Reminder: Pharmboy is available to chat with Members, comments are found below each post.

For the past few years at Phil’s Stock World, many of my articles have focused on cancer therapies or the robust (or not so robust) big pharma pipelines. I have not delved into many specific diseases, their mechanisms, and potential treatments. Two of the hottest areas in the industry right now are fibrosis and hepatitis C. In the fibrosis area, large deals are being made for early stage compounds in scientifically plausible, but unproven mechanisms (Gilead’s purchase of Arresto Biosciences for $225M, Bristol-Myers buying Amira Pharmaceuticals for $325M). Fibrosis will be a topic for another write-up. The area where there is a flurry of activity is in the treatment of hepatitis C. Vertex and Merck received approval for their new drugs in May 2011, Incivek and Victrelis, respectively, where Roche bought Anadys Pharmaceuticals for $230M, and Gilead is purchasing Pharmassett for $11B!

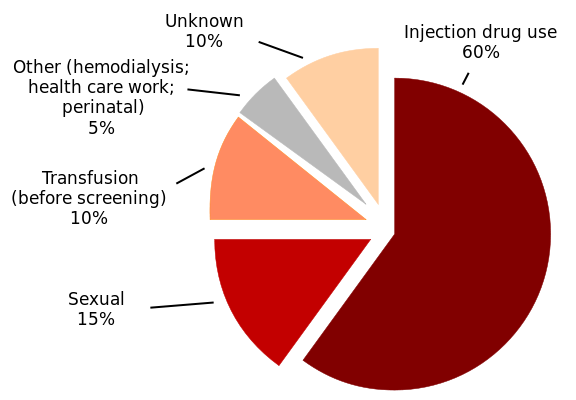

Hepatitis C (HCV) is a viral disease that is spread by blood to blood contact, and it primarily affects the liver. The infection is often asymptomatic, but chronic infection can lead to scarring of the liver and ultimately to liver cirrhosis. Liver cirrhosis can lead to liver failure and/or other complications, including liver cancer or life-threatening esophageal and gastric varices.1 There is no known cure or vaccine for HCV, and an estimated 180M people are infected . The shear number of infections makes it an attractive market for pharmaceutical companies, and thus there are many drugs being clinically tested.

Hepatitis C (HCV) is a viral disease that is spread by blood to blood contact, and it primarily affects the liver. The infection is often asymptomatic, but chronic infection can lead to scarring of the liver and ultimately to liver cirrhosis. Liver cirrhosis can lead to liver failure and/or other complications, including liver cancer or life-threatening esophageal and gastric varices.1 There is no known cure or vaccine for HCV, and an estimated 180M people are infected . The shear number of infections makes it an attractive market for pharmaceutical companies, and thus there are many drugs being clinically tested.

Figure 2. HCV Infections

After an HCV infection, the disease enters an acute phase and subsequently, a chronic phase. During the acute phase, people often have flu-like symptoms, decreased appetite, fatigue,abdominal pain, jaundice, and itching. The acute phase is considered less than 6-months. The chronic phase (50-80% of those infected) of the disease is noted by higher liver enzymes (ALT/AST), and is often discovered when people are going through a routine checkup. The liver is often inflamed, and cirrhosis and fibrosis could also begin to set in. Of those that are in the chronic phase of the disease, approximately 20–50% do not respond to treatment. There is a very small chance of clearing the virus spontaneously in chronic HCV carriers (0.5% to 0.74% per year).

After an HCV infection, the disease enters an acute phase and subsequently, a chronic phase. During the acute phase, people often have flu-like symptoms, decreased appetite, fatigue,abdominal pain, jaundice, and itching. The acute phase is considered less than 6-months. The chronic phase (50-80% of those infected) of the disease is noted by higher liver enzymes (ALT/AST), and is often discovered when people are going through a routine checkup. The liver is often inflamed, and cirrhosis and fibrosis could also begin to set in. Of those that are in the chronic phase of the disease, approximately 20–50% do not respond to treatment. There is a very small chance of clearing the virus spontaneously in chronic HCV carriers (0.5% to 0.74% per year).

