I'm just putting together a quick review.

I'm just putting together a quick review.

We did one after the first 10 days of the year, when I was worried I was being too bearish but it turned out I wasn't too bearish at all in picks, but certainly in tone as I had (and still have) grave concerns about the sustainability of this "recovery" (as does David Fry, obviously). In that post, I emphasized the need for BALANCE – no matter how bullish or bearish you are and, from what I hear in chat – not everyone gets that message so we'll try it again and see if we can make a little progress with the education thing.

Keep in mind that, no matter how bullish or bearish we are, 70/30 is an extreme mix in a portfolio, 60/40 is preferable but the closer we get to the top of our range, the more we tend to bet the other way. When and if the range does break, we will, of course, be caught on the wrong side but even if you lose 20% of 70 (14) and make 20% of 30 (6) it should not be a devastating event.

We regularly put out trade ideas on both sides and it's important to get a sense of if you are too bullish or too bearish – at which point you can make an adjustment by adding to (or subtracting from) one side or anohter. These were the trade ideas since Wednesday's review:

Wednesday (in order of posting):

- Shorting oil Futures at $102, now $98.50

- SCO Feb $34/40 bull call spread at $2.10, selling $34 puts for $1.60 (net .50), now $2.80 – up 460%

- WFR 2013 $5 buy/write at $2.11/3.56, now $4.62 – on target

- WFR 2014 $3/5 bull call spread at .45, now .90 – up 100%

- WFR 2014 $3 puts sold for .80, now .63 – up 21%

- SCO Jan $36 puts sold for $1.20, expired worthless – up 100%

- SCO Jan $35/36 bull call spread at .45, expired at $1 – up 122%

That was a pretty good day for picks. Really it's just two picks – oil down and WFR up so no big deal – just different ways to make the same bet. We had a 10-year note auction that day and a pretty bullish Beige Book.

That was a pretty good day for picks. Really it's just two picks – oil down and WFR up so no big deal – just different ways to make the same bet. We had a 10-year note auction that day and a pretty bullish Beige Book.

Thursday: We also reviewed our fairly bullish Income Portfolio that morning, I won't count those adjustments as it's a separate review on that virtual portfolio. I mentioned in the morning post that I was trying REAL hard to get more bullish but we had a very poor retail sales report and earnings were coming in mixed at best so I said: "This is very likely the time to be fearful when others are greedy – if nothing else – it certainly merits us staying in cash and giving ourselves another week to make sure there's a real trend here."

In the morning Alert to Members, we discussed our hedges from December 28th and their bullish offsets – this is a VERY IMPORTANT thing to read as it's a great example of how, even though our bearish bull call spreads have gone completely against us – the bullish offsets make the trades neutral – allowing us to fully benefit from the rally on the bullish side.

- CHK 2013 $17.50 puts sold for $1.80, now 2.15 – down 19%

- TNA Feb $47/53 buill call spread, selling SCO Feb $35 puts for net .95, now $3.10 – up 226%

- XRT 3 March $55 calls at $1, selling 5 Jan $52 calls for .95 for net $175 credit ($25KP), expired at net $860 – down $685 (391% – rolled to a March/Feb spread).

- 20 GLL Feb $17/18 bull call spread at .60, selling 10 $17 puts for .60 for net $600 ($25KP), now $300 – down 50%

- TZA Feb $21/28 bull call spread, selling $24 puts for net $1, now -$1.52 – down 252%

Of course the trick with the TZA spread is that the $21 calls are still $2.05 and, if you lose faith in the trade, you can pull the $21 calls for $2 off the table and then just deal with the roll of the short $24 puts, now $3 with $1 in premium, which can currently be rolled to the April $21 puts at $2.75 for net .25.

This is the problem with watching options trades in a portfolio – they can look terrible (down 225%) while in progress but the reality is this trade is barely off target with TZA at $22.08 and a month to go. It was an aggressive play where net $1,000 committed on 10 had a max gain of $6,000 and would now cost $1,500 out of pocket to cancel after a 2.5% up move in the market. If a 2.5% up move didn't offset the loss on the hedge, it was an over-hedge!

This is the problem with watching options trades in a portfolio – they can look terrible (down 225%) while in progress but the reality is this trade is barely off target with TZA at $22.08 and a month to go. It was an aggressive play where net $1,000 committed on 10 had a max gain of $6,000 and would now cost $1,500 out of pocket to cancel after a 2.5% up move in the market. If a 2.5% up move didn't offset the loss on the hedge, it was an over-hedge!

