Here is the virtual portfolio weekend update. Basically a recap of the positions and some notes about the trades. As usual, I'll post the previous week's P&L for comparison. Not the greatest of week in general!

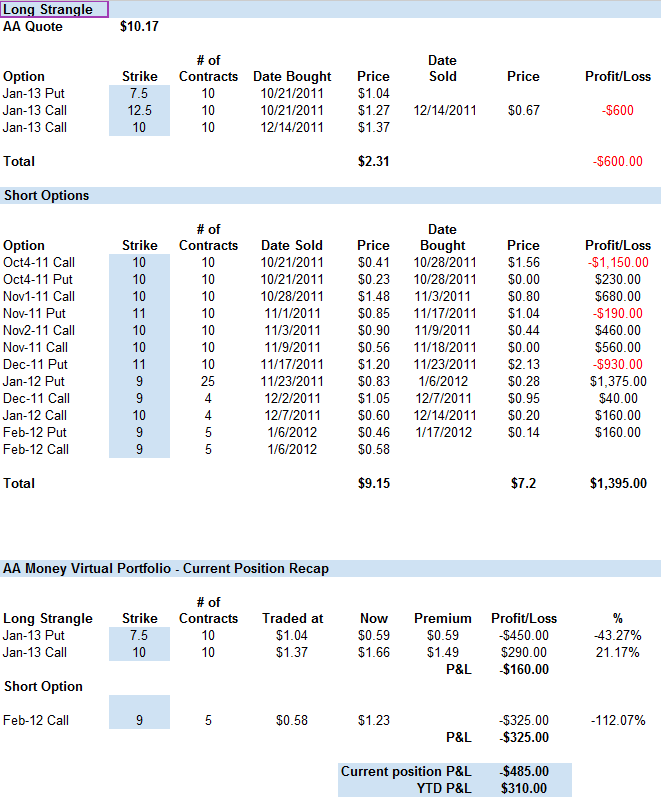

AA Money

Only transaction last week as we bought back the AA Feb 9 puts on Tuesday for close to a 70% profit. The idea is to sell another set of put as soon as we get a chance.

Previous week P&L - $400.00

We lost some ground this week, but we'll keep on selling premium!

