WTF?

WTF?

Do Ben Bernanke and I live on different planets? "For a lot of people," he said during a speech at Fort Bliss, "I know it doesn’t feel like the recession ever ended." For what people exactly, Dr. Bernanke, does it seem like it did end? Study after study after study show that, if you are not lucky enough to be in the top 10% of our society (and certainly not a shade of Johnson’s "Great Society" anymore) then you are pretty much f*cked – and, no, there’s not a nicer way to put it.

Bernanke seems to love the Great Depression so much he is Hell-bent on replicating it here so he can study it in greater detail. I suppose he has some sort of academic detachment regarding the untold suffering he is causing the American people but, who can blame him? He just got a great rate when he refinanced his $850,000 home.

Fortunately, we had complete confidence in Bernanke’s incompetence (see yesterday’s "To QE3 or not to QE3 – That Sets Direction") and, of course, we took advantage of yet another chance to short oil futures (/CL) off the $101 and then the $100 lines on the way down. We were HOPING (not a valid investing strategy) that we’d get some QE3 but, as I warned Members in the morning: "If not – well, Hell hath no fury like a market disappointed."

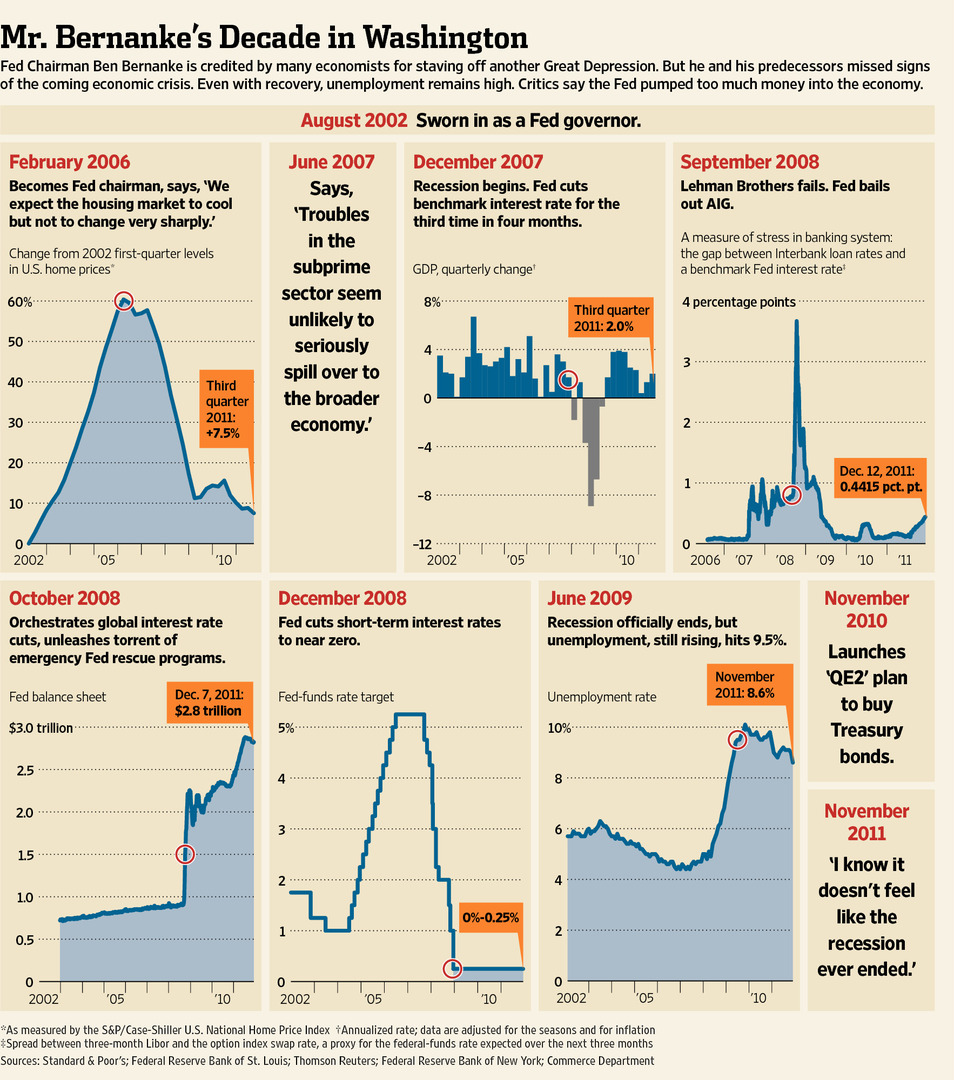

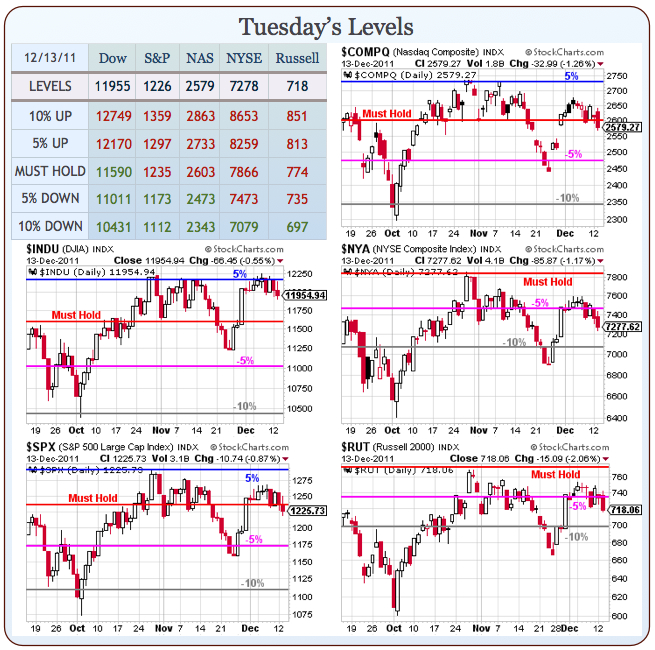

Clearly, as you can see from David Fry’s SPY chart – I was not overselling the point. Bernanke and the Fed are of the opinion that 10% unemployment is within their mandate of "promoting full employment" and don’t see the need to take action? Let’s have a little review of how good the Fed Chairman has been as a prognosticator for our economy as he enters his 7th year at the Fed:

Drivin’ that train, high on cocaine

Casey Jones you better watch your speed

Trouble ahead, trouble behind

and you know that notion just crossed my mind

Trouble with you is the trouble with me

Got two good eyes but we still don’t see

Come round the bend, you know it’s the end

The fireman screams and the engine just gleams – Grateful Dead

Scary, isn’t it? I think those lyrics sum it up better than me ranting about what an idiot this man is. Can our economic engine survive a Fed Chairman who is asleep at the switch?

Scary, isn’t it? I think those lyrics sum it up better than me ranting about what an idiot this man is. Can our economic engine survive a Fed Chairman who is asleep at the switch?

This economy, the whole Global Economy, in fact, has the potential to go off a cliff between now and the next Fed meeting (Jan 25th) but, rather than put the brakes on our downward spiral or at least nudge us in a different direction – Ben would rather wait until we’re falling off that cliff at 32 feet per second squared to take action – risking the possibility that it may no longer be possible to "fix" things if our downhill slide begins to gain momentum.

