500 Billion Euros – Muhahaha!

500 Billion Euros – Muhahaha!

This is, as they say in the Euro-zone, a good start. Money was offered and 523 banks requested a total of 489Bn Euros ($641Bn) in funding from the ECB at the delicious rate of 1% for three years.

We already discussed the merits of this program in Member chat this morning and Pharmboy and I will be debating the issue on National television very soon if this keeps up as it's a shame to waste such a good debate.

Despite my bullish take on $641Bn being handed out to people who can lever it 10:1, this morning we shorted the run in the Dow Futures (/YM) to 12,100 and got a little dip to 12,070 but the big winner was, as usual, oil – which got all full of itself and ran up to $98.50, where we caught multiple rides down with the last hitting $97.50 so, as is often the case, the Egg McMuffins are paid for.

After the announcement of the "Longer-Term Refinancing Operation" (LTRO) – it did finally occur to some people that dropping that kind of money bomb on the EU might, somehow, devalue the Euros that are currently in circulation. Some theory about "supply and demand" which you may have hear of… Well, it seems the people who took Econ 101 were of the opinion that $1.32 was a bit much for the Euro under the circumstances (5am) and by 6am it was back down to $1.305 – a pretty crazy drop for a currency in an hour in any of the other 100 years of currency trading but, in 2011, we call just another it Wednesday morning.

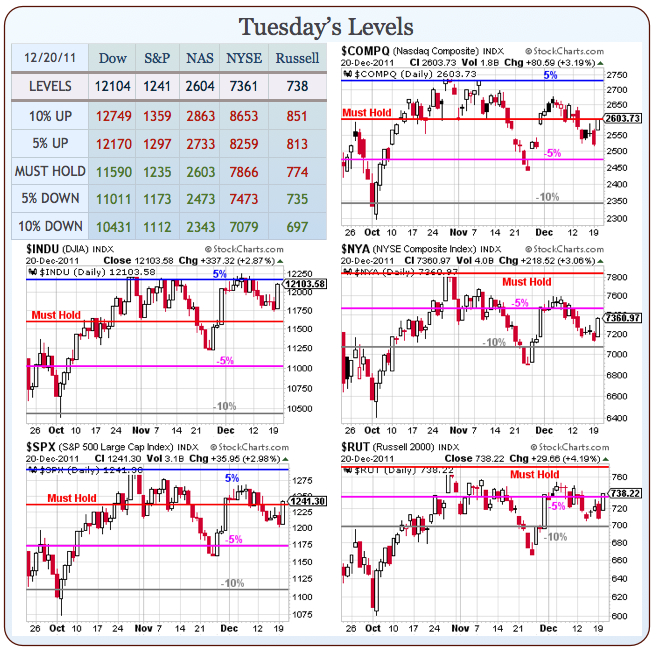

So we're done with our event-driven bearish bet on the futures and now we can go back to being bullish until and unless our levels fail to hold on our Big Chart.

So we're done with our event-driven bearish bet on the futures and now we can go back to being bullish until and unless our levels fail to hold on our Big Chart.

Unlike those voodoo moving averages, our Big Chart lines are fixed according to our 5% rule and these are the same lines we used to predict the market since early 2009 and the only reason we move the lines is to adjust for major changes in Dollar valuation, which the market is priced in.

Other than that, we are rock-solid on target to finish at our 1,250 goal for the S&P, which is (after taking into account the net 4% drop in the Dollar) almost exactly 50% up from the 800 base-line we've been using for the S&P since – forever.

So these are multiple crash-tested lines to say the least and now we are back to 3 greens on our Must Hold lines and, as usual, the NYSE and the RUT are dragging. 3 of 5 over the Must Holds leave us leaning bullish but not too bullish until the NYSE pops -5% at 7,473 because we are willing to tolerate a one-block drag, but not two.

So, the Dow popping 12,170 will be bullish – ESPECIALLY if confirmed by the NYSE making goal at 7,473 (112 to go) but a failure of the Nasdaq OR the S&P to hold 2,603 and 1,235 will have us layering on some more protection and probably cashing in the last of our bullish plays to move to all cash or all cash with some downside plays into the Holiday Weekend (we're closed Monday).

