Well here we go again.

Well here we go again.

Once again it's Tuesday and once again it's a primary and once again we are meant to believe everything is right in America as the Futures take the markets back to levels not seen since last August. As we discussed last week and as noted by David Fry this morning:

Throughout the week Fed governors will be making speeches: Dennis Lockhart (2 speeches), Charles Evans (2 speeches), Esther George, John Williams, Charles Plosser and Jeffrey Lacker. This is part of their transparency mission and/or a campaign to pump-up investor confidence. You choose.

Yesterday we made our breakfast money shorting the Dow off the 12,350 line and today we already had a double dip at the Dow off the 12,450 line but, on the whole, it would have been easier to drink the Kool-Aid and go long.

Unfortunately, I'm a Fundamental Investor and not a TA guy so, impressive as this run may seem, it doesn't match up with the data and, so far, it's neither matching up with Q4 earnings or Q1 outlooks. We HOPE the Fed will go for QE3 (Friday's Fed speak indicated that and more today) and we HOPE Europe is fixed and we HOPE China doesn't implode – is this a sound investing premise? Let's see how things have been going in the last Quarter:

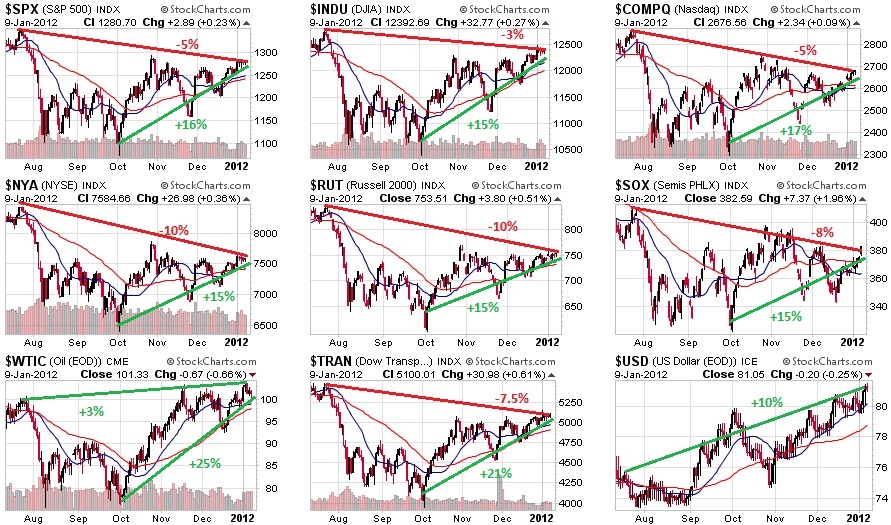

Up 15% in all of our indexes and led by the Transports, which are up 21% – even with oil up 25% over the same period which once again proves our theory that trucks and airplanes must poop oil when they run – which explains the non-inverse correlation between Transports and Fuel Costs that those of us who took Econ 101 may be familiar with.

The most interesting thing about the above chart set is the uniformity of the moves up in the majors but I think it's the NYSE and the Russell which PROVE beyond a shadow of a doubt, that this market is traded by robots. Look at those two charts – they are practically tick by tick matching – even to the point where the Russell is almost exactly 1/10th of the NYSE. Sure, you could assume some similarities in two broad indexes but this is 6 full months of daily moves that are in lockstep. That's just not natural on the order of maybe a Billion to one vs. two independently traded indexes.

The most interesting thing about the above chart set is the uniformity of the moves up in the majors but I think it's the NYSE and the Russell which PROVE beyond a shadow of a doubt, that this market is traded by robots. Look at those two charts – they are practically tick by tick matching – even to the point where the Russell is almost exactly 1/10th of the NYSE. Sure, you could assume some similarities in two broad indexes but this is 6 full months of daily moves that are in lockstep. That's just not natural on the order of maybe a Billion to one vs. two independently traded indexes.

