Does this look good to you?

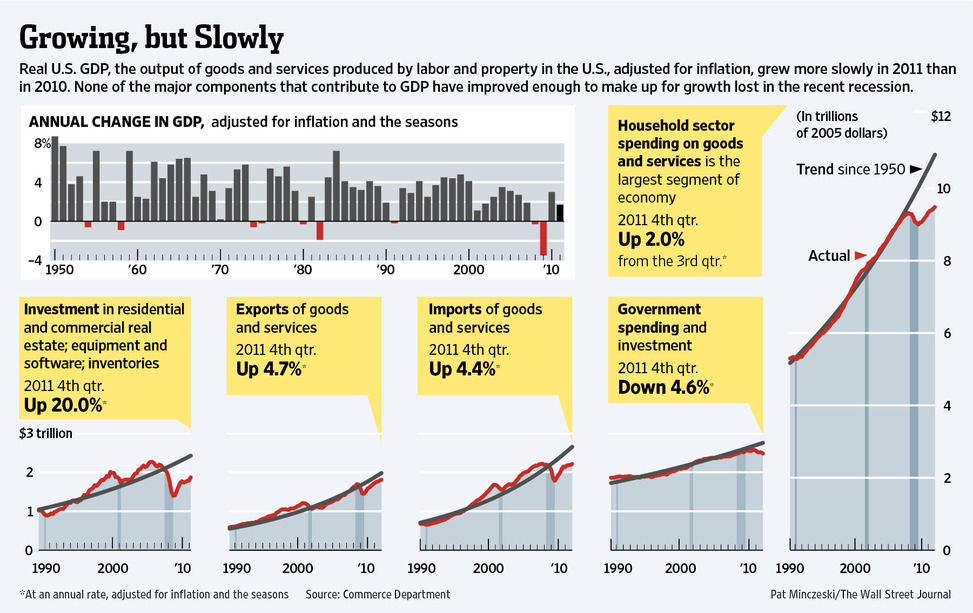

Here's that GDP analysts found so exciting on Friday and this very chart is from the WSJ article that spins it: "US Economy Picks Up Steam." I would especially like to draw your attention to the big graph on the right, which shows Household Spending, which is 70% of our economy, only now just getting back to our 2007 highs while Government Spending (20% of our GDP) begins to tail off and Real Estate and Business Spending are in an anemic at best recovery. And this is AMERICA – We're supposed to be LEADING the Global recovery.

By the way, huge Greek nonsense in Europe this morning – big market mover, blah, blah, blah – if you want to delve into that, we already wrote about it in great detail in Stock World Weekly, in our Week Ahead section (pages 10-14), so no need to go over it again. In fact, a lot of what is being considered "breaking news" today by CNBC and Bloomberg was already fully covered by us over the weekend.

By the way, huge Greek nonsense in Europe this morning – big market mover, blah, blah, blah – if you want to delve into that, we already wrote about it in great detail in Stock World Weekly, in our Week Ahead section (pages 10-14), so no need to go over it again. In fact, a lot of what is being considered "breaking news" today by CNBC and Bloomberg was already fully covered by us over the weekend.

Instead I think it's a good time to reflect on the good old US markets and whether or not they are worth buying back at our lofty pre-crash levels. Wall Street Rant does a nice job of summarizing the McKinsey Report on the Global Equity Gap – something our US-based traders have a difficult time absorbing since we are, by far, the most market-centric nation and, much like the Spanish Inquisitors who locked up Galileo, they don't like to hear that the Universe doesn't revolve around them…

US investors, in fact, do own 41.7% of all the World's equities and Western Europeans own 28.9% – that's 70.6%, leaving just 29.4% for the other 85% of the World's population to care about. Now, you may think that's somehow proportional to our share of the assets but it's not – in fact, the US is unique in that we actually own far more equities than we have assets – by 42%! So, even in stock interest – the US is running a tremendous net deficit with the rest of the World.

Japan's asset to equity ratio resembles their usual balance of trade, they buy a lot less than they sell. China holds 10% of the World's assets (1/3 of what we have) but buys just 5% of the World's Equities (1/8th of what we have) – so perhaps you should rethink your premise that China is going to save the markets – YOU are the only sucker buying Chinese stocks – even the Chinese don't buy Chinese stocks and they sure as hell aren't going to waste their money (used to be your money) bailing you out!

US investors currently have 42% of their assets in equities – that's down from 55% in 2000 and 47% in 2005 but still miles above our 1985 lows (S&L crisis) of 26%. What would the markets look like if investors pulled 40% of their money out? In 1965, we also were 53% invested but in 1970 it dropped to 46% (also after a disastrous Republican administration) and by 1975 we were at 32% and we had a lost decade in the markets from there.