Also, keep in mind that the higher the Russell goes, the more we WANT to own TZA as a long-term hedge. As I say to Members over and over and over again: "If you don't REALLY want to own the underlying stock or ETF as a long-term part of your portfolio at the net price – DON'T SELL SHORT PUTS AGAINST IT."

Friday: We noted that rail traffic was collapsing and David Fry pointed out "Bulls Blind to Bad Data Once Again." Oil was rallying pre-market and I put on my history teacher's had as we discussed how far manipulation could be pushed, circa 2008. I also pointed out in the main post another point that needs to be repeated early and often and may even be familiar to those of you who remember what you read at the top of this very page:

Friday: We noted that rail traffic was collapsing and David Fry pointed out "Bulls Blind to Bad Data Once Again." Oil was rallying pre-market and I put on my history teacher's had as we discussed how far manipulation could be pushed, circa 2008. I also pointed out in the main post another point that needs to be repeated early and often and may even be familiar to those of you who remember what you read at the top of this very page:

Other than our aggressive, short-term Portfolios, where we "go with our gut," we are never all bullish or all bearish – usually 60/40 one way or another with 70/30 being extreme and not usually long-lasting.

We also discussed the poor start the $25KP was having in context of the old $10KP, which dropped 50% before our convictions paid off. As we were only down $2,000 in our virtual portfolio as of Friday morning, we decided we could stick with our bearish stance a while longer. The market did take a nice dive that morning and we took full advantage and cashed in a couple of short positions but then, of course, it bounced back and we ended up having a rare day with no new trade ideas.

Of course we did have adjustments of our very bullish Money Trades but there are too many of those to track here and we have the daily tracking sheets for those anyway.

T uesday: Monday was MLK day and we started the short week off with another pre-market pop and I asked "How Many Times Will You Fall For The Same Thing?" We did, in fact, give back almost 100 points during the day but that revesed on Wednesday and it was up, up and away for the rest of the week. Of course the Dollar fell 2% for the week so it's hard to call a 2% run in the Dow "bullish" when it's priced in Dollars – something I pointed out in the morning post.

uesday: Monday was MLK day and we started the short week off with another pre-market pop and I asked "How Many Times Will You Fall For The Same Thing?" We did, in fact, give back almost 100 points during the day but that revesed on Wednesday and it was up, up and away for the rest of the week. Of course the Dollar fell 2% for the week so it's hard to call a 2% run in the Dow "bullish" when it's priced in Dollars – something I pointed out in the morning post.

As I said there: "Unfortunately, that means we continue to play it close to the vest, using our cash to poke at a few opportunities and picking up some good deals (like RCL this morning on the dip) but generally for quick trades until we get a clearer picture of where things stand." One place we did take a firm stand was oil, where I laid out our simple plan for the week:

Our position on oil has been very clear – over $100 we short it. At $101, we short it. At $102 (which we had early this morning), we short it. At $103.50 – we back up the truck and short it. Why? BECAUSE OIL IS NOT WORTH $100 A BARREL. I'm sorry, it's just not.

- AMT 2014 $54.65/69.65 bull call spread, selling $54.65 puts for net $0, still $0.

- EDZ April $15/22 bull call spread at $1.80, now $1.20 – down 33%

- EDZ April $14 puts sold for net $1.60, now $1.75 – down 10%

- VLO June $18 puts sold for $1.10, now .35 – up 68%

- RCL March $24 puts sold for $1.05, now .65 – up 48%

This is a great example of bullis vs. bearish offsets on hedges. The EDZ spread lost just .60 and selling the EDZ puts (very aggressively bearish) INCREASES the losses if the market moves against you while selling either of the bullish covers did exactly what they were supposed to do – they negated the loss.

If you REALLY want to own VLO or RCL at the net strikes – this is the way you get to buy FREE insurance on the rest of your portfolio. The trick is to always have things you want to buy and the trick to that is always keep plenty of buying power in your portfolio. Would you rather be 50% invested with almost free downside protection and short put positions that give you great entires for some of your sidelined cash or 100% invested and paying for insurance while you fear being "forced" to add another stock?

