Here is the latest weekend update of our virtual portfolios. As before, I will list some of the trades we made, recap last week's P&L and post the listing of the current positions:

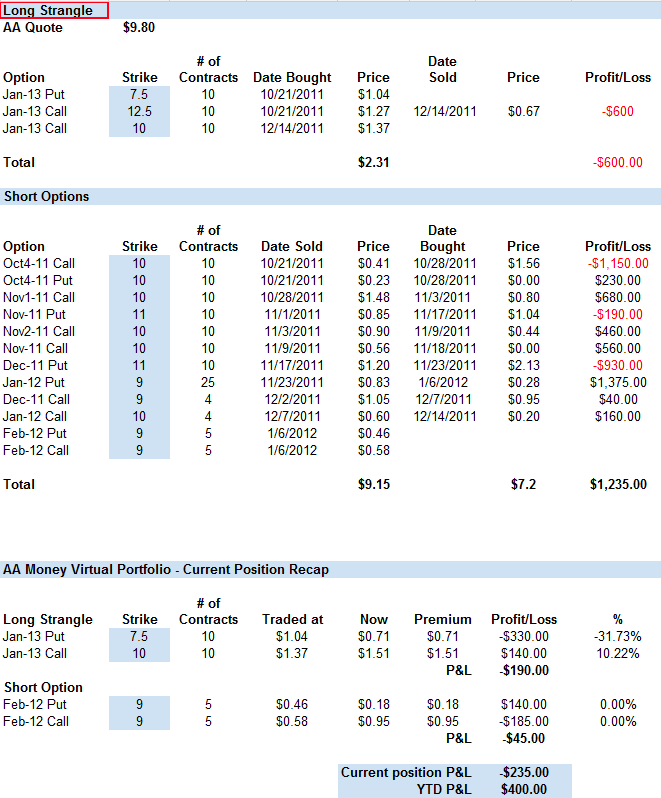

AA Money

No trade to report this week. We are just waiting for decay to do its work on the February puts and calls sold last week. The position improved slightly over the week.

