But where's my Trillion Dollars?

But where's my Trillion Dollars?

Federal Reserve officials said they expect to keep short-term interest rates near zero for almost three more years and signaled they could restart a controversial bond-buying program in yet another campaign to rev up the disappointing economic recovery.

The Central Bank's pronouncements came after a two-day policy meeting from which officials emerged still frustrated at the slow pace of growth and a bit more confident that inflation is settling down after climbing last year. The combination of persistent slow growth and low inflation, Fed Chairman Ben Bernanke signaled in a news conference after the meeting, could give the Fed leeway to take more action to support the economy, though he didn't commit to it.

A bond-buying program—also meant to push down long-term interest rates—could be the next step. Mr. Bernanke said there would be a "very strong case" for even more action by the Fed "if the recovery continues to be modest and progress on unemployment very slow and inflation appears to be likely to be below target for a number of years out."

What amazes me is not one reporter at yesterday's news conference asked Dr. Bernanke what is COSTS to ARTIFICIALLY keep rates 3.75% below what his own board considers "normal" for another 3 – 4 years. Maybe that's because we don't know what it cost already, do we? We do know the Fed now has a $3Tn balance sheet. Since I don't recall a bake sale at which the Fed sold $3Tn worth of cookies, I have to imagine that money was borrowed from somewhere and don't things that are borrowed eventually need to be paid back?

I mean, I understand that, since Reagan, there has been a massive effort to destroy the American Education system and make the beautiful sheeple as dumb and compliant as possible (a less crazy article on the subject here) – but surely there must be some reporter who was accidentally exposed to some rudimentary economics who can come up with a better question than "when in 2014?"

I mean, I understand that, since Reagan, there has been a massive effort to destroy the American Education system and make the beautiful sheeple as dumb and compliant as possible (a less crazy article on the subject here) – but surely there must be some reporter who was accidentally exposed to some rudimentary economics who can come up with a better question than "when in 2014?"

Apparently, it is beyond the grasp of the MSM that, when the Government borrows money at 3% and lends money at 0.25% – SOMEONE has to pay that 2.75% difference. I don't know how to put this in the "new math" terms my kids are learning but, in old math, if I borrow $1Tn at 3%, I owe the person I borrowed it from $1,030Bn at the end of the year – are you with me so far?

OK, so then I LEND that Trillion Dollars to my Bankster Buddies for 0.25% and, at the end of the year, they give me back $1,002.5Bn. Here comes the really hard math part (hopefully someone from the NYTimes can keep up) – $1.030Bn minus $1.0025Bn is $27.5Bn and that's the amount we LOST lending money to the Banksters for 0.25%.

OK, so then I LEND that Trillion Dollars to my Bankster Buddies for 0.25% and, at the end of the year, they give me back $1,002.5Bn. Here comes the really hard math part (hopefully someone from the NYTimes can keep up) – $1.030Bn minus $1.0025Bn is $27.5Bn and that's the amount we LOST lending money to the Banksters for 0.25%.

What's $27.5Bn between friends, right? Well, that's where this math stuff really kicks in because we lent that $1Tn over and over and over again for the last 3 years so that's 3 x $27.5Bn or $82.5Bn. Still, sounds like chicken feed in the grand scheme of things so why should we care if the Fed extends these ultra-low rates to their Bankster Buddies for 3 more years – after all, if we were in trouble, the Bankers would certainly do the same for us, right?

Unfortunately, we're going to need a calculator now because, funny story, the Fed didn't just lend $1Tn to their pals. In fact, they didn't just lend the $3Tn on their balance sheet. Nope. It is estimated that the Fed lent an additional $7 TRILLION to their friends ON TOP OF the $3Tn they reported. So $3Tn + $7Tn = $10Tn. That means $82.5Bn (3 year loss) x 10 = $825Bn. THAT is how much OF YOUR MONEY Bernanke just gave away yesterday (assuming they don't sneak in another bonus $7Tn) by extending 0.25% for 3 more years.

Even this would not be so terrible if those banks were using all this free money to lend out to American Citizens at ultra-low rates to help them get back on their feet and help businesses refinance through rough economic times but that's not what's happening at all.

Even this would not be so terrible if those banks were using all this free money to lend out to American Citizens at ultra-low rates to help them get back on their feet and help businesses refinance through rough economic times but that's not what's happening at all.

In fact, the banks are simply turning around and lending the money back to – you guessed it – US, at 3%. So it not only costs us $825Bn to GIVE the banks a $10Tn loan but they turn around and lend it back to us for another $825Bn. Mommy, when I grow up – I wanna be a BANKER!

I know it seems like the same money but it's not. We borrow first, THEN we give the banks money, THEN they lend us more money and our Deficit grows and grows and grows until, like Greece, a bunch of Bankers decide we're a poor credit risk and decide to foreclose. Don't worry though, they're not done lending us money yet. Before we leave this point, I want to make sure it's clear enough for the Fox viewers – If I borrow $10 at 10%, at the end of the year I owe $11. If I then lend you, my Bankster Buddy, $10 at 0% and then you lend me $10 back at 10%, then at the end of the year I owe $12 and you have $1.

