Will the Fed Bring Clarity or Confusion?

Courtesy of Bruce Krasting

Next Wednesday, between 12:30 and 2PM, we will get a ton of new information to digest and analyze. The Federal Reserve will make a series of statements while unveiling its new communication effort. A portion of the new information will be contained in the revised Summary of Economic Projections (SEP).

The Fed has worked long and hard on its new communication policy. The question is, “What will people think and how will the markets react?” I believe that there is a very good possibility that the Fed's plan will add to uncertainties regarding monetary policy. Contrary to its objectives, the new "openness and clarity" may end up causing the confusion.

The Fed will provide information regarding member's thinking on the future size of the Fed’s balance sheet (BS). This is critical. We might see a consensus view that the Fed’s balance sheet will grow another 25% over the next 18 months. That would bring this headline:

Fed Signals Another $1T Of QE

Stocks rise sharply. Oil, copper, gold see largest one-day rise in two years

TIPs spreads widen to 2.5%

We could just as easily get a consensus opinion that the Fed’s BS will remain unchanged for the foreseeable future. That would also be a shocker:

Fed Forecasts End of QE

Global stocks in broad retreat.

Next move is to tighten?

The Fed will provide information regarding its thinking on GDP, inflation and the timing of an increase in the Federal Funds rate (new info). This is all potentially explosive data. The Fed's most recent read (November) on the economy painted a somewhat upbeat picture. Almost all of the data since then has been on the positive side. While I doubt the Fed will signal that happy days are here again, it would appear likely that a +2.0% growth forecast for GDP is in the cards. How is the Fed going to square this (relatively) upbeat economic assessment with a loose monetary policy that is currently at biblical historic levels? The answer is, "It can’t".

Fed Predicts Improvement. To Keep Monetary “Pedal on the Metal”

Global Central Bankers Critical, OECD head says, “Reckless”

Dollar in rout, Gold rises $65

For the Fed to continue ZIRPing, Twisting and QEing, it has to support the policy with a bleak assessment on the economy. A negative outlook is the only scenario that justifies maintaining, let alone expanding, the existing "emergency" monetary measures.

I think the Fed will hint that monetary contraction is in our future (about a year away, if not sooner). To me, the only circumstance that would avoid this conclusion is if the Fed were to come out with some decidedly disappointing expectations for growth and unemployment for the next 36 months. This too would make for headlines:

Fed Downgrades Expectations

Three More Years of Sub-par Growth

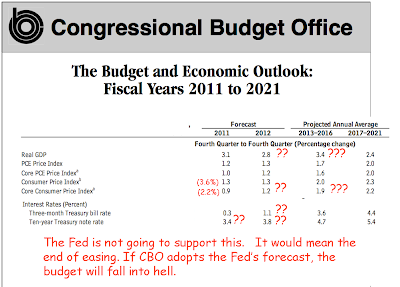

A downbeat assessment would influence the Congressional Budget Office (CBO). On January 30, the CBO will release its ten-year economic outlook. This is what they said a year ago:

The CBO forecasts for 2011 were off the mark. I think they will have to significantly downgrade their expectations for 2012 and 2013. The CBO numbers are the basis upon which long-term estimates for future deficits and the financial status of Social Security (and other big entitlement programs) are made. The Office of Management and Budget (OMB) uses these numbers to craft legislation for the White House.

I find it interesting that the forecast that would best serve Ben Bernanke’s desire to maintain and expand monetary policy is exactly the opposite forecast that the CBO “wants” to use in evaluating America’s macro economic outlook.

On Friday, Morgan Stanley’s David Greenlaw commented on prospects for the Fed’s announcements this week:

In sum, there seems to be some risk of significant market confusion next week.

At the end of the day, we’re concerned that market confusion next week could lead to an unintended tightening of financial conditions.

Mr. Greenlaw is assuming that the Fed will produce an economic forecast that will force a conclusion that further easing is off the table. We may get that. The alternative is that the Fed downgrades its collective assessment for growth, inflation and interest rates. Should it do that, the folks at the CBO will have to either scramble to adjust their own expectations, or face severe criticism for presenting a rosy view of the future while the Fed is singing a different tune.

What will we get next week? Will it be clarity?

Or confusion?

Either way, I can’t wait.

Note: This is a Banksy. What original oil painting is this from?