Courtesy of The Automatic Earth

"New York City, Broad Street exchange and curb brokers"

Ilargi: In a nice coincidence, while Nicole Foss (Stoneleigh) wrote about decentralization a few days ago in The Storm Surge of Decentralization, today Ashvin Pandurangi, independently from Nicole, also focuses on that theme, albeit from a completely different angle.

Perhaps even from the 180 degree opposite angle: it's precisely because the 1% push so hard for centralization that it's crucial for the 99% to push back and decentralize. And it's precisely because our economic models exist only by the grace of growth unchecked that we need to get out and take a step back, or that growth will surely eat us alive.

It's exactly like Arthur Miller's Willy Loman, as quoted by Ashvin, says: "After all the highways, and the trains, and the appointments, and the years, you end up worth more dead than alive".

That's what societies founded on perpetual growth and its inevitable companion, centralization, end up doing to 99% of their citizens: they degrade and pervert their dignity, their lives, and their value. In that sense, decentralization marks the beginning of a return to our true human potential, since it restores the values and dignity that make our lives worth living.

Unfortunately, today most of the 99% will not recognize this, and if they did it would scare them senseless, so they help push the growth paradigm forward even as it's gnawing at their bones. Life as a cog in a machine is the only life they've ever known. What else could there be? When you're told a hundred times a day that you live in the land of the free, what's not to believe?

It's high time we begin to understand to what extent the interests of the politicians and bankers and CEOs that we allow to make our decisions for us (read: against us), differ from our own. But since our education systems and media have denied the very existence of any such difference all of our lives, this understanding will be very hard to come by for 99% of the 99%.

"After all the highways, and the trains, and the appointments, and the years, you end up worth more dead than alive."

-Arthur Miller, Death of a Salesman

Ashvin Pandurangi: The word of the last few centuries is centralize. That's what "institutions" do, whether they are technically financial, political, educational, "corrective", religious or medical; private or public. Those labels are largely irrelevant when you want to understand the fundamental nature of an institution. They are simply structured hierarchies of distributed power that strive to grow larger and more influential with each passing day.

Perhaps they are trying to influence the outcome of an election, the direction of foreign policy, the prices of a market, the focus of scientific research or the psychology of society's youth, but, rest assured, they are trying very hard to influence something. Some institutions are much more influential than others, and typically these are the most self-serving.

These institutions are also inherently self-limiting structures; fractal constructs that are self-similar and limiting at every scale, right up to that of our global economy and civilization. They never freely compete with each other to reach some generally productive equilibrium, but rather coerce their respective sectors to become more and more dependent on their functions over time.

By exercising more power and influence in a given field, they crowd out both their own opportunities for further expansion and the opportunity of other institutions to enter the sector and grow. The world's "too big to fail" financial institutions have clearly demonstrated how a few giant players can grow so large to threaten the collapse of the entire global economy when they can no longer grow.

The current crises of capitalism also demonstrate a rapidly progressing, yet age old trend which reveals the strategy of almost all of society's "industries" and their respective institutions – boundless aggregation. One of the major pieces of propaganda in today's financial world is that increasing mergers & acquisitions ("M&A") activity is a sign of growth and health in the economy.

It is, in reality, a sign of desperation and a harbinger of decreased resilience (a.k.a. "impending doom"), and that becomes quite clear when we consider the type of M&A activity that has been occurring over the last few years. Relatively large companies are suddenly finding themselves in a position of pure desperation, where they must either combine with other companies through some legal process or die.

I recently met a guy who was finishing his second year in Wharton Business School at the University of Pennsylvania, and had an internship position with an unnamed investment banking firm. He told me that his responsibilities at the firm were related to conducting "fairness opinions" for corporate clients that were involved in merger deals and wanted to insulate themselves from shareholder liability (if the banker says it’s a fair deal, then it must be).

He also told me that M&A activity had unsurprisingly slowed down immensely since the onset of the "recession", in terms of total valuation of deals, but that it was markedly off its lows in 2009 and there were still many companies pursuing deals because they simply have no other options to remain viable. Many of these deals are increasingly conducted at the international scale, since domestic markets have already been picked clean to the bone.

These are mid-sized companies in manufacturing, IT, telecommunications, retail or services with a depressed consumer base, relatively high debt to equity ratios and very little ability to access the credit markets and obtain affordable financing; the institutions that have struggled for years to become "successful" business operations, but are now nothing more than basement bargains for much larger institutions.

They are the last remaining dust particles of competition within those industries, waiting to be vacuumed up as soon as the slightest window of opportunity presents itself. These opportunities are pervasive in the current volatile environment, where share prices of public companies are frequently pummeled down in tandem and the markets remain in an indefinite state of uncertainty due to opaque asset valuations and government policy.

As a targeted company's share price continuously comes under pressure, it becomes more vulnerable to "hostile takeovers", since it is cheaper and the larger acquiring company holds significantly more leverage, literally and figuratively, with the company's shareholders (which typically include its executives and directors). The latter must hastily decide whether to remain independent and hope for a miraculous recovery, or give in to a proposed merger.