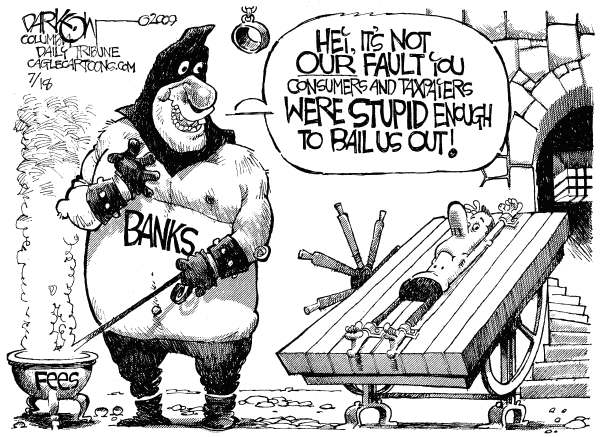

That's right, not only is the Fed screwing us with this scam but they are INEFFICIENTLY SCREWING US – we have to borrow $2 additional dollars in order to give the Banksters $1 – how stupid is that? If we DIDN'T borrow the money to give to the Banksters, then we would not have additional debt and wouldn't need to borrow money from the Banksters. That's why the key to this whole system is to have a society that has poor math skills and an even poorer understanding of economics because – ANYONE ELSE WOULD BE OUTRAGED!

That's right, not only is the Fed screwing us with this scam but they are INEFFICIENTLY SCREWING US – we have to borrow $2 additional dollars in order to give the Banksters $1 – how stupid is that? If we DIDN'T borrow the money to give to the Banksters, then we would not have additional debt and wouldn't need to borrow money from the Banksters. That's why the key to this whole system is to have a society that has poor math skills and an even poorer understanding of economics because – ANYONE ELSE WOULD BE OUTRAGED!

But why should we be upset? After all – "only" 377,000 Americans were laid off last week and that's just 21,000 (5.5%) more than last week and continuing claims "only" went up 88,000, to 3.55M (up 2.4%) – thank goodness for that 99-week limit right! Durable Goods were up 2.1% ex-Transports and up 3% on headlines in December and many, many analysts will tell you how bullish that is – but they will never show you this chart:

That's funny isn't it because, usually, they LOVE showing charts and this one is free from the Government, so the graphics department doesn't have to do anything but put it on screen. Yet, strangely, it's almost as if it didn't exist at all! We love BA and do you know why we love BA? Because BA is the ENTIRE difference between this complete and utter disaster and the lovely, lovely headline numbers you'll be hearing about all day.

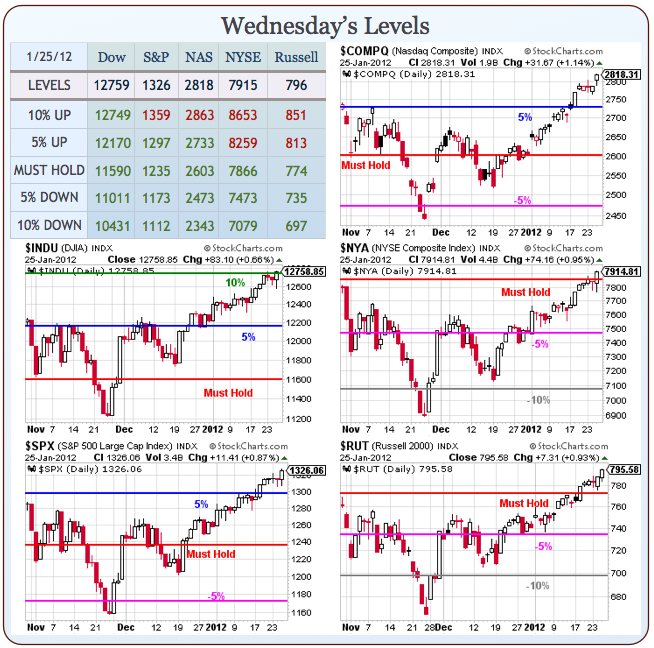

Nonetheless, these may be our last 48 hours of being bearish because, if we hold our breakout levels over the weekend – we have no choice but to switch off our brains and run with the bulls. So let's enjoy it while it lasts and short oil at $101 again along with the Dow at 12,800 and the Russell at 800 and see if they can burn us one last time.

After that, we'll be happy to join in the fun.

Once upon a Great Recession, while I pondered Global Depression,

Over what the New Year's markets may have yet in store,

While I nodded, nearly napping, suddenly there came a tapping,

As of some one gently rapping, rapping at my chamber door.

`'Tis some creditor,' I muttered, `tapping at my chamber door –

Only this, and nothing more.'Back into the chamber turning, all my soul within me burning,

Soon again I heard a tapping somewhat louder than before.

`Surely,' said I, `surely that is something at my window lattice;

Let me see then, what thereat is, and this mystery explore –

Let my heart be still a moment and this mystery explore; –

'Tis a Mormon, nothing more!'Open here I flung the shutter, when, with many a flirt and flutter,

In stepped Ben Bernanke right on through my chamber door.

Not the least of greeting gave he; not a minute stopped or stayed he;

But, to my charts he went directly and drew on each of them a floor –

TLT at 116, Dow 12,000, 20 VIX –

Twenty VIX and nothing more.`Profits!' said I, `this is evil! – profitable still, but clearly evil! –

You tempt us yet, what of the risks your plans ignore,

What of Debt and high inflation, the lack of jobs throughout the nation –

Surely you don't want stagflation – tell me truly, I implore –

Is there an end to you manipulation? – tell me – tell me, I implore!'

Quoth Bernanke, `Nevermore.'