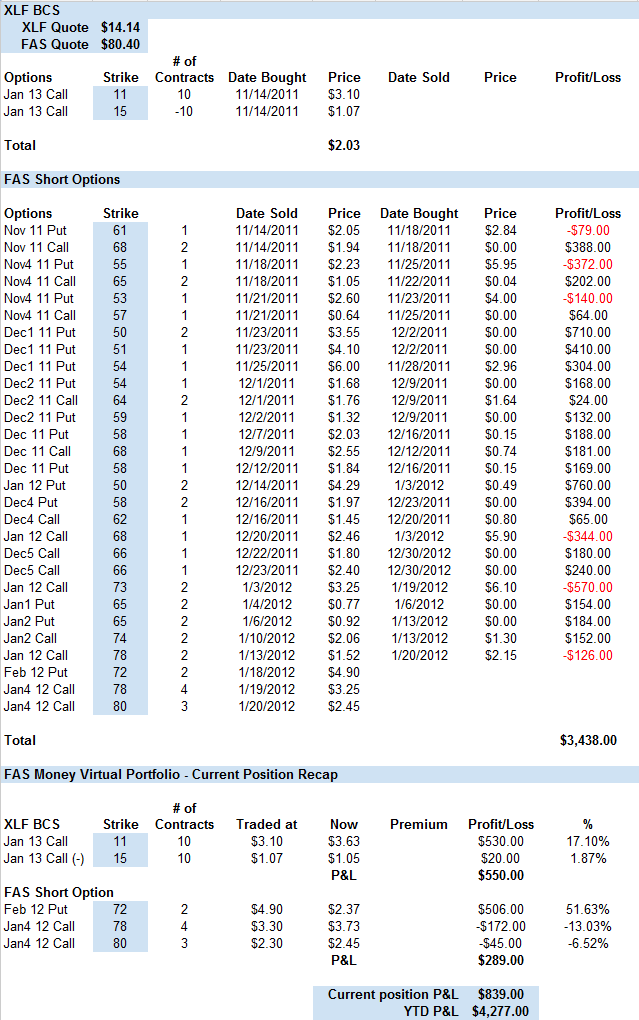

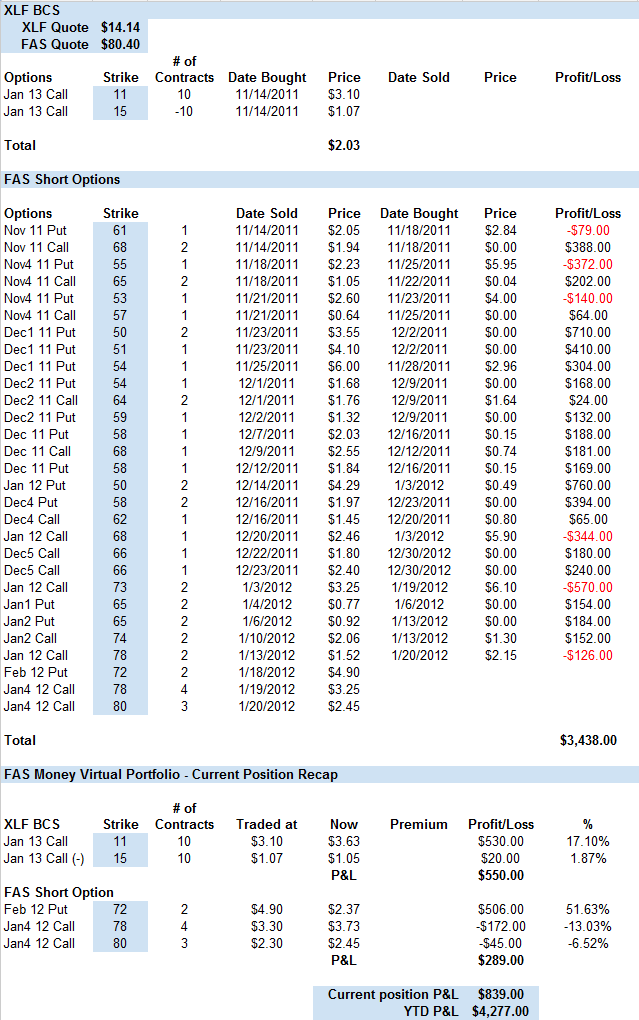

FAS Money

We also lost some ground in this virtual portfolio, but we have sold plenty of premium for the coming week. A little correction would go a

long way to help! On Wednesday we sold the FAS Feb 72 puts (already good for 50%), on Thursday we added the Jan4 78 calls and on Friday we had to roll the Jan 78 puts to the Jan 80 puts. We were hoping for these ones to expire worthless on Friday, but a late stick killed that hope.

