It's World Economic Forum time!

It's World Economic Forum time!

This is one of my favorite conferences as the Global Elite head over for their annual gathering and schmooze-fest where they end up wandering around and trying to get seats with the cool people at lunch and trying to find out where the good parties are and getting told there's no tables at the restaurant they want to go to – just like normal people! Nassim N. Taleb described it to Tom Keene of Bloomberg Television, the event is “chasing successful people who want to be seen with other successful people. That’s the game.”

The minimum price for admission to the conference is $50,000 for a membership to the World Economic Forum plus a $20,000 ticket to the conference so $70,000 before trying to get a hotel room at a place you won't be embarrassed to mention to the other guests. Getting to Davos is also a nightmare at the best of times but worth it for the skiing, if not the schmoozing. In short, it's group of people who have at least $80,000 to blow on a weekend sitting around discussing the problems ordinary folks like themselves face in the ever-changing global economy.

The event is being be well-covered (best so far by Josh Brown) and we will get many, many sound-bytes and, like any conference, there is sure to be some enlightening information if you are lucky enough to catch the right lecture but I'd probably enjoy it a lot more if someone sent Ricky Gervais to ask a lot of awkward questions and point out what BS this exercise is than having to spend another week watching the CNBC girls throw their panties at passing Billionaires.

Meanwhile, in the real World, the UK's GDP CONTRACTED by 0.2% in Q4. In short, the country is sliding back into recession, with economists expecting another dip in the first quarter of this year. As one expert tells the Wall Street Journal:

"Our bet is that the U.K. is now back in recession and that the economy will continue to contract for most of this year," said Vicky Redwood, chief U.K. economist at Capital Economics.

Several factors are hurting the British economy: slowing manufacturing, rising unemployment, stagnant wage growth, decreasing construction activity, and dimming consumer confidence — and, of course, Europe's raging debt crisis.

The decline in factory output in the U.K. owes directly to the ongoing troubles in the eurozone. Roughly 40 percent of U.K. exports head to the Continent, but much of the region's consumers are in no position to shop. The IMF said this week that the eurozone is "deeply in the danger zone" and predicted that the 17-member monetary bloc would fall into a "mild" recession this year.

Not surprisingly, Timmy Geithner is performing his swan song in Davos, calling for a bigger financial firewall in Europe, saying "a stronger and more credible" system of protection will draw the support of the IMF and other nations (we discussed the IMF's pleas for more money earlier this week). Geithner correctly says that The outlook for U.S. growth and unemployment depends on the resolution of the European crisis, developments in the Gulf because of oil supplies, and "whether Republicans decide to legislate things that are good for growth" – all factors that are being ignored in this current BUYBUYBUY market environment.

Most importantly for this morning's discussion, the Treasury Secretary of the United States said US growth will be between 2% and 3% in 2012 IF all goes well in Europe. Meanwhile, as I pointed out to Members in yesterday's Chat – expectations for this morning's Q4 report are set at what I believe is an unrealistic 3.2%. Even if we hit that number – essentially Geithner is telling is that it's all downhill from here.

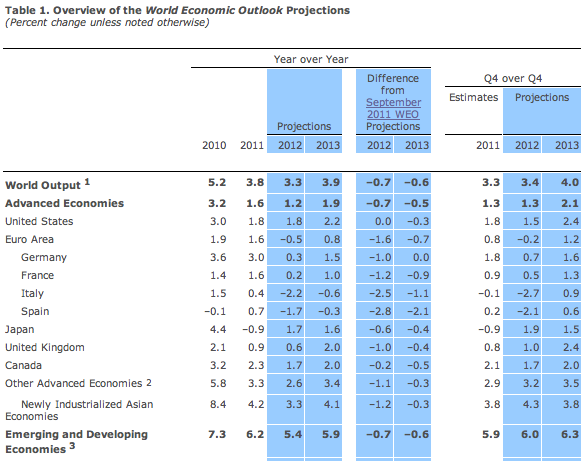

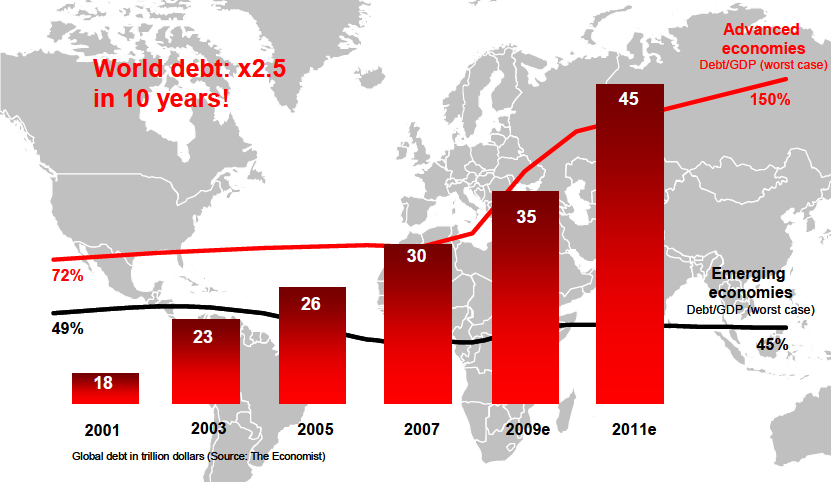

Global debt is the projected $80Tn gorilla in the room at Davos but, this conference likes to focus on the upbeat things and they circulate their "Global Risk Report" ahead of time so everyone can pretend they read it before they get on camera talk their book. Two years ago, I reported on the conference and the IMF was predicting 3.9% global growth in 2010 and Roubini was saying we were all doomed. Greece was the big negative hanging in the air at that time as well – plus de change, as they say…

