I think I've seen this movie before.

Or, more accurately, I've seen myself on TV before predicting intervention by the Bank of Japan as the Dollar fell to these lows (131 to the Dollar) against the Yen, to the point where it began to impact the earnings of Japanese export corporations and forced Japan's Central Bank to take action to boost the Dollar and weaken the Yen, which has the unfortunate side effect of tanking the markets.

They did this on August 4th (link above) when I predicted the 20% correction on the button (down to 1,100) and again on October 29th, when we cashed out our White Christmas Portfolio after catching the run from 1,100 all the way back to 1,292 (17.5%) and once again nailed the Yentervention, that came just 2 days later and sent the markets plunging back to 1,158 into the Holiday.

Since Thanksgiving, we have gone all the way back to 1,333 – and that's 15% up from pre-Thanksgiving and 24% up from the October low at 1,074 and almost exactly 100% up from the S&P low of March, 2009 at 666.79. 666, as we know, is the mark of the Blankfein, so we take our numerology seriously at PSW – hallowed be Lloyd's name!

Anyway, so we're up 24%, which is a bit much without a significant correction and let's say 1,100 is the proper base and 20% up from there is 1,320 and you can see from Dave Fry's SPY chart that we're into a serious zone of resistance here with a very toppy-looking MACD and RSI accompanying this quadruple-top.

Anyway, so we're up 24%, which is a bit much without a significant correction and let's say 1,100 is the proper base and 20% up from there is 1,320 and you can see from Dave Fry's SPY chart that we're into a serious zone of resistance here with a very toppy-looking MACD and RSI accompanying this quadruple-top.

Yesterday we discussed some of the Global Macro forces at play but this morning we only have to look at Toshiba and Honda's quarterly reports, with both companies down around 70% in profits and issuing poor guidance based, in large part, on the too-strong Yen – to get a pretty good idea of the pressure the BOJ is currently under to take some sort of action right away.

JFE Holdings, Japan's second-largest steelmaker posted their first loss EVER – also on Yen strength and their outlook for next year is break-even. Demand for steel is slowing in Asia and Japanese Steel is far more expensive than competing, weaker currency-based manufacturers.

Last week, Japan had it's first overall trade deficit since 1981, if this spills over to affect their borrowing costs — well, it can't spill over because that would be a catastrophic event that would likely lead us into a full-blown Global economic collapse with Japanese debt at 220% of their GDP. So, there really is no choice – the BOJ needs to begin printing Yen and using it to buy Dollars ASAP. This morning, in Member Chat, we shorted Oil (/CL) at $100 (again) and the Russell (/TF) at 800 (again) and gold (/YG) at $1,750 on the Futures with the Dollar testing 79 as I think that should be the floor from which we can expect some action.

Last week, Japan had it's first overall trade deficit since 1981, if this spills over to affect their borrowing costs — well, it can't spill over because that would be a catastrophic event that would likely lead us into a full-blown Global economic collapse with Japanese debt at 220% of their GDP. So, there really is no choice – the BOJ needs to begin printing Yen and using it to buy Dollars ASAP. This morning, in Member Chat, we shorted Oil (/CL) at $100 (again) and the Russell (/TF) at 800 (again) and gold (/YG) at $1,750 on the Futures with the Dollar testing 79 as I think that should be the floor from which we can expect some action.

Today is the last day of the month so I imagine we'll have another day to paint a pretty January but, after this – it's anybody's game and I really can't imagine the Japanese are willing to drop the ball on this one.

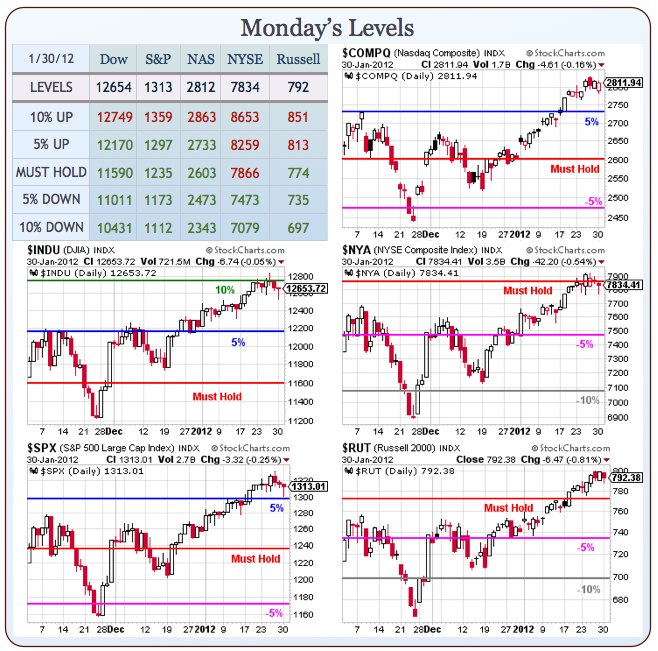

We'll be looking for a 4-5% pullback off the top on our indexes, a move that should bring us back to about 12,200 on the Dow against a corresponding move in the Dollar back to 81 as the Yen is reset to about 78 to the Dollar. That's going to top the Euro out at $1.32 and the Pound at $1.58 so those are the lines we believe the BOJ will draw in the sand this week.

At today's open they have driven the Dollar back down to 79 so we should see an attempt to keep the NYSE at our 7,866 level as well as Dow 12,749 and our premise is blown if we hold those for more than 24 hours so it's going to be an interesting last day of the month and I'm sure all the stops will be pulled out to close us at the highs and, of course, give us that fabled "golden cross" on the S&P.

After that – I wouldn't count those chickens before they hatch…