So the theory is that the broad indexes are difficult to manipulate and so they have underperformed by about 5% over the past 6 months but they were both part of the BuyBot express that has jammed this market higher since early October and lulled investors back into a state of complacency that usually comes right before the rug is pulled out from under them.

First of all, let's keep in mind that we bottomed out on the 28th at 12,150 on the Dow and the next morning we gapped up to 12,200 in a futures move that Retail Investors were unable to follow. We went up to 12,300 on Thursday and closed back at 12,200 on the last day of 2011 and then the poor Retail Traders woke up last Tuesday with the Dow at 12,450 and we flopped to 12,300 again on Friday and yesterday we closed at 12,400 and today we should open around 12,500 (keep in mind Futures don't match the Dow, about 50 points lower). So, of the 350 points added to the Dow since December 28th, 400 of those points were added pre-market and all the Retail Traders got to do was buy into a 50-point loss.

First of all, let's keep in mind that we bottomed out on the 28th at 12,150 on the Dow and the next morning we gapped up to 12,200 in a futures move that Retail Investors were unable to follow. We went up to 12,300 on Thursday and closed back at 12,200 on the last day of 2011 and then the poor Retail Traders woke up last Tuesday with the Dow at 12,450 and we flopped to 12,300 again on Friday and yesterday we closed at 12,400 and today we should open around 12,500 (keep in mind Futures don't match the Dow, about 50 points lower). So, of the 350 points added to the Dow since December 28th, 400 of those points were added pre-market and all the Retail Traders got to do was buy into a 50-point loss.

This is, of course, a gold mine for the Banksters, who KNOW they are going to jack up the Futures so they just wait for a nice dip, buy from the Retailers (using the money we lend them for free through the Fed) and then they jack up the Futures and dump it on the suckers who chase the rally in the morning. It's nothing more than a 3-Card Monty game where EVERYONE is in on the scam except the mark – and that mark is the retail investor!

See, it's not just about having a card game you can't win – if that's all it was then eventually even Retail Traders would wise up – it's about creating the impression that you CAN win and getting you to commit your money and THEN making the loss seem like a fluke so that you are encouraged to go back to work, save up your money and gamble it again because "it could never happen twice," right? As the great George Bush used to say: "Fool me once, shame on you, fool me you can't get fooled again."

Speaking of getting fooled again, NFLX is back to $100 up about 60% since Thanksgiving and it's already tempting but I want to see if they can fill that gap to $120 from the last time they had earnings and fell from $120 to $75 overnight as reality is a very ugly experience for NFLX bulls. Earnings are on Jan 25th so we have a couple of weeks to see how this little run plays out but, with a market cap back over $5Bn on less than $250M in profits, NFLX is priced for healthy growth and they'd better deliver or they will de-lever VERY quickly.

1,297 was our +5% line on the S&P and we're not there yet, nor have we hit our 2,733 target on the Nasdaq and we're still miles below 774 on the Russell and 7,866 on the NYSE – all levels we discussed last Tuesday and even the Dow needs another 250 points to hit it's 10% line at 12,749 and it's a wide swing in the range between there and the +5% line at 12,170 so, essentially, meaningless moves in the Dow should not be the basis for bullish investing (see last Wednesday's post).

1,297 was our +5% line on the S&P and we're not there yet, nor have we hit our 2,733 target on the Nasdaq and we're still miles below 774 on the Russell and 7,866 on the NYSE – all levels we discussed last Tuesday and even the Dow needs another 250 points to hit it's 10% line at 12,749 and it's a wide swing in the range between there and the +5% line at 12,170 so, essentially, meaningless moves in the Dow should not be the basis for bullish investing (see last Wednesday's post).

AA certainly didn't report numbers that justify it being higher than last year (when it opened at $16) and we're long on them at $9 but that doesn't mean we feel the rest of the Dow components should be off to the races. We'll stay Cashy and Cautious while we wait for either the other indexes to get over their Big Chart lines or for the Dow earnings to come in and somehow justify a 10% move up from last year and a 20% move up from last quarter.

Just trying not to get fooled, AGAIN…