Global debt is the projected $80Tn gorilla in the room at Davos but, this conference likes to focus on the upbeat things and they circulate their "Global Risk Report" ahead of time so everyone can pretend they read it before they get on camera talk their book. Two years ago, I reported on the conference and the IMF was predicting 3.9% global growth in 2010 and Roubini was saying we were all doomed. Greece was the big negative hanging in the air at that time as well – plus de change, as they say…

This year, we had a huge rally leading into the conference as everyone expects a gasthering of the World's Billionaires and Leaders to come to the conclusion that the Billionaires will forgive us all our debts and accept higher taxes and not gouge us for prices to make up for the hit on their wealth taken by the inflation the Governments are causing with their endless streams of money printing. Yeah, this is going to all work out just fine. We have been bearish here, at the top of our range and I have promised to capitulate this weekend if our NYSE (7,866) and Dow (12,759) levels can be held for more than one day – still waiting.

Just as the debt chart above ignores over $300Tn of "unfunded liabilities" like US Social Security, Medicare and Medicaid (Bush's prescription drug program alone is an unfunded $20Tn) but that's OK because there are over $600Tn worth of derivative bets for and against the eventual default of various sovereign nations so maybe someone who's a big winner on the derivatives side will help us out with a $50Tn donation to buy us another decade. Yeah, that's the plan…

We've held our bearish plays so far this week as we felt the Dollar would bounce off that 79 mark and, as you know, it's ALL about the Dollar. The Dollar has been driven down in anticipation of Bernanke promising at least another Trillion of them but Obama did not promise much new spending in his State of the Union message. As we discussed yesterday, the Fed sort of/kind of gave us another Trillion, but is it going to be enough?.

BUT (and it's a Big But. perhaps even a Big But, Davos Style), we'll have to wait for this morning's US GDP report and see how the markets react to that before we can even consider getting more bullish at what are pretty much the pre-crash highs for many companies. As the candidates will be asking us later this year – are we better off today than we were in 2008? Of course, the real question, since the Stock Market is a forward-looking pricing mechanism – are we better off today than we THOUGHT we were in early 2008 – because that's the kind of valuations we're being asked to pay for these days.

8:30 Update: Wheeeeeeeeeeeeeeeeee!

GDP came in light at 2.8% and we got a lovely little dump in the Futures of about half a point so far (8:45) but GDP is up considerably from last Q's 1.8% performance so it's not necessarily going to be seen as a total catastrophe. Breaking down the numbers, Consumer Spending was up 2% but Personal Savings fell a whopping 5.9%, from $456.5Bn to $429.3Bn so I'm not sure if we can call that a win.

Motor Vehicle Sales contributed 0.3%, a nice improvement over 0.12% last Q and there's a surprising uptick in Durable Goods of 14.8% but we didn't see it in the Durable Goods Report (but this GDP is preliminary and based on incomplete data). Unfortunately, Real Nonresidential Fixed Investment increased just 1.7 percent in the fourth quarter, compared with an increase of 15.7 percent in the third. Nonresidential Structures decreased 7.2 percent, in contrast to an increase of 14.4 percent – so still no life in Corporate Spending.

Government Consumption was down 7.3%, Defense down 12.5% – those were big hits as we continue on the insane path towards having the World's smallest Government. I think the worst part of the GDP report was what we discussed in yesterday's Chat – Real Private Inventories added 1.94% out of that 2.8% figure. Inventories add to GDP because the assumption is that we are all brilliant business people and we wouldn't be ordering things we can't sell. Unfortunately, RIMM has a warehouse full of Playbooks that is next to Nintendo's warehouse full of Wii's that might disagree with that premise.

As we all know, a better shopping season was expected than came to pass and this led to a big build-up of unsold merchandise – I always find this to be a stupid way to measure GDP and it's at it's stupidest when you consider a full warehouse on December 31st to be a good thing for the economy. That's also reflected in Real Final Sales, which were up 0.8% in Q4, down considerably from 3.2% in the 3rd.

Of course the headline in the WSJ is "US Economy Gathers Pace" because, as you can see from Cramer's bullish rant last night – they're still herding all the lambs in for the slaughter at the top of the market.

Interest come and we need another loan

Debt-O, debt-uh-oh

Interest come and we need another loanWork our lives just to lose our homes

Interest come and we need another loan

Stack default swaps till they come undone

Interest come and we need another loanCome on Economists, tell us some more BS

Interest come and we need another loan

Come on Economists, tell us some more BS

Interest come and we need another loan6%, 7% – it’s a credit crunch

Interest come and we need another loan

6%, 7% – it’s a credit crunch

Interest come and we need another loanDebt-O, debt-uh-oh

Interest come and we need another loan

Debt-O, debt-uh-oh

When interest comes we’ll need another loan

Ponzinomics pic credit: William Banzai7