- DIA Jan $125 puts at .82 ($25KP), expired worthless – down 100%

- SQQQ Jan $17 calls at .25 ($25KP), expired worthless – down 100%

I was over at the Nasdaq being interviewed by BNN that afternoon and my two trade ideas from that interview were old favorites for our Members:

I was over at the Nasdaq being interviewed by BNN that afternoon and my two trade ideas from that interview were old favorites for our Members:

- BAC ($6.49) 2013 $5 buy/write at $3.39/4.20, BAC now $7.07 – on target

- SCO Feb $34/38 bull call spread, selling Feb $35 puts for net .55, now $1.60 – up 190%

Gotta love those SCO plays, right? Between that trade (and BAC looks good too) GNW and AXP as my last three appearances for them, BNN should give me my own show!

Wednesday: The World Bank cut it's global growth outlook by 25% and projected Europe into a recession with a 120% downgrade – from 1.8% to NEGATIVE 0.3%. One might think would bother the markets but noooooooooooooo! In fact, it was no coincidence that, later in the week, rumors began flying that Larry Summers would be stepping in to take over the World Bank. Summers was a proud Member of Bill Clintons Plunge Protection Team and he's a guy you can count on never to say something like he's cutting the growth forecast.

- XRT Feb $55/53 bear put spread at $1.10, now .60 – down 45%

- Oil (/CL) Futures short at $102 – now $98.50

- FAS Feb $67/70 bull call spread, selling $55 puts for net .70, now $2.10 – up 200%

- DIA Jan $125 puts at .70 ($25KP), expired worthless – down 100%

- X 2013 $25 puts sold for $4.75, now $4.55 – up 5%

- X 20014 $25/35 bull call spread at $3.75, now $3.80 – up 1%

- FFIV April $120/Feb $110 call spread at $0, now -$1 – down infinity %

- SLM Feb $13/14 bull call spread, selling $14 puts for net .15 ($25KP), now .50 – up 233%

Thursday: From early morning chat at the end of Wednesday's post (always read the end of the last post in the morning as we often have early morning discussions along with our Futures trading there):

Thursday: From early morning chat at the end of Wednesday's post (always read the end of the last post in the morning as we often have early morning discussions along with our Futures trading there):

$25KP/Danny, RDN – Yes, it is HIGHLY SPECULATIVE and, more importantly, it's meant to be a small, aggressive part of a CONSERVATIVE, long-term bullish portfolio – like our Income Portfolio, which MADE $5,000 last month and will do much better this month on this crazy move up. So we're going to lean bearish in our short-term speculation as we've got nothing but bullish long-term plays (I can't think of any bearish ones we have at the moment). Just last Wednesday I noted that we were actually much more bullish than I thought in our overall picks – and it was only the $25KP picks that were heading the wrong way (so far).

And, of course, CASH has been and still is my main call for 2012 so far.

Balance, BALANCE, B-A-L-A-N-C-E!!! Without balance, you will never enjoy trading because, even when you win, the fear of loss will always be with you.

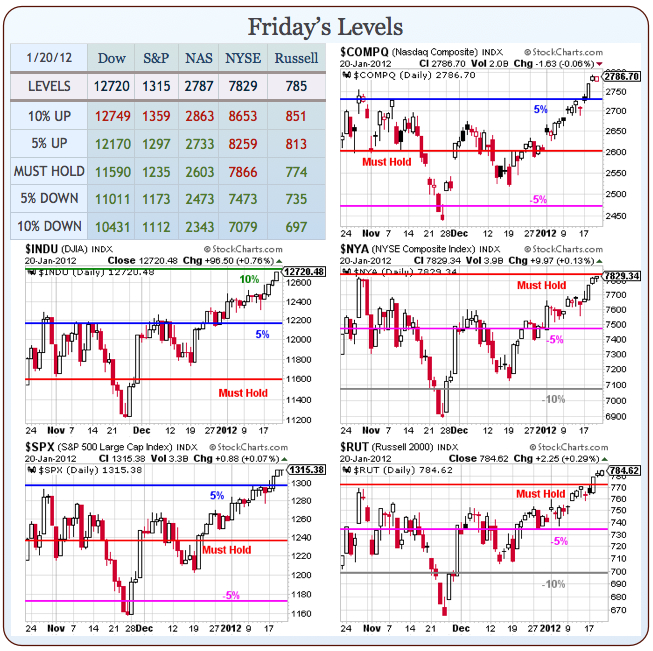

This is GOOD advice! In the morning post we were thrilled with BAC's jump to $7.50 on earings as our "One Trade for 2012" was already looking like a winner. I went over our "Secret Santa's Inflation Hedges for 2011" and promised that, when the NYSE takes the 7,866 line (Must Hold on the Big Chart), I'll be ready to put up some new ones for 2012 but, until then, I'm ho-ho-holiding my enthusiasm in check this year.

