Want a Raise? Vote on it! The Swiss do.

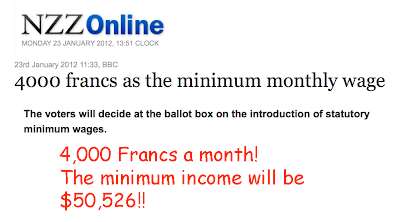

Switzerland is vote crazy. It has a referendum on most issues. There is a vote coming up that I’m sure will pass. This time around, the Swiss are going to vote themselves a big salary increase. As a result, Switzerland will have the highest minimum wage on the globe. That’s nice for the Swiss.

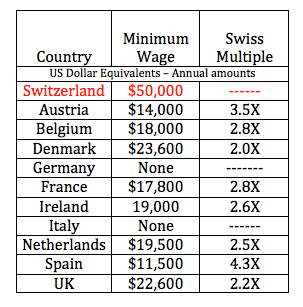

The annual minimum wages of Switzerland’s neighbors: (Link)

Being on the top of the list of minimum guaranteed income is a positive reflection on the Swiss economy. But it will also bring envy. It is an embarrassment of riches. I don’t think it will go unnoticed. The country is surrounded by economic problems, yet it's flourishing.

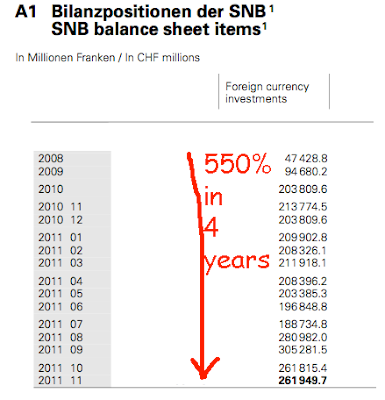

Switzerland has insured that its domestic companies are insulated from the economic chaos of its neighbors. It has achieved this with a currency peg. This appears to be a simple solution. So far, the peg is working. But there are consequences to this policy. In order to maintain an artificially low value for the Franc, the Swiss Central Bank (SNB) has had to absorb a huge chunk of official reserves, the bulk of which has been in Euros.

An argument has been put forward by the SNB, economists and bloggers, that there is no reason why the Swiss can’t continue to absorb foreign reserves. They argue that it doesn’t matter if it is E260b today, it would not matter if it were E500b in six months. I disagree. The SNB has investment restrictions. It only invests its Euro reserves in the debt obligations of France and Germany.

At some point we will see headlines like these:

Month #1

Finance Ministers of France, Germany, Netherlands

Call on Switzerland to Invest excess reserves in

Bonds of ECB.

Month # 2

Swiss Finance Minister Rejects Calls for Reserve Diversification

“The investment policies of the SNB are not for discussion”

Month #3

Merkel travels to Bern to discuss direct

investment in EU Central Bank

Month #4

Swiss Parliament Rejects Pressure from Neighbors

Swiss President: “The Swiss people have no ability to influence the SNB”

Month #5

EU leaders threaten economic sanctions against Switzerland

French President, “We can have Beggar my Neighbor policies too!”

Month #6

EU Considers Tariffs on Swiss Agricultural Products

Farmers Protest

Month #7

Swiss Tourist Industry in Slump

Hotelier: “We have a bad image, so people don’t come”

Month #8

Belgium’s rail road Cancels Purchase of Swiss Locomotives

Pressure from government responsible

Month #9

Swiss Politicians Raise Possibility of Referendum

on Independence of the SNB

SPP Leader, “Let the people decide”

Two Days Later

SNB Reverses Stance On Investments. Will Invest 10%

of Euro Reserves in ECB Debt.

Major concession. Threat of vote forced

change in policy.

Month #10

Swiss Reserves Rise to New Record

Up E100B in Six Months

One Week Later

Italian Finance Minister Calls on Swiss

for Direct Investment in

Italian Bonds – Swiss say, “No”.

One Week Later

Italian Parliament Considers New Laws

on Swiss Bank Accounts.

Severe restrictions, penalties to equal 50% of account balances

Two Days Later

SNB to Hold 10% of reserves in direct obligations of

Italian government bonds

Italian Press: We put a gun to their head; they said

“Si.”

Two Days Later

Spanish Finance Minister Travels to Bern to Discuss Bond Sales

The question for the SNB: “Is Portugal next to visit?”

This is a bit whimsical, but I hope you get the point. I doubt the Swiss can hold unlimited amounts of reserves without pressure on them to diversify those huge holdings to some of the governments (and the Supra-nationals). I’m surprised that this has not happened already. Possibly Switzerland’s neighbors will look at the results of the upcoming vote on the minimum wage, and start asking those questions.

This very rich country may end up being the banker for some of its neighbors. What comes around, often goes around.