Last week's P&L - $340

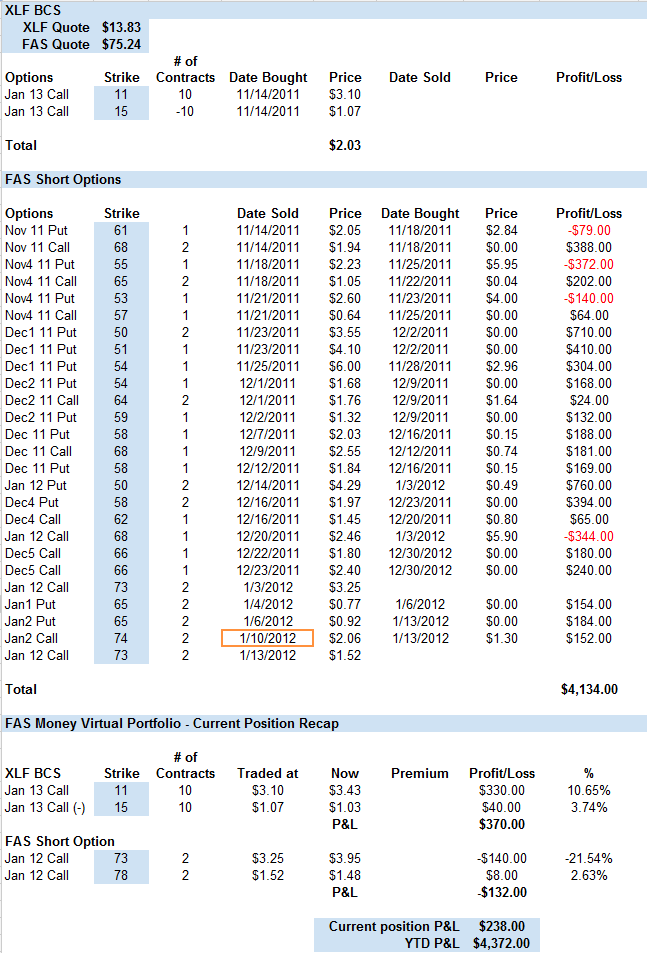

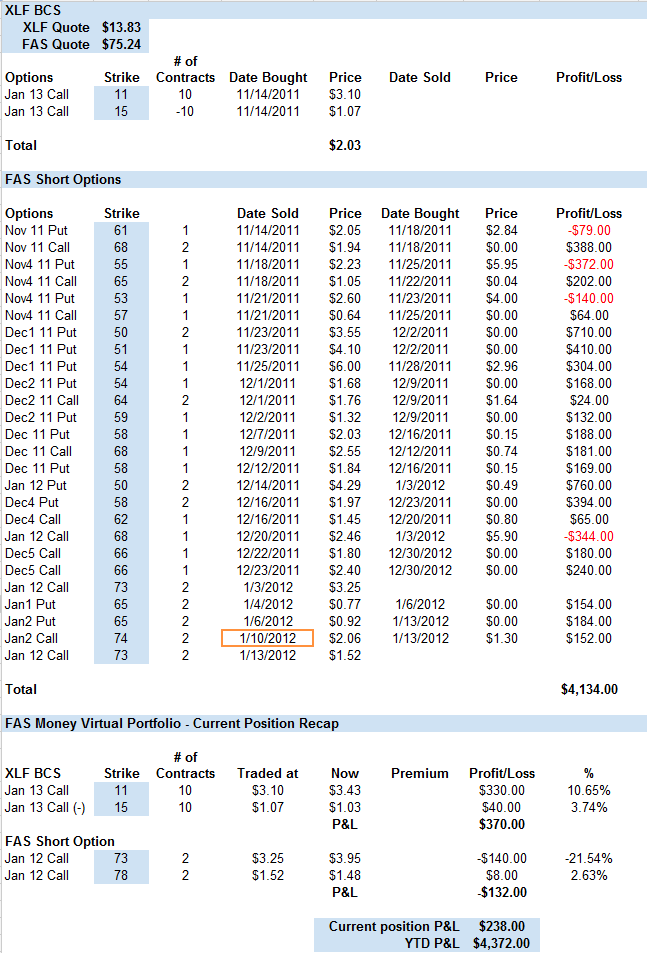

FAS Money

Only 3 trades to report this week. We sold 2 weekly FAS 74 calls on Tuesday and rolled them to the Jan 78 calls on Friday. We did show a profit on these calls, but honestly missed a better opportunity early afternoon when they were even

more profitable! Also, the weekly 65 puts sold the week before expired worthless. But overall, a very good week for the portfolio - up 6.7%

