One trade to rule them all!

One trade to rule them all!

That was our goal and our one precious trade for 2012 was BAC on January 5th, buying the stock at $5.75 and selling the 2013 $5 puts and calls for $2.55 for a net $3.20/4.10 entry (see "How to Buy a Stock for a 15-20% Discount" for more on this strategy). On Tuesday afternoon, I modified the entry live on TV at about 3:45, with BAC at $6.70 and you can see the immediate reaction the stock had on my pick into the close.

BAC was $6.49 on Tuesday afternoon at the start of my interview but the 2013 $5 puts and calls were $3.10 so the net was only $3.39/4.20 – not a huge change. BAC came through on earnings this morning and is up at $7.20 pre-market and we're well on our way to our 56% profit target, now with a 30% cushion.

It's no wonder that the TV crowd jumps on my picks as my last two appearances gave them a GNW spread on 10/24 for a 127% gain and an AXP spread from 10/5 for a 140% gain. BAC was, by comparison, a fairly conservative play and that's because, as you know if you've been reading this week – I'm not entirely convinced that this rally is sustainable – but I'm feeling much better about it now that we have BAC earnings out of the way!

This is a great time to thank my friendbuddypal Jim Cramer for chasing all his sheeple out of BAC this year with his SELLSELLSELL rating – without you and your half-assed opinions Jim, we'd have to work for a living! Why just yesterday, my trade idea for Members in the morning Alert was the FAS Feb $67/70 bull call spread at $2, selling the Feb $55 puts for $1.30 for net .70 on the $3 spread but last night – Jim didn't like my bullish Financials pick:

Financials were, in fact, one of my "Secret Santa's Inflation Hedges for 2011" that were published on Christmas Day, 2010 (and you can read that post for the logic behind each trade). All 4 of those trades are done tomorrow so let's see how they performed for the year:

- 30 XHB Jan $15/18 bull call spreads at $1.40 ($4,200), selling 20 XHB Jan $14 puts for $1.70 ($3,400) for net $800.

XHB Finished the day yesterday at $19.12 so we collect $3 on the bull call spread ($9,000) and the short puts expire worthless for a $4,800 gain (600%).

- 2 XLE Jan $55/60 bull call spreads at $2.60 ($520), selling 1 Jan $50 put for $4 ($400) for net $120.

This was a trade just to pay for gas and the 2012 spread finished at $1,000 and the puts are expiring worthless with XLE at $71.08 yesterday so a profit of $880 is up 733% for the year – paying for a few tanks of gas, as intended.

- 6 DBA Jan $26/29 bull call spreads at $1.90 ($1,140), selling 4 DBA Jan $25 puts for $1.90 ($760) for net $380

The Jan 2012 spread finished way in the money for $1,800 and DBA closed yesterday at $28.63 so the short puts should expire worthless and that's a net profit of $1,420 or 373%. The goal was to knock $100 a month off the cost of groceries.

- 40 XLF Jan $12/13 bull call spread at .80 ($3,200), selling 40 Jan $11 puts for .40 ($1,600) for net $1,600.

XLF finished the day at $13.92 so we collect $4,000 on the bull call spread and owe nothing on the short puts for a $2,400 gain (150%)

Wasn't that fun! Just like BAC, I love to have just a few simple trades for lazy people (or people who have real lives) that don't want to sit around trading all day trying to "beat the market." The trick is to be realistic. If you have $100,000 to invest and you hope to make 10% for the year – then you only need to put $1,500 into a trade that has the potential to make 733%, right?

Wasn't that fun! Just like BAC, I love to have just a few simple trades for lazy people (or people who have real lives) that don't want to sit around trading all day trying to "beat the market." The trick is to be realistic. If you have $100,000 to invest and you hope to make 10% for the year – then you only need to put $1,500 into a trade that has the potential to make 733%, right?

In this case, $2,900 of cash put into these inflation hedges returns $9,500 – a very respectable blended 227% gain and, of course, as inflation hedges against things you are forced to buy every day – if they "lose" then you spend less at the pump and at the grocery store so it's a true hedge, meant to guarantee your buying power at the cost (potentially) of some of the savings you would have gotten if we were wrong and hit a deflationary cycle. As it was, 227% has kept us well ahead of actual inflation – so far!