Today's LTRO operation can (and will be) be interpreted in many ways. Are the EU banks simply taking advantage of FREE MONEY or would the EU have collapsed without it. Will this ease liquidity between now and the next round in February or have we now, having satiated the money lust of the Banksters now left them with no reason to borrow money between now and then – effectively drying up liquidity by providing it?

Today's LTRO operation can (and will be) be interpreted in many ways. Are the EU banks simply taking advantage of FREE MONEY or would the EU have collapsed without it. Will this ease liquidity between now and the next round in February or have we now, having satiated the money lust of the Banksters now left them with no reason to borrow money between now and then – effectively drying up liquidity by providing it?

These are not the kind of questions that will be answered in the short-term and that means, unfortunately, that the rumor-mongers and extrapolaters will have a field day proclaiming, all with great certainty, whatever it is someone pays them to proclaim. We already took the easy money and ran as my 4:53 comment to Members this morning was:

Speaking of Capitalism – Oil back to $98.50, Dow back to 12,100 so another opportunity to short below the line if they cross again, with the Dollar currently at 79.865 – so failing to hold 79.85 is a good indicator to get off a bear trade. BOE minutes show a lot of support for more QE in the UK and that should boost the Buck once people read it over. Overall, though, I don’t see any reason we won’t open up 1% or better so far so we’re just playing for a short-term pullback unless something happens but something already happened to pop up up 70 points and that’s the main premise of the bet – down is easier than up at the moment and we have a nice, fat support line to play off – it’s as simple as that.

We don't trade the Futures every day – only when it's obvious. At least then we have a 50/50 shot of being right! Now (8:20 am) the Dow is testing 12,000 (up $500 per contract) and oil is below $97 (up $1,500 per contract) and, as I said, the Egg McMuffins are covered. Of course, we don't need to wait for the futures to make a sensible play – that was just a bonus – at 1:31 pm yesterday, in Member Chat, with the Dow at 12,092, I commented to Members:

Now we’re at the point where this rally is looking a bit fake. Volume just 71M at 1:15 on the Dow and we’re up on a flat Dollar 80.23 and oil stopped going up ($96.34) and gold too $1,617. Just a little fake, Fake, FAKE to me but there may be a bit of a short squeeze after yesterday’s head fake. Or, as Pharm notes, something is very wrong with the internal conditions…

DIA 12/31 $118 puts at .63, 10 in the WCP to lock in some gains.

WCP is our aggressive, White Christmas Portfolio and, as I mentioned the other day, we were down to 3 bullish plays and 94% cash so we just wanted to lock in the 300-point gain for the day by shorting the Dow – overall, we are still bullish until we cash out our longs, which will be happening if we fail our levels (see, not a very complicated strategy to follow, is it?). The Dollar was at 80.25 at the time and it did fall all the way to 79.60 to give us the morning highs we shorted earlier but now it's back to 80.40 in time for real trading to begin – likely poised to be taken down again to goose the markets into the open.

I like the Dow Futures (/YM) bullish off the 12,000 line with very tight stops below and I even like oil (/CL) bullish off the $97 line with the same tight stops, until the 10:30 oil inventory report where we'll take the money and run and, hopefully, have a chance to go short again if oil spikes up on some BS little build in inventories. 80.40 is the line in the sand for the Dollar – above that and no one should be bullish until it calms down. On the whole though – it's a lovely day to be in cash and watch the mayhem from the sidelines!

Unless, of course, you happen to be one of the hedge fund managers who spend millions buying information from Congresspeople – a practice that is not only not illegal (technically) but is so widespread that it has spurred an industry, with companies like JNK Securities who are proud enough of what they do to quote right on their own web-site (and I WISH I were making this up):

Unless, of course, you happen to be one of the hedge fund managers who spend millions buying information from Congresspeople – a practice that is not only not illegal (technically) but is so widespread that it has spurred an industry, with companies like JNK Securities who are proud enough of what they do to quote right on their own web-site (and I WISH I were making this up):

"Many [investors] turn to William Williams, president of JNK Securities, a firm that brings lawmakers and investors together "to bridge the information gap between Washington and Wall Street."" – The Wall Street Journal

"JNK Securities," continues the pitch, "offers practical, real time intelligence on all matters of US Government Policy including financials, healthcare, energy, transportation, defense and much more. To better serve our clients, JNK offers a wide variety of options with which to utilize our product including 1 on 1 meetings with key stakeholders, roundtable discussions, meetings in Washington, DC, conference calls, and the ability to work bespoke projects and issues on an individual basis.