As soon as the deal is announced and before it is even finalized, share prices could stabilize and increase on expectations of "synergies" from centralization (a.k.a. "a temporary bailout"), but only after the small-time, passive investors have already jumped ship. Indeed, it is no coincidence that U.S. M&A activity picked up in 2009-10, right in time for the Fed's QE asset purchases and the stock market rally. Companies who have remained off of public exchanges are by no means immune to this scourge of centralization, either.

That fact has become especially true in recent years, when "private equity groups" re-surged as a popular and relatively discreet vehicle for institutional investors (such as pension funds) and extremely wealthy individuals to conduct leveraged buyouts of various companies around the world. Ironically, the private "equity" group typically uses substantially less than 50% of investor equity in the buyout, and finances most of the deal through debt.

Dan Primack for CNNMoney reported on M&A trends in early 2011.

Report: 2011 M&A gaining on 2007 record-breaker

"The 2011 total represents a 58% increase over the same period in 2008, inclusive of a 52% increase in private equity-sponsored transactions. About half of the deal volume is for U.S. targets (up 36%) and around one-quarter is for European targets (up more than 100%), while both emerging market and cross-border deals experienced declines.

Energy and financials were the leading sectors, although materials experienced the largest year-over-year growth (see chart). Financials were sparked by the $59 billion restructuring for AIG — a deal whose inclusion here is questionable — while energy got a boost from Duke Energy agreeing to buy Progress Energy for $26 billion. Those are the first and third-largest so far in 2011, sandwiched around AT&T buying T-Mobile for $39 billion.

Graph: Fortune; Source: Thomson Reuters

On the private equity side, the largest deal is Blackstone Group's (BX) agreement to acquire the U.S. shopping mall assets of Australia's CentroProperties for $9.4 billion. It's followed by Apax Partners buying Smiths Medical for nearly $3.9 billion and Clayton Dubilier & Rice taking Emergency Medical Services private for $2.9 billion.

In a separate report, S&P Leveraged Commentary & Data reports that leverage multiples for large deals have climbed half a turn to 5.2x — lower than the heights of 2007, but besting 2008, 2009 or 2010.

Since private equity funds are illiquid investment vehicles that require long-term commitments, much of the capital invested during the boom of the mid-2000s is still in the process of being deployed, despite the horrendous macro-economic situation. Small to mid-sized companies can neither run nor hide from the slithering tentacles of leveraged capital seeking returns, which have only increased in length since 2010.

It should be pointed out, though, that the massive $39 billion deal between AT&T and T-Mobile has recently fallen apart, costing the former $4 billion simply to walk away from the deal. Even the highly-conflicted Federal Communications Commission and Department of Justice couldn’t ignore how damaging this monopolistic merger activity would be to the telecommunications industry, and therefore they decided to block the deal. [1]. That’s the official story, anyway.

Now that we have reached the end of 2011 and the European sovereign debt crisis has reached a crescendo from which there is no turning back, M&A volumes are once again being pummeled down as they were in 2008. Once again, though, we are talking about total valuation of deals and not necessarily the number of mergers and acquisitions that will be taking place in 2012.

Helen Thomas and Anousha Sakoui of the Financial Times report on the opportunities for further centralization of corporate assets:

Collapse in M&A Amid Debt Turbulence

"Fourth-quarter M&A volumes fell 32 percent to $375.3 billion from the previous three months, led by a 41 per cent decline in Europe. The drop, combined with a pullback in equity issuance amid turbulent markets, contributed to an 8 per cent fall in investment banking fees to $72.6bn for 2011, against 2010.

In Europe, fees totalled only $2.57 billion across all products, the worst quarter since records began at data-provider Thomson Reuters in 2000. "Volumes in equity and debt capital markets and M&A in 2012 are likely to be challenged, but with a crisis comes opportunity," said Manuel Falco, co-head of European investment banking at Citigroup.

"There will be huge opportunities in the public sector to acquire state-owned assets, and companies will need to issue equity [for] defensive [purposes]. The crisis presents the best buying opportunity for acquiring a company in Europe."

Should we be surprised that the wholesale destruction of European economies is described as presenting the "best buying opportunities" in history? Perhaps we should call them the "best opportunities for institutional cannibalism in all of history". This centralization process does not only take the form of "voluntary" mergers, especially in present times, but more often results from bankruptcy filings that force companies to liquidate or restructure their assets.

There have been quite a few examples of this dynamic in the world of high-stakes international finance over recent years, and there are many more to come. While the number of actual US "bank failures" in 2011 reached a 3-year low of 90, perhaps due in part to the pickup in financial merger activity noted above, the number of "problem banks" listed by the FDIC has remained pretty much constant over this same time period.

The largest, most recent victim of the global debt crisis was MF Global, a large broker-dealer, which was bankrupted and is in the process of being liquidated. Many of MF Global’s European sovereign debt assets were already sold off to investors such as George Soros and JP Morgan at huge discounts (5%) to fair market value. [2]. There are also claims that MF Global fraudulently filed Chapter 7 as a securities broker, rather than a commodities broker, to give major creditors access to the company’s cash before its clients.