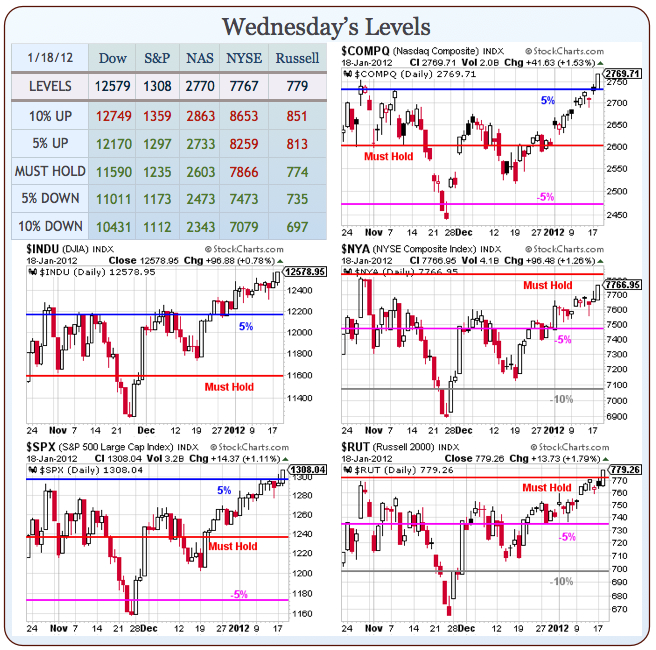

We've been holding off on getting bullish in 2012 until we A) See some earnings and B) See the NYSE over our 7,866 target. Earnings have not been that hot and the NYSE has exactly 100 points to go after yesterday's close as it sits at a very unusual 10% below the Dow's on our 5% Rule Big Chart.

We've been holding off on getting bullish in 2012 until we A) See some earnings and B) See the NYSE over our 7,866 target. Earnings have not been that hot and the NYSE has exactly 100 points to go after yesterday's close as it sits at a very unusual 10% below the Dow's on our 5% Rule Big Chart.

The Dow has it's own big level to hit at 12,749 and it's not likely to happen today but let's now prepare to get bullish next week. I'll be laying out a new round of Inflation Hedges for 2012 and we'll certainly have more upside picks like yesterday's FAS trade idea but first we need our indexes to SHOW US THE LEVELS!

Corporate earnings are simply not that impressive so far, we still have a concern about Europe that doesn't seem too irrational and who knows what's going on in China but it doesn't sound all that good. We're not seeing data that reassures us the US itself isn't in the throes of a recession (but we are definitely in denial of one) and it's gotta be a concern that the ECB handed out €489Bn to EU banks and they simply turned around and deposited €502B in the ECB's overnight facility (a record). You're not creating economic liquidity when all the banks do is park the money and collect interest!

Putting on my happy hat though, we are seeing a flow of capital out of bonds and into equities. Perhaps the ridiculously low rates paid for bond risk – even as Greece prepares to give their bondholders 70% haircuts with other countries in just as bad shape – is forcing people to move to dividend-paying stocks as well as riskier equities in search of the kind of returns that can keep them up with inflation.

Putting on my happy hat though, we are seeing a flow of capital out of bonds and into equities. Perhaps the ridiculously low rates paid for bond risk – even as Greece prepares to give their bondholders 70% haircuts with other countries in just as bad shape – is forcing people to move to dividend-paying stocks as well as riskier equities in search of the kind of returns that can keep them up with inflation.

We've been partial to cash and cash has been very good to us as the Dollar has marched from 74 in October to 82 last week – giving us 10% more buying power from our sidelined money but if the Euro is "fixed" and getting stronger – we need to get off the sidelines and into things that generate good returns – like our One BAC trade or yesterday's more aggressive FAS spread.

Last Wednesday, I reviewed or trades from the first 5 sessions of 2012 and we were surprisingly bullish but that was because there were lots of good bullish opportunities and, above all, we try to stay balanced – no matter how bullish or bearish we feel.

Recently, we've seen better ISM numbers in the US (53.9) and Consumer Confidence jumped to 74 while Chinese GDP is rolling along at an 8.9% growth rate. China's Industrial Production rose 12.8% in 2011 and, although they seemed to slow down in Q4 (waiting for better data), we are not yet making a good case for a "hard landing" over there. Just this morning, in fact, the PBOC put their foot back on the gas and will allow the Nation's 5 largest banks to increase Q1 lending by 5% over last year (when their lending seemed out of control).

This is the kind of NEW INFORMATION that forces us to rethink our bearish premise. We already know the ECB is pouring $1.5Tn into the Banks through the EFSF and the Fed has put in Trillions of Dollars through the back door into US banks and the BOJ and the SNB are both printing like crazy trying to devalue their own currencies at least fast enough to keep up with the money printing in the US and EU so, at a certain point – we can't afford to be bearish or we may drown at the bottom of Trillions of freshly printed Yen, Euros, Francs and Dollars – money, Money, MONEY!

Over in the Eurozone, those bond auctions are certainly going swell so far, just weeks after $700Bn was dumped into the market and 3% on French paper certainly beats 0.25% in the overnight vaults of the ECB and it's "so far – so good" except we're only taking the first of 1,000 steps towards a true recovery. Oh sorry, I'm supposed to be thinking only happy thoughts…

We got our EU downgrades and they were taken in stride and Germany's ZEW Investor Survey dramatically improved and they are the guys with all the money in the EU so we have to pay heed to their opinion on the subject. So our risk factors are certainly "improving" and certainly better looking than they seemed before the ECB pledged another Trillion Euros and, from the EU's perspective, before Obama had another $1.2Tn of his own spending money "approved" (ie. not blocked) yesterday.

So it's MONEYMONEYMONEY keeping the markets from going down in 2012 – so far and, if they can keep it up next week – we'll have to start taking it seriously. For the rest of this week, however, we'll continue to just sit back and enjoy the show!