Here is a quick update of all our virtual portfolios performance over the last week. No detailed explanation this week as I outlined the strategies last week. As before, I will indicate the P&L at the end of last week and the list of trades and P&L at the end of this week.

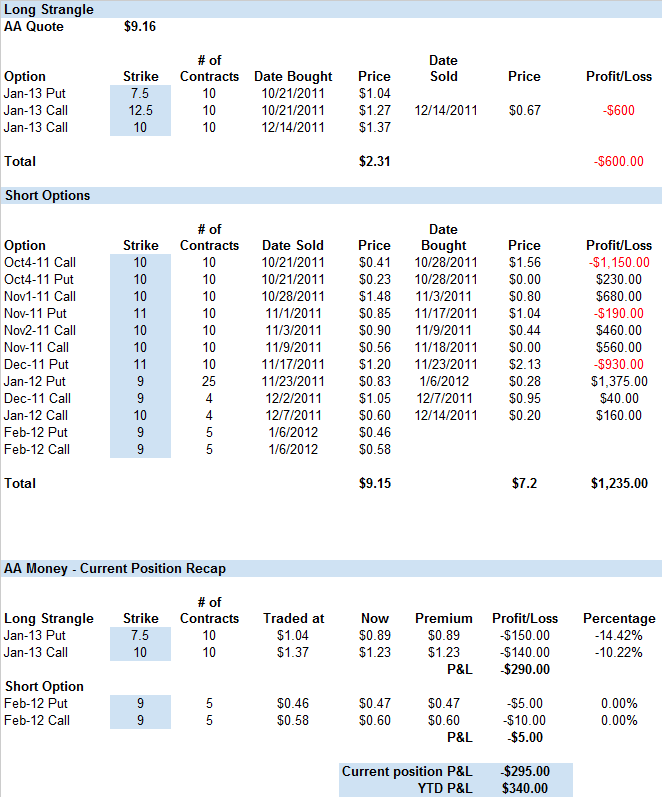

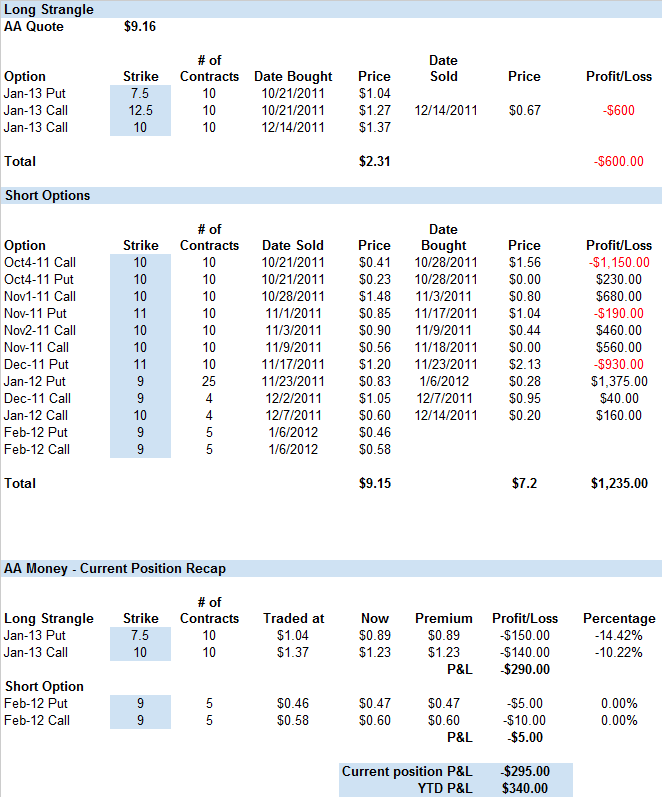

AA Money

Big turnaround for AA Money as AA crossed over $9.00 during the week which boosted the profit of our short 9 puts. We cashed them for a 66% profit on Friday and sold a set of February puts and calls (9 strikes) in advance of AA's earnings slated to be released on Monday.