Last week P&L - 4098.00

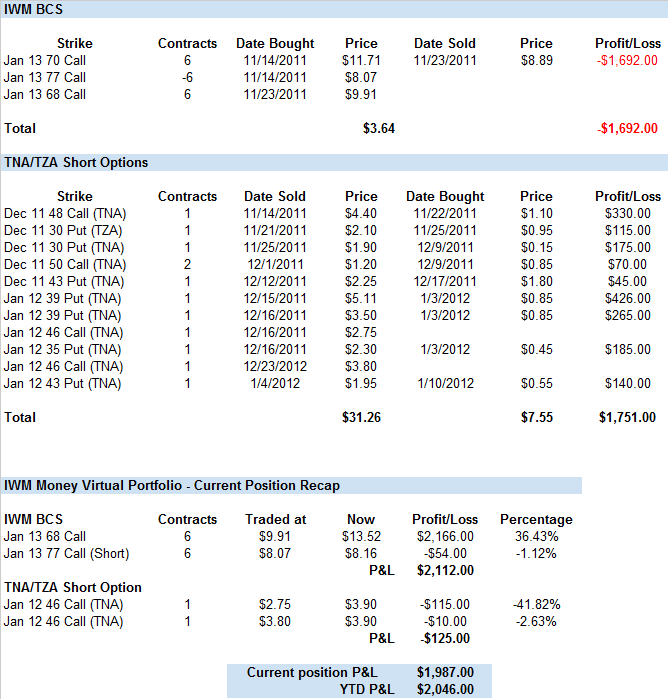

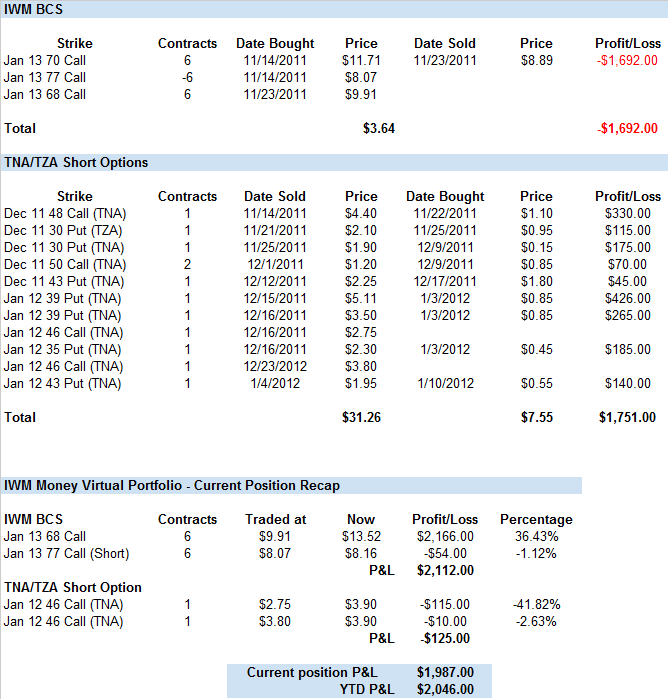

IWM Money

Also a quiet week in this portfolio - only one trade. We bought back the TNA Jan 43 put on Tuesday for a 70% profit. We are still holding some TNA Jan 46 calls and these are hurting us now (we lost some ground this week on the P&L)- but still a week to go.

Last week P&L - 2089.00

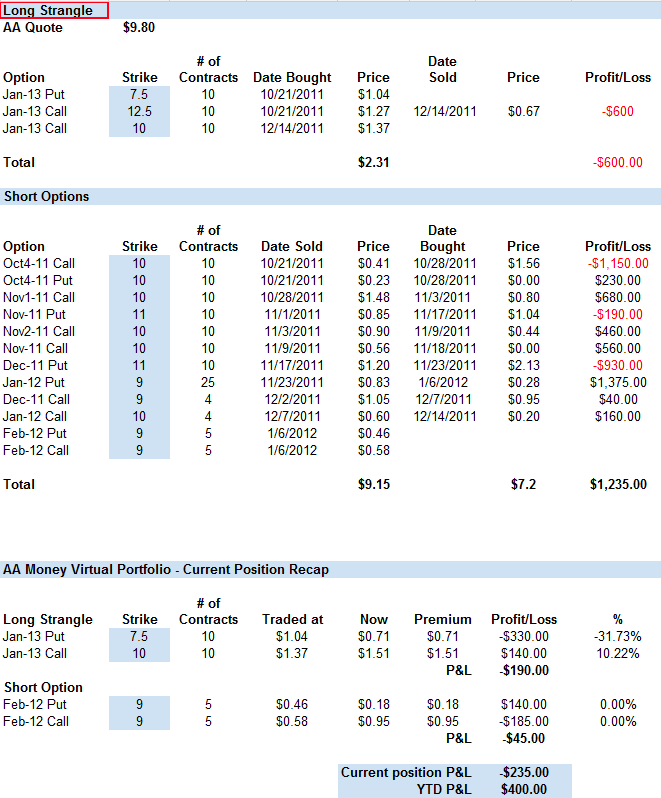

FAS Strangle Experiment

We only sold 4 set of options last week and covered them all by Friday but still had a decent week. We got lucky on Friday as the correction saved the 76 calls we had sold earlier that week. I regret not taking advantage of the up move on Friday to sell some put, but overall a decent week - up over 10% for the week. The low VIX is really making a difference in the amount of premium we sell. In addition, the short weeks have also hampered our premium sales!