterparts in the US and Europe"

All in all,

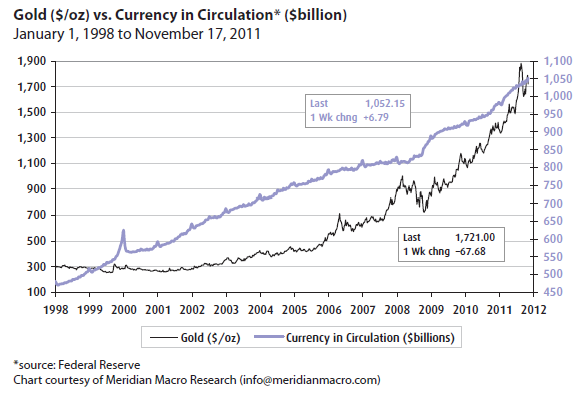

"Commodities remain in a long-term bull market that shows scant signs of the excesses of the 1970s. Even gold, which is frequently cited as being in bubble mode, is merely catching up to long-term monetary expansion."

To protect wealth against monetary excesses on a global scale, there are several options:

- Gold Bullion or ETFs

- Gold Royalty and Streaming companies

- Large-Cap Gold Miners

- Medium- and Small-Cap Gold Miners, and Exploration Companies

Read on for Coxe’s advise on detail asset allocation model.

The views and opinions expressed herein are the author’s own, and do not necessarily reflect those of EconMatters.