Recap of 1/2/2012 – YTD P&L –

($375.00)

Overall, a $715 turnaround....

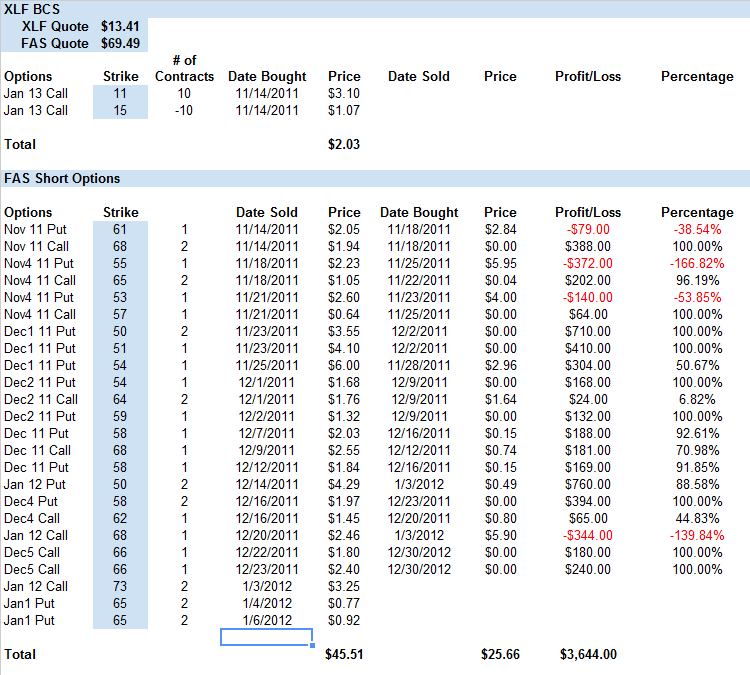

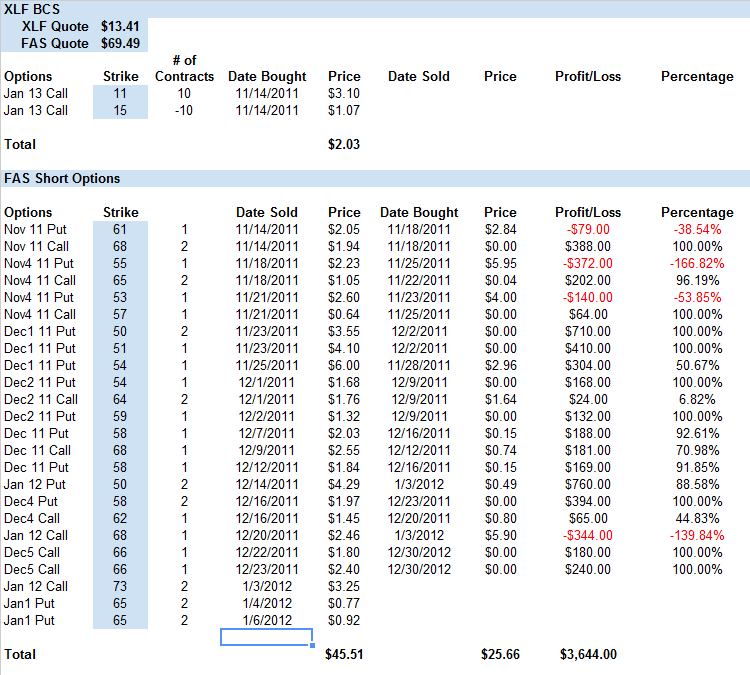

FAS Money

A decent week for FAS Money - we bought back the FAS Jan 50 puts for an 88% profit during the run-up but had to roll the Jan 68 calls to the Jan 73 calls as FAS ran past 70. We also sold 2 sets of FAS 65 puts, one of which expired worthless on Friday. The XLF BCS is also in the money now.