We didn’t wait for Ben to screw us over, fortunately – we were already deeply concerned about the Global Economy (see Monday’s "Robbing Peter to Pay Portugal") and had gone back to "Cashy and Cautious" last week. Now that our hopes of QE3 and a Santa Rally are dashed on the rocks – we’re glad for the DXD Jan $15 at $1.25 (now $1.50) calls from Friday’s post (offset with short FCX Feb $33 puts at $1.25, now $1.45) as well as our SQQQ Jan $16/19 bull call spread at $1.50 (now in the money at $20.19 with the spread at $2 – up 33% in 2 days) and all of our offsetting put sales there (GOOG, AAPL, MSFT) were up for the day yesterday so big winners from Monday morning’s post as well as my calls to short the S&P (/ES) Futures at 1,250 (now 1,219) and the Russell (/TF) futures at 740 (now 713) with the RUT, for example, gaining $2,700 per contract on that drop!

In Member Chat on Monday, we did pick up a long on NLY (very hedged) and an aggressive FAS $60/61 bull call spread for the White Christmas Portfolio at .55 on the assumption XLF would hold $13 through Friday. We tested $12.50 yesterday and, if we’re not over $13 by lunch, we’ll pull those $60s (now $1.70) off the table and leave the $61s as a naked call – if those expire worthless, then it’s a $1.15 profit off the .55 net entry (209%), which is not bad for a trade we called wrong!

In Member Chat on Monday, we did pick up a long on NLY (very hedged) and an aggressive FAS $60/61 bull call spread for the White Christmas Portfolio at .55 on the assumption XLF would hold $13 through Friday. We tested $12.50 yesterday and, if we’re not over $13 by lunch, we’ll pull those $60s (now $1.70) off the table and leave the $61s as a naked call – if those expire worthless, then it’s a $1.15 profit off the .55 net entry (209%), which is not bad for a trade we called wrong!

SLF was another bottom fishing find (thanks Savi) and we took a chance on DMND – in case they don’t go BK. Yesterday, we added a bearish play on NFLX at 11:52, TLT at 1:08, a bullish trade on RIMM at 1:51 (also betting they don’t go BK, like they are priced),

DIA $117 puts for .90 at 2:12 that we took off the table at $1.20 at 2:45 (up 33% in 35 minutes), then the DIA 12/31 $116 puts at $1 at 2:50, which we dumped for $1.20 (up 20%) followed by the 12/31 $115 puts at $1 at 3:36 which we got out even on. That put us back to fairly balanced into the close but, if we fail to take back the 1,235 Must Hold line on the S&P this morning (doubtful) – it will be bearish bets we’re looking to add this morning.

What’s the good news that can take us higher now? What catalyst can we expect as Europe has done whatever it is that it did and China and Japan did their things and Ben did his thing (which is nothing) so – now what? Now the attention turns back to the data, back to the Fundamentals and the Fundamentals are NOT sound. Not at all. My prior bullishness on the Fundamentals included the expectations of an injection of QE3, without new money coming in from somewhere – we can expect those Must Hold lines to begin to look more like the top off a 10% lower range.

It’s all about the Dollar, of course but, if Europe is easing and China is easing and Japan is doing whatever they are doing – then doesn’t that make the Dollar relatively stronger and, if the Dollar is stronger, then commodities are lower and, if commodities are lower – then won’t that drag down the commodity sectors and won’t they, in turn drag down the S&P and, in turn, the Nasdaq, Dow, NYSE and Russell?

That’s all Fundamentals are – follow the money. Or, in this case, thanks to the Fed – the lack of it.