Courtesy of Mish

It’s difficult to catch the early news from Europe and the US open as well, unless one never sleeps. Here we are in the midst of another flatline gap-up rally.

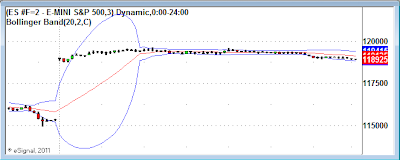

Here is an intraday chart of the S&P 500.

S&P 500 3-Minute Chart

As with the last gap-up on rumors now dead, I confidently predict this nearly-3% gap will fill sooner, rather than later.

Let’s take another look at the bond market.

Italy 10-Year Government Bonds

Italy 2-Year Government Bonds

Spain 10-Year Government Bonds

Spain 2-Year Government Bonds

The yield on 10-Year Italian bonds barely budged. In contrast there was wild action in 2-year bonds, opening up at 8.11% then finishing 100 basis points down from the high and 56 basis points lower than Friday’s close. This intraday move is probably another 6-Sigma event.

2-year bonds for Spain showed similar action, but the swings were not as dramatic.

Nonetheless, in spite of these swings, the yield on both 10- and 2-year Italian bonds is over 7%, and Spanish bonds are sick as well.

As I said at 2:52 AM in Equity Futures Ripping, Bond Market Still on Deathbed; Germany Allegedly Mulls Five-Nation "Elite Bonds" ….

If there was any reason to believe "elite bonds" would help Italy, or the IMF would help Italy, then 2- and 10-year yields would not be above 7%, and the 2-year yield certainly would not have soared to a new high above 8%.

Equity markets are responding to something the bond market does not see, most likely pure nonsense.

Expect More Nonsensical Rumors

Don’t worry, when the equity gaps fill, there will be still more nonsensical rumors to excite the stock market.