Recap of 1/2/2012 – YTD P&L – $3852.00

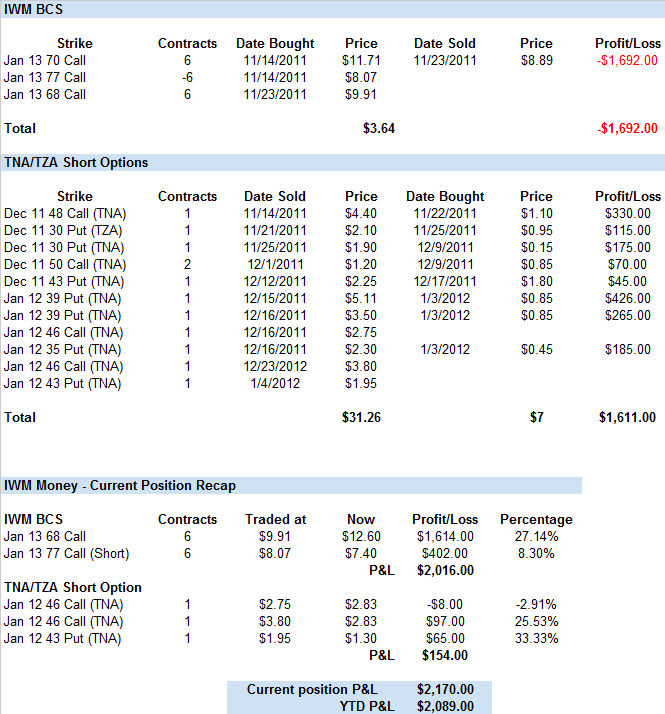

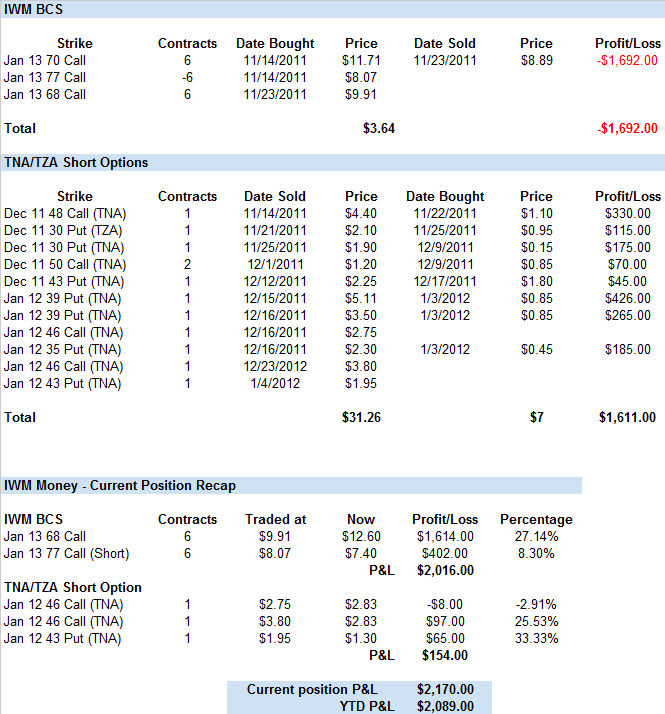

IWM Money

Very good week for IWM Money where we were positioned almost perfectly at the beginning of the week. We bought back all the sold puts on Tuesday for large wins (at least 75%). And we sold another put on Wednesday. The BCS is now well in the money. We will have to monitor the TNA calls as they are now ITM.

Recap of 1/2/2012 – YTD P&L – $1683.00

A 24% improvement in the P&L!

FAS Strangle Experiment

Another decent week given the fact that we traded only 3 days as I didn't like any setup on Thursday. We tried another tight strangle on Friday and got scared in the middle of the afternoon when FAS run up over $1.00, but were able to squeeze by at the end.

Overall, a $715 turnaround....

Overall, a $715 turnaround....

A 24% improvement in the P&L!

A 24% improvement in the P&L!