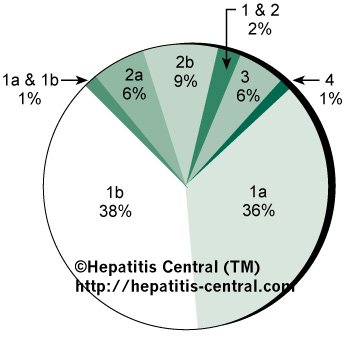

Figure 3. Common Genotypes

Like many viruses, hepatitis C has several genotypes. Think of them as relatives with very similar traits. Figure 2 shows the different genotypes and their prevalence in the population. This is not the end of the list, as below is the entire list in the population and their location in the world (list from Hepatitis Central).

1a – mostly found in North & South America; also common in Australia

1b – mostly found in Europe and Asia.

2a – is the most common genotype 2 in Japan and China.

2b – is the most common genotype 2 in the U.S. and Northern Europe.

2c – the most common genotype 2 in Western and Southern Europe.

3a – highly prevalent here in Australia (40% of cases) and South Asia.

4a – highly prevalent in Egypt

4c – highly prevalent in Central Africa

5a – highly prevalent only in South Africa

6a – restricted to Hong Kong, Macau and Vietnam

7a and 7b – common in Thailand

8a, 8b & 9a – prevalent in Vietnam

10a & 11a – found in Indonesia

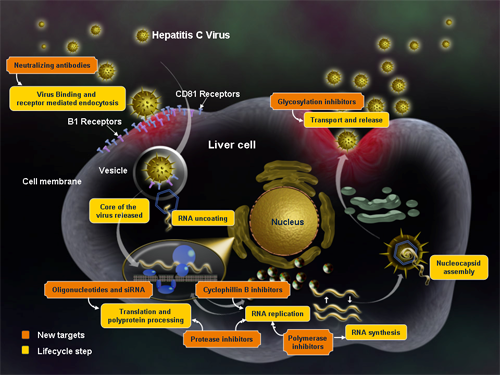

Treatments for hepatitis C patients are becoming more varied with the approval of two new drugs boceprevir (Victrelis) and telaprevir (Incivek). Both drugs are protease inhibitors that block the virus’s ability to reproduce (Figure 3 below). In addition, other treatments are usually contenement including pegylated interferon-alpha-2a or pegylated interferon-alpha-2b (brand names Pegasys or PEG-Intron) and the antiviral drug ribavirin. The treatment time is for a period of 24 or 48 weeks, depending on hepatitis C virus genotype.

Figure 4. Drugs mechanisms of action against HCV (from Medscape).

As noted in Table 1 below, there are many players in the race for treating hepatitis C. Since this is a virus, treatments are going to be in combination (as noted in the above paragraph), and thus there is room for many players in the industry. The table below was modeled after the one producted by the HCV Advocate here.

| Phase 2 | ||

| Drug | Mechanism of Action | Company |

| ABT-450 | Protease Inhibitor | Abbott / Enanta |

| ACH-1625 | Protease Inhibitor | Achillion |

| ANA598 (Setrobuvir) | Polymerase Inhibitor | Anadys / |

| BI 207127 | Polymerase Inhibitor |  |

| BIT225 | Protease Inhibitor | Biotron |

| BMS-650032 (Asunaprevir) | Protease Inhibitor | |

| BMS-791325 | Polymerase Inhibitor | |

| Filibuvir | Polymerase Inhibitor |  |

| GS-9190 (Tegobuvir) | Polymerase Inhibitor |  |

| GS-9256 | Protease Inhibitor |  |

| PSI-938 | Polymerase Inhibitor | |

| IDX184 | Polymerase Inhibitor | |

| RG7128 (Mericitabine) | Polymerase Inhibitor | |

| RG7227 (Danoprevir) | Protease Inhibitor | |

| INX-189 | Polymerase Inhibitor | |

| Vaniprevir (MK-7009) & MK-5172 | Protease Inhibitor |  |

| VX-222 & VX-759 (no updates since 2010) | Polymerase Inhibitor | |

| Phase 3 | ||

| BI 201335 | Protease Inhibitor |  |

| BMS-790052 (Daclatasvir) | NS5A Inhibitor | |

| PSI-7977 | Polymerase Inhibitor | |

| TMC435 | Protease Inhibitor | Medivir / Tibotec |

With all the different drugs (many having the same mechanism of action), a race to be the first to market is on. There is plenty of room for several player in the field, as analysts have projected that the hepatitis C market could be as large as $12B per year. New protease inhibitors from Merck (MRK) and Vertex (VRTX) were approved this year, but Vertex has taken the sales lead ($420M vs. $31M as of October 2011) with its drug due to its efficiacy data.

Victrelis and Incivek’s indication is for the treatment of chronic hepatitis C genotype 1 infection in combination with pegylated interferon and Ribavirin. Both drugs are not be used as monotherapy as its efficacy has not been studied in patients who had previously received either protease inhibitor. Both drugs have similar dosing (800 vs. 750 mg 3X/day, respectively). The advantage comes in the treatment time, where Incivek’s is 24 weeks, and Victrelis is 28 weeks. Merck has tried to be very aggressive on its price points, but Vertex sales over the first 6-mo says it all.

Pharmasset has a RNA replication inhibitor, PSI-7977. In conjunction with pegylated interferon and Ribavirin, PSI-7977 seems to work on several HCV genotypes. The FDA fast tracked their status, so if the clinical trials continue to impress, approval should be in 2013. The big news here is that Pharmasset is looking at a pivotal Phase 3 study that will evaluate a 12-week, all-oral, interferon-free regimen of PSI-7977 and ribavirin in patients with HCV, independent of viral genotype or their ability to take interferon therapy. Should this work, Pharmasset will set the bar very high for any other monotherapy! It is my belief that this will be a very high hurdle, as the virus has an uncanny ability to mutate, so a one drug shot is very unlikely (but it is worth the risk). There are several clinical trials with PSI-7977 in contenement with other agents.

Bristol-Myers has several compounds in the clinic, and one interesting one is their NS5A inhibitor, daclatasvir. NS5A resides in the endoplasmic reticulum as a membrane-associated phosphoprotein, but its exact role is not very well understood. The protein regulates multiple steps of the HCV life cycle, including viral RNA replication and virion maturation. In conjuction with Tibotec (JNJ), diclatasvir and TMC435, a NS3 protease inhibitor, are also in trials for HCV genotype 1.

There are many other agents as noted in the table that are in clinical trial. I don’t want to go through each one, as many similar mechanisms of action. A major concern with HCV, though, is its ability to quickly build up a resistance to medications used to eliminate it. Scientific papers have demonstrated both in vitro and in patients that drug-resistant mutants can emerge quickly under selective pressure from NS3 protease and NS5B polymerase inhibitors.3 More time is needed, but with the advent of the two new therapies, as well as many more making there way through the clinic, hepatitis is quickly becoming manageable.

I have advocated at buying VRTX in chat as well as in the SWW Newsletter, so I encourage you to stay abreast of industry news, and join Phil’s Stock World for more ideas on not only the biotech and pharma field, but for all the other good investors and traders who are in chat every day!

Happy Holidays!

– Pharm

1. Ryan KJ, Ray CG (editors), ed (2004). Sherris Medical Microbiology (4th ed.). McGraw Hill. pp. 551–2. ISBN 0838585299.

2. Watanabe et. al. (2003). J. of Medical Virology 71 (1): 56–61.

3. Sarrazin et. al. (2010) Gastroenterology,![]() 138:2, pp. 447-462.

138:2, pp. 447-462.