So as the lower and upper "middle class" citizenry of the developed world are being rapidly digested in the acidic bowels of financial capitalism, the "big, yet not quite big enough" institutions are systematically having their "assets" aggregated on the books of a few supranational giants at not only cheap prices, but through illegal transfers and illegally discounted prices. As the weak wither and die, the strong draw lots to see who among them will be devoured first (JPM and Goldman always draw the biggest straw).

Whether it's Bear Stearns and Lehman handed over to Barclays and JP Morgan for a pittance, a large telecommunications provider targeted by AT&T, a few executive agencies rolled up into the Federal Reserve via Dodd-Frank or MF Global’s assets auctioned off at discounts to Soros and JPM, there is very little choice in the matter for either side of the deal. Either you submit to the "mercy" of centralization, or you are shoved out of the "market" and lose every speck of institutional value you had left.

Make no mistake, these are not rational economic actors acting in the best interests of their stakeholders and maximizing long-term institutional value, but desperate, irrational and short-sighted actors coerced into deals for a quick payoff. The low-level employees and mid-level managers of the acquired institutions usually find themselves joining a line in the local unemployment office or perhaps attending a "networking seminar", designed to create the illusion that they remain important to the system.

Meanwhile, there are millions of new, starry-eyed faces that have been spewed out of various "educational" institutions, wading tens of thousands deep in debt, who are now "willing" to work longer hours for much less salary and fewer benefits. Your degree, work experience and interpersonal skills mean next to nothing, because there is simply no more room for your specialized "credentials" in the institutional system.

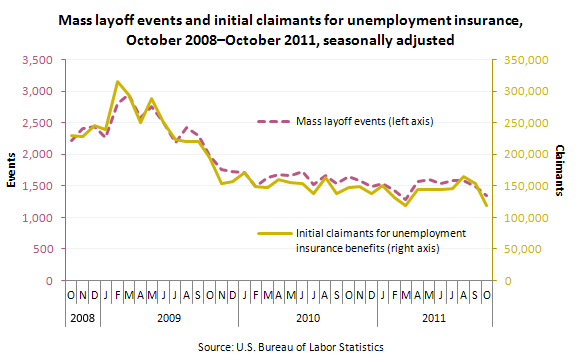

As the unsurprisingly misleading chart from the BLS shows below, "mass layoff events" (at least 50 initial claims for UI filed against an institution in a 5-week period) have hovered around 1500/month for the last two years. [3]. Initial unemployment claims are generally revised upwards after initial publication and still remain well above what is necessary to actually improve the unemployment situation. Expect these mass layoffs to only get worse in 2012.

As noted above, much of this shake-up is occurring in the financial industry right now, where large banks are shedding assets like skin cells to raise capital, and of course this process starts with the only asset that can’t afford to be shed, their low to mid-level employees. The graph constructed below only captures those banks which have announced mass layoffs over the next year or so, and both the number of banks and number of planned layoffs are sure to increase as the year progresses. It is also important to remember many of these banks already conducted mass layoffs in the shake-ups and restructurings of 2008-09.

The only thing that matters now is how much of an institutional slave you can force yourself to be, which means lower wages for more hours and no benefits; unless, of course, you can count yourself among the entrenched class of the top 1-5%. These corporate directors, high-level officers and government officials, who bled their respective institutions dry, will typically secure positions in an acquiring institution. That, or they will secure a similar position at another large institution somewhere in our global society, only a private jet ride and a gated complex away.

At the very least, they can retire with a healthy severance package and/or pension, start up a "non-profit" organization and invariably use it as a front for a corporate interest lobby. Most of the small and mid-sized clients/customers in these industries are also squeezed like the small-fry employees, because they are not benefiting from "economies of scale", but instead are paying for the privilege to access the centralized market. Nowhere is this fact more evident than in the financial industry, where individual and small business debtors are charged ever-more interest and have to put up ever-more collateral to obtain credit and/or rollover obligations.

While the effect of the institutional squeeze is to generally depress wages and asset/consumer prices, the effect of that depression is to eliminate choices and make everything much less affordable. Meanwhile, the unfortunate (and relatively large) clients of failing institutions such as MF Global have their funds outright stolen from them and transferred to large institutional creditors who were engaged in "repo" lending and derivative trades with the now bankrupt entity.

Welcome to the world of exponential centralization, where 99% of the population reeks of desperation and the other 1% personifies destruction in the form of "synergistic" acquisitions. The latter will inject a few more drops of lifeblood into the heart of ponzi-aggregation capitalism, but it too is rapidly losing its ability to create the illusion of economic stability and growth. That driving force of capitalism, capital, has become much too scarce for the centralization ponzi to continue outside of direct totalitarian force.

The largest institutions are clearly the least flexible to "new and unexpected" conditions that will arise, and therefore are the most acutely vulnerable to "black swans" and systemic shocks in the near-term. When, not if, some politician, bureaucrat or banker takes one wrong step on the tightropes stretching across every line of latitude from the North to South Pole, look out below. Despite what we are told, nothing material of man is immortal and we only get one chance to survive this world. Our global institutions already blew theirs many years ago, and most are now worth much more dead than alive.