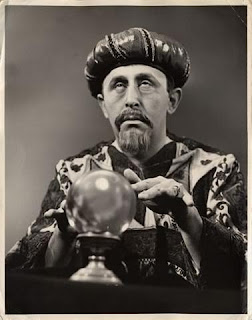

I like the message here, it’s okay to admit you don’t know much and may even be stupid. Takes all the pressure off. ~ Ilene

Do let’s be optimistic . . . even if we don’t feel like it

Courtesy of Baruch of Ultimi Barbarorum

Courtesy of Baruch of Ultimi Barbarorum

Tis (or, by the time I finish this post, ’twas) the season for pundits to give specific predictions for 2012 and a more pointless exercise has yet to be devised. Baruch isn’t going to waste your time doing this, for various reasons. The main one is that Baruch has long been convinced he is almost always wrong about almost everything. His only solace (and it is a big one*) is that everyone else is always wrong as well, and unlike him they don’t know it.

This year prediction seems a lot more difficult anyway. If Baruch is at all representative of bien pensant investor opinion the overriding emotion among practitioners today is a lack of confidence in anything, especially themselves. This is because almost without exception everyone traded like an idiot in 2011, both on the hedge fund side, where “slightly down” is the new “up”, and on the side of benchmarked long only funds. As you may know, Baruch is a professional investor and helps run one of these latter things. Looking at his peer group he is amazed, despite a mild underperformance, to find himself firmly in the top quartile in YTD relative returns. Despite this, he feels like a schmuck. How much worse must the average PM have fared, he asks himself. Just why has everyone done so badly this year?

Baruch has some ideas about why this is; a lot of it can be put down to the narrative of the year and investor positioning. Overall, the majority of the active management community were extremely badly positioned for the key moves in the market in the back half of 2011. They were mostly long for the big August swoon associated with the US credit rating cut, and many compounded this by adding exposure into the decline too early — catching falling knives, in the parlance. Having finally understood the appalling ramifications of the European debt crisis, investors were nice and short, or in cash, for the quick but steep October rally that brought the major indices almost back up to the point at which they had broken down back again in August. Shellshocked, with what seemed had seemed a decent year now in tatters, all they were able to do in November and December was curl up in a foetal position, to derisk, and hope the kicking stopped.

A time of derisking, by the way, is a terrible time for those who are not derisking to make money. It means PMs selling positions that they like, and buying the ones that they hate. If everyone is doing this it makes for the market of Bizzarro World, where down is up and up is down. Good stocks, at best, make no traction, while bad stocks are likely to squeeze. November and December were marked by this worst of enviroments, what Baruch calls “high amplitude chop”. This had the effect on putting the kibosh on the few players left who still had any profits, and who had thus been less inclined (the fools) to join the mass huddle.

By the end of 2011, then, the performance-led derisking must have been largely complete, and at least some investors, if not the majority of them, are probably looking at trying their luck in a new year, with slates wiped clean, and having another go at earning those management fees again. Indeed the last datapoint in 2011 from ISI, who tracks these things, had the gross at hedge funds (a measure of how much of their capital they have deployed in short and long positions) at the same level as June 2008 — ie very low, crisis levels. Not at all what you would expect at the end of a year in which the S&P was only flat.

Just off that then, it would seem that maybe we don’t have to worry too much, and we could have a return to something approaching a normal environment where active management works again. In fact it is necessary to be mostly optimistic in this business, as a general rule. But then again I suspect I am merely trying to reassure myself because while people may be underinvested, there is also a very high degree of nervousness out there. It won’t take much to bring us back to derisk mode again, and if 2012 is another chop-filled year like 2011 for active managers, well the only people who are going to be happy are the indexers. And they’re the enemy.

I would like to end the blogpost right there, and not talk about the things which are actively making me worried, such as $200bn in dodgy European sovereign paper to roll over, the apparent Chinese slowdown, nasty commodity trends and record high corporate margins etc etc, because thinking about these things makes me stressed out.

Happily, others have done that better than me**. So I sign off and wish my reader(s) a very happy and prosperous new year.

* knowing that whatever thesis you have in your head is likely to be wrong makes it much easier to discard it when it gets falsified, or when you think of something better. Knowing also that you are really quite thick makes it harder to worry about looking stupid (why live a lie?), and more money is lost trying not to look stupid than in any thing else you are likely to do in the stockmarket.

** Baruch is not sure whether The Interloper makes him want to retire from blogging or want to blog a lot more. Either way, it is grand he is around to be read. If he wants a hand on Euro Telcos he can drop me a line.

Pic via Jr. Deputy Accountant.