Previous week P&L - $4372.00

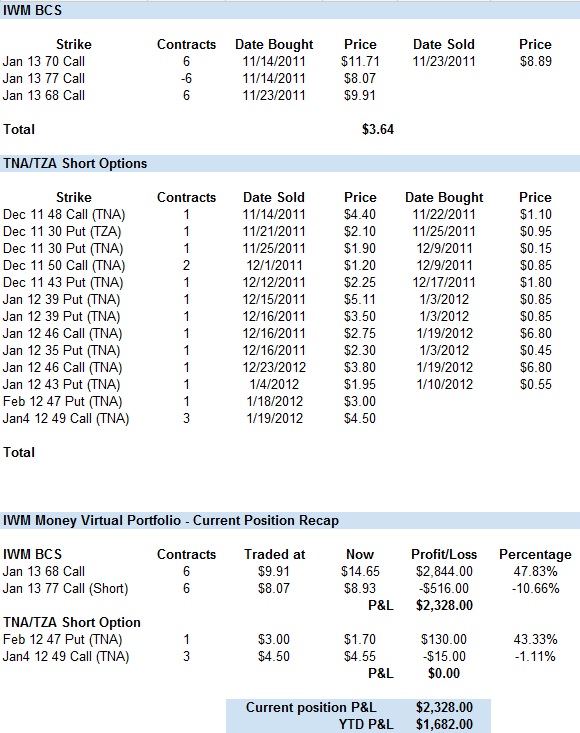

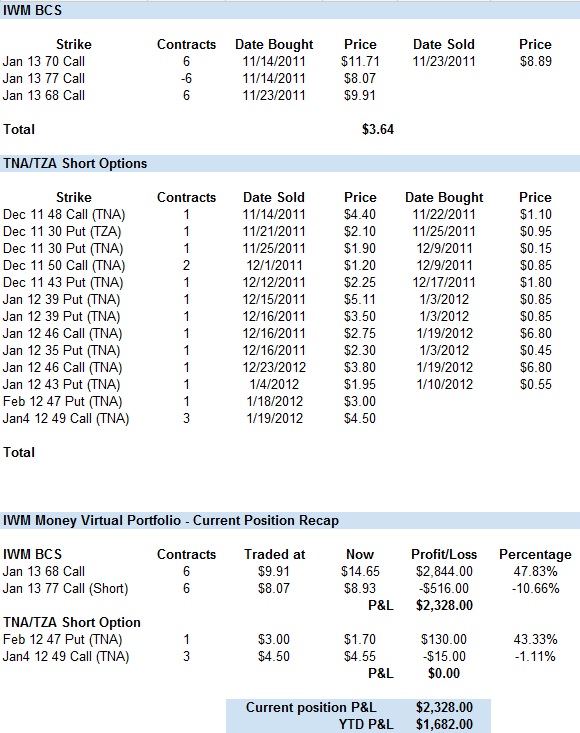

IWM Money

Not the best of week either here... As with the other portfolios we were a tad bearish with more calls sold. On Wednesday we sold the TNA Feb 47 puts (already up 40%) and on Thursday we rolled the TNA Jan 46 calls to the Jan4 49 calls.

Previous week P&L - $2046.00

As with the FAS Money portfolio, plenty of premium sold to get us back on track.

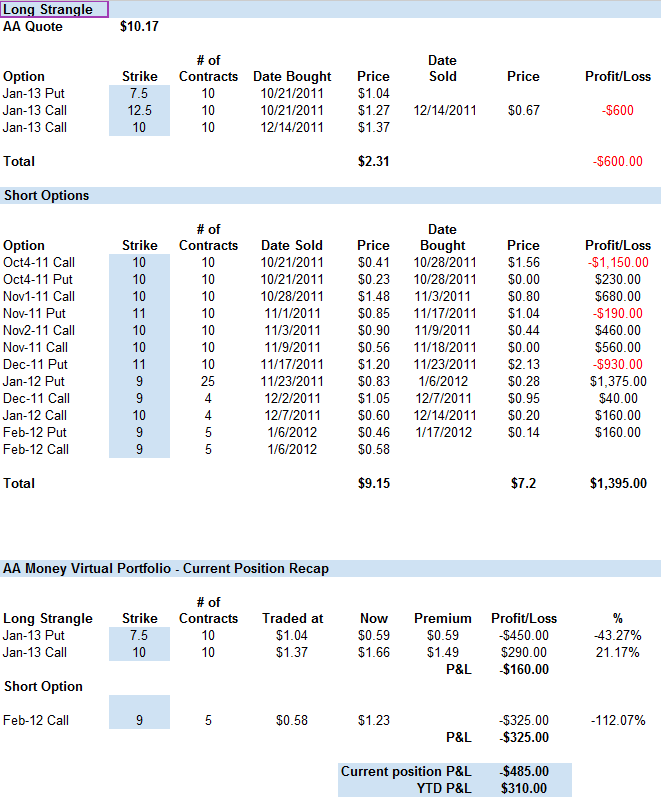

FAS Strangle Experiment

One bad move on Friday almost wiped out the entire week's profit. There might be 2 lessons learned from that:

1) Every Friday will be different - the week before, patience was rewarded, this week, a late stick punished it.

2) Better to take the profits when we can.

We lost some ground this week, but we'll keep on selling premium!

We lost some ground this week, but we'll keep on selling premium!

As with the FAS Money portfolio, plenty of premium sold to get us back on track.

As with the FAS Money portfolio, plenty of premium sold to get us back on track.