US investors currently have 42% of their assets in equities – that's down from 55% in 2000 and 47% in 2005 but still miles above our 1985 lows (S&L crisis) of 26%. What would the markets look like if investors pulled 40% of their money out? In 1965, we also were 53% invested but in 1970 it dropped to 46% (also after a disastrous Republican administration) and by 1975 we were at 32% and we had a lost decade in the markets from there.

As WSR notes: "Sorry folks, now is not a generational buying opportunity by any stretch of the imagination, despite all those who use idiotic forward PE ratio's or useless graphs of the "fed model" to tell you otherwise. Please see (chart on left) some more useful market valuation indicators which actually have a strong correlation with subsequent longer-term returns (this chart is from Doug Short at Advisor Perspectives)."

So the US is now stuck in a trap because WE have been responsible for the Global Equity Bubble with our ridiculous running around buying every crap issue that emerging markets felt like floating and they've got our money already. So now, the valuations are moving towards more rational levels because there simply IS NOT ENOUGH MONEY IN THE WORLD to support the prices we were paying for things and now it seems like an emergency, TO US, to do something to re-inflate Global Equities.

While other countries are cutting back their allocations (and demographics take care of the rest), we and our equally foolish cousins in Western Europe are running our printing presses at full blast in what is likely to be an ultimately futile attempt to sustain our obviously unsustainable lifestyles which were, unfortunately, based upon a completely unsustainable Global Market fraud that was perpetrated by Western Banksters who very simply make more fees as they get us to commit more and more of our hard-earned assets to equities, where they get to chew them up with fees (when they are not able to outright steal the money through manipulation).

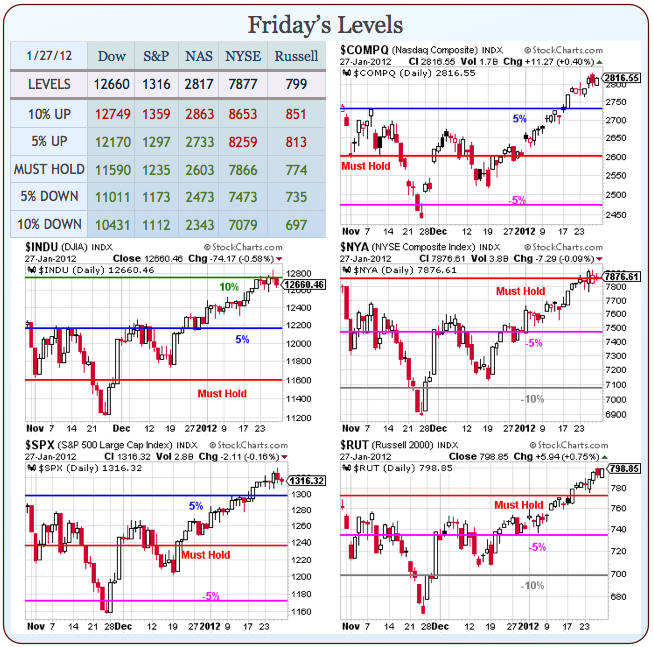

I'm sorry if that sounds cynical but that's what happened and here are the pictures of it happening in graph form – what more can I say? This is certainly not me saying that ALL stocks are bad – there are still plenty of solid companies with great growth opportunities but I am saying that it is ridiculous to believe that ALL stocks are good – and that is the way this market has been trading since November, now at the top of a 20% run and putting the top of our Big Chart range to a real test:

Look at the European investors in exhibit 16 – they are half in cash (like our Members!) but the average US investor under 65 has just 22% of their money in cash and that's pretty dangerous because, if we are not able to single-handedly re-inflate the global equity bubble, Americans are in no position whatsoever to pick up the pieces if it pops (again).

So I apologize if I am wrong and we've been too bearish and this is the dawn of a new stock market Age of Aquarius where it's all peace and love and ever-rising valuations but I'm just not seeing it yet.

What I am seeing is the markets being whipped into a frenzy leading up to the insanely ridiculous Facebook IPO where we are somehow meant to believe that a company which already has the lion's share of the market and has $2Bn in total revenues is worth $100Bn. With 82% of last year's Social Media IPOs finished below their IPO price – you might think investors would be cautious but this IPO is starting a frenzy that is likely to make Facebook the best short of 2012.

Even as I write this, Cramer is on CNBC (9:11) giving a "New Paradigm" speech and telling the sheeple to treat this dip (the one he said wouldn't happen last week) as a buying opportunity. Oh the humanity!

Let's be careful out there – if we're just entering enthusiasm, there will be many, many opportunities to go crazy and buy things. If it turns out that this is indeed the top – it's a very long way down (again). Greece may be fixed today and then we'll see if attention turns to Portugal – who are selling 10-year notes for 16.75% – if all is well, let's all give our money to Portugal to hold and let our cash compound for 10 years – at 16.75%, $100,000 becomes $470,510 – obviously there is nothing to worry about as people turn $100,000 into half a million dollars every decade, right?