Wheee, what fun!

The futures are up 200 points on the Dow (/YM) on a massive gap up after being closed since Friday at 6. The Dollar was smacked down all the way to 79.97 at 6:30 and oil rocketed to the magic $101.50 mark and just because it's a new year doesn't mean we got stupider so my comment to Members in this morning's Chat was:

Futures finally opened with massive gap up of 200 on Dow (1.6%). Dollar dove to 80.045 – total joke and my knee-jerk reaction is to short the Dow (/YM) futures below the 12,350 line (12,352 now) and the RUT (/TF) if they cross back below 750 (now 754). Iran oil may have some legs so we may have to wait for inventories (Thursday) to short but we’ll see.

Yep, new year – same BS is the story of 2012. I made my market prediction yesterday and already today it's panning out as we have the opportunity to sell to the suckers who think that China's official PMI coming in over 50 for the first time in 3 months trumps the independent HSBC PMI of 48.7. We have discussed the very flaky nature of PMI data in the past so I won't get into it here but the key takeaway from that report is "The “festival effects” of western and Chinese New Year celebrations helped to boost the PMI reading."

Yep, new year – same BS is the story of 2012. I made my market prediction yesterday and already today it's panning out as we have the opportunity to sell to the suckers who think that China's official PMI coming in over 50 for the first time in 3 months trumps the independent HSBC PMI of 48.7. We have discussed the very flaky nature of PMI data in the past so I won't get into it here but the key takeaway from that report is "The “festival effects” of western and Chinese New Year celebrations helped to boost the PMI reading."

So these are the BOOSTED numbers?!? Oh dear. “Europe’s debt woes, the austerity measures the European countries are taking and the sluggish U.S. recovery mean demand for Asian goods this year is likely to be weak, posing a downside risk,” said Yao Wei, a Hong Kong-based economist for Societe Generale SA. Thank goodness investors don't read the actual reports or check the analysis or we wouldn't be able to make money betting against the reactions to headline numbers.

In the Chinese PMI data, an index of export orders was at 48.6 from 45.6 in November, still below 50, the dividing line between contraction and expansion. The rebound in the PMI “does not signal that the economy has turned around,” said Zhang Zhiwei, a Hong Kong-based economist at Nomura Holdings Inc. who previously worked for the International Monetary Fund. “Growth momentum will continue to wane this quarter, as the European crisis will hurt China’s exports and a cooling property market will drag down domestic demand.”

In the Chinese PMI data, an index of export orders was at 48.6 from 45.6 in November, still below 50, the dividing line between contraction and expansion. The rebound in the PMI “does not signal that the economy has turned around,” said Zhang Zhiwei, a Hong Kong-based economist at Nomura Holdings Inc. who previously worked for the International Monetary Fund. “Growth momentum will continue to wane this quarter, as the European crisis will hurt China’s exports and a cooling property market will drag down domestic demand.”

CHINA is the story of 2012. Europe is a mess, Japan has been a mess for 20 years and is still a mess, America has been a mess we've all ignored for a decade and will remain so for the next decade so we're worrying about the day when people stop ignoring what a mess America is (and, in election season, you may see some of the candidates bring it up) and, if America manages to somehow kick the can into 2013 – it will all be up to China, who will make or break the global economy this year.

Which way will it go? Who knows? Even if we get data from China, the chance of it being an accurate reflection of their economy is very slim. Predicting what will happen is pure nonsense. As Barry Ritholtz points out in his excellent Washington Post Article this weekend:

Do a quick Google search for “where to invest in 2011.” I read through the first dozen or so. For the most part, the performance was pretty awful.

Whenever I see one of those “Buy this now for the new year” columns, I diary them in my calendar or use the free Web siteFollowupthen.com. A year later, I look back at these recommendations and forecasts, and, for the most part, they’re terrible.