JNK Securities Corp. does not participate in any lobbying or fundraising events. All reports, events and interactions are intended to provide information for JNK Securities clients about relevant and current issues only. JNK is not a member of the MSRB. All US Government Policy events comply with the Congressional ethics rules and regulations."

It's certainly not just the Republicans that engage in this activity. When Senate Democrats finally brokered a compromise over the proposed health-care law, a group of hedge funds were let in on the deal, learning details hours before a public announcement on Dec. 8, 2009. The news was potentially worth millions of dollars to the investors, though none would publicly divulge how they used the information. They belong to a select group who pay for early, firsthand reports on Capitol Hill.

Hedge-fund managers at Viking Global Investors and Karsch Capital Management were among investors who met privately that afternoon in a nondescript Capitol basement with senators whose support was crucial to passage. The lawmakers said they would soon reach a deal that eliminated a proposed government-run insurance plan, according to people there. The deal, announced after markets closed, helped buoy shares of such giant health insurers as Aetna Inc. and Cigna Corp. through the end of the year: A government plan could have posed serious competition.

Hedge-fund managers at Viking Global Investors and Karsch Capital Management were among investors who met privately that afternoon in a nondescript Capitol basement with senators whose support was crucial to passage. The lawmakers said they would soon reach a deal that eliminated a proposed government-run insurance plan, according to people there. The deal, announced after markets closed, helped buoy shares of such giant health insurers as Aetna Inc. and Cigna Corp. through the end of the year: A government plan could have posed serious competition.

Viking and Karsch placed bullish bets on health-insurance stocks including Aetna during the fourth quarter of 2009, which they sold in the first quarter of 2010, according to regulatory records that don't pinpoint trading dates. Shares of Aetna rose more than 6% within days of the announcement.

According to Hoover's Peter Schweizer – John Boehner, as the House minority leader in 2009, invested in health-insurance stocks before the so-called public option in President Barack Obama’s health-care overhaul bill was killed. Shares in those companies eventually soared.

"Hedge funds and other investors have found that Washington can be a gold mine of market-moving information, easily gathered by those who are politically connected," according to Sanford Bragg, CEO and president of Integrity Research Associates, an independent group that analyzes research providers.

What's more outrageous – that this happens at all or that it happens, the story is out there – and no one seems to be making a big deal about it? I'd say write to Congress but they are not only making money for divulging legislative details to hedge fund managers in private meetings but they also park their money with the same hedge fund managers to make themselves a fortune trading on inside information – a story we covered in November that sadly gained no national traction.

What's more outrageous – that this happens at all or that it happens, the story is out there – and no one seems to be making a big deal about it? I'd say write to Congress but they are not only making money for divulging legislative details to hedge fund managers in private meetings but they also park their money with the same hedge fund managers to make themselves a fortune trading on inside information – a story we covered in November that sadly gained no national traction.

According to CBS News, In mid September 2008 with the Dow Jones Industrial average still above ten thousand, Treasury Secretary Hank Paulson and Federal Reserve Chairman Ben Bernanke were holding closed door briefings with congressional leaders, and privately warning them that a global financial meltdown could occur within a few days. One of those attending was Alabama Representative Spencer Bachus, then the ranking Republican member on the House Financial Services Committee and now its chairman.

Schweizer: "These meetings were so sensitive– that they would actually confiscate cell phones and Blackberries going into those meetings. What we know is that those meetings were held one day and literally the next day Congressman Bachus would engage in buying stock options based on apocalyptic briefings he had the day before from the Fed chairman and treasury secretary. I mean, talk about a stock tip."

For a successful revolution it is not enough that there is discontent. What is required is a profound and thorough conviction of the justice, necessity and importance of political and social rights. – B. R. Ambedkar

If we don't make earnest moves toward real solutions, then each day we move one day closer to revolution and anarchy in this country. This is the sad, and yet potentially joyous, state of America. – Louis Farrakhan

No real social change has ever been brought about without a revolution… revolution is but thought carried into action. – Emma Goldman

We revolutionaries acknowledge the right to revolution when we see that the situation is no longer tolerable, that it has become a frozen. Then we have the right to overthrow it. – Ernst Toller

Those who make peaceful revolution impossible will make violent revolution inevitable. – John F. Kennedy