I did, however, take the opportunity to make the bullish case for the global economy – which essentially boils down to MORE FREE MONEY! In fact, China eased lending limits on their 5 largest banks that morning (the rich getting richer in China) and that gave the entire investing World QE Fever as it has been widely anticipated that China would be part of some massive Global effort to stimulate the World Economy.

I did, however, take the opportunity to make the bullish case for the global economy – which essentially boils down to MORE FREE MONEY! In fact, China eased lending limits on their 5 largest banks that morning (the rich getting richer in China) and that gave the entire investing World QE Fever as it has been widely anticipated that China would be part of some massive Global effort to stimulate the World Economy.

- BA 2013 $65/75 bull call spread, selling $65 puts for net $1.15, now $1.60 – up 39%

- SQQQ Feb $17 puts sold for $1.45 ($25KP), now $1.60 – down 10%

- DIA Feb $121 puts at $1.05 ($25KP), now .58 – down 45%

- VXX Feb $29/35 bull call spread, selling $28 puts for net .10, now -.65 – down 750%

Ouch on those VXX spreads! This is a fine example of how leverage can be dangerous but, more importantly, a fine example of how the balance in your portfolio can make you freak out over nothing. VXX is at $28.42, even after the stunning 2-day run we had since picking up that spread. That means, the entirety of the loss plus another 1,300% of potential gains is reflected in the $1.95 PRICE (not VALUE) of the short $28 puts – which are ALL premium.

Again (and again and again) I will say that if you don't REALLY want to be long VXX LONG-TERM, then you have NO BUSINESS selling short puts on it. If you do think being long volatility is a smart part of your long-term BALANCED portfolio, then we note that the $1.95 Feb $28 puts can be rolled to the $1.51 March $25 puts or the $1.71 June $22 puts or the $1.55 2013 $16 puts. If you don't have the faith to stick out the position and be long on the VIX at 50% below our entry – why the Hell did you short them at $30+?

These trades WILL move against you but it's not a big deal if you plan for it in advance and know exactly what your tolerance is but, if your tolerance for a loss on a trade like this, at net .10, is net .05 or even net .20 – you need to understand that this kind of trade is too volatlie to play that way and it would only be sheer luck that would prevent you from having to stop out.

These trades WILL move against you but it's not a big deal if you plan for it in advance and know exactly what your tolerance is but, if your tolerance for a loss on a trade like this, at net .10, is net .05 or even net .20 – you need to understand that this kind of trade is too volatlie to play that way and it would only be sheer luck that would prevent you from having to stop out.

Friday: One TRILLION Dollars was the number being floated by CNBC and shame on anybody who believes anything being broadcast on that propaganda network! Still, the trick works every time and the markets had another fine day at the top, led by IBMs 4.5% gain on the day, which saved us from GOOG's miss dominating the news.

Now it's the weekend and we're hearing reports that there is no way there will be QE3 next week (see main page) but who knows what new rumor Moday will bring. Nonetheless, it is our obligation to try to find something to short when the market is spiking up and we took a poke at the Dow, in hopes it would correct but, sadly, Friday was not the day.

- DIA $126 puts for .15 ($25KP), expired worthless – down 100%

That didn't work out at all and we did, in fact, give up on them at .07 – as we always should when we have a 50% loss and don't intend to roll or DD. If you follow the most basic rules of scaling in and stopping out then your initial commitment to a position should be no more than 1/4 of an allocation, which is not more than 10% of your portfolio, so 2.5% at most and losing 50% of that is a 1.25% loss on your whole portfolio.

That didn't work out at all and we did, in fact, give up on them at .07 – as we always should when we have a 50% loss and don't intend to roll or DD. If you follow the most basic rules of scaling in and stopping out then your initial commitment to a position should be no more than 1/4 of an allocation, which is not more than 10% of your portfolio, so 2.5% at most and losing 50% of that is a 1.25% loss on your whole portfolio.

Hopefully, it should not take more than a series of 8 1.25% losses (10%) before you figure out you are betting the wrong way. We're at about that point in the $25KP because, although 18 of our 33 trade ideas for the week are already winners our aggressively bearish stance in the $25KP has given us almost all losers so far.

We have our Fed meeting next week and, of course, we have all these exciting breakout levels to watch on the Big Chart. Is this finally, the week we break up to new highs or is this just another one of those very exciting rallys that fizzle right at the top?

Stay tuned for another exciting week.