Interestingly, China is not on Barry's top 10 list of things people are predicting this year (although he does mention the "Buy Emerging Markets" camp, which we are on the other side of due to China) but the WaPo also carried an interesting list of the best performing S&P stocks of 2011. Which analyst called COG (up 101%) as the year's winner last January? We had ISRG (up 77%) and BIIB (64%) but we didn't like CMG (60%) and we gave up on MA way too early as they finished the year near their highs, up 67%.

Interestingly, China is not on Barry's top 10 list of things people are predicting this year (although he does mention the "Buy Emerging Markets" camp, which we are on the other side of due to China) but the WaPo also carried an interesting list of the best performing S&P stocks of 2011. Which analyst called COG (up 101%) as the year's winner last January? We had ISRG (up 77%) and BIIB (64%) but we didn't like CMG (60%) and we gave up on MA way too early as they finished the year near their highs, up 67%.

7 of the top 10 performers were things consumers HAD to buy – Energy and Health Care while MA, CMG and ROST all benefited from strong consumer demand. MA, to some extent, reflects higher prices for gas and food, which most people charge and ROST is a discounter that found its groove but CMG is baffling to me – who buys an $8 burrito in this economy? Barry had this nice, clickable graphic this morning with fun holiday statistics:

It's very nice but the statistics that matter to us begin tomorrow with earnings from MOS and TXI, followed by STZ, HELE, MON, APOL, DMND and FDO on Thursday. Next week "officially" begins earnings season with (partial list) PTSM, SCHN, AA, OCZ and WDFC on Monday, just SNX on Tues, LEN and SVU Wednesday, INFY and ZZ Thursday and – hold your breath – JPM on Friday morning and then we are off to the races with C, CBSH, WFC, PNFP, GS, BAC, BK, PBCT, SIVB, PRSP, STI and GE all reporting from the Financial Sector next week. If the World doesn't end when BAC reports that Thursday morning (19th) – I might be inclined to get a bit more bullish!

That is going to be a VERY exciting options expiration week so it's a good thing we are kicking off our virtual 2012 $25,000 Portfolio with a cash balance after our White Christmas Portfolio finished up over $30,000 (200%) last week. These are our aggressive, "fun" virtual portfolios, which are meant to be the aggressive carve-out of a larger, more sensibly balanced portfolio, like our Income Portfolio, which is going to have a busy month finally as we make our January adjustments.

Meanwhile, after a dip down to 12,327, the Dow is back at 12,350 and we can short it all over again if it breaks below that line but the first Egg McMuffin of 2012 is paid for and there will more likely be a bullish squeeze at the open as those who took their money off the table last week in case of terrorist shenanigans over the holiday weekend (like us) rush to get back in today (not like us at all).

Our job is to wait PATIENTLY and see what happens next. The Euro needs to be over $1.30 (now $1.3042) and the Pound over $1.55 (now $1.558) and the Dollar needs to be below 80 (now 80.09) for us to get interested in making long plays.

Tomorrow, we'll discuss our levels after we get a chance to see where today settles out. 1,297 is where the S&P needs to be to impress up (+5%) but the Russell is likely to hit 774 (Must Hold) before that happens and the NYSE, our broadest index, is still a drag on the rest and needs nearly 400 points to make their Must Hold at 7,866. This morning's ridiculous Futures rally should get them halfway there, what matters then is what they do with it into the close.

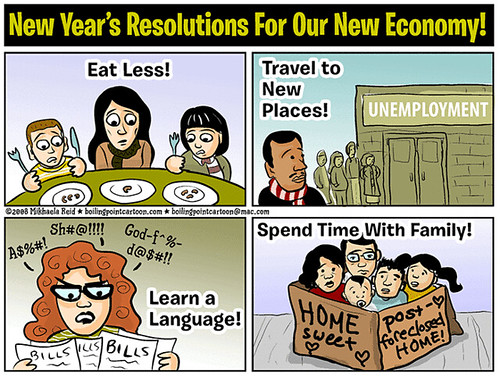

Happy 2012 – same as it ever was: