Take out the papers and the trash

Or you don't get no spendin' cash

The stock market's gonna soar

As easing puts the Dollar through the floor

Yakety yak (don't talk back)

Appropriately, Yakety Yack was sung by The Coasters and, as I said to Members on Tuesday: "All this nonsense is probably (just as I said last week) da Boyz taking the roller coaster up to the top before the big wheeee!"

I am trying to get bullish, truly I am but, as Samuel Jackson reminds us: "The path of the trader is beset on all sides by the inequities of the selfish and the tyranny of evil Banksters."

In the name of charity and good will (and profits), I will attempt to shepherd our trades through the valley of earnings darkness but it has been HARD this week as the market is acting as if it doesn't have a care in the World and I am trying SO HARD to go along with it but we are indeed beset by all sides by problems that are NOT going away and I still think that we are in a technical sucker's rally.

In the name of charity and good will (and profits), I will attempt to shepherd our trades through the valley of earnings darkness but it has been HARD this week as the market is acting as if it doesn't have a care in the World and I am trying SO HARD to go along with it but we are indeed beset by all sides by problems that are NOT going away and I still think that we are in a technical sucker's rally.

Unfortunately, I won't really be able to sing a different tune until I see earnings data that convinces me that we have a reason to move that Must Hold line up to the 10% line – a move we were tempted to make in October, when my skepticism into that rally saved us all from a nasty sell-off – as almost all of October's gains were given back in November.

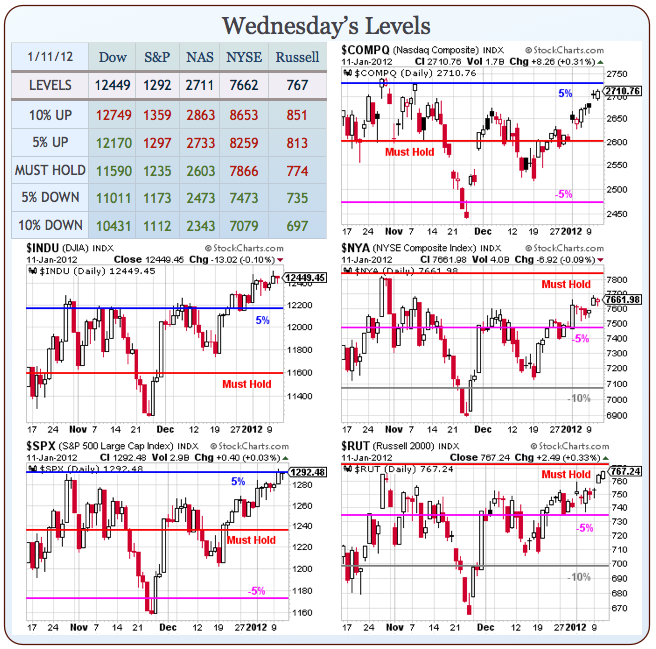

As you can see from the Big Chart, like an ORGANIZED ballet – all of our indexes are testing breakout levels this morning and, since the Dow is 10% ahead of the Russell and the NYSE – we certainly won't be missing much by waiting for the S&P to confirm 1,297, the Nasdaq to confirm 2,733 and the Russell to confirm 774 before we jump on the technical bandwagon. Even then, I'll want to see the NYSE confirm at 7,866 but that's not going to happen today – but the other 3 better.

Back in October, we were pushed to these highs on a $1.7Tn stimulus announcement through Europe's EFSF. That euphoria quickly faded as the details of the bailout were not as exciting as the headline announcement – much like we are currently rallying on expectations of additional stimulus from China, Japan, the US and Europe again – none of which has actually been announced yet.

I pointed out, at the time, that we were dangerously overbought just as I had pointed out on September 29th, that we were ridiculously oversold with the S&P at 1,150. At the time, my "One Trade" in that morning's post was XLF – buying 50 2013 $10/11 bull call spread at .45, ($2,250) and selling 20 2013 $9 puts for $1.10 ($2,200) for a net $50 entry.

XLF is now at $13.86 and the bull spread is now .80 ($4,000) and the short puts are .35 ($700) for net $3,300 – a 6,500% profit in just over 3 months. And that was just one of our free trades! Of course, I had "guaranteed" XLF would be at $13 next week a year ago in our "Secret Santa Inflation Hedges for 2011" and that trade (Jan $12/13 bull call spread at .80, selling $11 puts for .40 for net .40, now net .96 – up 140%) so we were just going back to the well on a dip with a more aggressive play in September.

Anyway, the point is – I DO know how to be bullish and we WILL be able to make fabulous amounts of money if we have a genuine bull rally and we are NOT going to miss anything by simply waiting to see if the data matches up with the enthusiasm. I simply am not seeing it yet.

Anyway, the point is – I DO know how to be bullish and we WILL be able to make fabulous amounts of money if we have a genuine bull rally and we are NOT going to miss anything by simply waiting to see if the data matches up with the enthusiasm. I simply am not seeing it yet.

Certainly the Fed and the people they speak to in compiling the Beige Book were enthusiastic yesterday (see my detailed commentary in yesterday's Member Chat). It was, by far, the most bullish report we've seen since the great crash of 2008 but the BBook is, unfortunately, a SENTIMENT indicator and sentiment can only get you so far – about to the lines we're testing right now, in fact…

8:30 Update: And wheeeeeeeeeeeeeeeee! Down we go. Oddly enough, the 5 minute chart in the futures looks EXACTLY like the picture of the roller coaster above now as we dropped like a rock on the release of Jobless Claims (399,000) and December Retail Sales (+ZERO point 1% vs 0.4% expected by economorons, who obviously did not read our PSW 2011 Holiday Shopping Survey).

Even ex-Auto, we were on up 0.2% vs 0.4% expected by the idiots who are paid to expect these things. We began our own survey in Mid December and, by December 18th, my take on the information gathered by our Members (many of whom are World-Class executives from many industries) led me to conclude at the time:

My conclusion so far – people are just cutting back on gifts this year – leaving them more money to go out. We’ll see what happens but I think that some of that 50% of the business they are counting on this week doesn’t show up.

On December 26th, I added:

New York City also still has many, many vacancies. On the one hand, it’s a fantastic time to start a business (see Build a Berkshire Workshop) but, on the other hand, I think we need to start looking at some of these CRE statistics and see if we’re still in a downtrend.

Keep in mind a lot of retailers will "hang on" through Christmas but its possible that some of the remaining stores haven’t paid their rent for 3 months and there will be many more "space for rent" signs in the spring.

Already we've gotten the bad news from Sears and other retailers that are cutting significant amount of stores and the 50% miss in ex-auto retail sales is right in-line with our observations so no surprises there. What has been surprising is the way the markets few up in anticipation of this data. Meanwhile, in the first week of earnings season, we are just waiting for my beloved JPM to report tomorrow. So far this week we have beats from AYI, MG, SCHN, LEDS, WFSL, EXFO, INFY and SJR (8) and misses from AA, OCZ, SMSC, WDFC, LEN, SVU and DRWI (7) so "even" you might thing but nooooooooooooo – the market is not priced for even, the market is priced for 66% beats.

Clearly, 15 reports is nothing to base a conclusion on but it does indicate the very same "experts" who are predicting how the indexes will perform over the next 12 months, can't even predict what the individual components will do over the next week. Of course it always cracks me up when people like LYG or RBS or C put out reports telling you what investments are good or bad when they themselves lost Billions making bad investments – why do we give these people the floor?

Keep in mind (see image above) that poor retail sales and lack of employment mean there's a lower demand for Dollars and that will now weaken the Dollar and BOOST commodities and perhaps even the indexes today and then Idiot Cramer will go on TV and tell you how the markets are "shaking off" the bad data and will then conclude that the market is "UNSTOPPABLE" and will tell you to "BUYBUYBUY" all those stocks that were 20% cheaper at Thankgsiving.

This is very likely the time to be fearful when others are greedy – if nothing else – it certainly merits us staying in cash and giving ourselves another week to make sure there's a real trend here.