Short post today as I have the flu.

Short post today as I have the flu.

To quickly summarize the news (see Member Chat for details), Asia was up but not all that much (around 2%) and Europe is up about half a point at 8am. Italy had a very expensive bond auction but at least people bought them just under 7% and they need that 7% because inflation in Belgium just popped to 3.85% in November.

Moody’s put 87 EU Banks on review (ie. downgrades coming) and Fitch put the US on negative watch and there are rumors that a French downgrade is imminent. Bets against the euro are at a 17-month high and Japan’s unemployment rate rose to 4.5% in October. On the whole, it’s not the kind of news that generally leads to impressive market rallies.

As you can see from the chart above – it’s pretty clear from the OECD Leading Index that Europe is already in a Recession – we’re just waiting for the lagging GDP results to catch up. That means we can look forward to strings of disappointing numbers and, so far, we can’t even get the EU to come up with bailouts to stop things from getting worse so good luck getting the 2009-style stimulus it will take to stop things from tanking altogether.

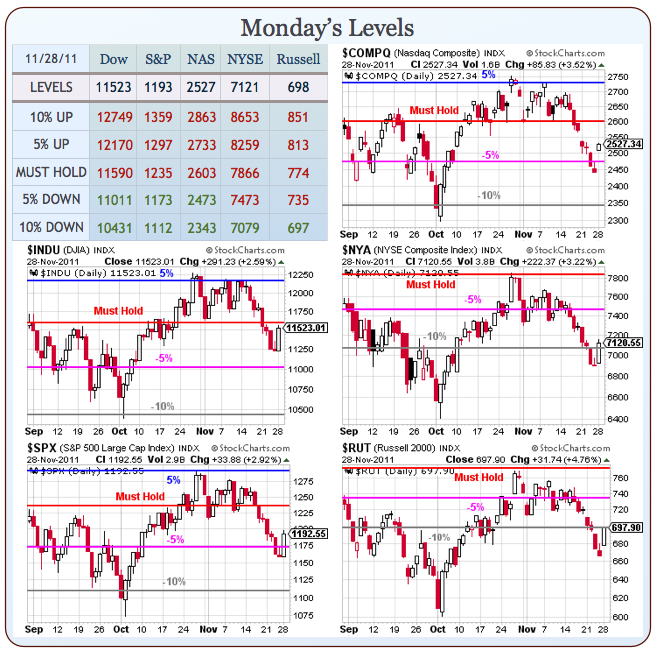

Yes, I’m in a bad mood because I’m sick but this is some sickening data so let’s be very careful out there! As I said yesterday, we saw this rally as an opportunity to cash out our bullish positions and we killed our weekly plays as we topped out in the afternoon and today, if we fail to get over 11,590 on the Dow (our Must Hold line) – then it’s time to pull the plug on the rest of the bull side (short-term bets – including our WCP) and get back to cash.

Yes, I’m in a bad mood because I’m sick but this is some sickening data so let’s be very careful out there! As I said yesterday, we saw this rally as an opportunity to cash out our bullish positions and we killed our weekly plays as we topped out in the afternoon and today, if we fail to get over 11,590 on the Dow (our Must Hold line) – then it’s time to pull the plug on the rest of the bull side (short-term bets – including our WCP) and get back to cash.

Still, the best advice I heard came from Mark Grant at Southwest Securities, who said:

Reacting to news headlines – like today’s morsel of good news out of Europe – is a trap to steer clear of. It’s just another whipsaw, the type that that has dominated Wall Street for months. The equity markets’ rallies upon some headline are always followed by a downdraft as the slow-witted finally figure out that the grand pronouncement is little more that hot air being belched up to mislead the masses.

There’s a huge effort being made to take the markets higher but we’ll need to solve the EU Debt Crisis AND then move on to do some proper stimulus before we can get really bullish but we’re still working off some massively oversold conditions so it’s OK to get technically bullish if we take back our technical levels. On our Big Chart, we’ll be looking to take back AND hold 11,590 on the Dow, 1,235 on the S&P, 2,603 on the Nasdaq, 7,473 on the NYSE and 735 on the Russell.

The NYSE and the Russell are both about 4% below their targets so not going to happen today but it better happen by Friday. The majors, on the other hand, are within striking distance and the Dow, as we predicted, tested 11,590 yesterday and failed so we really don’t want to see another failed attempt and, technically, they already made on in the futures. So today is a good day for some speculative covers. DIA puts like the Dec $112 puts at $1.50ish or the IWM weekly $67 puts for .35 are what I would look at if the RUT fails to hold 700 and the Dow fails to hold 11,600 but, for now, I’m going back to bed!

IN PROGRESS (hopefully).